Clarida Admits Fed Models “Have Been Wrong”, May Have Cost Hillary The 2016 Election

Tyler Durden

Mon, 08/31/2020 – 11:30

Much has been said in recent days about the death of the Phillips Curve, which was officially cast into the funeral pyre last week when the Fed unveiled its new approach to monetary policy, which puts more emphasis on shortfalls in employment and less weight on the fear that low unemployment could spark higher inflation.

Of course, to our readers the demise of the long-held convention that inflation tends to rise when the unemployment rate falls, and vice versa, as the Phillips Curve posits is hardly new as we discussed in recent years:

- Demise Of Phillips Curve Shifts Focus To Asset Cycles And Financial Stability

- Fed Study Confirms Phillips Curve Is Useless: Admitting The Bloody Obvious

- Yet Another Fed Study Concludes Phillip’s Curve Is Nonsense

However, for the Fed to admit that one of its core tenets has been monumentally wrong was a stunning development for academic technocrats who – like all central planners – have perpetually relished in their omnipotence and infallibility. After all, the mere possibility the Fed has been wrong, threatens to insert doubt that the core pillar of today’s crony capitalism may crack and undo decades of capital misallocation. It’s also why the ECB never ever once admitted to considering a Plan B in which it saw Greece exiting the euro (even though it did): such an outcome would after all obviate the central bank’s presence, and for it to even contemplate it would trigger a chain of events that would result in its own demise.

Which is why we were shocked to see none other than the Fed’s Vice Chair make a pointed, on the record admission that the Fed was indeed wrong, and worse, the models it has been using to pursue its two mandates (really three, including elevated stock prices) were incorrect.

In a speech titled “The Federal Reserve’s New Monetary Policy Framework: A Robust Evolution” delivered before the Peterson Instite, Clarida discussed the Fed’s “new” framework – which is not really new as the Fed had for years struggled to reach a 2% inflation and failed – and highlighted various policy implications that flow from the revised statement and our new strategy. Readers can read the whole thing here.

What caught our eye was Clarida’s discussion of the maximum-employment mandate, i.e., the demise of the Phillips Curve, in which the former PIMCO employee said that “the new statement now acknowledges that maximum employment is a “broad-based and inclusive goal” and continues to state that the FOMC considers a wide range of indicators to assess the level of maximum employment consistent with this broad-based goal. However, under our new framework, policy decisions going forward will be based on the FOMC’s estimates of “shortfalls of employment from its maximum level”—not “deviations.” This change conveys our judgment that a low unemployment rate by itself, in the absence of evidence that price inflation is running or is likely to run persistently above mandate-consistent levels or pressing financial stability concerns, will not, under our new framework, be a sufficient trigger for policy action.”

This, Clarida concludes, “is a robust evolution in the Federal Reserve’s policy framework and, to me, reflects the reality that econometric models of maximum employment, while essential inputs to monetary policy, can be and have been wrong.”

But wait there’s more: Clarida also says that “a decision to tighten monetary policy based solely on a model without any other evidence of excessive cost-push pressure that puts the price-stability mandate at risk” – such as what happened the last time the Fed tightened “is difficult to justify, given the significant cost to the economy if the model turns out to be wrong and given the ability of monetary policy to respond if the model were eventually to turn out to be right.“

Translation: when we warned in 2015 that the Fed’s catastrophic hiking cycle was the second coming of the “Ghost of 1937” we were spot on. And, incidentally, so was Trump when he criticized the Fed for its rate hikes, something Clarida just tacitly admitted.

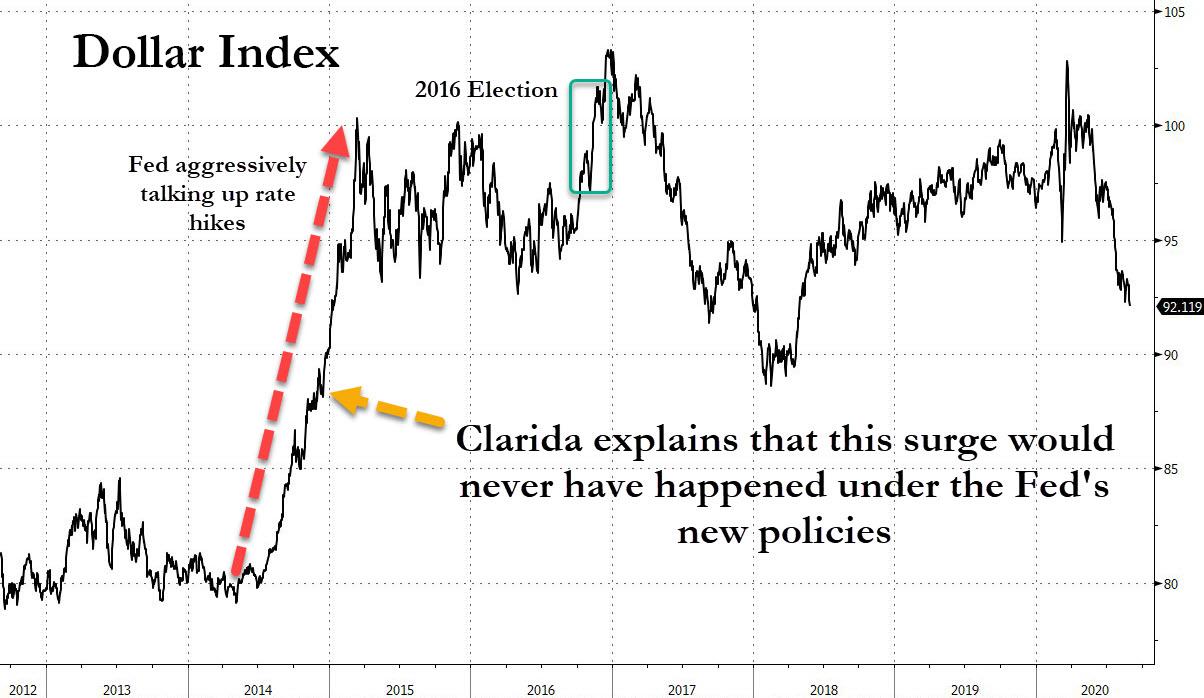

What does all of this mean? As the latest Bear Traps report noted, Powell – and now Clarida – basically told the market that under this framework, they never would have done the last hiking cycle. An apology tour for 2015-2019 rate hikes (which the Fed started talking up years earlier in 2014) with Trump smiling somewhere.

And here is the real punchline: “The Fed’s last hiking cycle cost Hillary the election, strong USD, rust belt. The “not for a really long time” on overshoot line.”

As the Bear Traps continues “You can make a strong case the Yellen Fed had a LARGE impact” because ahead of the 2016 election “the US lost 50k manufacturing jobs, many of which were in key rustbelt states. Trump and Mnuchin know this and have been begging for a weaker dollar.” In short, the Fed admitted not only a massive policy error, but also costing Hillary the election. No wonder Bill Dudley last year published a scandalous op-ed urging the Fed to crash the economy and cost Trump his 2nd term.

In the end, Yellen tried to tie a bow for Hillary (in the 2016 election), but had to put out a large inferno caused by the earlier rate hike policy and the very deflationary USD surge 2014-2016, so in Feb 2016 she and Dudley and co reversed course (the Shanghai Accord fire hose) as 12 rate hikes became 2, but they were too late, the damage was done and it helped Trump in 2016 November.

One final thought: just over a year ago we asked the most obvious question – perhaps it was not the Phillips curve that was dead but “the way the government measures inflation is (purposefully) wrong.”

What if maybe, just maybe, the Phillips curve is alive and well but the way the government measures inflation is (purposefully) wrong

— zerohedge (@zerohedge) July 12, 2019

Unfortunately, with both parties standing to gain from perpetuating the myth that inflation remains stubbornly low – even though to most people it is anything but – we don’t expect to ever get an answer.

via ZeroHedge News https://ift.tt/34QkTqC Tyler Durden