Apple Soars Over $500: Adds Another $65BN In Market Cap On Morgan Stanley Price Target Hike

Tyler Durden

Mon, 08/24/2020 – 08:45

We thought that the Apple levitation would end on Friday ahead of Monday’s 4:1 stock split record date (because in this market stock splits are bullish) which is scheduled to take place on Aug 31, but we were wrong and with AAPL closing just shy of an all time high $500 on Friday, the stock has smashed the psychological barrier of half a grand, rising to $515 this morning, and adding another $65 billion to its market cap after Morgan Stanley raised its price target to a street-high $520 from $431, writing that the stock had more room to run after eclipsing a $2 trillion market valuation.

Apple “trades at a discount to both tech platforms and strong consumer brands,” wrote Katy Huberty, who reiterated an overweight rating on the stock, saying it “has further room to run.” She noted the growth rate Apple has posted in revenue, earnings and free cash flow over the past four quarters despite iPhone revenue declining over the same period.

“On a P/E basis, Apple currently trades at 28.9x, a ~10% premium to other tech and consumer platforms however given Apple’s reporting of only GAAP EPS which isn’t always the case for peers, we believe free cash flow is a better valuation metric for comparing to peers. On an EV/FCF basis, Apple trades at 25.5x, a 2% discount to tech platforms and 10% discount to consumer platforms, which indicates the stock is not as expensive vs. peers and implies the stock has further room to run, in our view.”

“These results underscore the strength of Apple’s broad ecosystem of products and services” and show that AAPL is less reliant on the iPhone.

This is what “not expensive” supposedly looks like:

With today’s gain, AAPL has added a quarter trillion dollars to its market cap in just the past week.

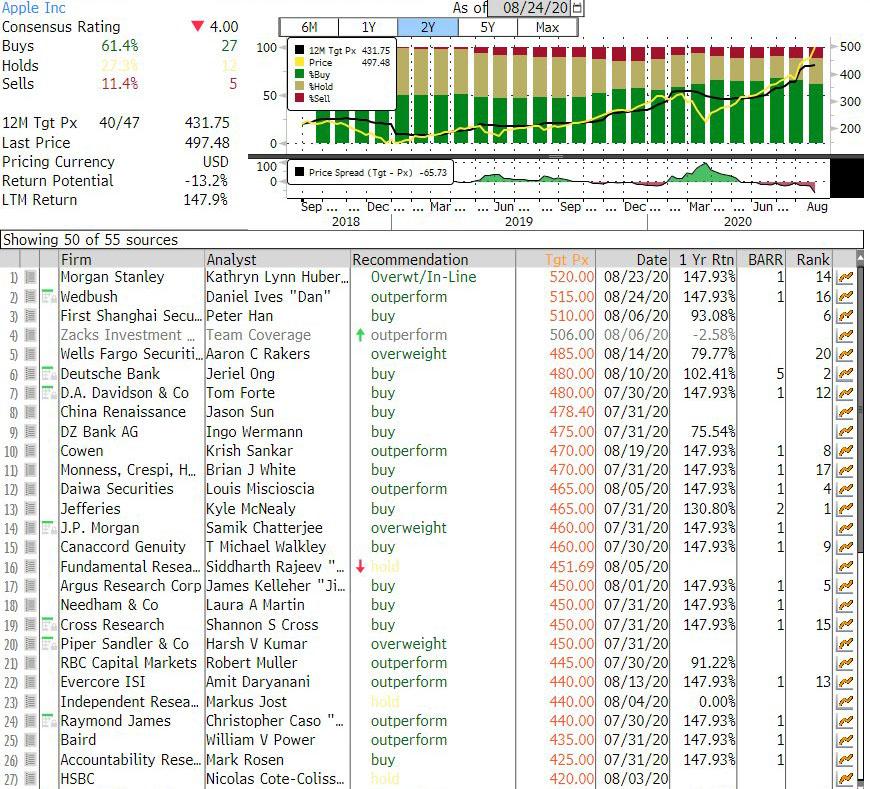

AAPL currently has 27 buys, 12 holds and 5 sells with an average 12 month price target of $431.75, we expect many more sellsiders to chase the unprecedented price action as they seek to justify their pay, especially since AAPL’s price is about to surpass the highest Wall Street estimate at $520 (incidentally, that of Morgan Stanley).

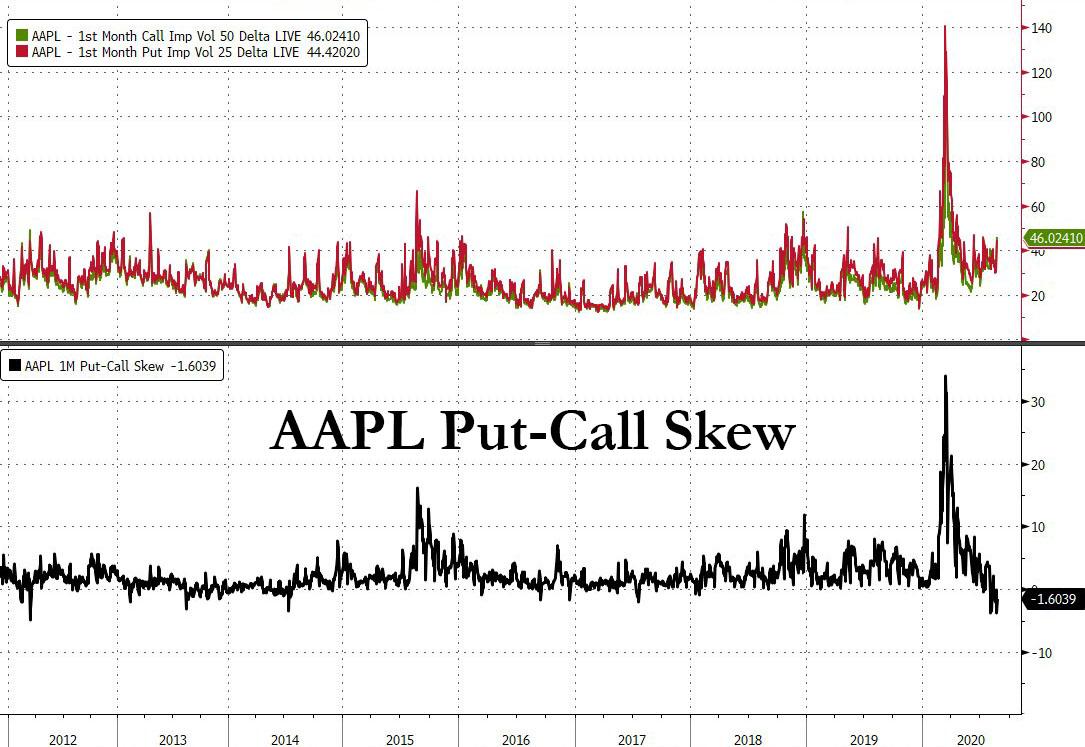

Finally for those asking what is really behind the move, look no further than the next chart which shows that AAPL’s put-call skew is now negative, meaning that the stock has entered that special gamma place where furious call buying pushes the stock higher, resulting in more call buying, leading to even higher prices and so on.

via ZeroHedge News https://ift.tt/3gmRJS4 Tyler Durden