A COVID Vaccine Will Mark The “Big Top” For The Market, According To BofA

Tyler Durden

Fri, 09/04/2020 – 15:20

While 2020 has been an unprecedented year in so many ways, in one way it reminds us of 2008. Consider that it was Jerome Kerviel’s infamous bad trade in January 2008 which sent stocks plunging (and ended up costing SocGen a lot of money) that prompted the Fed to cut rates by a remarkable 75bps to stabilize markets amid fears that a systemic threat was imminent, when in reality it turned out to be a bad trade by just one trader. So much for macroprudential regulation (in retrospect, a systemic threat was imminent as first Bear failed then Lehman).

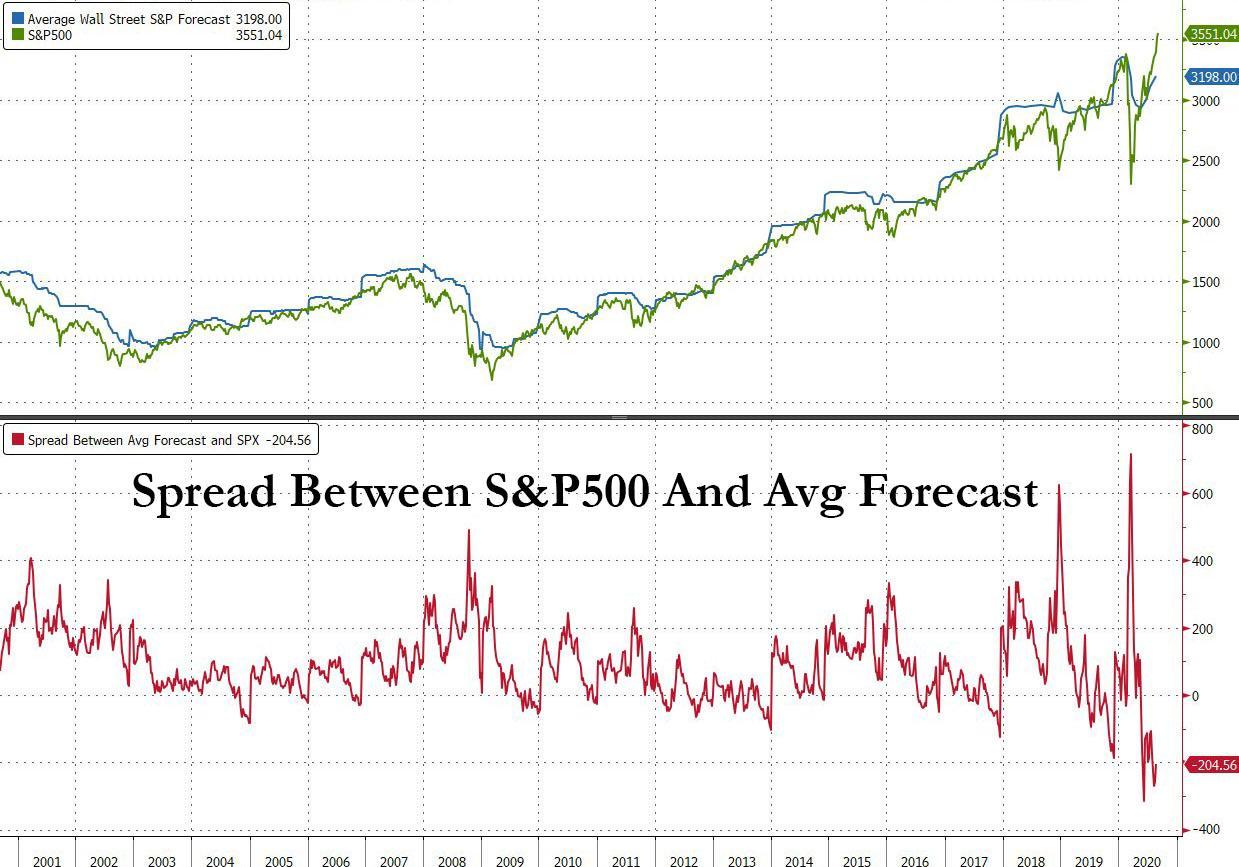

Fast forward to 2020 when in the past few weeks we have seen one bank after another rush to hike their price targets on Apple, Tesla and, of course, the S&P500, which as we noted is perhaps understandable because the broad market index just hit the biggest difference with the average sellside target on record.

Then, on Thursday just as stocks peaked, Bank of America unveiled that it was hiking its year-end price target from 2950 to 3250 (even though it admitted it had absolutely no visibility and in fact forecast a range of 2200 to 4000). This just days after BofA analysts raised their price targets on both AAPL and TSLA.

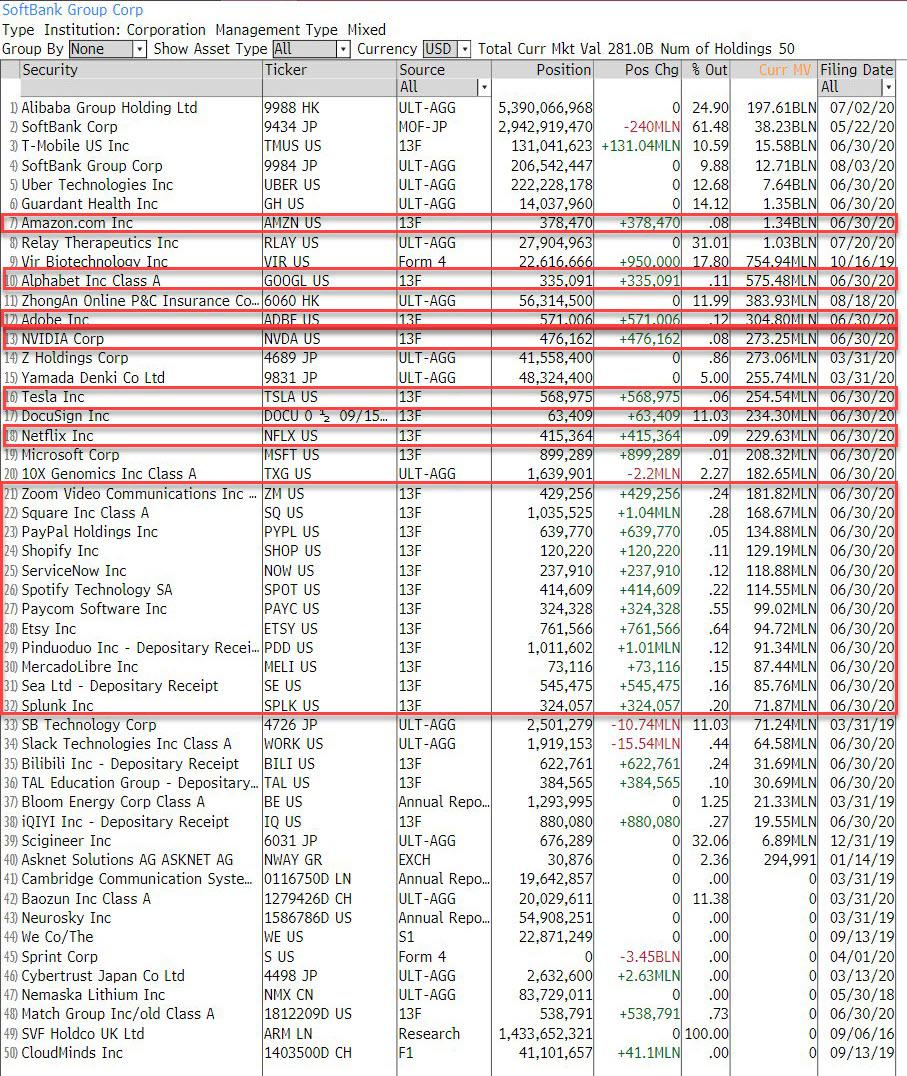

Of course, we now know that behind the massive meltup in stocks over the past month was nothing fundamental, but merely one massive call-buying trade by SoftBank which now appears to have blown up leading to major losses for the same tech companies that soared in the past few weeks as Masa Son was aggressively buying calls on stocks it had purchased in the second quarter in what appears to have been an attempt to corner gamma and reprice its portfolio higher.

To be sure, neither BofA nor any of the other analysts who rushed to upgrade their price targets (read: slap an even higher P/E multiple forecast) to chase the price knew that they were not in fact justifying a fundamental repricing but merely validating what was yet another whale trade, this time by SoftBank pushing a handful of stock higher courtesy of gamma, which eventually spilled over and pushed the broader market higher as well.

It just goes to show that analysts really don’t know anything more than average Joes, and their whole role is to give their clients peace of mind when they too chase prices higher (and occasionally lower).

So today, in what may be an attempt to mitigate some of the damage from the latest S&P PT hike, BofA’s Chief Investment Strategist Michael Hartnett tried to put the brakes on the rampant euphoria – which his own bank helped magnify with its rampant upgrades, explaining why we may see a dip to 3300 in the coming days.

Accusing the Fed of remaining “the Pied Piper”, Hartnett writes that a “historic policy shift underway at Fed, willing to let financial assets overshoot to a. stoke employment & wages, b. finance fiscal excess (via YCC & MMT).” He then adds that the “market knows Fed will “intervene” to prevent <1% GT10 which has allowed SPX multiple to break 20x; policy has become more explicit in recent weeks" and while the recent change in Fed policy "is not factor behind sell-off, it will be factor causing dip in SPX to 3300” according to Hartnett.

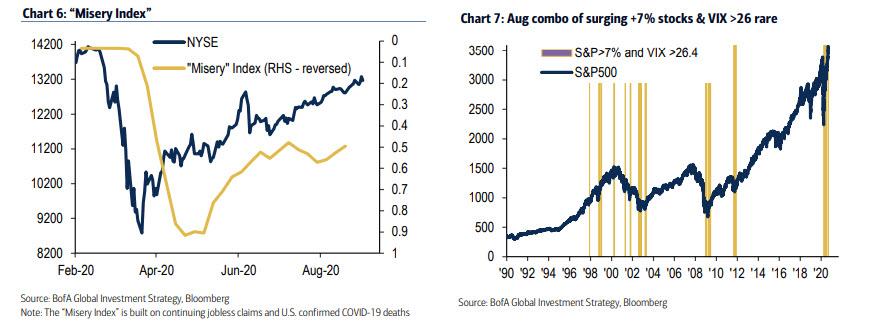

And while taking note of the current “September wobble”, looking ahead to 2021 Hartnett says that the “recovery = weaker Wall St: Sept’20 volatility and reversal in summer outperformance cyclicals/defensives (see TRAN/UTIL) reflects impatience with delayed U.S. phase IV stimulus at a time of “peak” V-recovery (see offthe-chart global orders/inventories – Chart 5); weak Aug payroll required to settle market nerves; Covid-19 “misery index” is improving (Chart 6) and global consensus forecasts for 2021 are GDP 5.1%, EPS 29.0%; note rare combo of surging stocks & higher VIX in Aug, happens only 1.5% of the time since 1990 – more typical after big market events e.g. LTCM, WorldCom, GFC, Covid-19 (Chart 7) than before.” Well, at least we now know what the reason for the “rare combo” was even if it remains unclear just how it will impact risk prices going forward.

What about a longer-term perspective?

Here, as we have noted in the past, it will be up to inflation to halt the rally in mostly-deflationary assets.

Hartnett agrees and writes that “stocks are toppy and credit has stalled after historic rally” yet with consensus getting bullish – in no small part thanks to his own bank – he “still thinks vaccine, big jobs recovery, disorderly dollar/yield events required for Big Top.”

Here, too, he breaks out the forecast in two parts, notably pre-election where he sees “correction risk/choppy range rising as yields/vol/spreads trough” while longer term the “big picture trends are higher vol, weaker US dollar, allocation to inflation assets in coming quarters as Fed’s deliberate inflation of Wall St mutates via fiscal policy into higher rates, steeper curves.”

The bottom line, is that the market will ultimately “sell the news” of a vaccine, which will ikely be the “big top for credit & stocks and big low for value vs growth.“

In terms of portfolio allocation, Hartnett sees the S&P at “3630 pre-election; but choppy, long vol, short $; inequality real estate and stocks”, or summarizing the rest of 2020 “don’t fight the Fed” while in 2021 it becomes “don’t fight inflation…long run contrarian entry point into inflation theme attractive; redistribution of wealth from metro-states to suburbs.”

via ZeroHedge News https://ift.tt/3brv0mM Tyler Durden