Used Class 8 Truck Sales Are Stabilizing As Prices Bounce Back

Tyler Durden

Thu, 08/27/2020 – 14:50

We noted less than a week ago that used car prices were rocketing past pre-pandemic highs – and now it seems as though the used truck market is starting to follow suit. It’s amazing what a couple trillion dollars in Fed liquidity can do, isn’t it?

Regardless, after a year of falling prices that was helped along by massive supply chain disruptions due to Covid, used Class 8 truck prices have had an upswing this summer. After stabilizing in July, prices appear to be once again on a steady rise, according to new data from FreightWaves.

Chris Visser, J.D. Power commercial truck senior analyst, said: “Pricing is solidifying, customers are buying more used trucks and new truck orders and deliveries are heading back in the right direction.”

Late model sleeper cabs are now fetching their highest average prices in a year, as Class 8 auction results continue to “remain solid” for the second month in a row. Same-dealer preliminary sales were up 16% month over month in July, according to ACT Research. Volumes are up 48% year over year and month-over-month average prices were up 4%.

ACT VP Steve Tam said: “The current economic slowdown is largely driven by a dramatic reduction in spending on services. In the commercial vehicle world, that means freight continues to move, albeit at a somewhat lower pace.”

Jim Griffin, chief operating officer at Fleet Advantage, added: “The used prices at least in the midterm have bottomed, and we’re seeing them come back. We’ve seen the auction values start to rebound a bit over the last six weeks. And now we’re starting to see a little bounce in the retail as well.”

The smaller fleets that have survived through the pandemic are once again adding both drivers and trucks, the report notes.

“They’re taking up some of our used assets. Most of what we’re seeing is with established channels or established smaller fleets that are looking for capacity,” Griffin concluded.

Visser concluded: “When a massive black swan event blows up everyone’s forecasting models, the human gut becomes the main driver of decisions. Fleets waited to see what would happen to freight volumes once the stockpiling effect shook out. And they seem to be OK with what they are seeing.”

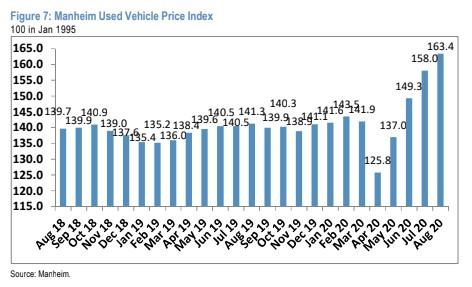

Recall, we noted less than a week ago that new research from Manheim showed used car prices had exploded to hit new all time highs. The Manheim Used Vehicle Value index climbed to 163.4 in the first 15 days of August from 158.0 in July.

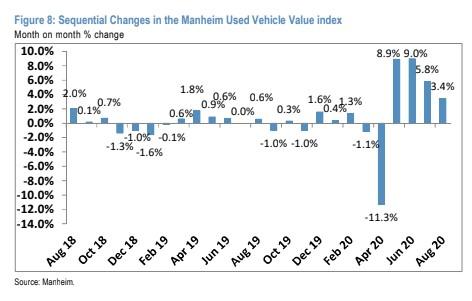

“Prices rose another +3.4% sequentially in the first 15 days of August after rising +5.8% m/m in July,” a new note from J.P. Morgan highlights. It continues: “With the Manheim Index at 163.4 in early August (January 1995 = 100), used prices are now +13.9% higher vs. the then record level in February just prior to the pandemic and are +15.6% y/y.”

J.P. Morgan notes that “Since April, the Manheim Used Vehicle Value index recovered +8.9% m/m in May, +9.0% m/m in June, +5.8% m/m in July, and is now +3.4% m/m in the first 15 days of August. Stronger prices suggest potential gains on sale of off-lease vehicles and higher collateral value, helping reduce loan losses.”

The note predicted that prices should see some respite heading into the fall, as “pent up demand” as a result of the Covid-19 pandemic should subside. Most of this demand has already been satisfied, according to Manheim, and consumers are growing “increasingly frustrated” from the high prices.

It’s worth noting, however, that these same prognosticators were predicting a “sharp drop” in prices heading into the back end of the summer. That obviously didn’t materialize. Additionally, the same note said that consumers could be waiting for a second round of stimulus to purchase a vehicle.

It doesn’t seem like fleet operators are doing the same…

via ZeroHedge News https://ift.tt/3hAuMfz Tyler Durden