Another Market Top Indicator: Paul Ryan Is Launching A $300 Million SPAC

Tyler Durden

Thu, 08/20/2020 – 13:50

The similarities with the housing bubble boom-bust are growing by the day. Not only are stocks at all time highs, to which we can now add record low yields and an all time high gold price as the 10Y real yield has dropped to an unprecedented minus 1% all time low sparking rampant risk-on euphoria among the retail investing community, but over the past year there has also been a veritable explosion of “blank check” companies which are shell companies that have no operations but plan to go public with the intention of acquiring or merging with a company with the proceeds of the SPAC’s initial public offering.

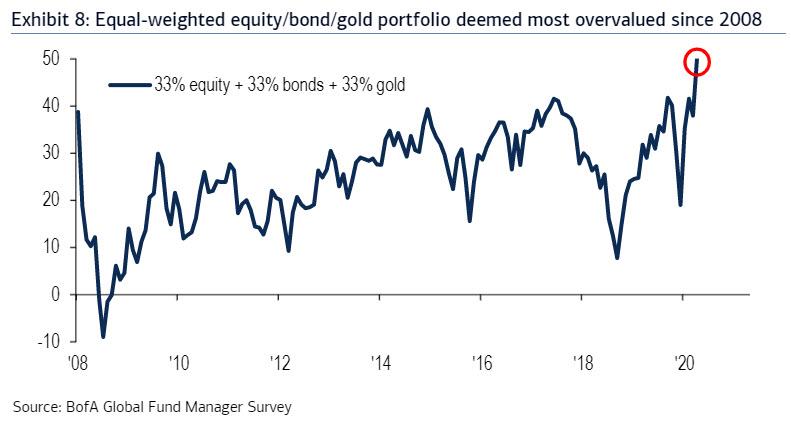

As we discussed three weeks ago, investment in SPACs usually surges near market peaks, when there is broad consensus among the professional investing community that equities are overvalued as there is now – as a reminder the August Fund Manager Survey from BofA found that a record 78% of Wall Street professionals believe that not only stocks but every other assets is the overvalued on record.

The last time we saw such a surge in SPACs? 2007, just before the housing/credit bubble crashed and Lehman defaulted.

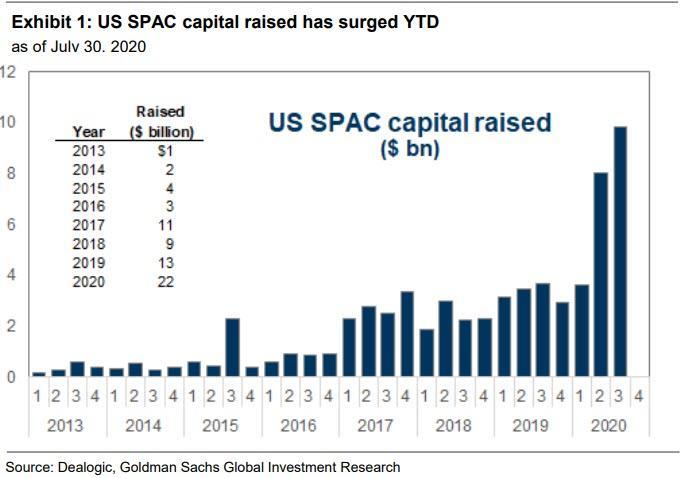

And while the SPAC bubble burst in 2008 along with the rest of the housing/credit bubble, it has now completely recovered, and as Goldman’s David Kostin showed in a recent Weekly Kickstart, SPAC capital raising has soared YTD.

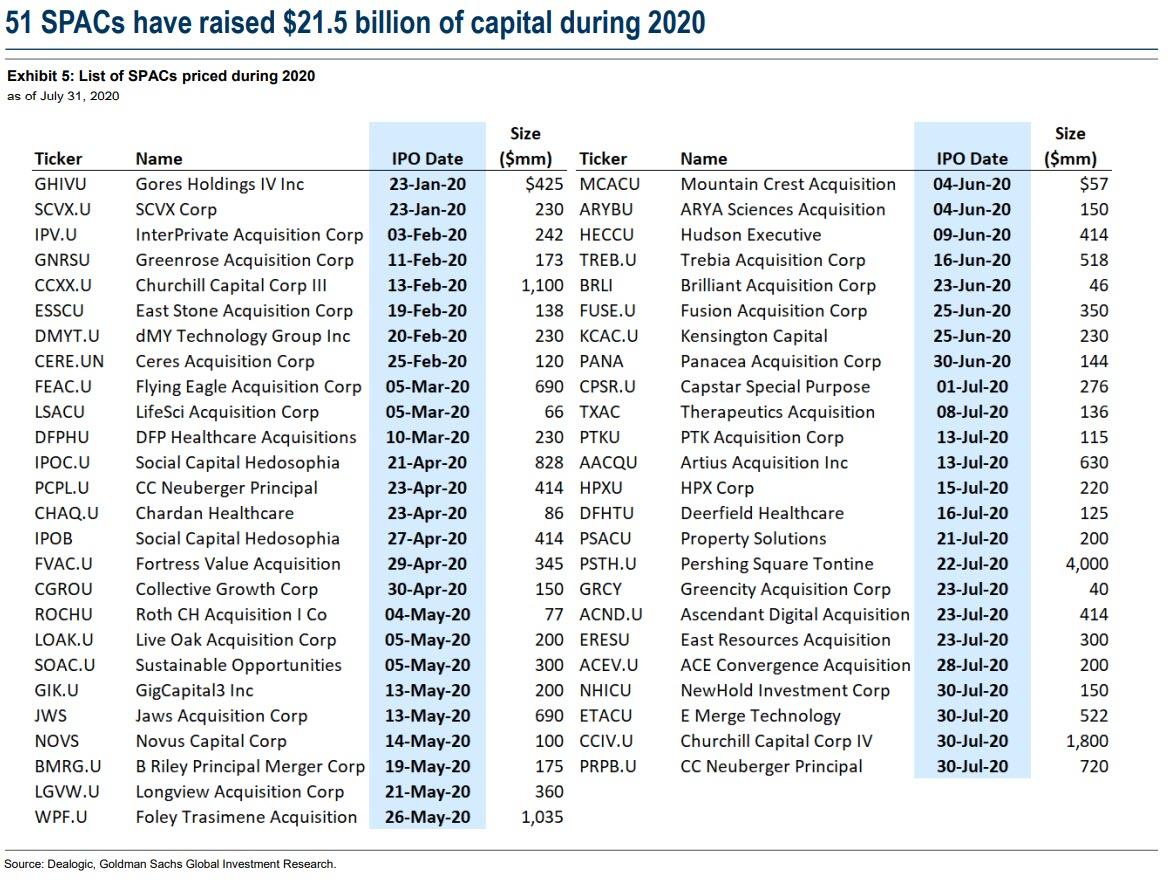

For those who missed it, some statistics: since the start of 2020 through the end of July, 51 SPAC offerings have been completed raising $21.5 billion, up 145% from the comparable year-ago period. In 2019, 51 SPAC IPOs were completed totaling $13.2 billion and 2018 witnessed 35 offerings for $9.3 billion. SPACs have accounted for one-third of all US IPO activity since the start of 2019. Completed SPAC offerings currently searching for acquisitions exceeds $38 billion.

Well, to this “blank check” frenzy we can now add the consummate smooth-talking politician and former vice-presidential candidate, Paul Ryan, who according to Dow Jones is also “jumping into the rush on Wall Street toward blank-check acquisition companies.”

According to the report, the former Republican House speaker will serve as chairman of a SPAC known as Executive Network Partnering which will seek to raise roughly $300 million in an initial public offering.

While SPACs have been all the rage among Wall Street icons including Bill Ackman and Chamath Palihapitiya, Ryan is the first prominent politician to join a surge this year in the creation of blank-check companies.

And now that the fusion of Wall Street and K Street has been tapped, expect a flood of other US politicians hoping to capitalize on the biggest stock bubble in history which their total dysfunction made possible as it left the Fed in charge of virtually every aspect of the US economy.

via ZeroHedge News https://ift.tt/3aJUKe4 Tyler Durden