Spanish Stocks Break Support As Virus Concerns Reemerge

Tyler Durden

Tue, 08/04/2020 – 02:35

Spain’s IBEX 35 Index futures have slumped 11% in 9 trading sessions “as fears of new lockdowns coupled with weaker than expected macro data soured investors’ sentiment,” said Reuters‘ Stefano Rebaudo.

“There is a combination of factors,” said James McKenzie, head of research of Fidentiis in Madrid.

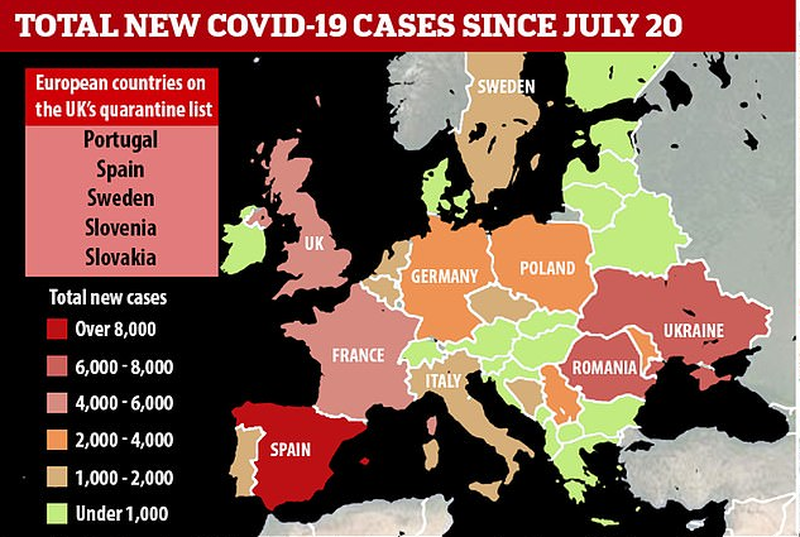

“Worries about possible new lockdowns as coronavirus cases keep rising, recent bad numbers for Q2 GDP and probably even worse data ahead as the UK quarantine for travelers to Spain will put under further pressure the tourism industry,” McKenzie said.

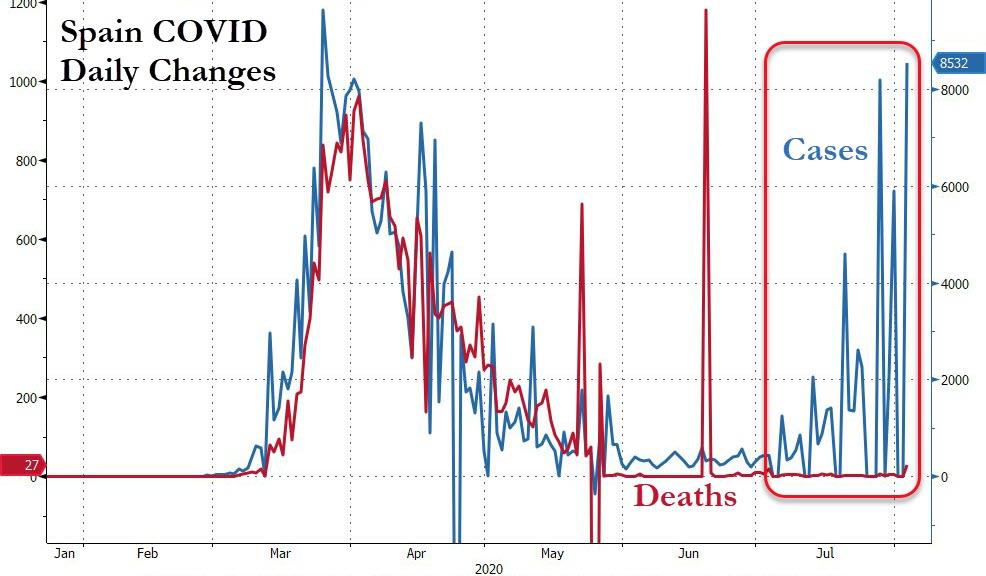

Spain reported 1,525 new COVID-19 cases on Friday, making it the most significant increase in cases since June, which was around the time national lockdown was lifted. Countries in Europe are now advising citizens against travel to Spain.

Virus cases have surged across Europe

Spain’s GDP, like Germany and France, reported last week some of the biggest crashes ever for the second quarter. The eurozone economy contracted by 12.1% in 2Q YoY.

Depressing data in the eurozone, more importantly, Spain, highlights the collapse in the travel and tourism industry, fading any hopes a quick rebound will be seen.

The selloff in Spanish stocks is an eye-opener for world stocks, currently powered by a bubble in US technology stocks.

The virus is re-emerging across the world, maybe the souring of investors’ mood in Spanish stocks is a precursor to a much broader sell-off.

via ZeroHedge News https://ift.tt/2XpcHck Tyler Durden