The Fed Faces A “Complete Nightmare”: Convincing The Public That Higher Inflation Is Good For Them

Tyler Durden

Wed, 08/26/2020 – 11:55

Yesterday we explained why Bank of America, a contrarian voice among Wall Street banks, believes that hopes for an explicit announcement of Average Inflation Targeting (AIT) by Jerome Powell in his highly-anticipated speech titled “Monetary Policy Framework Review” to be delivered at 910am on Thursday which wraps up an examination of inflation which started in early 2019 among both among central bank officials and the public, will be a disappointment.

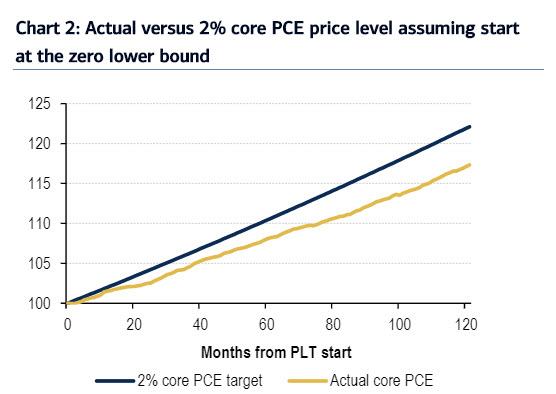

The first reason that an explicit policy would entail picking a specific time period over which PCE inflation is required to average 2% before beginning a policy normalization (hiking) process. This is a problem, because in simulations conducted by the BofA rates team, it found this could in require the Fed to remain on hold for 42 years!

Furthermore, explicit AIT could also cripple the Fed’s already waning credibility, not least of all because “it would also bring up difficult issues around the appropriate time period to calculate averages and the maximum realized inflation rates the Fed would tolerate while the average climbs higher.” Ultimately, BofA concludes that an explicit policy of AIT could greatly complicate both Fed communication and logistics. This would risk a reduction in the Fed’s credibility, which is already vulnerable given:

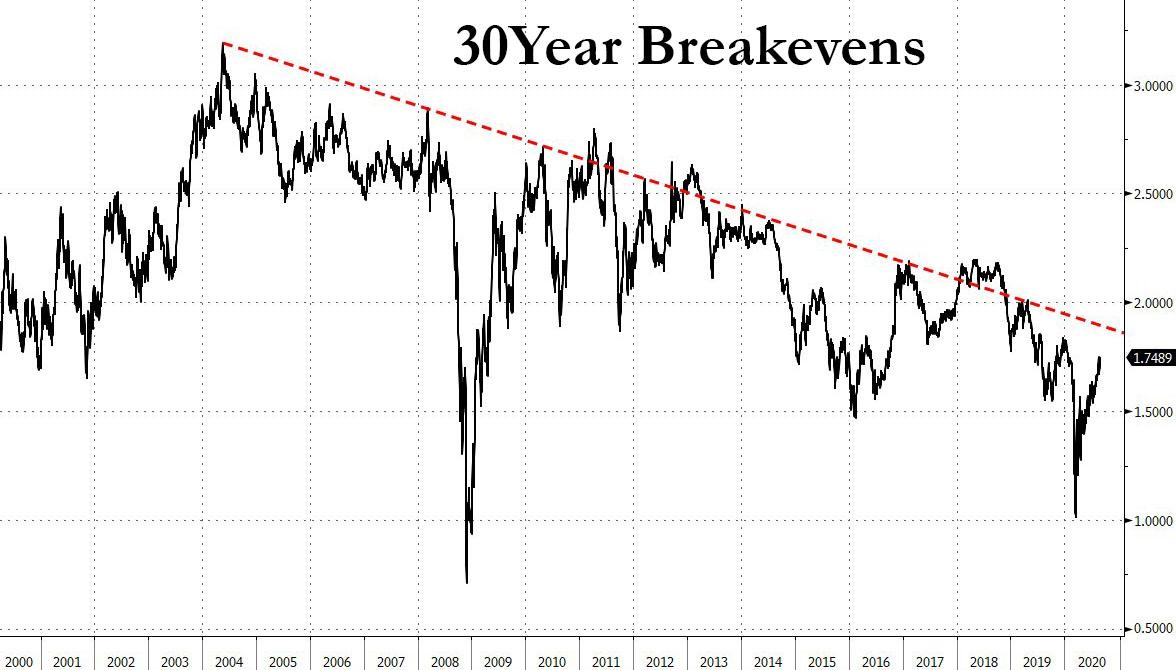

- the market’s pricing of inflation expectations well below 2% for the next 30 years, and

- its decade-long miss in achieving its inflation mandate

Explicit policies aside, there is the question of just what mere “forward guidance” and jawboning can do when the Fed is already at the limit of its firepower, and according to some has even crossed into illegal territory by purchasing corporate bonds. In other words, “the market is overhyping the Fed’s ability to change the course of inflation in the future, under any policy.” Here’s why:

To begin with, interest rates are already close to 0 across the entire Treasury curve. The principle of monetary easing is to increase aggregate demand by lowering the cost of funding, theoretically increasing borrowing for spending and investment. But at the current low rates, even if the Fed were to set all Treasury rates to 0bp, how many new borrowers and spenders would emerge? This is the problem of the zero lower bound that has worried the Fed and other central banks for years. The incremental ability to ease, without adopting deeply negative rates, is limited.

Yet one look at the market and front page headlines today, suggest that Bank of America is in the minority when it comes to what Powell will announce tomorrow, when under the smokescreen of “Average Inflation Targeting”, the Fed will essentially assure markets that rates will be at zero for years to come (42 if BofA is right).

So assuming that Powell does everything he can not to disappoint markets, the Fed chair then faces a far tougher task: convincing the public not only that the central bank can and will deliver in the wake of a pandemic that has eroded trust in institutions and put a huge chunk of the labor force on the unemployment rolls, but more importantly, convince Americans that higher inflation will be good for them in the long run – even as analysts, such as BofA , have already begun second-guessing whether a new Fed “framework” will fare any better than the current one in an environment where monetary policy is at the limit of what it can do to help the economy.

“The situation is really perilous right now and there is little that monetary policymakers at this point have left in their arsenal,” David Wilcox, former head of the Fed’s research division and now a senior fellow at the Peterson Institute told Reuters, adding that the Fed’s new framework, expected to be unveiled soon, will seem abstract unless it is coupled with new steps to enforce it, such as massive new bond-buying or the setting of explicit unemployment goals.

Which begs the question: if buying $3 trillion in bonds over just 3 months, a never been seen pace of debt monetization, failed to convince the market that inflation will rise over the long term as 30 Year breakevens at just 1.75% show…

… what will: buying $30 trillion? $300 trillion?

Or perhaps the Fed will punt, afraid of sparking an even more massive asset bubble, and instead of making an explicit AIT goal, merely acknowledges that a period of inflation overshoot is necessary to produce an average inflation rate of 2% over a cycle. This, according to BofA’s Ralph Axel “could take the form of officially changing the 2% inflation target to a range of 1.5-2.5%, or codifying that it will officially seek periods of inflation overshoots on the order of, say, 50-100bp to achieve its 2% goal on average through the cycles.”

Indeed, the minutes from the Fed’s last policy meeting indicated that may be the case, giving the central bank time to see how the economy behaves at this stage of the coronavirus pandemic. After all, it has already chopped interest rates to zero, started some bond-buying, and approved massive lending programs, however the market was disappointed when the Fed renounced Yield Curve Control for now – arguably a key market component of any inflation targeting regime.

One thing is certain: the Fed must do something if for no other reason than to give the impression it is fighting to reduce the surge in US unemployment as a result of the coronavirus shutdowns. And yet it begs the question: does the Fed really have any control over unemployment rate via the inflation channel?

It is not that long ago that the Phillips curve – which represents the theoretical linkage between the inflation rate and the unemployment rate in an economy – was declared dead. Indeed, until the March shutdowns, unemployment had collapsed to historically low levels without inflation even hitting the Fed’s 2% target. Expectations about inflation, considered key to the future pace of price hikes, also lagged, prompting even Yellen in one of her last speeches as Fed chair, to say that our understanding of inflation may be flawed by models that are misspecified and our inability to predict trends in sectors such as health care and housing which are large components of the price index.

In short, as BofA noted, the complete breakdown of the Phillips curve, inversely relating unemployment rates to wages, has long mystified the Fed and has caused them to rethink long-held concepts such as NAIRU (the non-accelerating inflation rate of unemployment).

And yet, despite a decade of failure, the hope now is that the reverse will work: that by sparking “asymmetric” as it is called in polite economic circles, or runaway – in the proper vernacular – inflation, will spark a flood of hiring. But why? In a world where it has become abundantly clear the US economy can operate just as efficiently on a “work from home” basis, why would corporations rush to rehire the same people they paid steadily rising wages instead of outsourcing to Vietnam or Eastern Europe?

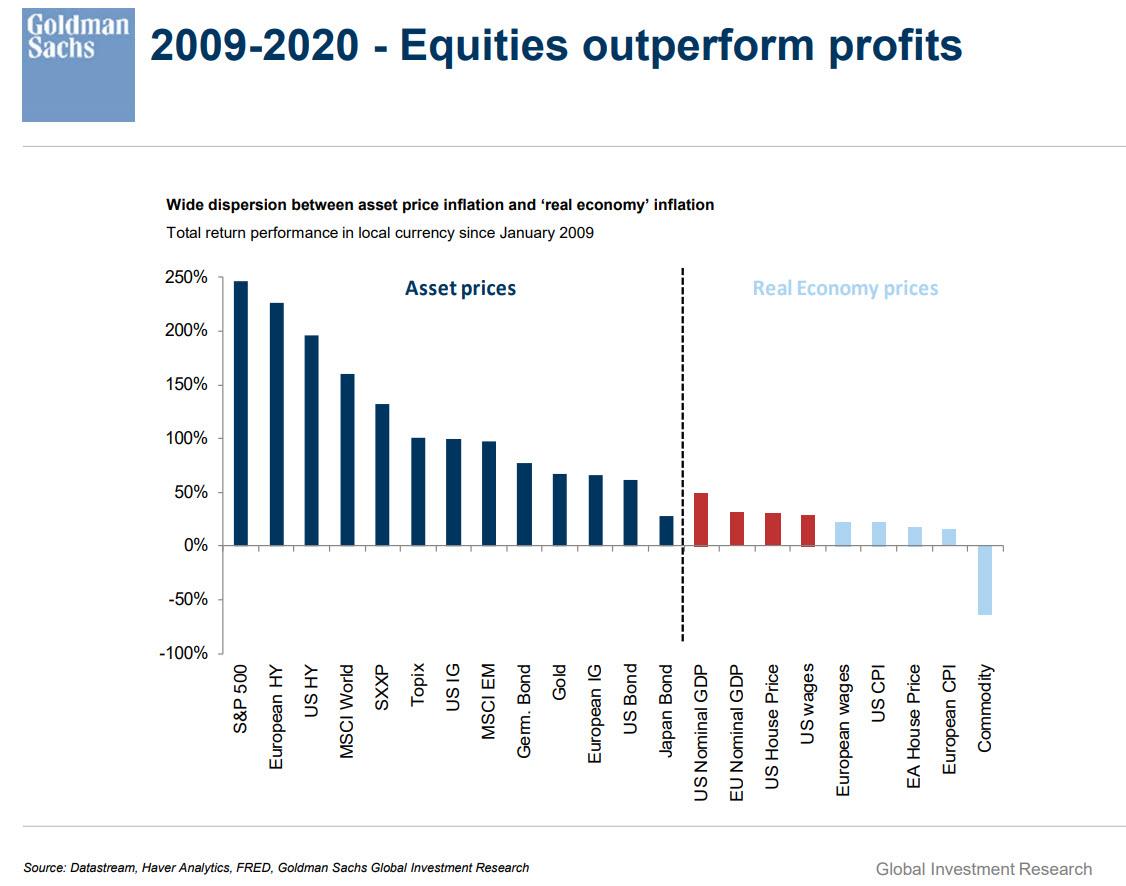

As Reuters notes, the disconnect between employment and inflation has become a chronic problem not only for the Fed but for central bankers around the world. Without some inflation, interest rates remain lower than normal which while great for asset prices (this headline literally just hit on Bloomberg: *MSCI ALL-COUNTRY WORLD INDEX REACHES RECORD HIGH), it affords little room to help the economy by reducing them when recessions hit, as happened this year. Central banks are then faced with cutting rates quickly to zero and using politically more difficult tools like buying of government bonds and – for the first time ever – corporate bonds.

The Fed first put the inflation target in place in 2012, and has missed it most of the time since. As shown above, markets indicate the expected U.S. inflation rate 30 years out is just 1.75%, a level reflecting little worry about the risk of a jump in inflation and little faith in the Fed’s sway over the one economic variable a central bank is thought to control.

Which brings us full circle, with the thinking going as follows: if what the Fed has done so far hasn’t worked, then it’s time for the Fed to do even more of it.

“There is a growing realization that a 2% inflation target as originally put in place in the U.S. and around the world is not quite enough,” St. Louis Fed President James Bullard said in a recent interview with Reuters. Changing the framework could help “shore up the target and get expectations to stay at 2%,” he said. Actually, no, it would crush America’s already suffering middle class by sending prices higher even as wages continue to shrink.

It’s also why after Powell’s speech tomorrow laying the groundwork for AIT, at its policy meeting next month, the Fed is expected to change how it characterizes its inflation goal and instead of looking to achieve 2% inflation on an annual basis, it is expected to aim to achieve that level as an average over a longer time, and explicitly allow perhaps years of faster price increases to make up for years when prices rose too slowly.

And here again we go back to BofA’s math: it will take 42 years of 2.0% inflation to get back to normal; it would also take a decade of 2.5% inflation to offset the target shortfalls since 2012. It would also mean stocks at all time highs, while the average American standard of living will hit an all time low.

What about unemployment?

Well, the existing strategy treats super-low unemployment as a risk to inflation that the central bank needs to “mitigate” rather than as a bonus for workers as long as prices are tame. Ironically, record low unemployment in 2019 and early 2020 did nothing to spark higher inflation expectations; just the opposite.

And yet – the thinking goes – as the Fed supercharges inflation and greenlights faster price increases, implicit in an average inflation goal, which these days means simply higher stock prices with little impact on the broader economy or that biggest variable of all – higher wages – also known as “good inflation”…

… it ought to allow for lower unemployment since the Fed would leave financial conditions looser even as prices picked up.

Which basically boils down to the following argument: Americans will need to suffer through years, if not decades, of declining purchasing power and higher prices just so unemployment declines… which of course is bizarre in a time when increasingly more are hoping that Universal Basic Income from the government will replace traditional work for a growing chunk of the population.

Good luck selling the American people on that, especially at a time when the fastest price increases have been for essentials like food and appliances.

“What if we are unlucky and we get high unemployment and inflation over 2%?”, Columbia Threadneedle analyst Ed Al-Hussainy told Reuters. Those were the very conditions that led the Fed in the 1970s – a period of devastating stagflation – to wage a two-decade battle to set its credibility as an inflation fighter.

“Messaging the algebra to Congress and the public is a complete nightmare.”

via ZeroHedge News https://ift.tt/3jbVco4 Tyler Durden