The Market Is “Addicted To Dove” But BofA Sees Troubling Signs Ahead

Tyler Durden

Fri, 08/21/2020 – 15:10

No matter what one throws at it, the stock market – led by a handful of tech stocks – keeps rising and according to BofA’s Chief Investment Strategist the reason is that it has become “addicted to love.“

Writing in his latest Flow Show, the BofA CIO notes that the “unadulterated success of Fed’s “financial repression” is shown via 2020 collapse in volatility, yields, credit spreads, particularly in light of US corporate bond issuance annualizing $2.5tn in 2020 (IG $2.1tn, HY $0.4tn).”

But this addiction can come to an end in just one week if the Fed confirms “peak liquidity” at the August 27th Jackson Hole & Sept 16th FOMC when the key “floors” for MOVE (40), VIX (20), 10-year UST (50bps), HY spreads (500bps), IG spreads (125bps) hold and “peak policy” correction in risk assets occurs. Of course, if Powell says nothing that the speculative mania will continue unabated.

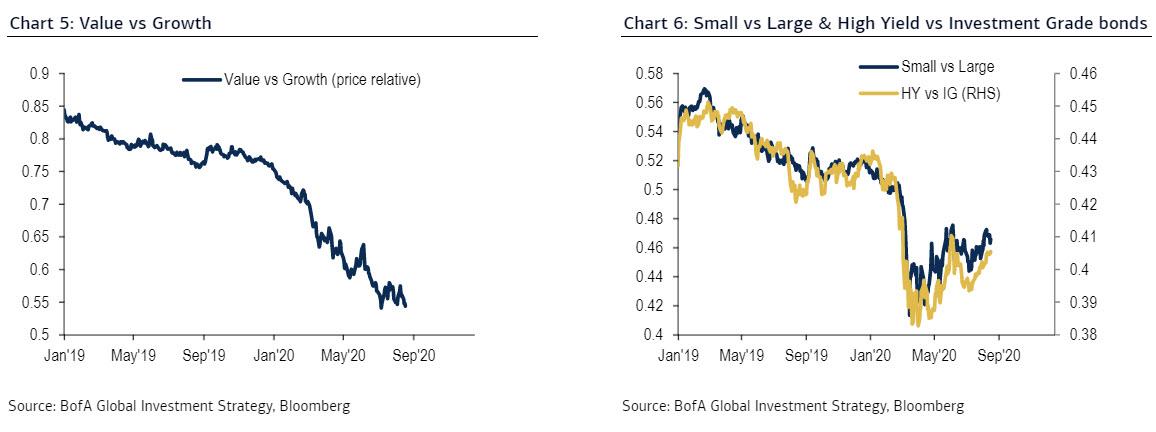

Jackson Hole aside, Hartnett sees an “autumn of Fine-Tuning” where a “messy but obvious Aug/Sept/Oct shift in health/fiscal/monetary policy to “fine-tuning” the trade-off between vaccine & virus, jobs & deaths means the nascent rotation trades (commodities vs credit, HY vs IG, value vs growth, small vs large) have been blunted”…

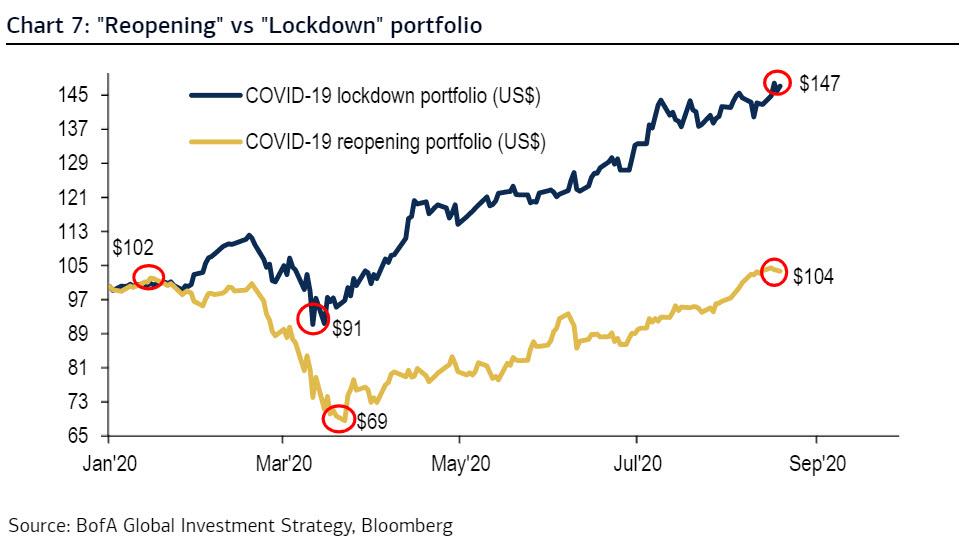

… as the BofA “reopening portfolio” remains in relative trading range with “lockdown portfolio.”

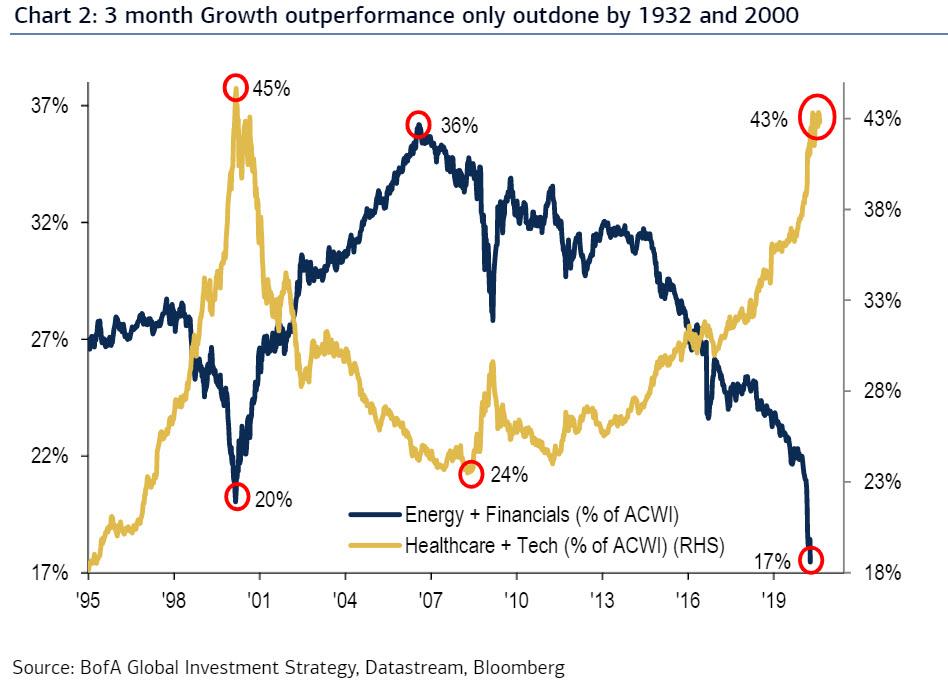

Looking beyond the autumn, the BofA strategist sees further risks due to a bigger picture that is “less positive for growth stocks” – Apple’s market cap ($2tn) almost equivalent to UK FTSE index ($2.2tn); duration of secular bull market in growth>value 6 months away from being longer than the Jul’26 to May’40 growth bull, while the magnitude of growth outperformance Apr-June’20 almost as powerful as the Oct’32 and Jan’00 periods.

Meanwhile, “the exogenous catalysts of 2020” which include 800k COVID deaths, 50mn unemployed, $10tn GDP loss, 173 rate cuts, $8.5tn in QE, that’s $1.6bn/hour will not be repeated in the next 12 months… unless of course there is yet another, even bigger crisis next year.

Looking further ahead BofA sees the bigger picture once again as more positive for value (assuming there are any value investors left) as secular themes of Bigger Government, Smaller World, Dollar Debasement drive Main St inflation: the fiscal stimulus ($12.1tn) is now dwarfing monetary stimulus ($8.5tn), meanwhile the “US dollar in bear market & bear markets of 1970s & 2000s were outperforming decades for EM equities, commodities, small cap, and value stocks, and broken global and local supply chains will cause frictional inflation (vaccine & virus to improve), but wage increases will still be necessary to drive labor back to school and back to office.”

In other words, with everyone and the Fed expecting zero rates for years to come, keep an eye on inflation making a comeback, something which the Fed may hint at as soon as next week.

via ZeroHedge News https://ift.tt/2CNWPsN Tyler Durden