Key Events This Week: Summer Is Over; PMIs And Payrolls

Tyler Durden

Mon, 08/31/2020 – 09:43

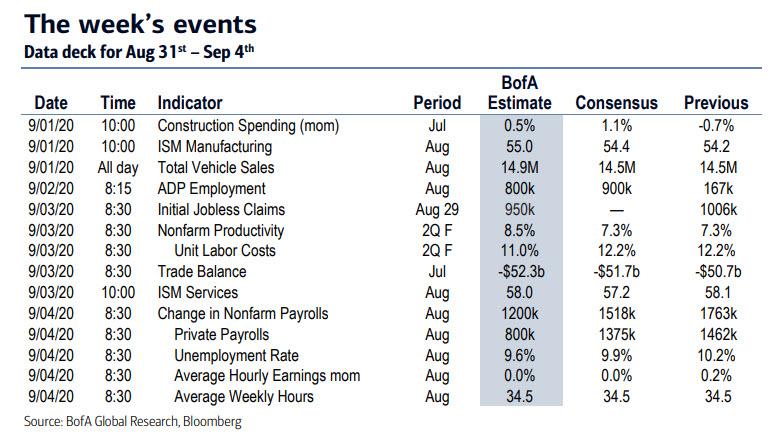

As we move into September tomorrow, markets will turn their attention to a number of important data releases, including the PMI readings and the US jobs report. Otherwise, as DB’s Henry Allen writes, the events calendar is somewhat quieter following Jackson Hole, with the only major central bank decision coming from Australia on Tuesday. Investors will also continue to pay close attention to coronavirus case numbers and the possibility of further restrictions, particularly in Europe where the numbers have risen in recent weeks.

As Allen notes, this week will see a number of high profile data releases, most notably with the release of the August PMIs from around the world, as well as the ISM readings from the US, which will give us an indication of how the global economy has fared through the month. We already have some idea of how these might pan out from some of the flash readings, with the Euro Area seeing a loss of momentum into August as its composite PMI fell from 54.9 to 51.6. The UK saw a stronger move as it rose to 60.3, but that simply reflected the UK climbing out of a more protracted downturn rather than a higher level of activity. Remember with the PMIs that they’re diffusion indices, so are simply asking respondents whether conditions are better or worse than the previous month, and don’t capture by themselves how rapidly activity is expanding or contracting.

The other top-tier release comes from the US jobs report on Friday, which will also have a reasonable amount of political significance, given it’s the penultimate monthly jobs report before the presidential election on November 3. In terms of what to expect, the consensus on Bloomberg is currently looking for a further +1.518m increase in nonfarm payrolls in August, which if realised would bring the total growth in nonfarm payrolls to +10.797m over the last four months. However, even if that was achieved, that would still mean that less than half of the -22.16m jobs lost in March and April had been recovered, so there’s still a long road back before the labour market fully recovers to where it was pre-Covid.

Central banks will take something of a back seat this week following the Jackson Hole symposium and the announcement of the results of the Federal Reserve’s policy review framework. The only G20 policy decision to expect comes from the Reserve Bank of Australia on Tuesday, where the view is that policy will remain unchanged, with the cash rate and three-year AGS target remaining at 0.25%. Meanwhile, with recent high-frequency data looking to have mostly confirmed their expectations on the cost of Melbourne’s second lockdown, the RBA’s economic assessment is also expected to see little change.

Otherwise from central banks there isn’t a great deal on the calendar, though both Vice Chair Clarida and Governor Brainard will be speaking on the new monetary policy framework. We’ll also get the release of the Fed’s Beige Book which is published 8 times per year.

In the background, it’ll be important for investors to keep an eye on coronavirus case numbers, which have risen in Europe in particular in recent days. For instance here in the UK, the 1,522 cases reported yesterday were the highest in over two months, while France just reported its worst 24 hours since late March, with 6,111 cases. This rise in cases comes as the start of September next week will see schools go back from their summer holidays in a number of countries. Meanwhile governments face the continued challenge of seeking to revive their economies and relax restrictions whilst avoiding a new outbreak of infections.

Day-by-day calendar of events courtesy of Deutsche Bank

Monday

- Data: Japan preliminary July industrial production, July retail sales, housing starts, China August composite PMI, manufacturing PMI, non-manufacturing PMI, Italy final Q2 GDP, preliminary August CPI, Germany preliminary August CPI, US August Dallas Fed manufacturing activity

- Central Banks: Fed Vice Chair Clarida and Bostic speak

- Other: UK bank holiday

Tuesday

- Data: August manufacturing PMIs for Australia, Indonesia, South Korea, Japan, China, India, Russia, Turkey, Italy, France, Germany, Euro Area, UK, South Africa, Brazil, Canada, US and Mexico, Japan July jobless rate, August vehicle sales, Germany August unemployment change, Italy preliminary July unemployment rate, UK July consumer credit, mortgage approvals, M4 money supply, Euro Area July unemployment rate, August CPI estimate, US August ISM manufacturing, July construction spending

- Central Banks: Reserve Bank of Australia monetary policy decision, Fed’s Brainard and ECB’s Knot speaks

Wednesday

- Data: Japan August monetary base, Euro Area July PPI, US weekly MBA mortgage applications, ADP employment change, July factory orders, final July durable goods orders, nondefence capital goods orders ex air, Canada Q2 labour productivity

- Central Banks: Federal Reserve releases Beige Book, Fed’s Williams, Mester and ECB’s Weidmann speak

Thursday

- Data: August services and composite PMIs for Australia, Japan, China, India, Russia, Italy, France, Germany, Euro Area, UK, Brazil and US, Euro Area July retail sales, Canada July international merchandise trade, US weekly initial jobless claims, continuing claims, July trade balance, August ISM services index

Friday

- Data: Germany July factory orders, August construction PMI, UK August construction PMI, Canada August net change in mployment, unemployment rate, US August change in nonfarm payrolls, unemployment rate, average hourly earnings, labour force participation rate

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the ISM manufacturing index on Tuesday and the employment report on Friday. There are several speaking engagements by Fed officials this week

Monday, August 31

- 09:00 AM Fed Vice Chair Clarida (FOMC voter) speaks: Federal Reserve Board Vice Chair Richard Clarida will participate in a virtual discussion on the Fed’s framework review hosted by the Peterson Institute. Prepared text and questions from a moderator are expected.

- 10:30 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak about philanthropy and inclusion at a virtual event. Prepared text is not expected. Audience Q&A is expected.

Tuesday, September 1

- 09:45 AM Markit US manufacturing PMI, August final (consensus 53.6, last 53.6)

- 10:00 AM ISM manufacturing index, August (GS 55.0, consensus 54.5, last 54.2): We expect the ISM manufacturing index to increase by 0.8pt to 55.0 in August amid continued industrial rebound after rising 1.6pt in July. Our manufacturing survey tracker rose by 1.5pp to 55.6 in August.

- 10:00 AM Construction spending, July (GS +0.9%, consensus +1.1%, last -0.7%): We estimate a 0.9% increase in construction spending in July following four consecutive monthly declines.

- 01:00 PM Fed Governor Brainard (FOMC voter) speaks: Federal Reserve Governor Lael Brainard will participate in a virtual discussion on the Fed’s framework review hosted by the Brookings Institution. Prepared text and questions from a moderator are expected.

Wednesday, September 2

- 08:15 AM ADP employment report, August (GS +1,600k, consensus +950k, last +167k): We expect a 1,600k gain in ADP payroll employment in August, reflecting a boost from lagged payrolls and lower jobless claims.

- 10:00 AM Factory orders, July (GS +6.1%, consensus +6.0%, last +6.2%); Durable goods orders, July final (last +11.2%); Durable goods orders ex-transportation, July final (last +2.4%); Core capital goods orders, July final (last +1.9%); Core capital goods shipments, July final (last +2.4%): We estimate factory orders increased by 6.1% in July following a 6.2% increase in June. Durable goods orders rose by 11.2% in the July advance report.

- 10:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak during a webinar on effects of the coronavirus pandemic. Prepared text and audience Q&A are expected.

- 02:00 PM Beige Book, August FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the August Beige Book, we look for anecdotes related to growth, labor markets, wages, price inflation, and the economic impacts of the ongoing coronavirus outbreak.

- 06:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will give a speech on the economy hosted by Harvard University. Prepared text is not expected. Audience and media Q&A are expected.

Thursday, September 3

- 08:30 AM Initial jobless claims, week ended August 29 (GS 930k, consensus 950k, last 1,006k); Continuing jobless claims, week ended August 22 (consensus 14,000k, last 14,535k); We estimate initial jobless claims dropped to 930k in the week ended August 29.

- 08:30 AM Nonfarm productivity, Q2 final (GS +7.4%, consensus +7.4%, last +7.3%); Unit labor costs, Q2 final (GS +12.0%, consensus +12.1%, last +12.2%): We estimate nonfarm productivity was revised up by one tenth to +7.4% (qoq ar) in Q2. We estimate growth in Q2 unit labor costs – compensation per hour divided by output per hour – was revised down to +12.0% in Q2.

- 08:30 AM Trade balance, July (GS -$58.0bn, consensus -$57.0bn, last -$50.7bn): We estimate the trade deficit increased by $7.3bn in July, reflecting a sharp increase in the goods trade deficit.

- 09:45 AM Markit US services PMI, August final (consensus 54.7, last 54.8)

- 12:30 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will speak on monetary policy and the economy at an event hosted by the Lakeshore Chamber of Commerce.

Friday, September 4

- 08:30 AM Nonfarm payroll employment, August (GS +1,900k, consensus +1,400k, last +1,763k); Private payroll employment, August (GS +1,650k, consensus +1,275k, last +1,462k); Average hourly earnings (mom), August (GS -0.1%, consensus 0.0%, last +0.2%); Average hourly earnings (yoy), August (GS +4.3%, consensus +4.5%, last +4.8%); Unemployment rate, August (GS 9.8%, consensus 9.8%, last 10.2%): We estimate nonfarm payroll growth rose +1.9mn in August after +1.8mn in July and +4.8mn in June. The resurgence of the coronavirus did not produce a meaningful rebound in layoffs in the Sunbelt, and nationwide continuing claims fell by 2.2mn from survey week to survey week (adjusted by GS). Because of measurement issues with the BLS birth-death model, we also expect the establishment survey to better capture business reopenings and gross hiring than the mid-summer business closures resulting from the virus. We also expect a 250k boost to government payrolls from Census canvassing activities (we estimate private payrolls rose 1.65mn).

- Because of difficulty measuring temporary business closures in the establishment survey, we note scope for a relatively smaller rise in the household employment measure (which surveys employees directly). Based on this and a possible increase in the labor force participation rate, we estimate the unemployment rate declined by four tenths to 9.8%. We estimate average hourly earnings declined 0.1% month-over-month, lowering the year-on-year rate by five tenths to 4.3%. This forecast reflects a continuing unwind of the composition shift from lower to higher paid workers, partially offset by positive calendar effects.

Source: Deutsche Bank, Goldman, BofA

via ZeroHedge News https://ift.tt/3hENyCt Tyler Durden