Bonds & Bullion Bid To New Records As Stocks See-Saw On Stimulus Scares

Tyler Durden

Tue, 08/04/2020 – 16:01

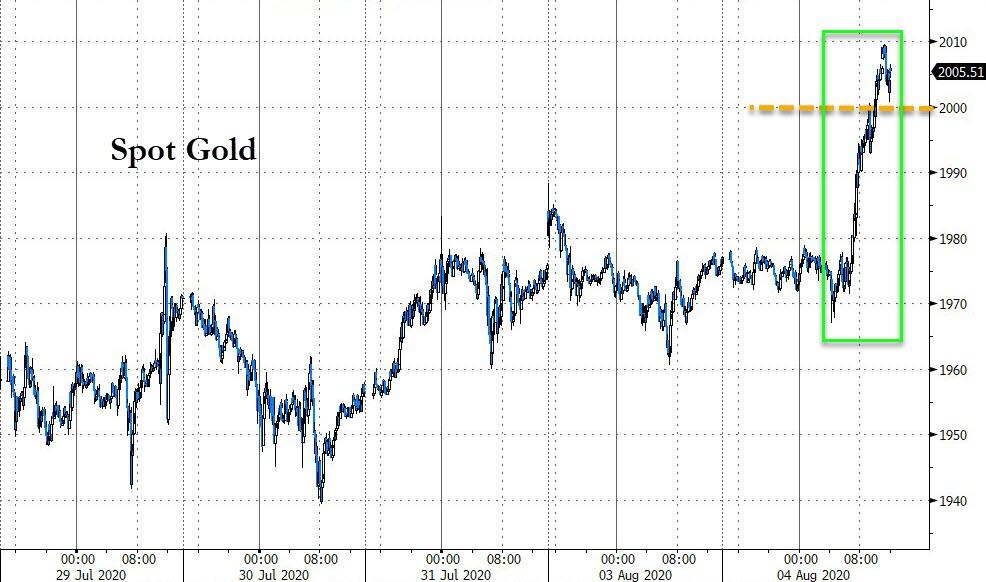

Spot Gold prices settled above $2,000 for the first time in history today…

Source: Bloomberg

After a series of confusing headlines about virus relief talks sparked anxiety (in some) stocks, and sparked a bid in bonds and bullion and selling of the dollar.

-

1142ET Pelosi: “doesn’t think there will be a deal this week.”

-

1415ET *SEN. PERDUE SAYS SENATE STIMULUS TALKS MAY TAKE ANOTHER 2 WEEKS

-

1425ET *MCCONNEL: WILL NOT FIND TOTAL GOP CONSENSUS ON VIRUS RELIEF

-

1450ET *SCHUMER SAYS NOT GOING TO STRIKE A DEAL JUST FOR THE SAKE OF IT

-

1455ET *SCHUMER SAYS HE IS HOPEFUL, TALKS MOVING FORWARD BIT BY BIT

Algos were crazy on words like “hope” and “nope” pinging markets around like a f**king cannabis/blockchain penny-stock…

Nasdaq underperformed most of the day (but the machines managed to get it green late on) as Small Caps were just panic-bid at every excuse.

And in case you wondered why – which you really shouldn’t by now – it was another major short-squeeze day…

Source: Bloomberg

FANG Stocks have been unable to extend after the huge gap higher on last Thursday night’s earnings…

Source: Bloomberg

Treasury yields tumbled led by the long-end (30Y -5bps, 2Y -0.5bps)…

Source: Bloomberg

With 10Y Yields back to a 50bps handle – a record closing low…

Source: Bloomberg

In fact, record low closing yields for the entire curve aside from 30Y…

Source: Bloomberg

But stocks still don’t care…

Source: Bloomberg

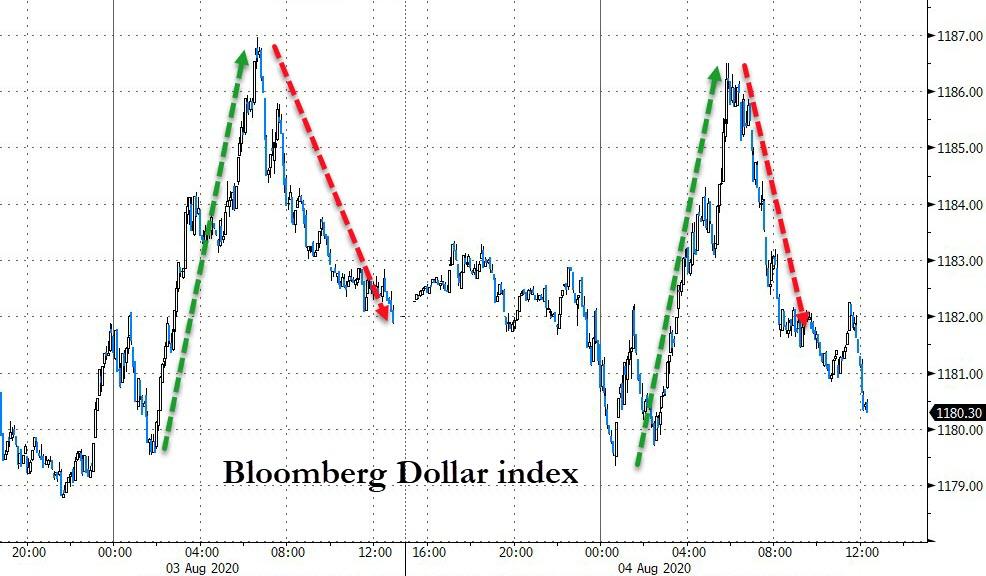

The Dollar mirrored Monday almost perfectly with a buying panic during the European day and selling in the US session…

Source: Bloomberg

Ripple and Ethereum are up on the week with Bitcoin and Litecoin just in the red from Friday…

Source: Bloomberg

Bitcoin continues to hold half its flash-crash loss…

Source: Bloomberg

Gold futures surged and closed above $2,000

Gold is notably overbought but the last few times it has been this overbought there has been consolidation and new high…

Source: Bloomberg

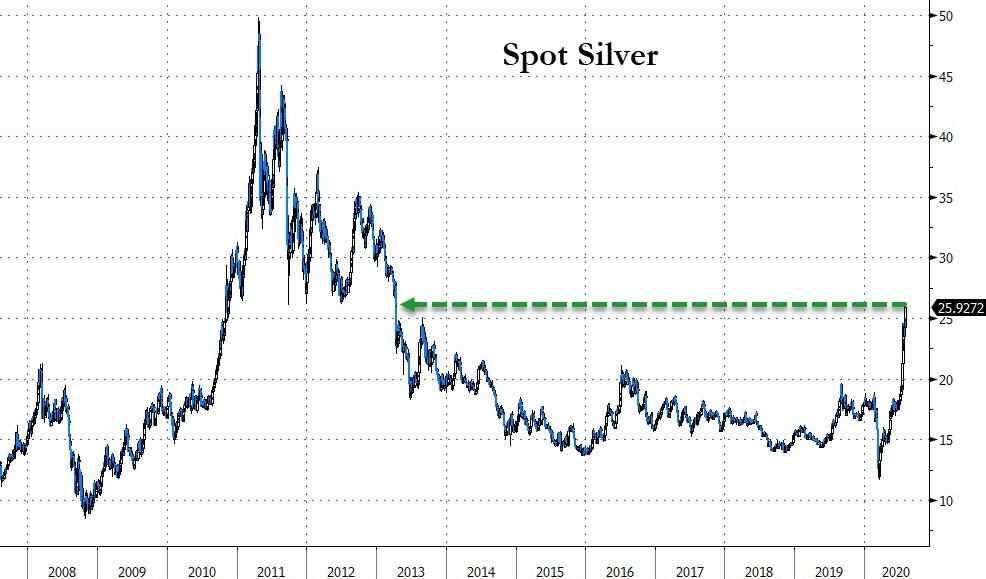

Silver futures hit $26…

Spot Silver is back at its highest since April 2013…

Source: Bloomberg

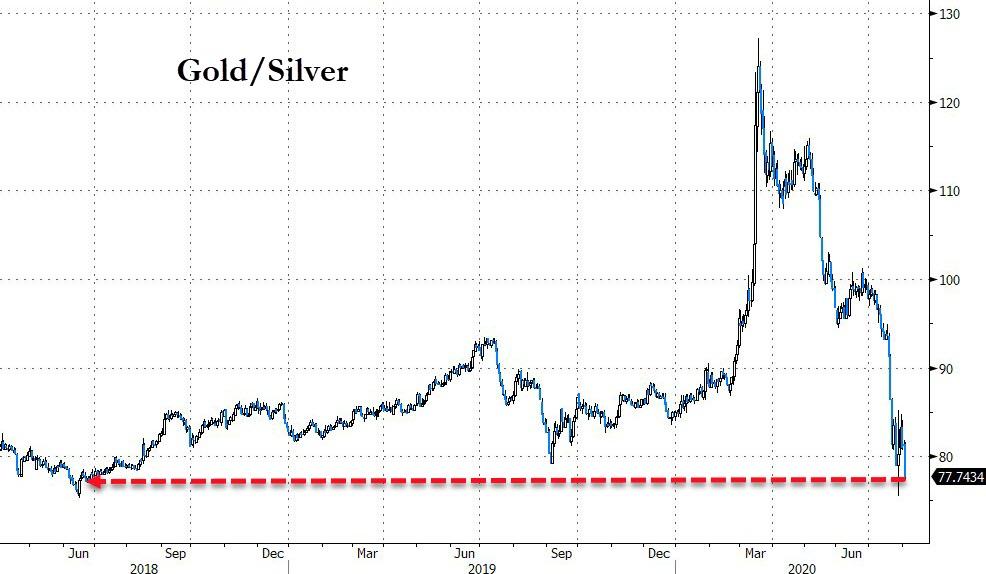

Silver’s outperformance sent the Gold/Silver ratio back to its lowest close since June 2018…

Source: Bloomberg

Oil prices chopped around as algos followed the same stock algos on headlines and ended higher ahead of tonight’s API inventory data (also helped by the dollar’s demise during the US session)…

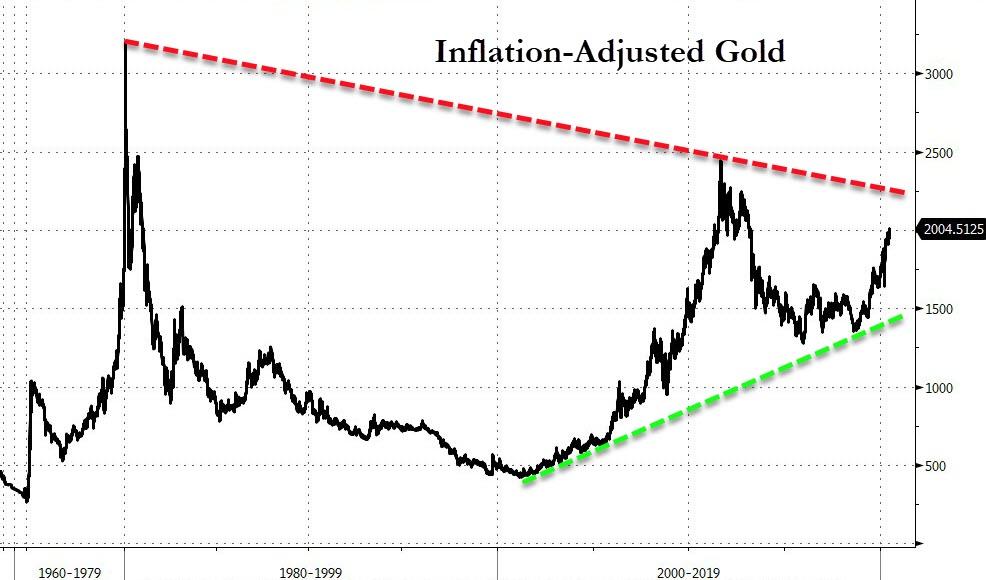

Finally, as nominal gold reaches a record high…

Source: Bloomberg

…on an inflation-adjusted basis, it has room to run…

Source: Bloomberg

And if the world’s central banks keep doing what they’re doing (and does anyone really believe there will ever be a normalization now), then negative-yielding global debt will force allocations increasingly to bullion and bitcoin…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3i5MtDw Tyler Durden