Silver Soars Amid Momo Meltdown, Apple Almost As Big As Entire Russell 2000

Tyler Durden

Mon, 08/10/2020 – 16:00

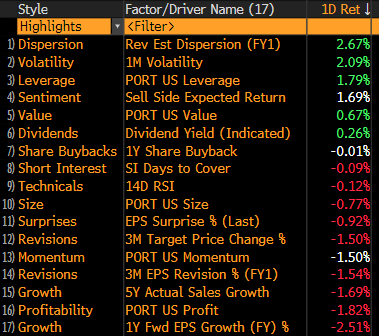

The last two days have seen the biggest plunge in momentum since the early June quant-quake…

Source: Bloomberg

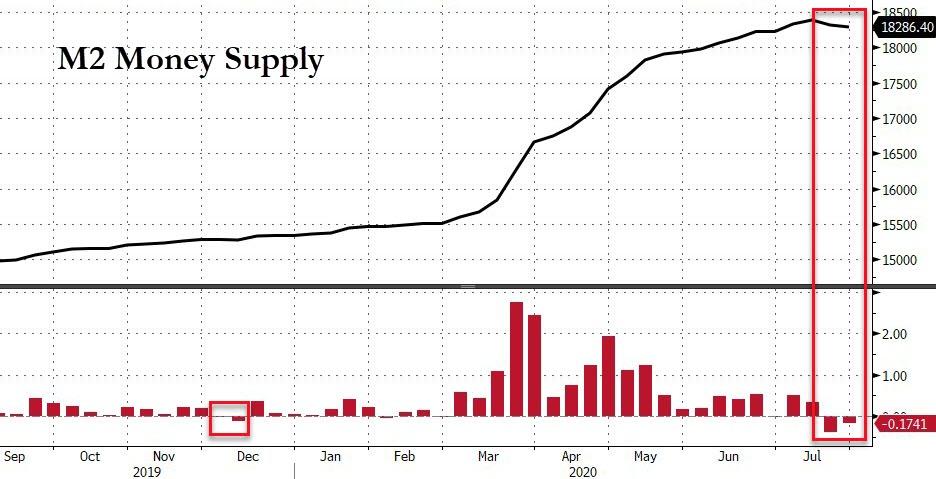

As the reflation trade inflects as money supply falls for two straight weeks…

Source: Bloomberg

…and momentum vs value flips…

Source: Bloomberg

The biggest two day rotation since the June collapse…

Source: Bloomberg

Cyclicals also dominated defensives…

Source: Bloomberg

Source: Bloomberg

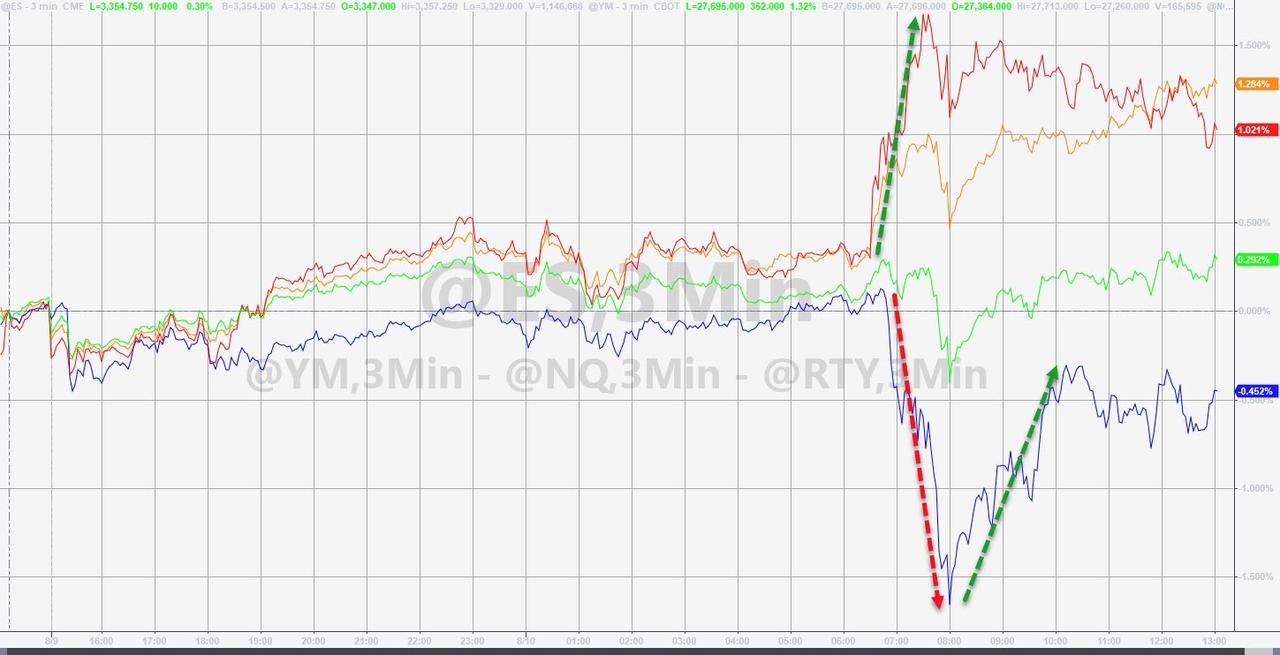

All of which sparked a major divergence between Small Caps (and The Dow) and the Nasdaq on the day (though BTFDers diod not allow that to stand for long)…

That is the 7th straight day higher for the Dow and S&P (and 2nd down day in a row for Nasdaq)

Pushing the Russell 2000 to its highest relative to Nasdaq in almost two months…

Source: Bloomberg

Treasuries rollercoastered in a narrow range today, bid during the EU session overnight and sold during the US session…

Source: Bloomberg

Elsewhere in crazy land, the Junk bond market set a record-low coupon today with a Ball Corp deal. The aluminum packaging company, is selling 10-year notes at a 2.875% yield. As Bloomberg notes, about 40% of high-yield deals sold last week priced at a yield of less than 4%.

Source: Bloomberg

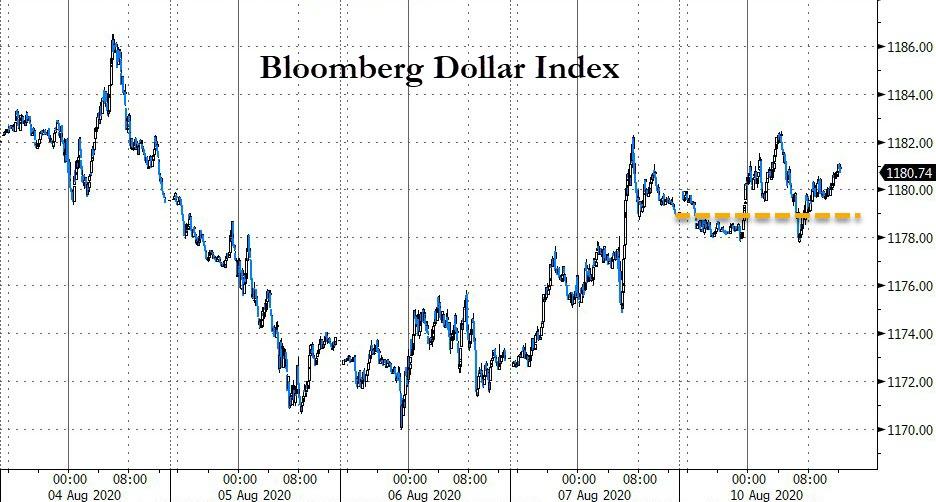

The dollar chopped around all day in a tight range and ended marginally higher

Source: Bloomberg

Bitcoin topped $12k before being flash-crashed once again… but staged a valiant recovery…

Source: Bloomberg

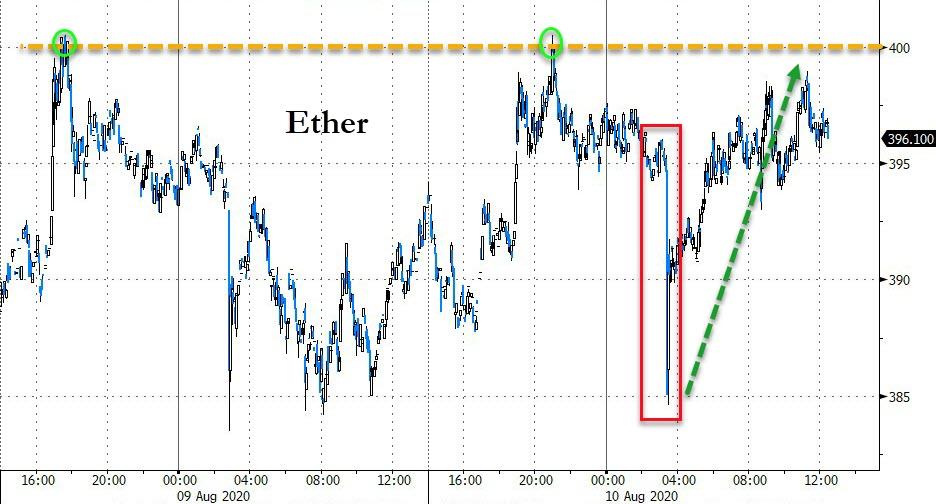

Ether also plunged but managed to make it back into the green…

Source: Bloomberg

While gold ended modestly lower after a morning surge above $2060 (futs), silver, copperm and crude all managed solid gains…

Source: Bloomberg

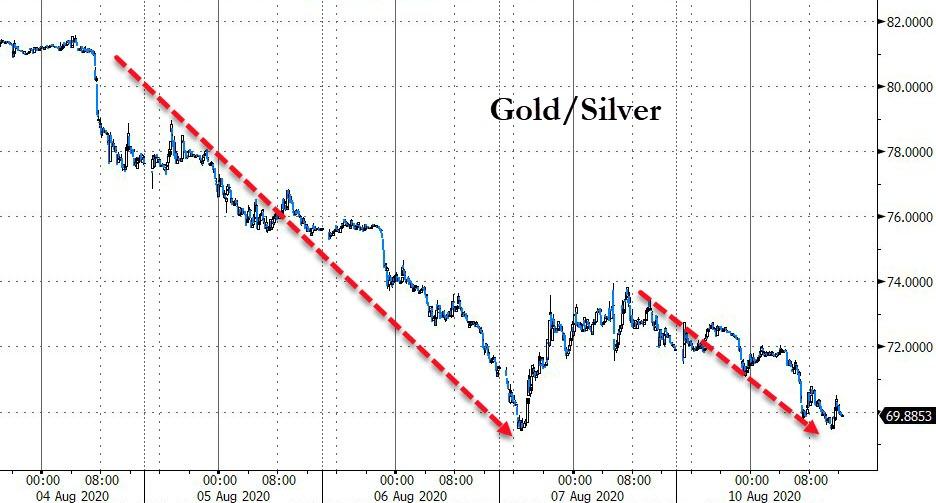

Silver and gold decoupled for a few hours today (between 11amET and 2pmET)…

Silver’s outperformance sent the ratio to gold back below 70 once again…

Source: Bloomberg

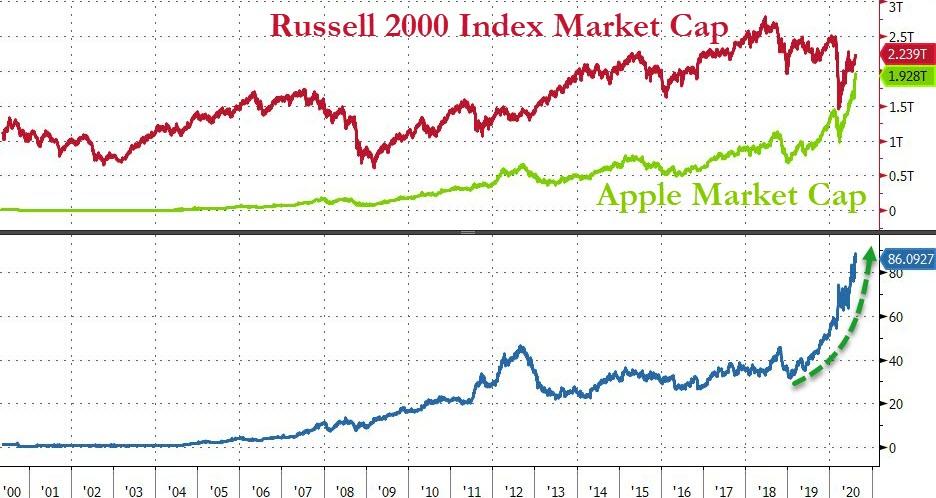

And finally, as one wit quipped, Tech is eating the world: The recent surge in Apple shares is pushing the value of the world’s largest company toward that of the entire Russell 2000 Index. The iPhone maker is worth $1.93tn, almost 90% of combined mkt cap of 2,000 US small-cap stocks listed in Russell…

“This is astounding – in the past 40 years, no single stock has come close to dwarfing the value of so many other companies,” wrote Sundial Capital Research Inc. founder Jason Goepfert in a recent note.

Source: Bloomberg

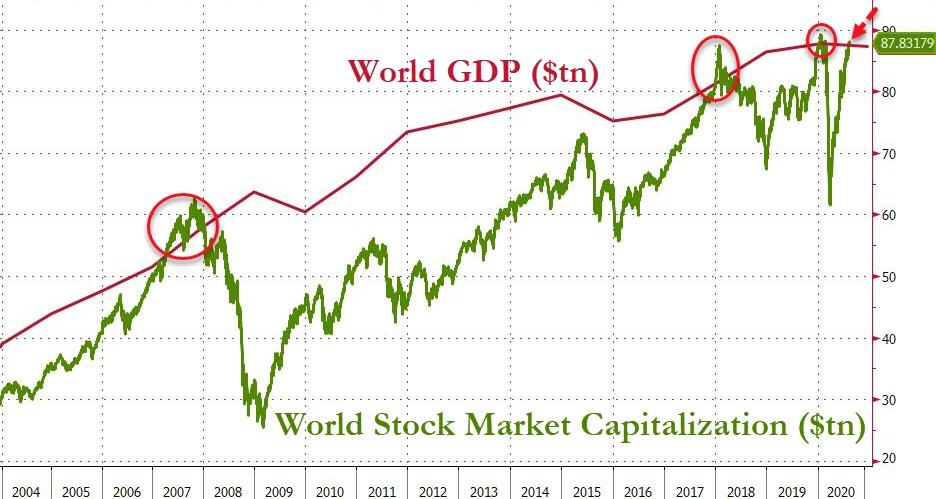

And then there is this…The market value of the world’s equities has risen above the dollar value of the global economy, which some investors say is a sign of overheated markets. As Bloomberg notes, total stock-market capitalization reached $87.83 trillion on Sunday, compared with the 2019 gross domestic product of all countries at $87.75 trillion. With this, stock values have returned to where they were earlier this year, even though the Covid-19 pandemic has dragged many countries into recession.

Source: Bloomberg

It’s a Mad World alright!

via ZeroHedge News https://ift.tt/2XPtwx4 Tyler Durden