Apple Hits $2 Trillion Market Cap

Tyler Durden

Wed, 08/19/2020 – 10:52

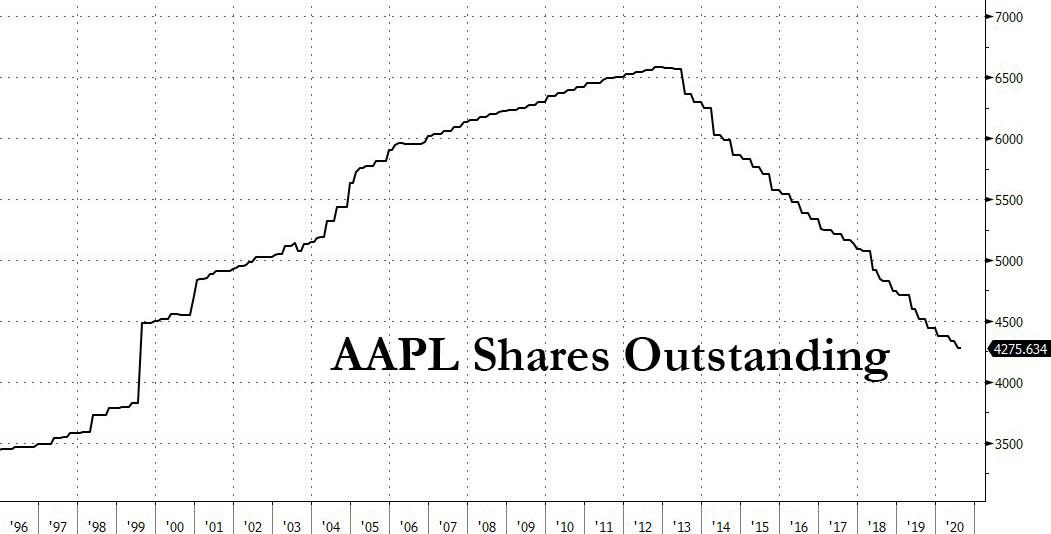

With the “magical number” at $467.73, which is the price per share at which Apple would reach a $2 trillion valuation based on its current shares outstanding of 4,275,634,000, moments ago AAPL hit an all time high of $467.97, pushing it into historic territory, with a market cap of just over $2 trillion.

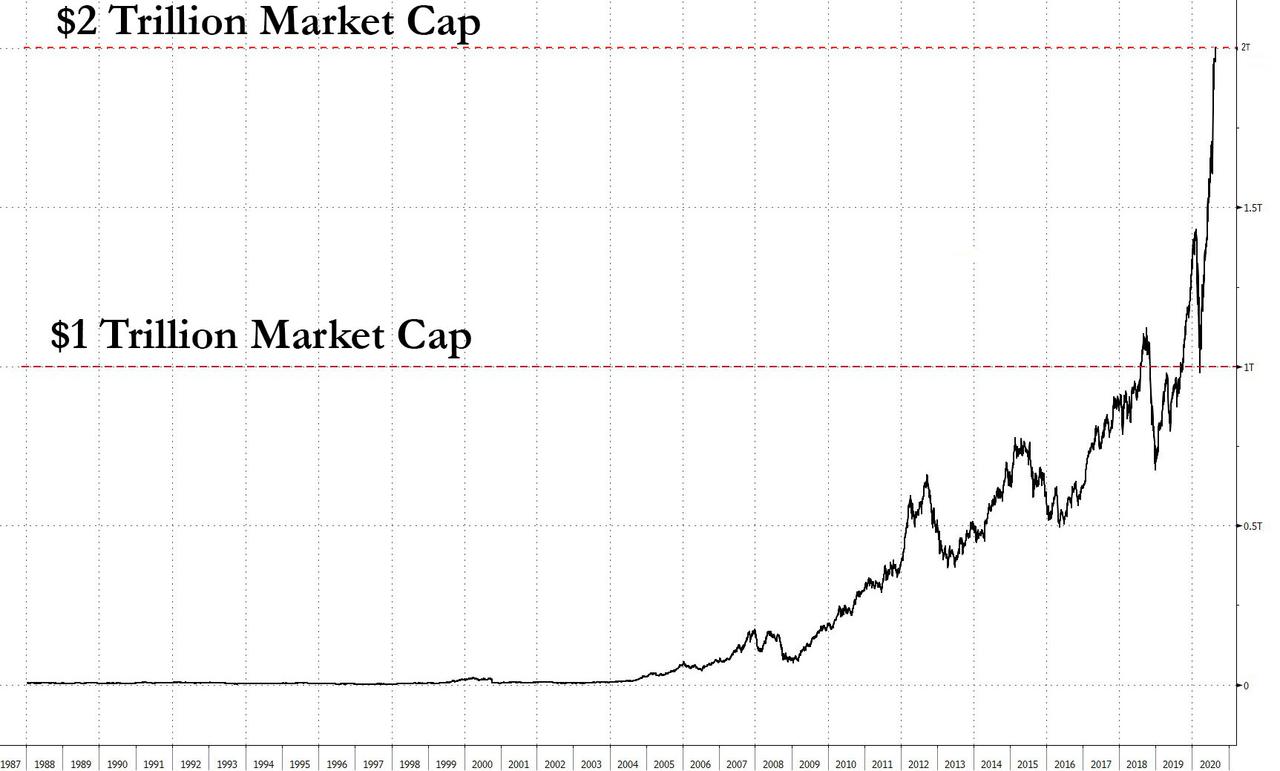

This means that while it took Apple 38 years to hit its first $1 trillion in market cap in August 2, 2018 since its December 12, 1980 IPO (at $22/share which on a split adjusted basis comes to $0.39), it took just two years to go from $1 trillion to $2 trillion, largely thanks to a unprecedented 59% gain this year, with AAPL’s market cap hitting $1 trillion during the mid-March crash.

Apple is followed by Amazon.com and Microsoft, the second and third largest U.S. stocks, both of which have market caps just under $1.7 trillion.

As the FT notes, Saudi Aramco briefly hit the $2 trillion milestone last December, on the day after its initial public offering, but its shares subsequently closed below the $2tn dollar mark. Aramco’s stock market fortunes have waned since its IPO to trade at a market valuation of around $1.8tn, and Apple surpassed it last month.

While Apple’s trillion-dollar milestone was first surpassed in August 2018, Neil Campling, an analyst at Mirabaud Securities, has noted that its share price has doubled since its low point in March this year, when panic about the coronavirus pandemic swept Wall Street.

“Adding a trillion in four or five months — that’s really quite unbelievable,” Mr Campling said. “We have in a very quick period of time for Apple gone from a discount valuation to the market to a premium valuation.”

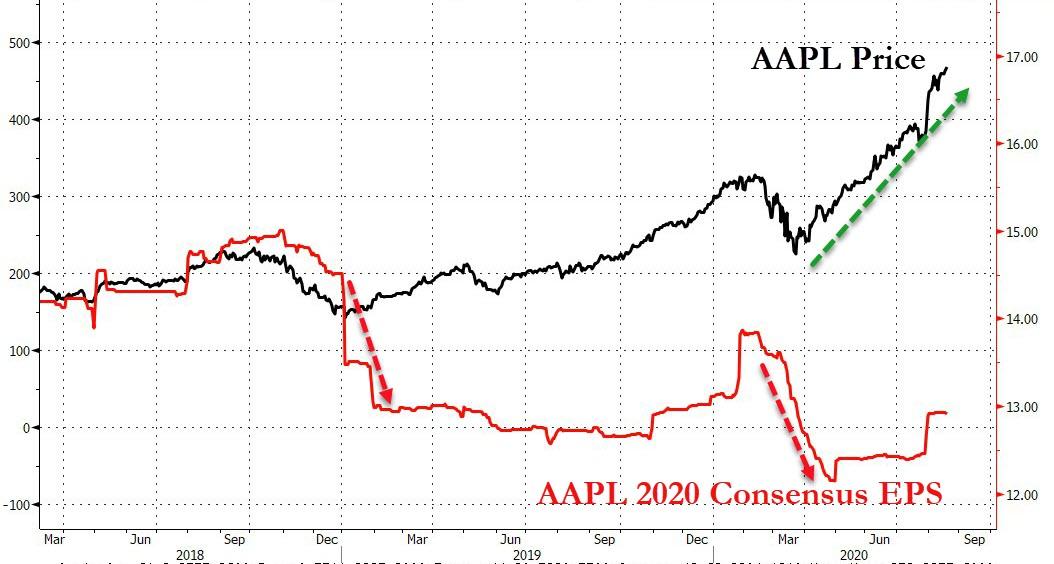

Do Apple’s fundamentals justify this mindblowing ascent? Well, here is the company’s consensus EPS – you decide.

The valuation is “a milestone, but in terms of its ultimate impact, it is just a number,” said Logan Purk, an analyst at Edward Jones, who said it was more psychologically than fundamentally significant. Speaking to Bloomberg, Purk reiterated his hold rating on Apple shares, recommending that “new money look elsewhere in the tech space” for better opportunities. For Apple, “the big catalysts are fairly well priced in, the 5G iPhone especially,” meaning that “there aren’t a lot of stones left unturned.”

Furthermore, at the pace AAPL is repurchasing its stock – with over 2 billion shares or more than a third of its float repurchased in the past 7 years – which implies that the current shares outstanding have declined by about 50MM in the current quarter to 4.225 billion, the real $2 trillion price equivalent number is likely around $473 per share….

… but for the sake of market record soundbites, this will do.

via ZeroHedge News https://ift.tt/3aBEBHt Tyler Durden