What Happens To Abenomics With Abe Gone?

Tyler Durden

Fri, 08/28/2020 – 13:13

For the second and final time in his political career, Japan’s Shinzo Abe said he was resigning the post of prime minister and

head of the ruling Liberal Democratic Party (LDP) due to ulceritive colitis (i.e., severe diarrhea) ending a tenure as the country’s longest-serving prime minister in which he sought to revive an economy stricken by deflation and push for a stronger military.

The news was first reported by national broadcaster NHK at 14:08 JST, and prompted a violent rally in the Japanese Yen.

The PM’s health issues, arguably precipitated by the recent collapse in his approval ratings had led to growing speculation that Abe may step down well before the end of his current term as LDP President (which runs through September 2021), but the suddenness of the resignation came as a significant surprise to markets, and has prompted many to ask: what happens to Abenomics without Abe, and does the head of Japan’s government even matter as long as Kuroda is there to hit CTRL-P in perpetuity?

The emerging consensus on Wall Street is that no matter who is chosen as Abe’s successor, the likelihood of a reversal in the current “Abenomics” macro policy mix is very low.

As BofA’s Izumi Devalier writes, on monetary policy, a continuation of the status quo under Governor Kuroda. On fiscal, the need to shore up the economy and markets during the leadership transition and ahead of lower house elections (due by October 2021), implies modest upside risks to additional stimulus that is likely to be announced before year-end. Meanwhile, the “white swan scenario” of a consumption tax cut remains low.

In other words, while the risk of a meaningful policy reversal is low in the near-term and the most likely outcome is a continuation of the status quo, over the long-term, the main downside risk is that Abe’s departure marks the return of political infighting and gridlock that characterized the pre-Abe years. Given the LDP’s dominance in the Diet, the lack of an opposition, and consistency in the party’s policies, this may not be as damaging as it was between 2007-2012. But it could have a negative impact on Japan’s leadership on the foreign policy front, and ability to navigate the increasingly complicated geopolitical landscape that the country faces. On the upside, a successor with strong pro-reform credentials could usher in renewed interest in Japan.

What happens next?

At his press conference confirming his decision, Abe stated that he would stay on in his role until his party elected a successor. The focus thus turns to the LDP leadership race. One source of uncertainty is the format of the elections: as BofA notes, the LDP leadership has considerable leeway in choosing between an emergency vote giving a heavier weighting to the vote of its MPs, or a full election that would involve more participation from rank-and-file party members and local chapters. Kyodo News has reported that the party would opt for the emergency vote, although this is not confirmed; the LDP is expected to make a formal decision by 1 September. A truncated vote would disadvantage Shigeru Ishiba, who performed well with the rankand-file vote in the 2012 and 2018 LDP elections. Instead, there is a higher probability of a caretaker second Taro Aso government or that led by Chief Cabinet Secretary Suga. But the situation is fluid and uncertainty is high.

What about market reaction?

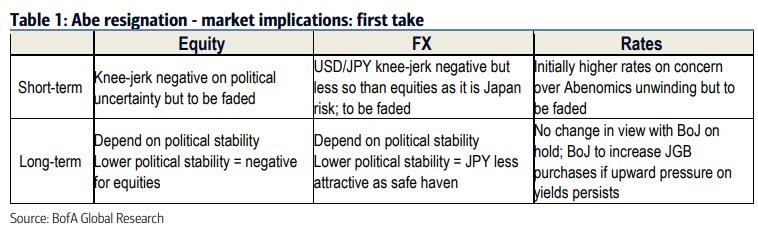

While most do not expect a material change in Japan’s macroeconomic policy mix, political stability is a bigger concern as PM Abe has achieved the unprecedented level of political stability through (1) internal politics, (2) favorable economic condition, and (3) diplomacy. It remains to be seen whether the next prime minister can achieve the same level of political stability. As a result there are two general themes:

- Short term: The equity market corrected today on PM Abe’s resignation as it is difficult to believe at this point the next PM will be able to maintain the same degree of political stability as PM Abe has. JPY has gained on risk-off. The immediate impact should be bigger for equities than USD/JPY as it is a Japan specific risk. However, according to BofA, the prevailing strength in the global equity market, high likelihood of a continued policy mix, and the lack of viable opposition parties suggest such risk-off reaction would be knee-jerk and faded.

- Long term: Longer term, the next prime minister’s leadership will be a key driver for the market as it will determine political stability and the administration’s ability to deliver effective policy. Lower political stability would be negative for equities and reduce the attractiveness of JPY as a perceived safe haven.

In rates, following the resignation announcement, markets have reacted as though to an Abenomics policy-off (policy reversal): weaker bonds, weaker stocks, stronger JPY. In reality, most investors probably do not think that current policies are heading for a sudden turnaround and we neither does Bank of America. However, with the markets showing this reaction, investors have to go along with it to some extent. While it is unclear how long it will take, the market consensus appears to be that things will settle down before too long.

The Table below summarizes the key market implications from Abe’s resgination:

via ZeroHedge News https://ift.tt/31zW009 Tyler Durden