“Extreme, Ill-Considered Views” – 38 Fed Alum Urge Senate To Reject Judy Shelton Nomination

Tyler Durden

Thu, 08/20/2020 – 14:47

Is the establishment panicking at the nomination of someone that dclearly thinks for herslf and refuses to accept as writ the groupthink of The Federal Reserve?

Judging by the wording of the following open-letter to The Senate urging Shelton be rejected, because her “views are so extreme and ill-considered as to be an unnecessary distraction from the tasks at hand,” and of course, the fact that she has not publicly disavowed the President as #OrangeManBad:

” She has advocated for a return to the gold standard; she has questioned the need for federal deposit insurance; she has even questioned the need for a central bank at all. Now, she appears to have jettisoned all of these positions to argue for subordination of the Fed’s policies to the White House – at least as long as the White House is occupied by a president who agrees with her political views. “

Here is the letter (emphasis ours):

Dear Senators:

President Trump has nominated Judy Shelton to one of the vacancies on the Board of Governors of the Federal Reserve System. The nomination recently cleared the Senate Banking Committee and will soon reach the Senate floor. We urge the Senate to reject this nomination.

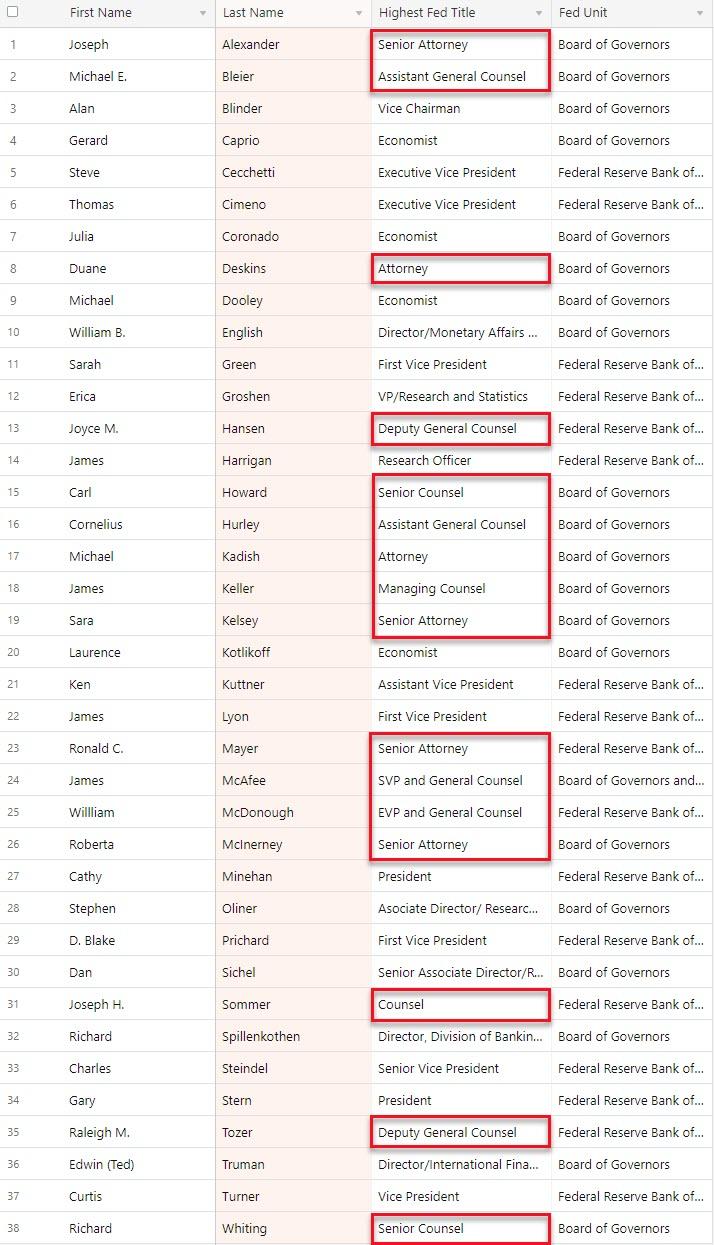

The undersigned all served on the staffs of either the Board of Governors or the Federal Reserve Banks. We have served in various capacities as economists, lawyers, bank supervisors, and in other professional capacities. We know and appreciate the unique position of the Federal Reserve in our nation’s economy and the need to preserve its nonpartisan approach to its many responsibilities.

The Federal Reserve is a vital part of our government and has been particularly important during our current crisis. The COVID-19 pandemic has required the suspension of much of the nation’s and the world’s economic activity. The Fed’s quick action to provide the markets with the necessary liquidity was crucial to restoring order to those markets and ensuring that the economic crisis that we are enduring did not become much, much worse. However, like the pandemic, the economic challenges persist.

Ms. Shelton has a decades-long record of writings and statements that call into question her fitness for a spot on the Fed’s Board of Governors. She has advocated for a return to the gold standard; she has questioned the need for federal deposit insurance; she has even questioned the need for a central bank at all. Now, she appears to have jettisoned all of these positions to argue for subordination of the Fed’s policies to the White House — at least as long as the White House is occupied by a president who agrees with her political views.

The Fed has serious work ahead of it. While we applaud the Board having a diversity of viewpoints represented at its table, Ms. Shelton’s views are so extreme and ill-considered as to be an unnecessary distraction from the tasks at hand.

The late Chairman Paul Volcker was noted for advising new governors that “when you enter this building, you leave your politics at the door.” Sound advice that, from her record, Ms. Shelton is incapable of following.

We urge the Senate to reject her nomination.

The signatories are mostly lawyers…

In an attempt to provide some balance, here is The Mises Institute’s Robert Aro explaining the reason why the establishment hates Judy Shelton…

Imagine if a member of the Federal Reserve’s Board of Governors said the following :

“When governments manipulate exchange rates to affect currency markets, they undermine the honest efforts of countries that wish to compete fairly in the global marketplace. Supply and demand are distorted by artificial prices conveyed through contrived exchange rates.

Or something honest like:

“The Fed should focus on stable money as a key factor in economic performance. Given that central banks today are the world’s biggest currency manipulators, it’s imperative that the next chairman prioritize the integrity of the dollar.”

And what if they showed an understanding of both history and sound money principles with something intelligent:

“For all the talk of a “rules-based” system for international trade, there are no rules when it comes to ensuring a level monetary playing field. The classical gold standard established an international benchmark for currency values, consistent with free-trade principles.

While she’s not a governor yet, the quotes were from Trump’s appointee Judy Shelton, approved this week by the Senate banking committee on party line at a vote of 13-12. To be nominated to the board of directors, Ms. Shelton will now be put forward to be voted on by the full senate, 53 of the 100 being Republicans.

Yet below, we can see everything wrong with the Mainstream Media (MSM), mainstream economists, and American politics starting with theNew York Times article entitled, God Help Us if Judy Shelton Joins the Fed. Former counselor to the Treasury secretary during the Obama administration, Steven Rattner began with :

Trump’s latest unqualified nominee to the Federal Reserve Board must be rejected.

The defaming article shows Mr. Rattner has no care nor understanding of economics. According to him, Ms. Shelton is known for taking “long-discredited positions in the monetary system,” referring to the gold standard, as he claims it was the “culprit in deepening the Great Depression.” Clearly he is no fan of (or perhaps isn’t educated enough to have heard of) Mises or Rothbard.

In what some may described as laudable on Ms. Shelton’s behalf, Mr. Rattner, fueled by ignorance, continues:

Among other heretical stances, she has supported the abolition of the Federal Reserve itself, putting her in a position to undermine the very institution she is being nominated to serve.

A similar tone was found in the National Review, a magazine which defines itself using the highly nebulous and ill-defined “modern conservative movement.” Going back several months the “controversy” surrounding Judy Shelton was shared in an oxymoronic write-up called: The Wrong Kind of ‘Intellectual Diversity’ at the Fed. It is nothing more than a rant showing the senior editor also knows little about history or economics, but being in a position to publish, does so with a vociferous opinion. He begins with the usual appeal to popularity:

First, she has been a single-minded advocate of a policy that most economists rightly reject: the revival of the gold standard.

What is popular is not always true, especially regarding economics. The article cites quotes from 2009 to the Wall Street Journal in an attempt to discredit her by showing she has not always been consistent in her stances over the span of the past decade. By contrast, the rant implies all other members of the Fed and economists have.

Unfortunately, some people claim to like diversity, but not when it’s different from their own bias. The senior editor who wrote the hit piece can be found on twitter.

Unlike the New York Times and National Review, surprising as it may seem, CNBC’s position was more neutral when discussing the senate hearing, noting :

She faced persistent and at-times hostile questions about her support for the gold standard, her beliefs on whether bank deposits should be insured and whether the Fed should be independent of political influences.

Last but not least, the Wall Street Journal wrote it best , much to the chagrin of its rivals:

the news write-ups inevitably described her with adjectives like “controversial.” She should take it as a badge of honor, given how she would provide needed intellectual diversity at the Fed.

Only in a world this backwards where, in a supposed free country, socialism is considered good and capitalism bad that Shelton could receive so much scorn. To think, 1 out of 7 members of the board could have ideas other than inflationist dogma but they would be shunned for speaking up, says a lot of the society in which we are living. Perhaps the real reason is, if appointed, it could set Judy Shelton in line to the position of Federal Reserve Chair?

Ironically enough, as long Congress stays partisan, we may see her in one of the most powerful central banking positions in the world. It won’t “End the Fed” overnight, but maybe it’s one step closer!

And finally, as Mark Hendrickson concludes, Shelton is 100 percent correct when she questions why a dozen people (the Federal Reserve Board of Governors) should set the prices of capital (interest rates) any more than they should set the price of cars, houses, or bubble gum.

Markets can do that and do it better – as they did before there even was a Federal Reserve system. Shelton opposes policies that would be more at home in a centrally planned economy. That alone is reason enough to confirm her.

via ZeroHedge News https://ift.tt/2YjygLM Tyler Durden