China To “Gradually” Sell 20% Of Its US Treasury Holdings, May Dump It All In Case Of “Military Conflict”: State Media

Tyler Durden

Thu, 09/03/2020 – 21:44

Ever since the early stages of the US-China trade/tech/virus/cold war four years ago, there were frequent rumors – which eventually gave way to increasingly legitimate chatter – that China was looking to go full “nuclear option” by selling some or all of its $1+ trillion of US Treasury securities, which incidentally has not been too far off the mark: as the chart below shows, after peaking in 2013, Chinese holdings of US debt have been steadily declining (and not so steadily in the aftermath of the Chinese devaluation), and are currently near the lowest level in 8 years.

In any case, while Beijing has been gradually reducing its Treasury holdings it has never shocked the market with a major liquidation; and yet this ultimate threat has now found its way into China’s premier state-run English language news source Global Times.

And while not official policy, the fact that GT on Thursday has made a US Treasury dump front page news, citing top “state-linked experts”, is cause for concern (and certainly suggests that the Fed may soon have to step in with another massive QE to purchase whatever China has to sell).

The Beijing-backed publication writes today that “China may gradually reduce its holdings of US Treasury bonds to about $800 billion from the current level of more than $1 trillion, as the ballooning US federal deficit increases default risks and the Trump administration continues its blistering attack on China” citing unnamed experts.

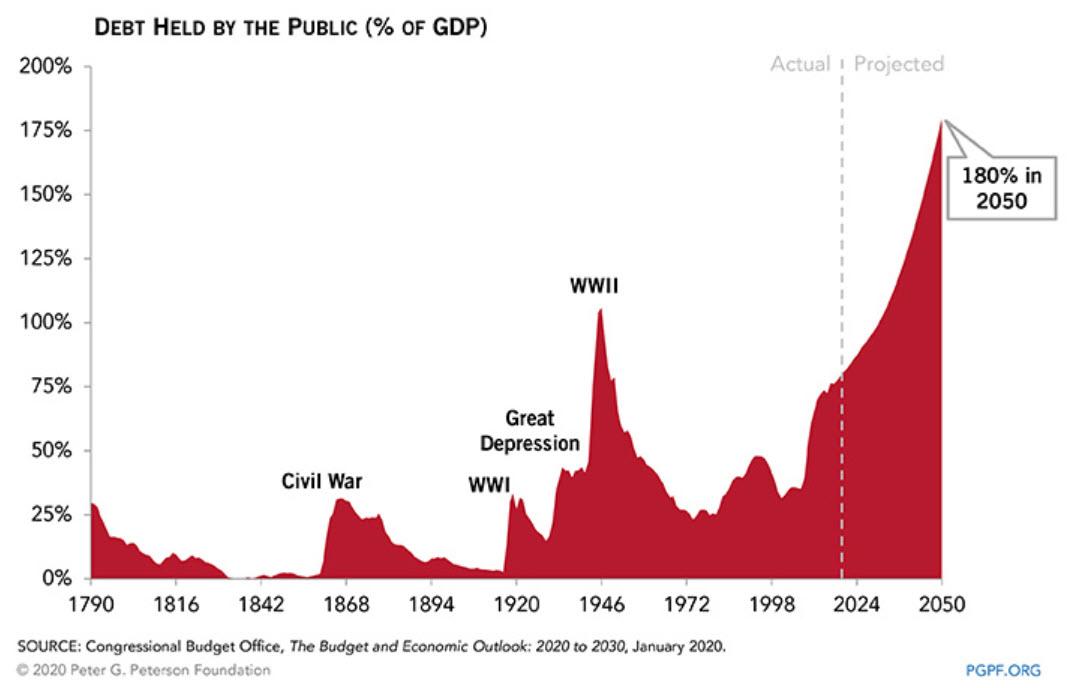

The facts are familiar to anyone who has been following the Sino-US trade war amid the US descent into fiscal hell, which as we noted earlier this week will result in the US budget deficit hitting a record $3.3 trillion and a record 107% debt/GDP in just 2-3 years: as the Global Times reviews, in the first six months of this year alone the world’s second-largest holder of US debts dumped some $106 billion worth of US Treasury bonds (annualized), and is looking to continue trimming its holdings “systematically” – the publication states.

A key reason stated for the liquidation is that China is anxious over risks associated with the surging debt level in the US, which is expected to actually exceed the size of the economy in 2021, which would be a first since the end of World War II. What’s worse is that as the CBO has shown, what happens over the next 3 decades is even more insane.

One expert cited in the GT report, professor at the Shanghai University of Finance and Economics Xi Junyang, emphasized that “China will gradually decrease its holdings of US debt to about $800 billion under normal circumstances.”

He added in what appears the most interesting and “dire scenario” quote in the article (or we’re perhaps meant to take it as a veiled threat under the guise of a mere aside):

“But of course, China might sell all of its US bonds in an extreme case, like a military conflict.”

But as we detailed previously, such a “nuclear option” may not be that nuclear after all, since the Fed has monetized three times as much debt as China holds in the past 3 months without a glitch – meanwhile, even though dumping its US paper would result in some brief dramatic headlines, not only would it not affect the US, but would prove too self-destructive for Beijing to pursue outright (which currently calibrates and fine-tunes its exchange ratio with the help of its trillions in US reserves). Still, the fact that Beijing views such as an option as an alternative if not bargaining chip, enough to mention it again in the state-owned media, suggests that the possibility of a full-blown capital war is now at hand.

Should China proceed with this highly symbolic if largely innocuous escalation, one can only imagine what the US retaliation would be.

via ZeroHedge News https://ift.tt/2DqY8Ov Tyler Durden