Gold Jumps, Dollar Dumps As S&P Ends “Shortest Bear Market In History”

Tyler Durden

Tue, 08/18/2020 – 16:02

…and just like that, it was all over. The S&P 500 ripped up to new record intraday highs at the open this morning – erasing all signs of the dismal economic reality – before plunging (no immediate catalyst for that drop) which was then let with the now ubiquitous armada of liquidity dip-buyers, lifting it back to record highs…BUT the late-day weakness almost left the S&P back below its record close at 3386.15, but the last second saved it…

This completes the end of the shortest bear market in US history.

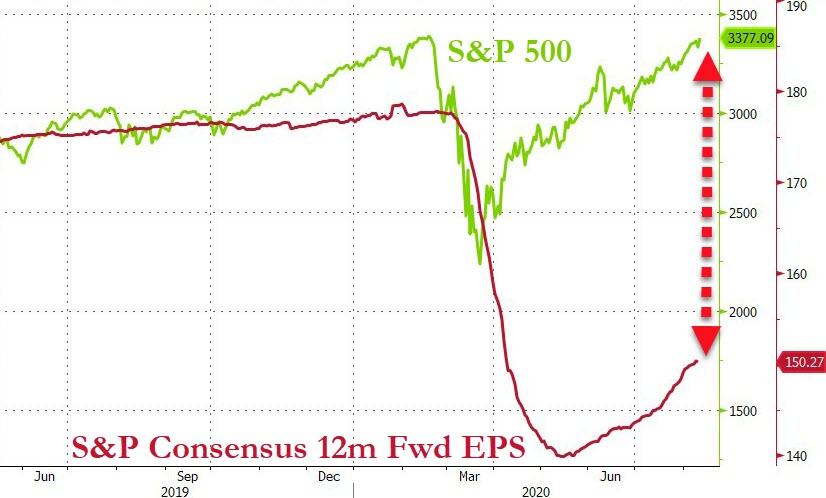

Of course, the S&P’s resurgence to record highs “proves” that everything will be awesome because markets are “forward-looking” things, right? Just Like in February 2020 and October 2007? All of which is distracting from this shitshow…

Source: Bloomberg

And then there’s this…

Source: Bloomberg

Nothing to see here, move along…

On the day, Nasdaq dramatically outperformed as Small Caps lagged (the un-rotation rotation is over)…

And Money Flow drastically diverged lower as stocks rebounded…

Source: Bloomberg

The Russell 2000 triggered a ‘Golden Cross’ today (50DMA crosses above the 200DMA)…

Source: Bloomberg

KODK exploded higher today amid a short-squeeze but quickly fell back…

And TSLA soared above $1900..

Momo continued to recover from the brief reflation drama rotation…

Source: Bloomberg

Treasuries were bid today with the long-end outperforming (30Y -4bps, 2Y -1bps)…

Source: Bloomberg

The dollar was monkey-hammered for the 5th day in a row to a new cycle low today, accelerating lower after it appears a deal is imminent in Washington over stimulus (and that means another $1.5 trillion in debt)…

Source: Bloomberg

The dollar is back at its lowest since May 2008…

Source: Bloomberg

Gold managed solid gains on the day, with futures back above $2,000 (but not before the standard pukefest slam effort)…

Silver followed a similar path, with futures back above $28…

Cryptos suddenly tumbled (along with everything else) this morning, before bouncing back to $12,000…

Source: Bloomberg

On the week, Ethereum is worst and Litecoin best among the bigger coins…

Source: Bloomberg

Finally, Nasdaq Breadth is diverging (bearishly) from the index.

As Bloomberg notes, the share of members trading above their key 50-day moving average has been on the decline since peaking at 99% at the end of May. This means that the largest of the large-cap tech stocks are driving the momentum, which could be an ominous sign if they become too overvalued. It didn’t end well the last time.

Source: Bloomberg

Mainstream media seems oddly quiet about the dramatic slowdown in the rise of US COVID cases…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3kVbMKI Tyler Durden