Apartment Boom & Bust, Where It’s Happening And Not

Tyler Durden

Wed, 08/19/2020 – 15:30

Authored by Mike Shedlock via MishTalk,

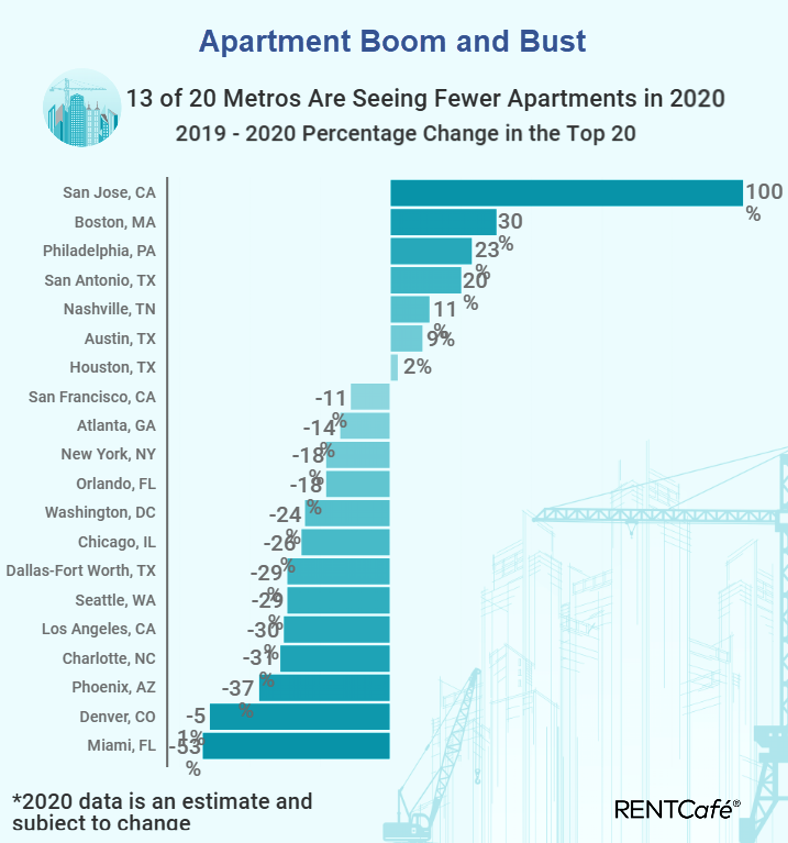

Apartment building is down 12% in 2020. 13 of 20 top metro area are in decline.

Five-Year Low Nationally

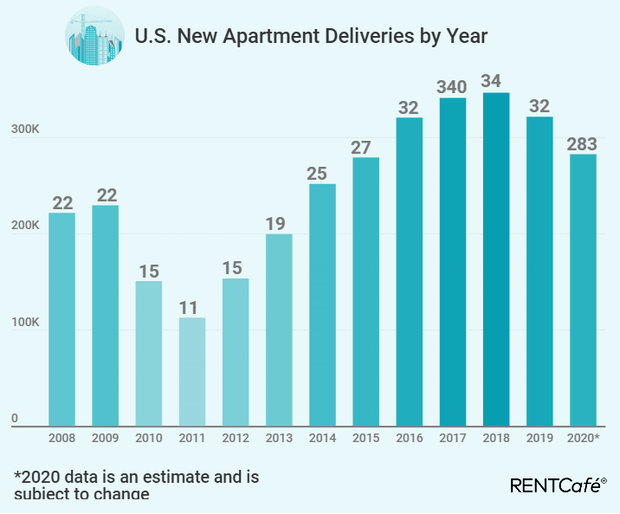

Apartment Construction in 2020 is at a five-year low nationally, Down 12% From 2019.

With the Covid-19 pandemic further complicating an already visible slowdown in apartment construction since its 2018 peak, new completions across the country are starting to mirror the downward trend following the 2008 crisis. According to Yardi Matrix, 283,114 new apartments are expected to be completed this year, a significant drop of 12% compared to 2019. The data refers to rental apartments in large-scale buildings of 50 units or more.

New Construction 2008-2020

Top Metro Areas

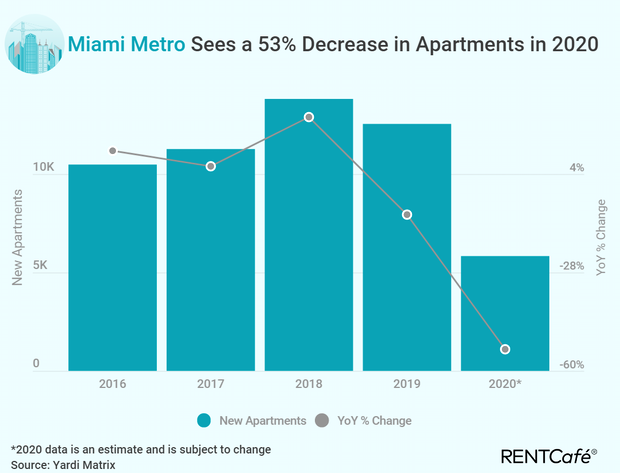

Miami Bust

Boom and Bust Highlights

-

With 283,000 new units expected to hit the market this year, apartment construction dropped a significant 12% compared to 2019. The pandemic further complicates an already visible slowdown in apartment construction, bringing the supply of new apartments at a 5-year low in 2020.

-

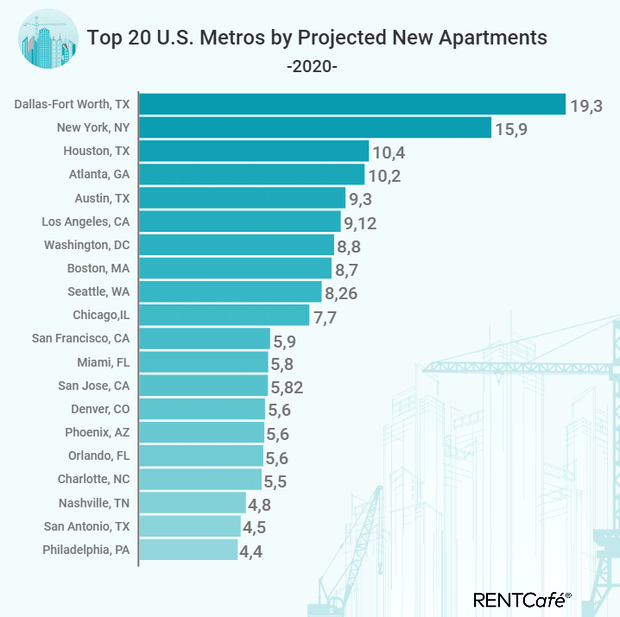

Overshadowing New York metro for the third consecutive year, the Dallas-Fort Worth area is first in the nation in terms of apartment construction, set to complete 19,300 new units by the end of 2020.

-

13 of the 20 most active large metros are expected to complete fewer units compared to last year. Miami metro is experiencing the biggest drop, 53%, down from a whopping 12,500 deliveries in 2019.

-

The San Jose metro area leads the only 7 large metros projected to build more this year, with a 100% increase in new apartments. Despite doubling its apartment construction, Silicon Valley is adding a relatively low number for a giant tech hub, 5,800 units.

-

At the city level, Austin is leading nationwide with the most apartment completions in H1, 3,800 apartments, followed by San Antonio, Denver, and Charlotte. Brooklyn rounds up the top 5, having delivered around 2,100 units, on par with Chicago.

In those areas where construction is artificially low rental prices will soar.

But in those areas subject to human flight, prices could crash. Illinois, NYC, and San Francisco are leading candidates of the latter.

via ZeroHedge News https://ift.tt/326yhDY Tyler Durden