Dan Loeb Explains Why He Went Long Amazon, Disney In The Quarter He Returned As CIO

Tyler Durden

Thu, 08/06/2020 – 15:10

There were several notable highlights in the latest Third Point investor letter published today.

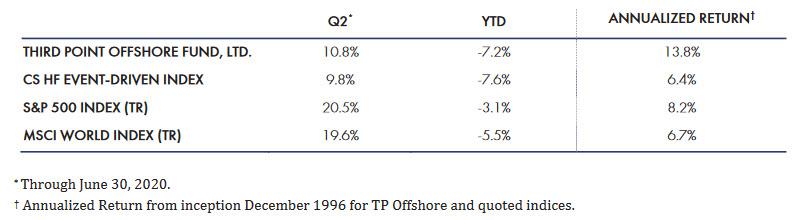

The first is that following an ugly first quarter to 2020, Dan Loeb’s hedge fund returned 10.8% in its main, Offshore Fund (which however was merely half the broader market’s return in the same time period). As Loeb notes, “following further gains last month, we have substantially reduced losses incurred during the First Quarter, bringing year‐to‐date losses for the Offshore Fund to ‐3.7% through July 31” although that too is below bow the return of the S&P500 and of the MSCI showing that even the world’s best hedge funds are powerless to outperform the broader market when central banks themselves swoop in and take over capital markets in order to prop everything up.

Also of note, in Q2, Loeb writes that the equity book returned ~9% on average net exposure of ~56%, with a 15% return in long equities offset by losses from short positions. Equities made up 5.4% of the firm’s 11.4% gain.

The second highlight is has to do with Loeb’s own role in his hedge fund: as we reported previously, in the past quarter the billionaire investor decided to become more actively involved in day to day decisions and resumed his role as a CIO at the famous hedge fund which he founded 25 years ago. The reason for that is that as Loeb says, “the second quarter was one of many important inflection points over the past 25 years.”

He explains why below:

My disappointment with some elements of recent performance led me to adjust certain parts of our strategy and investment process. One step was to take full control over the portfolio and resume my role as sole CIO. Another was to drive ideas to the team that better reflect the current environment of disruption and dramatic dispersion between winners and losers. These changes to the organization and our process are having the impact I desired: significantly increasing the volume and quality of actionable ideas and thereby creating a more dynamic and diversified portfolio with improved performance.

In 2010, I remember sharing with investors at our annual event the quotation attributed to John Maynard Keynes: “When the facts change, I change my mind. What do you do, sir?” Categories are important and central to how our minds make sense of a complex world by structuring and holding disparate information in our brains. Third Point was founded originally as an “event‐driven, value‐oriented” strategy1 that specialized in both credit and special situations such as spin‐offs, demutualizations, and post‐reorg equities. Over time, we developed the additional skill of creating our own events through activism. By structuring our funnel of ideas around these categories, we could easily prioritize our research process toward companies that were undergoing or could be catalyzed into making some sort of financial or operational “event”. As markets have changed, I have realized that while event driven is still an essential investment lens (clearly, as our two largest investments, Pacific Gas & Electric and Prudential plc, are both event‐driven situations that together comprise nearly 20% of our exposure), today, quality is also an essential screen.

This investment environment is characterized by breakneck technological innovation and sluggish growth which has only been amplified by COVID‐19. Considering this, it is essential to find companies with great leadership and unique products in growing end‐markets in which they are gaining share and achieving high topline growth and strong margins. These factors drive robust earnings and free cash flow growth supported by high returns on existing invested capital. However, when investing in a quality or “compounder” company, it is critical to find an entry point at which an investment is attractive since most of these businesses trade at relatively high multiples.

Interestingly, our most successful activist investments have been in companies that embody these very characteristics, where we were able to find appealing entry points when companies were changing positively in measure of quality. Our investments in Baxter and Nestlé were made at transition points in margin, ROIC and earnings growth. Our investment in Yahoo! was also driven primarily by our interest in buying a high‐quality business, Alibaba, in which Yahoo! held a substantial stake at an extremely attractive price.

Investing in “quality” companies or “compounders” is not a new endeavor for us but a longtime category. Some of our most successful investments that have doubled or tripled during the lengthy periods of our ownership including S&P Global, Visa, Danaher, Adobe, Salesforce and Sherwin Williams can rightly be described as such. To be clear, investing in compounders and event‐driven situations are not mutually exclusive activities. It has been our experience that our event‐driven focus provides us with a unique window into the creation or evolution of a quality company, since they are often born out of corporate events or management changes. As we discuss in the equity section below, recent market dislocations have created several unique opportunities for us to acquire more of these kinds of companies at bargain prices. We anticipate selectively adding to this long‐term portfolio when opportunities present themselves.

Yet while Third Point’s had a strong quarter in stocks, it was mostly credit that drove the fund’s gains, and as Loeb fund explains In Q2, Corporate Credit returned ~16.4% on average exposure and Structured Credit returned ~8.6%.

Corporate Credit returns were driven by timely purchases of high‐grade bonds near market lows including in Boeing, Kraft, and Ford. On the non‐performing side, our investment in Pacific Gas & Electric (which we added to near market lows) was also a material contributor, adding 90 bps to fund performance. In Q2, we took profits on some of the investments we made late in Q1 as High‐Yield and Investment‐Grade spreads tightened considerably and we reduced exposure to corporate credit from roughly 23% to 17% of Offshore NAV. I give extra praise to our credit team, who have spent their careers investing in distressed and high yield bonds, for decisively seizing the brief opportunity that we saw in investment grade debt. We expect additional opportunities in credit as the current economic situation disproportionately affects certain industries, offering opportunities for us to facilitate financing and restructurings and allowing companies to make it through this difficult period.

In Structured Credit, many of the investments we made during the panic and forced selling we saw in March appreciated in value during Q2. We are constructive on residential mortgages and consumer assets as interest deferral and forbearance plans are starting to work. Over the coming quarters, we believe opportunities in structured credit will emerge alongside deteriorating fundamentals in commercial real estate and corporate credit. From March through May, we saw a significant dislocation in the secondary markets with new issue securitizations largely on hold. In June, well before TALF was officially launched, the bid for senior portions of the capital structure increased dramatically. We have remained flexible during this period, alternating between investing in securities and loans when a strong funding opportunity presents itself. We are bearish on commercial real estate financials given a confluence of concerns around occupancy and cash flows (e.g. lower rents, required capex, excess capacity, pricing power) potentially impacting asset values. After the forbearance period, we are closely watching potential re‐defaults and liquidity options for many of these properties.

* * *

Most important to the market was the news that Third Point had launched new long positions in Alibaba and JD.com, Amazon, and Disney (even though technically the news of Loeb’s entry into Disney was unveiled back in May), as well as the initiation of a new equity position in recently emerged from bankruptcy Pacific Gas & Electric through a PIPE transaction.

Loeb discusses these investments below:

Amazon

Historically, Amazon was a company we admired that traded outside our valuation range. In March, we initiated a 5% position and although shares were flat on the year, we believed they were significantly undervalued due to the acceleration of the adoption of e‐commerce and cloud computing in the pandemic. We saw that e‐commerce penetration as a percent of total retail sales had nearly doubled and that Amazon was fully participating in that growth. Even as shopping patterns normalize, we believe that e‐commerce penetration has structurally ratcheted up and that Amazon’s share gains will be sticky. The COVID‐19 pandemic is also helping to accelerate the adoption of Amazon’s cloud computing services because they are a critical enabler of remote work, a trend that will similarly outlast the virus.

Amazon possesses all the key characteristics of a great “compounder”, including one of the highest cash returns on capital invested (“CROCI”). Shares are up significantly since March, but our attractive entry price enables us to continue to benefit from the company’s compounding of value as the twin engines of e‐commerce and cloud computing are expected to drive strong growth well into the future.

Disney

During Q2, we initiated a long position in The Walt Disney Company when shares traded down on fears that closures of theme parks and movie theaters due to the coronavirus pandemic would cripple the company. A slew of sell‐side analysts had recently downgraded the stock but we believed they failed to grasp that the pandemic also provided Disney with an important opportunity – to accelerate a plan to bring its blockbuster content directly to the consumer via streaming, which will further elevate Disney’s position as the world’s preeminent media company. Streaming is Disney’s biggest market opportunity ever with potentially $500 billion of revenue spread across over a growing market of 750 million current broadband homes globally ex‐China, dwarfing the size of Disney’s current addressable markets (roughly $100 billion between global box offices and theme parks). Disney’s dominant position in the global media landscape sets up the company to take a meaningful chunk of the growing DTC streaming market, shown by the early success of Disney+. In less than nine months, Disney+ attained 60 million global subscribers, a milestone that took Netflix over seven years to meet.

On August 4th, Bob Chapek addressed the market after his first full quarter as Disney’s CEO. We were pleased that he views DTC as Disney’s “top priority” and believe his decision to premiere a tentpole film like Mulan through Disney+ is a defining moment. We encourage Disney to continue leveraging its new digital platforms to further onnect fans with their iconic content and brands and, as Mr. Chapek said, “take full advantage of the opportunity” available to Disney today.

Alibaba & JD.com

During the quarter, we took advantage of jitters about China’s relationships with Hong Kong and the U.S. that created an air pocket in trading of Chinese‐related shares to establish new positions in e‐commerce leaders Alibaba and JD.com. As we have articulated in prior letters, our outlook for Alibaba and the broader Chinese e‐commerce market is bright. We believe online gross merchandise value (“GMV”) will grow at a mid‐teens CAGR over the next five years, propelled by both (1) rising consumption per capita, as the Chinese retail market is equal in size to the U.S. despite four times as many consumers, and (2) increased penetration of retail by online, a trend which we believe has been structurally accelerated by the COVID‐19 pandemic.

As the e‐commerce market matures, we believe Alibaba & JD will leverage scale and growing repositories of transaction data to increase monetization of their platforms through targeted advertising to improve revenue yields (revenues as a percentage of GMV) from a starting point of less than 4% today. As a point of comparison, brick‐and‐mortar retail store rent expenses in China are greater than 10% of sales on average, which provides a significant

umbrella for online marketplaces to take a greater share of GMV through a combination of commission and advertising spending as online retailer cost structures converge with brick-and‐ mortar retail.Finally, we continue to be excited about the latent potential in some of Alibaba’s businesses beyond the core e‐commerce marketplaces – particularly the cloud computing business, Aliyun. China’s cloud computing industry remains nascent but is growing nearly 3x faster than its developed market counterparts through a combination of rising IT intensity, rapid cloud penetration, and a gradual moderation in software piracy. Within that market, Aliyun is increasingly dominant (with nearly 50% market share) and will generate dramatic profit growth as margins expand with scale. As one reference point, Aliyun today resembles Amazon’s AWS business five years ago; this is an encouraging comparison given that today, AWS’ operating profits (and estimated enterprise value) exceed Alibaba’s business in its entirety. Ant Financial – in which Alibaba holds a ~30% stake that is worth roughly $70 billion – has announced its intention to go public later this year. Alibaba shares will benefit further should they become accessible to mainland Chinese investors through inclusion in the Southbound Connect.

Finally, here is Loeb’s outlook:

To say that markets have climbed a massive wall of worry since they bottomed on March 23rd is an understatement. There is still plenty to be worried about between a pandemic that seems to have re‐accelerated around the world; diminished prospects for normal school openings in the fall; whole swaths of the economy, especially SMB’s, decimated by the economic fall‐out; a highly volatile November election looming, with many unknown and market‐moving outcomes; and continued tensions with China. The market’s recovery has been more fragile than it appears, led by a few pandemic “winners” urged on by Fed policy, which flooded the market with capital and led to historically low interest rates, ongoing fiscal stimulus, and expectations of a vaccine by year‐end.

As challenging as things seem today, we have spent significant time with scientific experts to better understand evolving treatments and vaccines and have confidence that several will be effective and available later this year, which should lead to the next phase of market recovery in coronavirus‐affected companies. Our equity portfolio is balanced between companies that are doing well now, and later stage recovery names in aerospace, entertainment, and retail which are still trading near their March lows and should benefit when there is a move back into these sectors. Our net exposures reflect not so much a rosy market outlook as an abundance of new ideas that we believe will prosper in our current scenario analyses. But, like Keynes and consistent with our last 25 years in business, we always reserve the right to change our mind as new information presents itself.

His full letter is below:

via ZeroHedge News https://ift.tt/33vg0m9 Tyler Durden