“This Is NOT Normal”: A Stunned Morgan Stanley Says Volumes Are “Way Beyond Just Low”

Tyler Durden

Thu, 08/20/2020 – 13:10

While stocks have soared to new all time highs, there has been one aspect about this latest meltup that suggests the rally is built on nothing but hot air (and trillions in Fed liquidity injections of course): the complete lack of volume, prompting some to wonder if the Fed has finally succeeded in ‘killing’ the market. And sure enough, as Morgan Stanley’s Rob Cronin writes in an overnight note, “this is NOT a typical August lull in liquidity.”

The Market Has Died

The MS team points out that volumes across almost all products are way below historic seasonal averages. Which is bizarre because this is on the back of the highest volume Jan-to-July we have seen since 2010 (except single name options where volumes were the worst Jan-July since 2010). As the bank explains, the exaggerated August drop in liquidity (leading to higher impact costs) is driven by:

-

large amounts of trading behind us in 2020

-

spot level in equities ~65% recovered

-

in options, vol levels are still too high for many directional funds.

The exception is cash equities where volumes are only slightly below August norms, bid/offer spreads are not wide and data shows more intraday trading vs. closing auction use than normal – indicative of more active trading in single names, which in turn suggests that retail trading remains solid. The rest of August is likely to remain subdued as seasonally volumes are unlikely to pick up until the first week of September.

Below we republish key excerpts from the MS note:

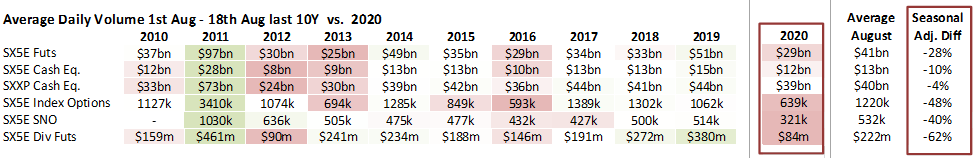

We look at liquidity across 6 products and compare average volumes traded from Aug 1st to 18th from 2010 to now.

-

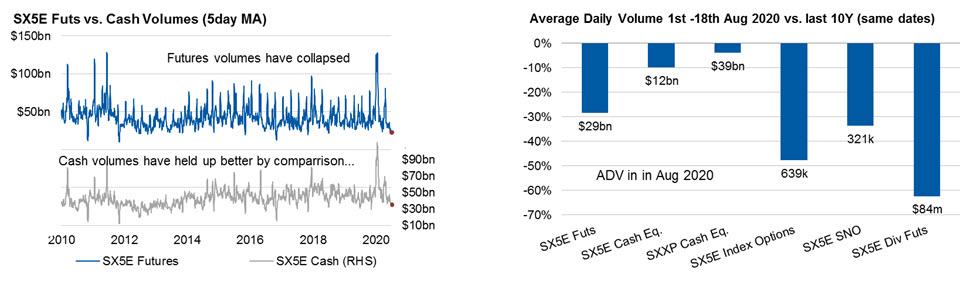

Over the last 10Y, SX5E futures would typically have traded an average ~$41bn a day so far in August. This year it’s just $29bn (-28% lower than normal August levels).

-

SX5E index options traded an average of just 639k contracts/day so far in August, –48% below normal levels. 20d volumes this low were last seen in 2013.

-

From 1st to 18th August 2019, SX5E dividend futures traded $380m/day – this year it’s just $84m (-62% vs. normal Aug levels).

Cash equities stands out as being more ‘normal’, registering volumes that are only slightly below historic norms for this time of year. SX5E traded on average $12bn/day in August (-10% below seasonal norms) and SXXP traded $39bn (-4% below seasonal norms).

Chart on the left breaks out SX5E futs vs. cash volumes (the cash volumes include data across all execution venues). We can see the drop in futures volumes is more pronounced as cash. Chart on the right shows the volume difference from Aug 1st to 18th of 2020 vs. the average of the same period of the last 10Y. The actual ADV for this year is marked on each bar. Again, you can see here the relatively better cash volumes vs. other products for this time of year.

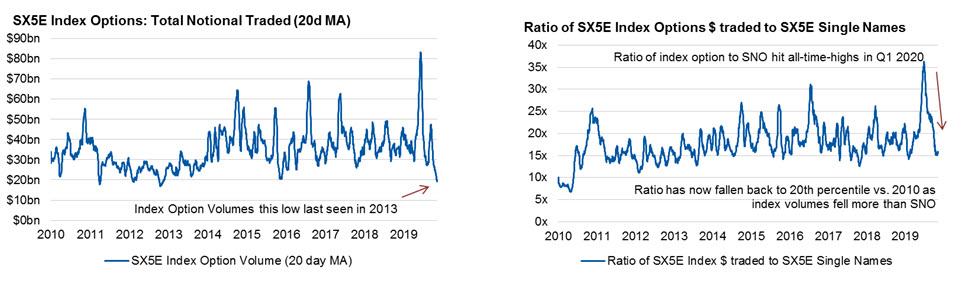

With the exception of dividend futures (where notional traded is typically <0.5% of equity futs), the biggest seasonal drop in volumes has come in SX5E index options where 20d MA volumes just hit levels last seen in 2013 (left chart below). In the last 5 days, we traded $5bn of combined put/call delta per day vs. ~$12bn/day 5Y average. Over-writing programs appear as active as ever, but non-directional volatility selling strategies (var sellers) and directional option users are less active.

Single name options had the WORST Jan-July of volumes since 2010 – totally at odds with other asset classes. In March, the ratio of notional SX5E index option notional volume traded vs. notional traded in SX5E single names reached 37x – a 10Y high (we have adjusted the SX5E single name basket to allow for index rebals through time). The ratio has since fallen to 15x (right chart below) driven by the drop in index. Both SNO and index option volumes are <1st %-ile vs. 2010.

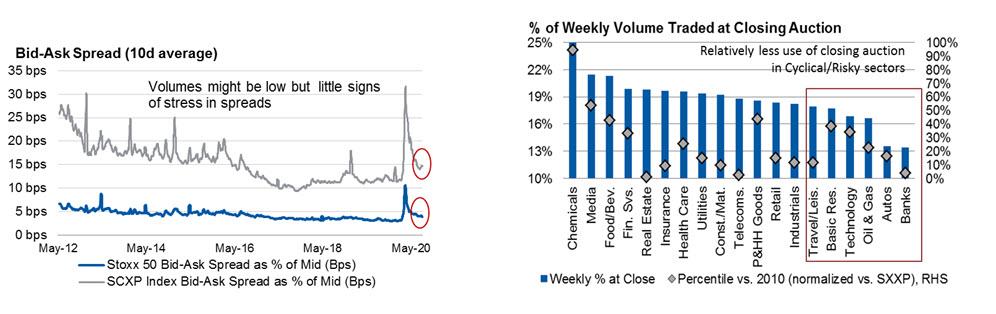

Separately, MS also notes that in Q1 2020, bid offer spreads in cash hit new highs. The average SX5E name traded ~12bps wide at their worst (vs. Jan 1st level of 3bps) while the Small Cap SCXP index names traded as high as 32bps wide (vs. Jan 1st level of 12bps). The good news is that spreads have tightened by ~80% since with the indices now trading 4bps and 15bps wide respectively, which is a “sign of normality in cash”, at least until the next time the market goes bidless.

Finally, at the SX5E/SXXP level, use of the closing auction has fallen sharply in the last month. It’s likely that those trading cash equities are more active/intraday players. This is supported further by the fact that key cyclical sectors are seeing the least use of the auction over the last week (Banks use is just 13%, 1st percentile vs. 2012).

via ZeroHedge News https://ift.tt/34hB93v Tyler Durden