How Fear And Uncertainty Drives Demand For Gold

Tyler Durden

Thu, 08/20/2020 – 15:26

Authored by Darren Brady Nelson via The Mises Institute,

Even those in the nonfinancial media have noticed the skyrocketing price of gold this year. Some partially identify, but don’t quite understand, some of the many (and more measurable) intermediary effects in the chain of causation such as a “weakened US dollar” and “low bond yields.” Those in the financial press add to these factors with ones like “central bank reserves” management, along with mining production and “jewelry and industrial demand.”

One mainstream headline surprisingly hit closest to the mark regarding the few (and less measurable) underlying causes: “Fear and Cheap Money Send Gold Price Soaring.”

But the chief cause for this and all major rises in gold prices is not “fear and” but fear of cheap money.

In a 2013 interview titled “What Is Key for the Price Formation of Gold?,” Robert Blumen makes the following seven key points, not only for then, but for today and the foreseeable (fiat money) future:

-

“There might be a statistical correlation between, for example, a net inflow into one sector and higher (or lower) prices. If someone has a statistical model that works, that is great. But it’s not causal. But it seems to me that even if someone has discovered correlations like that, they will be coincident with the price, rather than predictive. In order to forecast the price, you need an indicator that moves in advance of the price.”

-

“[There] is [a] vast amount of brainpower that goes into quantifying gold flows into market segments, such as industry, jewelry, coins, and funds. These quantities may be interesting for some purposes, but they’re not really that relevant if what you’re trying to do is understand the gold price, because there is not a connection between quantities and price in the way that most people think there is.”

-

“The gold market is not segregated into one market for the gold that was mined this year and another market for gold that was mined in past years. The buyer doesn’t care whether he’s buying a newly mined ounce of gold or buying from somebody who had purchased gold that was mined 100 years ago. All of the buyers are competing to buy and all of the sellers are competing to sell.”

-

“Gold is primarily an asset. It is true that a small amount of gold is produced and a very small amount of gold is destroyed in industrial uses. But the stock to annual production ratio is in the 50 to 100:1 range. Nearly all the gold in the world that has ever been produced since the beginning of time is held in some form.”

-

“In an asset market, consumption and production do not constrain the price. The bidding process is about who has the greatest economic motivation to hold each unit of the good. The pricing process is primarily an auction over the existing stocks of the asset. Whoever values the asset the most will end up owning it, and those who value it less will own something else instead. And that, in in my view, is the way to understand gold price formation.”

-

“Most of the market research about gold deals with exchange demand, which has the advantage that you can measure it. But reservation demand is far more relevant to the price. The profile of reservation demand among people who own gold is the main determinant of the gold price from the supply side….Reservation demand is where you demand something by holding onto it rather than selling it….I have reservation demand at the moment for an auto, a dining room table, a couch, a mobile phone, and so forth.”

-

Thus: “The gold price is set by investor preferences, which cannot be measured directly. But I think that we understand the main factors in the world that influence investor preferences in relation to gold. These factors are the growth rate of money supply, the volume and quality of debt, political uncertainty, confiscation risk, and the attractiveness (or lack thereof) of other possible assets.”

The 2015 book Austrian School for Investors: Austrian Investing between Inflation and Deflation serves as an important complement to Blumen’s work on gold price formation. The four authors are not just Austrians in an economic sense, but literal Austrians from the country of the same name. What follows are five key points from the “Precious Metals” section of chapter 9 on “Austrian Investment Practice”:

1. “The marginal utility of gold declines at a slower rate than that of other goods. It is owing to this superior characteristic that gold and silver enjoy their monetary status, and not their supposed scarcity. Their high marketability represents also their decisive advantage over other stores of value….For this reason, central banks hold gold as a currency reserve, and not real estate, artworks or commodities.”

2. “Most analysts assert that gold has the characteristics of an inflation hedge. There are, however, also critical voices. They opine that there is no statistical correlation between gold prices and price inflation rates, and conclude that the inflation hedge notion is thus a myth. We examined this question and drew the following conclusion: gold does not correlate with the rate of inflation as such, but with the rate of change of the inflation rate.

3. “If gold is already weakening in a period of disinflation, it must be even weaker in a period of deflation. This is however a fallacy. The trend of gold in a deflationary environment has barely been analyzed, not least because there exist only very few examples of deflationary periods….In a period of pronounced deflation, [not only do] government budgets become overstretched [but] trust in the financial system and paper currencies declines, while gold gains in importance due its top-notch credit quality.”

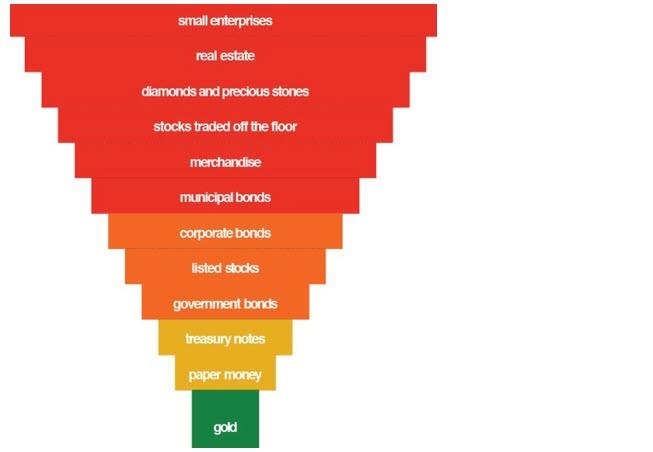

4. “Akin to an hourglass, liquidity in the financial system gradually flows downward as the willingness to take risks declines. At the very bottom is gold. Due to general skepticism, the circulation of gold declines as it is increasingly hoarded. The degree of hoarding is always proportional to the confidence in government and its currency.”

5. “Gold exhibits a very low correlation with most other asset classes, especially stocks and bonds.”

The answer to the question of why gold is skyrocketing is “follow the money printing.” US M0 money supply has been subject to a number of quantitative easing (QE) programs since 2008, pushing money supply growth ever higher.

All this suggests that “fear of cheap money” really is a primary factor in pushing up demand for gold. Such fear increases in times of economic turmoil. Such turmoil is almost always caused, and made worse, by government intervention. In 2020 that includes, not just more QE, but also the chaotic government responses to the coronavirus and civil unrest. But don’t expect economists or investors to agree on all this any time soon. I will end with a quote from an article by economist Bob Murphy:

There’s an old joke that the price of gold is understood by exactly two people in the entire world. They both work for the Bank of England and they disagree.

via ZeroHedge News https://ift.tt/32e4OrN Tyler Durden