Futures Drop Ahead Of Key Retail Sales Report

Tyler Durden

Fri, 08/14/2020 – 08:00

After again briefly hitting a new all time high on Thursday, S&P500 futures retreated on Friday after the latest Chinese econ data pointed to a wobbly economic recovery from the COVID-19 pandemic as two out of three key Chinese metrics missed…

… coupled while new quarantine rules in the UK sent European stocks sliding.

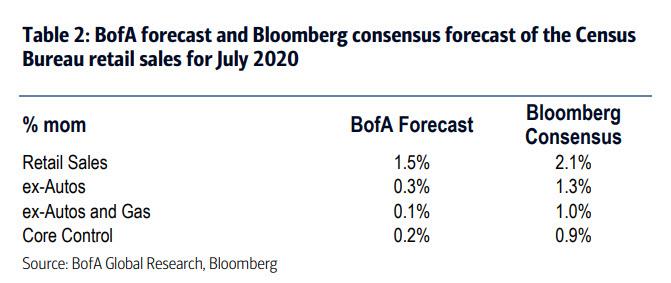

And as attention now turns to retail sales, where BofA warned that a miss is virtually assured based on its own internal card spending data, it may explain why both the dollar and Treasury yields are also sliding on the last day of the week.

The S&P has struggled to top its all-time high of 3,393.52, also set on Feb. 19, on growing evidence of a faltering labor market rebound. Data at 8:30 a.m. ET is expected to show retail sales increased 2.1% last month after jumping 7.5% in June, but as we explained last night, the reported number is likely to be well lower.

Also weighing on sentiment are ongoing negotiations between top Democrats and the White House over more stimulus measures to support the economy, which have hopelessly stalled and with Senate now out until September, it appears that a resolution is weeks if not months away. Nonetheless, Bloomberg notes, that traders continue to bank on further fiscal stimulus to help the nascent recovery, after U.S. and Asian stocks erased most of their pandemic-related losses.

On the virus front, Joe Biden said U.S. governors should require masks for the next three months, while New Zealand recorded 12 new confirmed local cases of the coronavirus. Germany added the most new cases since May, while the head of the French Health Agency Jerome Salomon said the situation in his country is worsening.

The Stoxx Europe 600 Index sank after Britain added France, the Netherlands and Malta to its list of countries from which people arriving have to quarantine for 14 days. The Eurostoxx 50 dropped 1.7%, Spain’s IBEX underperformed peers on tourism concerns, dropping over 2.25%. All sectors are in the red with travel, banks and oil & gas names declining the most. The UK’s FTSE 100 drops over 2% to trade back near Monday’s opening levels. EasyJet Plc fell as much as 8% and British Airways owner IAG SA by as much as 7%.

The latest euro area jobs data reflected the scale of the damage the coronavirus crisis has done to the bloc’s economy. The number of people employed fell by 2.8% in the second quarter. Governments now face difficult choices as to how to wind down the furlough programs that have kept the rise in unemployment below that of other countries such as the U.S.

Earlier in the session, Asian stocks were little changed, with energy and materials falling, after rising in the last session. Most markets in the region were down, with Thailand’s SET dropping 1.5% and South Korea’s Kospi Index falling 1.2%, while Shanghai Composite gained 1.2% as margin debt posted its first increase in three days. The Shanghai Composite Index rose 1.2%, with Harbin Xinguang and Haohua Chemical posting the biggest advances. News of China’s unexpected economic disappointment led to stocks rising in Hong Kong and China, on hopes of more stimulus. Japan’s Topix was little changed, with Mynet rising and DS falling the most.

In rates, Bund and Treasuries curves bull flattened slightly. Gilts steepen at the margin with 5s30s the steepest in a year. Treasury futures are higher as U.S. trading gets under way after falling every day this week, leaving yields lower by 1bp-2bp on the day. Treasury 10-year yields hover around 0.70%, 2bp lower on thee day; gilts lag by 3bp, bunds by 2bp; UST 30-year yields around 1.415%, still around 1bp cheaper than Thursday’s auction stop. Gains during Asia session stalled as gilts underperformed, extending move spurred earlier this week by stronger-than-forecast U.K. growth data and reduced expectations for additional BOE QE. Peripheral spreads widen, BTP futures bounce off Thursday’s worst levels.

In FX, the dollar faded a modest earlier gain even as the euro slipped 0.1%, ending a three-session positive run, after news of the sharp drop in employment for the second quarter. U.K. gilts edged lower led by the long-end, pushing the curve to its steepest in a year. The New Zealand dollar fell against most of its Group-of-10 peers as a coronavirus outbreak widened and amid indications that the central bank is seeking to slow gains in the currency.

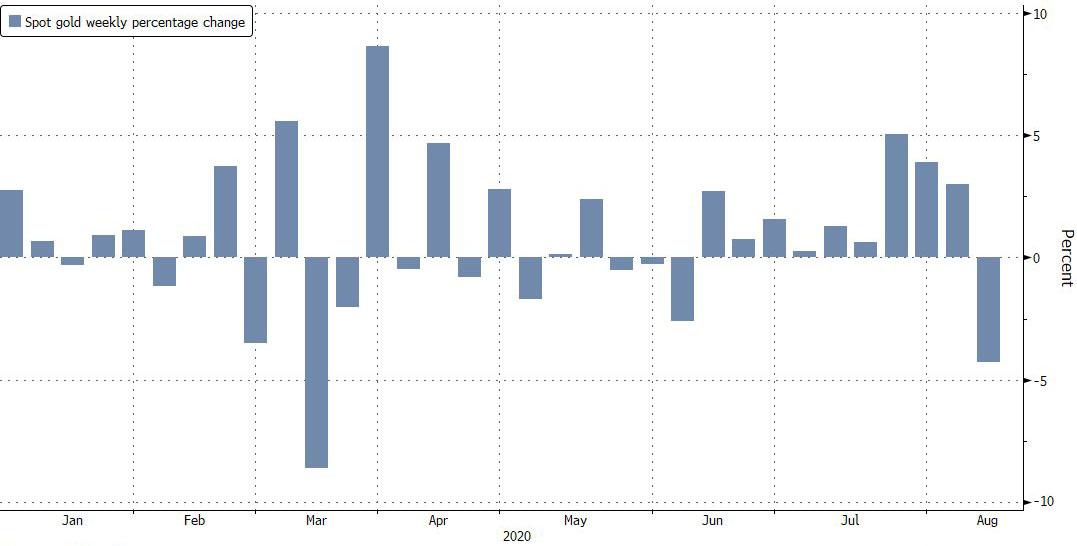

In commodities, gold edged lower following two days of gains, while oil headed for a second weekly advance. Gold was set to post its first weekly drop after 9 consecutive weeks of increases.

Looking at the day ahead, retail sales figures on Friday will offer clues about the health of the consumer recovery following a report that showed weekly jobless claims in the U.S. dropped below 1 million for the first time since March. Other expected data include industrial production, and University of Michigan Consumer Sentiment Index. DraftKings is reporting earnings

Market Snapshot

- S&P 500 futures down 0.5% to 3,351.00

- STOXX Europe 600 down 1.7% to 366.20

- MXAP down 0.09% to 170.90

- MXAPJ down 0.2% to 563.14

- Nikkei up 0.2% to 23,289.36

- Topix down 0.05% to 1,623.38

- Hang Seng Index down 0.2% to 25,183.01

- Shanghai Composite up 1.2% to 3,360.10

- Sensex down 1% to 37,919.13

- Australia S&P/ASX 200 up 0.6% to 6,126.25

- Kospi down 1.2% to 2,407.49

- Brent futures down 1% to $44.50/bbl

- Gold spot down 0.3% to $1,947.55

- U.S. Dollar Index down 0.1% to 93.25

- German 10Y yield fell 0.7 bps to -0.419%

- Euro down 0.07% to $1.1806

- Italian 10Y yield rose 4.9 bps to 0.885%

- Spanish 10Y yield rose 1.2 bps to 0.382%

Top Overnight News From Bloomberg

- The euro area jobs data reflects the scale of the damage the coronavirus crisis has done to the bloc’s economy. The number of people employed fell by 2.8% in the second quarter. Governments now face difficult choices as to how to wind down the furlough programs that have kept the rise in unemployment below that of other countries such as the U.S.

- The virus resurgence is gaining momentum in Europe, with Germany recording the highest number of new cases in more than three months while worrying infections figures are recorded in France, which the led the U.K. to impose a quarantine for travelers coming back from France as well as Malta and the Netherlands.

- The U.K. signed two more deals to expand its vaccine supply, ordering 60 million doses from Novarax Inc. and 30 million from Johnson and Johnson’s Janssen. That brings the total number of potential vaccine doses secured by Britain to 300 million.

- China’s industrial output for July grew as much as the previous month but didn’t beat estimates. Retail sales fell, reflecting an uneven economic recovery with demand unable to keep up with the factory output rebound.

Asian equity markets head into the weekend mixed as the region took its cue from the lackadaisical performance in global peers after both the S&P 500 and Nasdaq failed to carve out fresh record levels in the US but where downside was stemmed by encouraging initial jobless claims data, while participants also digested disappointing Industrial Production and Retail Sales data from China. ASX 200 (+0.6%) was underpinned by outperformance in tech and healthcare, while the largest weighted financials sector was dragged following a 7% decline in NAB’s cash profit for Q3 although shares in the Big 4 bank itself were kept afloat after its revenue rose 10% for the quarter and as it explores a sale of its MLC wealth business. Nikkei 225 (+0.2%) traded indecisively amid an uneventful currency and the KOSPI (-1.2%) was the worst performer following a flare up of virus cases in which the country posted its largest daily increase in cases since March. Hang Seng (-0.2%) and Shanghai Comp. (+1.2%) were choppy after both Industrial Production and Retail Sales missed expectations, although PBoC efforts resulted to a net weekly injection of CNY 490bln and it announced to conduct a medium-term lending facility operation on Monday, while focus also shifts to the US-China talks set for tomorrow. Finally, 10yr JGBs were lower amid spillover selling from USTs in the aftermath of an abysmal 30yr auction, with prices also dampened by weaker demand at the enhanced liquidity auction for longer-dated JGBs.

Top Asian News

- Malaysia’s Economy Shrinks Most Since 1998 Asia Financial Crisis

- Singapore Oil Legend and Hin Leong Founder Charged With Forgery

- China’s Pouring More Steel Than Ever to Power Virus Rebound

- China’s Industry-Led Recovery Continues But Retail Stays Weak

European stocks continue to bleed in early trade [Euro Stoxx 50 -1.7%] despite a mostly positive APAC handover, with little by way of fresh catalysts to spur the sell-off, although participants note of possible squaring ahead of the weekend following this week’s rally alongside some positioning ahead of US retail sales. Broad-based losses are seen across major bourses, with DAX cash and Sept futures back below the 13,000-mark, Euro Stoxx 50 cash under 3,300 and CAC cash sub-5,000. Sectors are firmly in the red with energy underperforming, whilst the detailed breakdown sees Travel & Leisure the clear laggard after the UK imposed the 14-day quarantine rule to travelers from France and Netherlands – a move France said will see reciprocal action. As such, pronounced losses are seen across easyJet (-7%), IAG (-6.2%), Tui (-5.2%), Air France-KLM (-5.7%), Ryanair (-4.7%), and Lufthansa (-3.5%). Upside movers are scarce with only some 9 stocks within the Stoxx 600 in positive territory at the time of writing; Qiagen (+3.2%) are the top mover, supported by a broker upgrade. Some smaller earnings-related movers include Hapag-Lloyd (+11%), Maersk Drilling (-8.4%) and Clas Ohlson (-0.2%). Finally, Atlantia (-3.0%) is pressured after Italian PM Conte noted that there are still details that need ironing out in Autostrade’s agreement with the government. The PM also noted that any deal will not prevent the government from launching legal action against the Co. in the case of “serious negligence”.

Top European News

- U.K. Expands Covid Vaccine Supplies With Novavax, J&J Deals

- Spain’s Business Leaders Fear Second Lockdown as Virus Surges

- Spike in Cigar Use During Lockdown Triggers STG Upgrade

- East EU Sees Worst Slump Since Communism But Finds Positives

In FX, the 2 renowned safe haven currencies remain in lock-step, but Usd/Jpy continues to respect and reject triple-top resistance around the 107.00 level where Japanese exporters are reported to have selling/hedging interests. This could also be a top line for the MoF and BoJ in similar vein to defences of 105.00 fairly recently, and 104.00 not that long ago. However, the Greenback has survived another test of its own with assistance from significantly higher US Treasury yields, a steeper curve and signs that global stock markets are losing momentum amidst the ongoing spread and re-emergence of COVID-19. Indeed, the DXY is back above 93.000 following Thursday’s fall to 92.922, albeit tentatively heading into more top tier data (retail sales, ip and Michigan sentiment) and Saturday’s US-Sino showdown, while the Yen holds a relatively firm line between 107.03-106.68 parameters.

- AUD – A very marginal ‘outperformer’ and straddling 0.7150 vs its US counterpart in wake of supportive Aussie jobs data in contrast to Chinese retail sales and ip missing consensus overnight. Resilience also coming after rhetoric from RBA Governor Lowe reaffirming no willingness to intervene directly to weaken the Aud even if he and the Bank would like to see it depreciate, or desire to devalue via negative rates.

- GBP/EUR/CHF – All marginally weaker against the Buck in comparatively quiet, consolidative trade, as Sterling retreats from 1.3100+ again, the Euro retests bids around 1.1800 and the 200 HMA and the Franc pivots 0.9100. Note, hefty option expiry interest may also be weighing on the single currency given 1.1 bn at 1.1825 and 1.1850 ahead of almost double that size at the 1.1900 strike, though 1.1 bn at 1.1750 should provide some underlying support.

- CAD/NZD/SEK/NOK – The Loonie also looks bound by big expiries in the absence of any inertia from oil ahead of Canadian manufacturing sales, with 1.5 bn running off at the NY cut very close to the top of the range (1.3250 vs 1.3248) and 1.1 bn below the base (at 1.3175 vs 1.3206). Meanwhile, the Kiwi continues to lag on the back of dovish RBNZ policy guidance and the pandemic resurgence, as Nzd/Usd pulls back further from 0.6600 and under 0.6550, while Aud/Nzd picks up pace beyond 1.0900.

- EM – No major adverse reaction to the aforementioned disappointing Chinese macro releases as attention is trained on the upcoming US-China meeting and the Yuan hovers around 6.9500, but other EMs are feeling the effects of the mini-Usd revival and a downturn in risk sentiment. In fact the Try has slipped to a new, albeit slender, record low circa 7.3765 after weaker than expected Turkish ip, the Rub has reversed through 73.0000 against the backdrop of softer Brent crude prices and the Mxn is sub-22.0000 following the latest Banxico rate cut, shrugging off 1 dissenter voting for a 25 bp ease rather than -1/2 point.

In commodities, WTI and Brent front month futures see a session of losses thus far, with the benchmarks pressured on a number of fronts – including the Israel/UAE deal providing some stability in the region, whilst the UK quarantine rule on France and Netherlands further dampens jet fuel demand as flagged by the IEA oil market report yesterday. Furthermore, participants will also be keeping stock of US-Sino sentiment heading into the weekend meeting, which comes against the backdrop of heightened tensions, although very little is expected to develop on the trade front. WTI Sept and Brent October are down some USD 0.50/bbl apiece and trade below 42/bbl and 45/bbl respectively, with eyes on retail sales for a possible sentiment-driven move ahead of the weekly Baker Hughes rig count. Elsewhere, spot gold is uneventful on either side of USD 1950/oz as the yellow metal trades in lockstep with the USD ahead of Tier 1 US data, albeit prices are set for the first weekly decline in ten weeks, whilst spot silver oscillates on either side of USD 26/oz. In terms of base metals, Shanghai copper closed lower amid sub-par Chinese retail sales and industrial output data, coupled with Shanghai warehouse copper stocks rising. Conversely, Dalian iron ore futures closed higher by almost 2% as the metal remains underpinned by steel producers’ demand alongside supply woes. Reports also note that China produced record amounts of crude steel last month amid infrastructure boosts. Finally, China’s aluminium output hit a record high last month as smelters were incentivized to restart production and launch new capacity by the rally in prices.

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. 2.05%, prior 7.5%; Retail Sales Ex Auto MoM, est. 1.3%, prior 7.3%

- Retail Sales Control Group, est. 0.8%, prior 5.6%

- 8:30am: Nonfarm Productivity, est. 1.5%, prior -0.9%; Unit Labor Costs, est. 6.85%, prior 5.1%

- 9:15am: Industrial Production MoM, est. 3.0%, prior 5.4%; Capacity Utilization, est. 70.3%, prior 68.6%; Manufacturing (SIC) Production, est. 3.0%, prior 7.2%

- 9:45am: Bloomberg Aug. United States Economic Survey

- 10am: Business Inventories, est. -1.1%, prior -2.3%

- 10am: U. of Mich. Sentiment, est. 72, prior 72.5; Current Conditions, est. 82.3, prior 82.8; Expectations, est. 65.5, prior 65.9

DB’s Jim Reid concludes the overnight wrap

The complete stalemate in fiscal talks won out over better than expected US labour market data yesterday with the S&P 500 (-0.20%) failing to capitalise on Wednesday’s surge. It was the last couple hours of the US session where sentiment appeared to shift however and it coincided with another bear steepening in rates which saw the 2s10s curve jump another +4.4bps to 55.8bps and the highest since June 9th. In fact, 10y yields have risen +21.4bps in the last 7 trading sessions alone after having gone a few months without doing much at all. At the long-end, 30y yields climbed +5.4bps to 1.429% after the market struggled to absorb the largest 30y auction on record in the first sign of indigestion following a busy run of supply.

There was no such struggle for Apple tapping the bond market for the second time since May however, including raising both 30y and 40y bonds, and joining other mega cap and cash rich tech companies like Amazon and Google in raising long-dated debt at ultra-low yields. Credit was slightly weaker yesterday nonetheless with US HY finishing 6bps wider and IG 1bp wider. Elsewhere, the DOW closed down -0.29% though the NASDAQ (+0.27%) did just manage to hold its head above water.

This morning the focus has shifted to China’s July activity data which was slightly disappointing with industrial output rising by +4.8% yoy (vs. +5.2 yoy expected) while retail sales printed at -1.1% yoy (vs. +0.1% yoy expected). Fixed asset investment was in line with expectations at -1.6% yoy and the surveyed jobless rate was unchanged at 5.7%. The Shanghai Comp has given up early gains to trade -0.16% following that while the Hang Seng is -0.19%. The biggest decline has come for the Kospi (-1.63%) following a tick up in virus cases (more on that shortly). There’s better news for the Nikkei (+0.13%) and ASX (+0.56%). S&P 500 futures are largely unchanged.

Back to yesterday, and the data did its best to help risk in the early going with the stronger-than-expected weekly initial jobless claims print in the US, which fell below a million for the first time since the pandemic started. They came in at 963k (vs. 1.1m expected) in the week through August 8, and the report added to hopes that the labour market recovery is continuing into August. This optimism was supported by the continuing claims reading which came in at 15.486m (vs. 15.8m expected), which is its lowest since early April. Nevertheless, to put this progress in some perspective, it’s worth noting that the worst week following the GFC saw initial claims of “only” 665k, so we’re well above that level even now, with a long way to go before we reach pre-Covid normality once again.

In terms of the latest on the stimulus, it was more of the same with House speaker Nancy Pelsoi saying she didn’t know when the next talks with Republicans would take place. Bostic became the latest Fed official to weigh in, saying “I’m hopeful we will see more relief efforts out there to provide that support”. As for the latest on the virus, US cases rose by 53,483 in the past 24 hours (+1.0%) while Florida’s governor warned that more Covid-19 deaths may be coming at nursing homes and assisted-living facilities. Across the other side of Atlantic, Germany recorded the highest number of new cases (1,422) in more than three months, as cases also continue to rise in France (2,669) and Spain (7,550). Meanwhile, the UK imposed a mandatory quarantine requirement for 14 days on travellers from France, the Netherlands and four other countries while at the same time in England theatres, casinos and beauty parlours are allowed to reopen. In Asia, South Korea reported a surge in new cases of 103, almost double from a day prior. New Zealand also recorded 12 new confirmed cases in the past 24 hours with 2 being outside of Auckland.

As for European markets yesterday, sovereign debt lost ground across the continent. 10yr bund yields climbed +3.5bps to reach a one-month high, while 10yr yields on OATs (+4.9bps) and BTPs (+5.0bps) also saw sizeable moves higher. In light of this recent sell-off, our global head of rates research, Francis Yared, wrote in a blog post yesterday that it’s not overdone yet, and there is scope for the correction to continue. He writes that since risky assets are moving in line with rates, financial conditions are holding up, so there’s no reason for central banks to lean against the repricing. Looking forward beyond the correction from stretched valuations however, their view is that a sustained trend higher in rates would require either medical progress on the coronavirus, or a positive resolution in the fiscal negotiations. See the full note here.

Elsewhere, oil prices also came down from their post-pandemic highs, with both WTI (-1.01%) and Brent crude (-1.03%) experiencing declines. The moves came after the International Energy Agency reduced their forecasts for oil demand this year by 140,000 barrels/day, the first downgrade in several months. Their 2021 demand estimate was also revised down by 240,000 barrels/day. Elsewhere in the commodities sphere, gold continued its recovery with a +1.98% advance, with silver also up +7.81%.

In other news, and ahead of the resumption in negotiations next week in Brussels, we got a couple of Brexit headlines yesterday. The first came from the UK’s chief negotiator, David Frost, who tweeted that “Our assessment is that agreement can be reached in September and we will work to achieve this if we can.” The transition period concludes at the end of the year, but with time needed to ratify any agreement, this means that the effective deadline is earlier, and the EU’s chief negotiator, Michel Barnier, has previously pointed to October as the deadline for an agreement. Meanwhile, Prime Minister Johnson met with Irish Prime Minister Martin yesterday, with Martin saying that “It seems to me that there is a landing zone if that will.

Looking at the day ahead, we will get France’s final July CPI and Euro area’s June trade balance, preliminary 2Q employment and preliminary 2Q GDP. In the US, July retail sales advance, preliminary 2Q nonfarm productivity and unit labour costs, July retail sales, July industrial and manufacturing production, preliminary August U. of Michigan sentiment survey are all due.

via ZeroHedge News https://ift.tt/2CwJeGc Tyler Durden