Half Of NABE Respondents Believe Return To 2019 Growth Levels Could Take Years

Tyler Durden

Wed, 08/26/2020 – 12:36

The most important question in all of finance is when the recession will end. The appearance of the strongest market recovery rally in 87 years, would suggest sunny days are ahead for the real economy. Though, the forward-looking market, is too forward-looking, ignoring today’s deep economic scarring and pricing in an economic recovery that could be years away.

A majority of economists believe the US economy could emerge from the virus-induced recession sometime later this year or at some point in 2021, according to Bloomberg, citing a new National Association for Business Economics (NABE) survey.

About half of the respondents surveyed expect the economy to return to 4Q19 GDP activity level sometime in 2022.

Sixty-six percent of respondents said the economy remains in a contraction that started in February, while 80% indicate a 25% probability of a double-dip recession.

In terms of a recession – a ‘V-shaped’ recovery in the real economy this year is becoming a distant dream. It sounds more like government propaganda, one that is routinely pumped by the Trump administration, because, hey, it’s an election year…

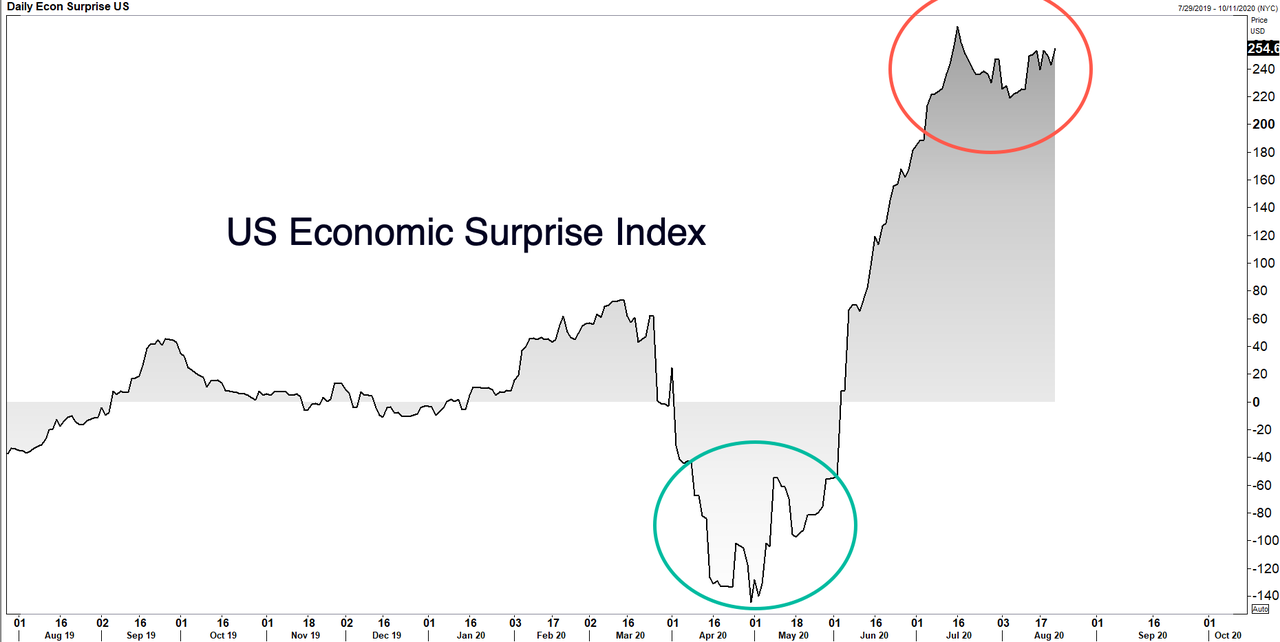

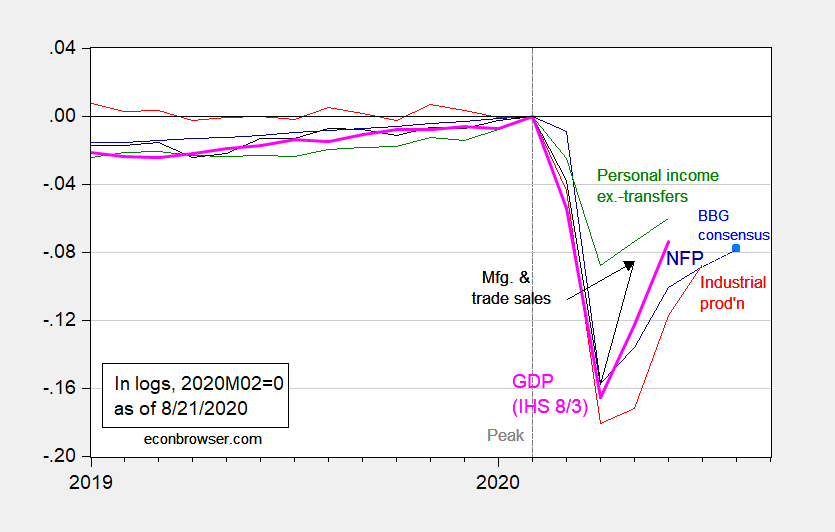

There’s an abundance of economic data out there suggesting the economic recovery is transforming from a ‘V’ to a ‘Nike Swoosh,’ shown below:

The NABE survey also showed many of the respondents believe Congress should pass another round of fiscal stimulus, with 22% indicating the size of the stimulus should be around $1.5 to $2 trillion.

About 40% of respondents grade Congress’ fiscal response as “insufficient,” 37% believe it’s “adequate – while 75% said the Federal Reserve monetary policy response is “about right.”

And maybe fears of a double-dip recession, or at least the belief a ‘V-shaped’ recovery is not in the cards this year as it would take trillions of more dollars of monetary and fiscal stimulus to supercharge the economy once again.

We’ve highlighted the surge in money supply, following the virus-induced lockdowns, unleashed a massive spike in positive economic surprises as tracked by the Citi econ surprise index – though with waning stimulus, positive economic beats appearing to be stalling, suggesting the recovery could reverse.

Even though President Trump signed an executive order to redirect disaster-relief funds to extend supplemental unemployment insurance, implementation has been slow.

Hopes for a ‘V-shaped’ economic rebound continue to diminish.

via ZeroHedge News https://ift.tt/32vHrKr Tyler Durden