Why America’s Poor Are Praying For A Market Crash

Tyler Durden

Sun, 08/30/2020 – 19:35

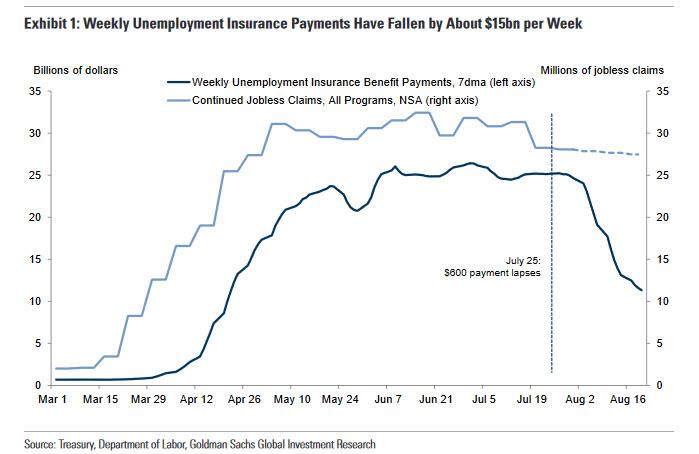

Last week we showed that following the July 31 “fiscal cliff”, which saw the end of the $600 weekly emergency unemployment benefit and as a result, weekly unemployment insurance benefit payments were cut in half, from $25BN pre-July 31 to just over $10 BN after…

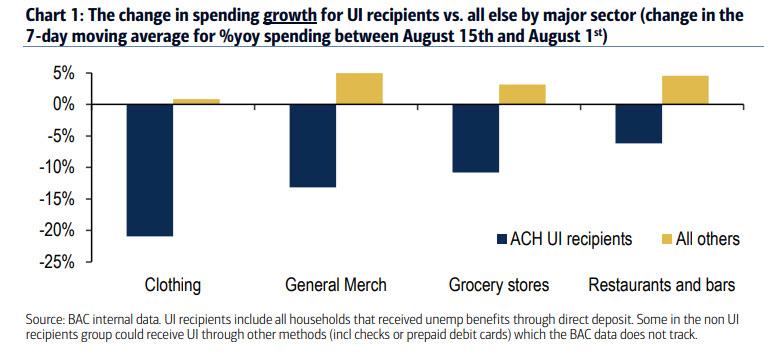

… spending among those most reliant on government stimulus – namely Americans who currently receive Unemployment Insurance payments – had tumbled even as spending by all other social groups continued to recover. Bank of America examined spending trends of the population of card holders who receive UI through ACH (direct deposit) and compared to all other households. What it found was a dramatic divergence as the YOY rate of growth for UI recipients slowed dramatically but increased for the broader population since Aug 1st.

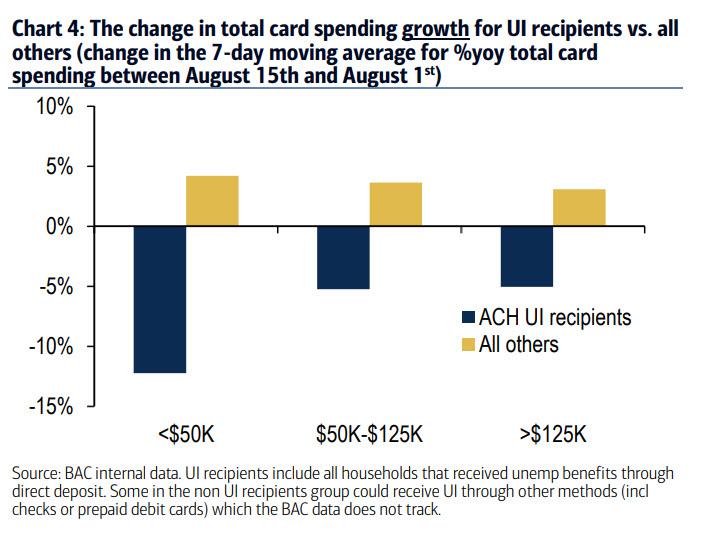

The drop in spending was also observed by income bucket: over the first two weeks since July 31, the YOY spending growth rate slowed by 12% for the unemployed cohort (formerly) earning under $50K vs. a roughly 5% drop for the middle and upper income cohorts.

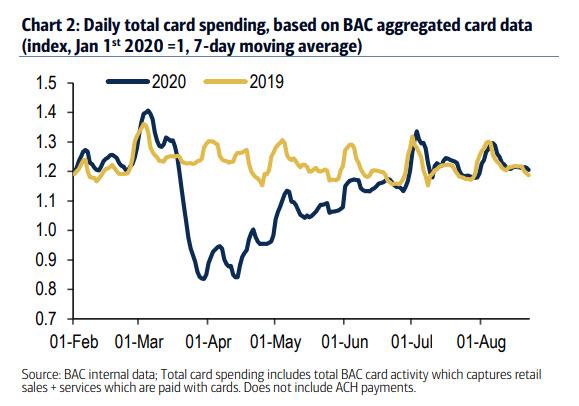

Bank of America then reran the analysis one week later and found that total card spending, as measured by BAC aggregated credit and debit card data, continued to grind sideways, running at a 1.4% yoy rate for the 7-day period ending Aug 22nd, just fractionally higher than 2019.

However, as was the case one week ago, there were two important distinctions: i) The decline in unemployment insurance continues to impact the lower income population disproportionately, and ii) The decline in UI is affecting discretionary spending.

Some more details:

- The decline in UI is impacting the lower income population disproportionately: BofA examined spending trends of the population of card holders who receive unemployment insurance (UI) through ACH (direct deposit) and when comparing that to all other households, saw a decisive differential – since July 31st, the YOY growth rate in total card spending for the UI cohort has declined while it has increased for the rest of the population. This is particularly clear when examining the income level data which shows a 17% slowdown in the yoy growth rate for the cohort earning under $50K – a deterioration from the -12% drop observed a week ago (see above), and a roughly 6% slowdown for the middle/upper income cohorts.

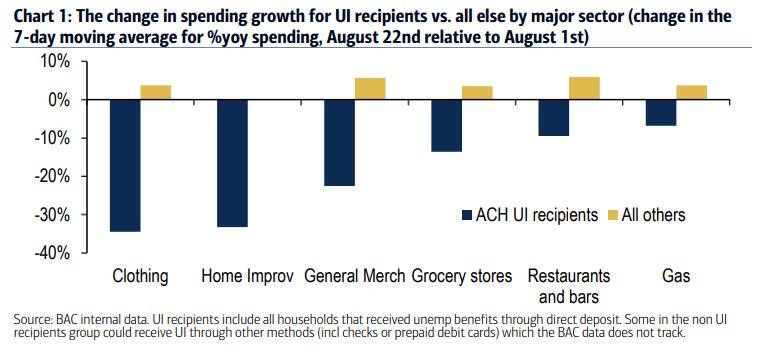

The decline in UI is affecting discretionary spending: Looking at the data by sector, the UI recipients cut back the most on clothing and home improvement spending and the least on gas and restaurants/bars (Chart 1). This compares to small increases in the growth rate of spending for the non-ACH UI recipient across these categories with the exception of home improvement.

As time goes on, this decoupling in spending between recipients of unemployment benefits and everyone else will only gross, especially once Trump’s stopgap executive order fades away some time in late September, unless of course Congress gets off its ass and passes yet another stimulus package.

When could that happen? Well, if Democrats get their way, certainly not before the Nov 3 election, but there is one catalyst that could wake Congress from its theatrical stupor and spark legislation much sooner. A market crash.

According to a separate note from Bank of America’s derivatives team led by Benjamin Bowler, the market once again finds itself in a Catch 22 – it is being held up by the promise of fiscal and monetary stimulus, which may not be forthcoming without pressure from a market selloff. In other words, for stocks to hit new highs they will have to crash again.

From the report:

On the fiscal side, the expiration without replacement of extended unemployment benefits may already be hurting economic and market fundamentals. The importance of this program to the recovery can’t be overstated. Quoting our US economists, “absent government support disposable income would have fallen the most in history; with that support it has risen the most in history.”

* * *

As markets continue their steady climb, two key engines of the rally may be running out of steam. The first is fiscal support – the critical but expired unemployment extension is unlikely to be restored soon. The second is the Fed, which stopped growing its balance sheet in June, deemed yield curve control a no-go last week, and faces new chances to step off the gas in Jackson Hole (27-Aug) and the Sep FOMC. Even if the Fed stands ready to act again, it will likely be in response to a market shock, which also looks needed to break the fiscal logjam.

BofA’s conclusion: “perversely, a [market] shock looks increasingly necessary to force policy measures allowing the market to sustain these levels to begin with.“

In other words, America’s poorest – those who rely on unemployment insurance to live – are (or should be) praying for a market crash which will force Congress to act. Which begs the question: will those same “poorest” stop killing each other across the US in the name of some ideological fallacy, and will they all finally congregate in front of the Marriner Eccles building and demand full accountability (a very polite way of putting it) from the Fed – the source of most of America’s troubles, as even Rabobank admitted last week.

via ZeroHedge News https://ift.tt/2DdmjA1 Tyler Durden