Global Dividends Plunge The Most Since 2009

Tyler Durden

Mon, 08/31/2020 – 09:25

Dividend payouts are a big part of the investment return for folks owning stocks. Given the unprecedented volatility in financial markets earlier this year, triggered by the virus pandemic, global dividend payouts have sustained the worst quarterly decline in a decade.

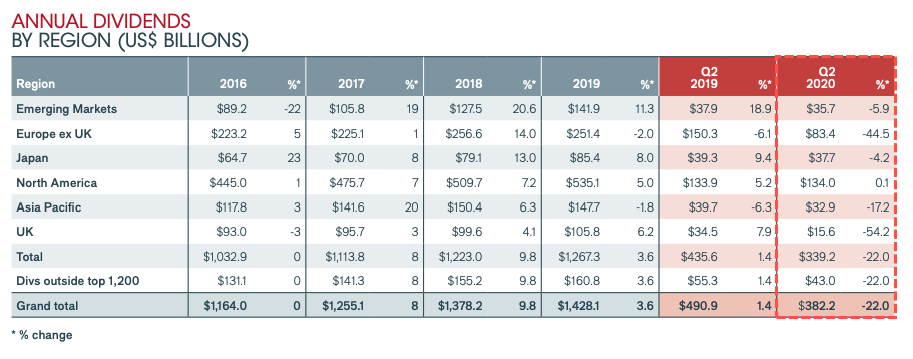

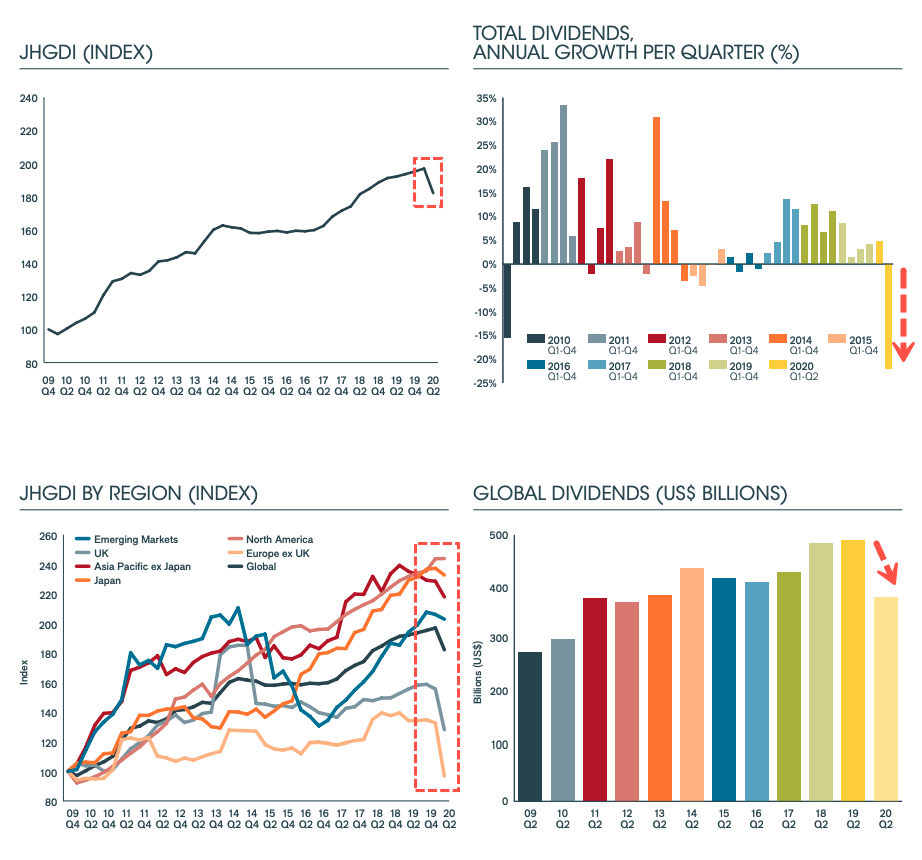

According to Janus Henderson, the asset manager that tracks dividends globally, global dividends fell by $108.1 billion to $382.2 billion in the three months to June. The 22% drop was the worst quarterly decline since the fund launched Janus Henderson Global Dividend Index (JHGDI), a long-term study into global dividend trends, a decade ago.

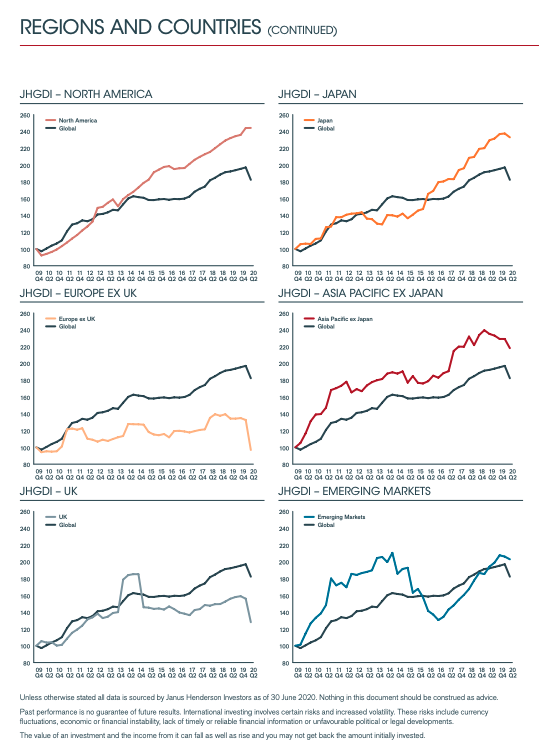

Janus Henderson said, “all regions saw lower payouts except North America, where Canadian payments proved to be resilient.” Worldwide, “more than a quarter (27%) of Q2 payers cut their dividends, and more than half of this group canceled them outright.” The worst affected region was Europe and the U.K., where companies slashed dividends by at least two fifths. In the U.K., dividend payouts dropped by 54% in the second quarter, down by $18.4 billion to $15.6 billion.

“2020 will see the worst outcome for global dividends since the global financial crisis, although by the end of March 2020 they had almost doubled from when the index was launched in 2009,” the report said.

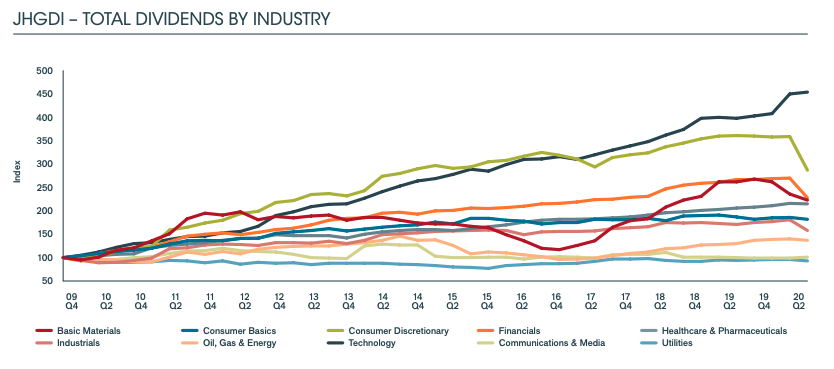

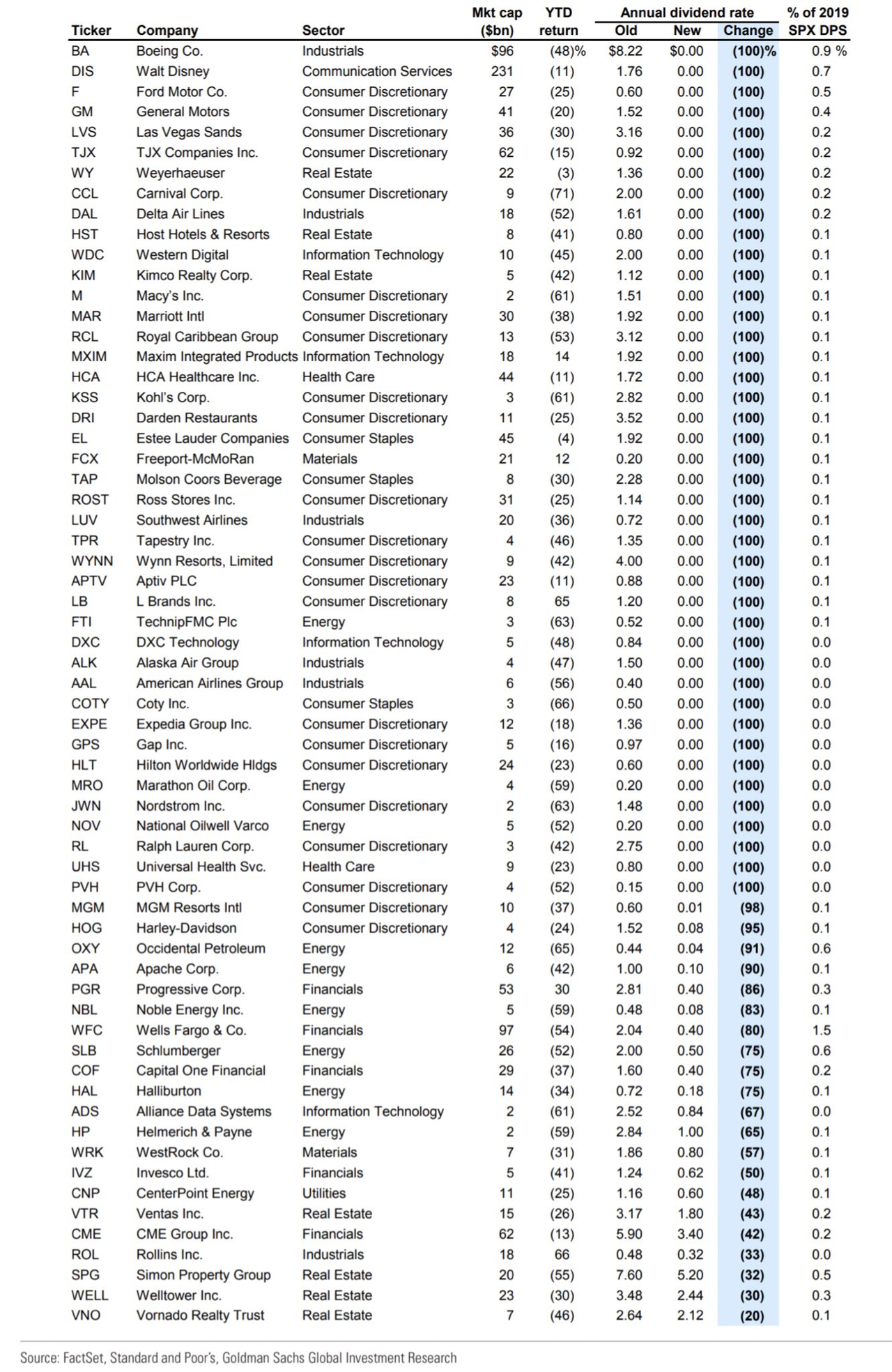

Natural resource and energy firms slashed their dividends the most as commodity prices tanked. Consumer discretionary companies were second as lockdowns prevented consumers from spending money in brick and mortar retail outlets.

The report noted technology companies were among the top global dividend payers for the first time this year.

Ben Lofthouse, Head of Janus Henderson’s Global Equity Income strategy, said the drop in dividend payments this year will be unpleasant for investors. He said ex-Europe, some companies continued paying dividends, despite the virus-induced recession.

“The short-term dividend cut or halt doesn’t necessarily change the long-term valuation of companies,” Lofthouse said.

He asked:

“The big question for the U.S. is what will happen in the fourth quarter. If many companies make significant cuts to their dividends, payouts will be fixed at a lower level until towards the end of 2021.”

A recent Goldman Sachs note shows US dividend cuts.

The latest quarterly plunge in global dividends (see: “Dividend Massacre In This Crisis Is Already Breaking Records, And It’s Only Just Starting”) , with the possibility North America could see cuts in 4Q20, suggests a worldwide ‘V-shaped’ economic revival is not in the cards this year.

via ZeroHedge News https://ift.tt/3lBYva6 Tyler Durden