Gamma-Unwind Sparks Markets’ Worst Week In 6 Months As Dollar Spikes

Tyler Durden

Fri, 09/04/2020 – 16:01

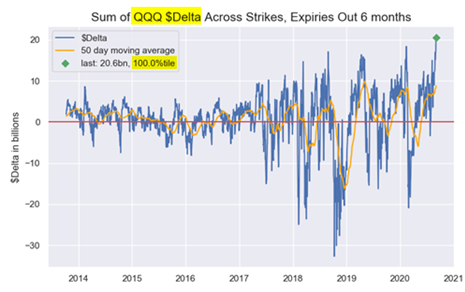

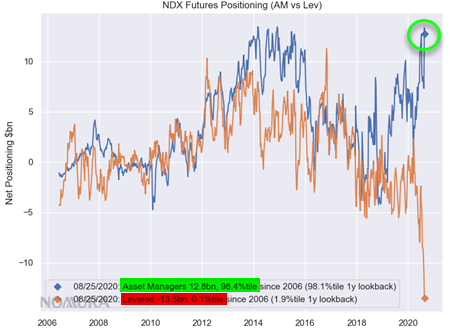

That much accumulated “short gamma” doesn’t just go away in a ~4% flush – the Street is still very much in a dangerous space, and that flow is still out there in full “Resevoir Dogs” standoff fashion both to UPSIDE AND DOWNSIDE (again, short gamma = sell when mkt going lower, buy when mkt going higher)

Masa-son, Momo, & Gamma-gutted home-gamers…“do you feel lucky?”

Or maybe it’s time to stop playing the game that you really don’t understand…

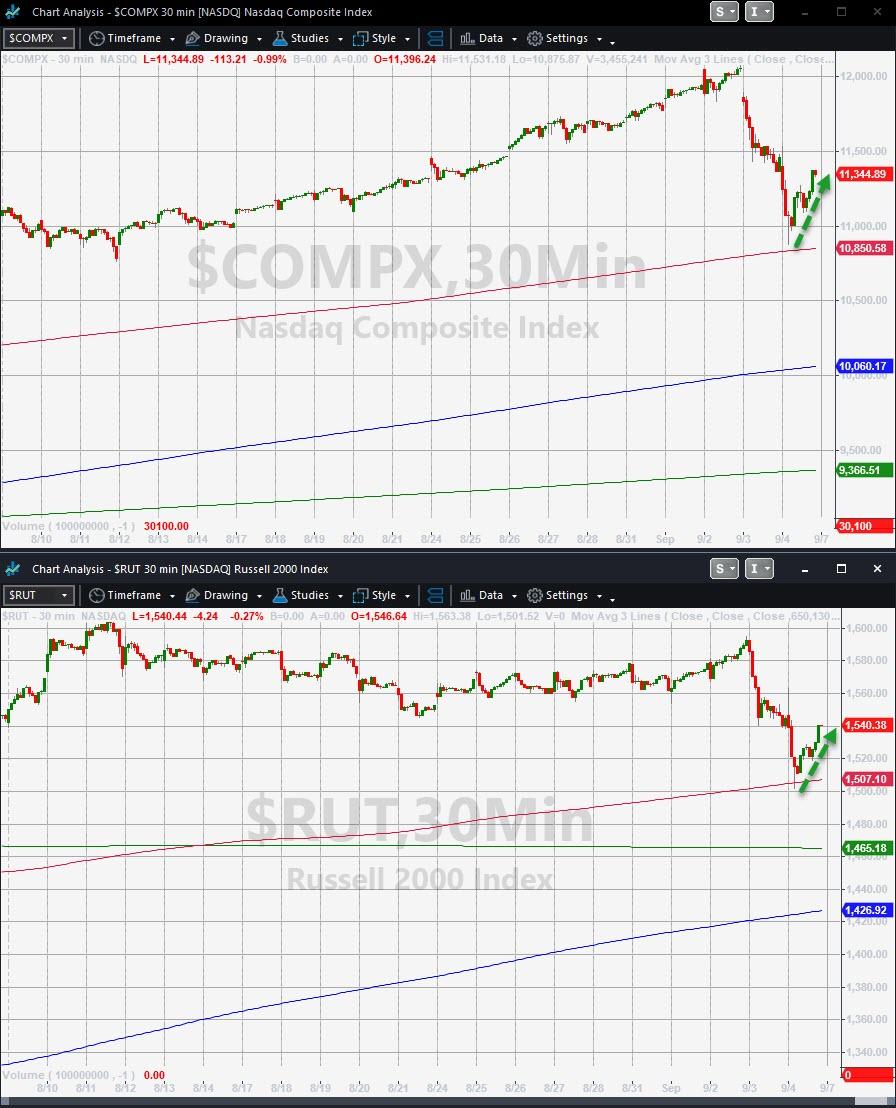

US equity markets were ugly again today, Nasdaq down 5% at its lows, only to be bid back dramatically higher with the Dow managed to get green briefly

Still an ugly week for stocks overall that was the worst since March for the majors…

Today’s rebounds began as The Dow and Small Caps tested their 50DMA…

The Momo meltdown continued for the 4th week in the last 5…

Source: Bloomberg

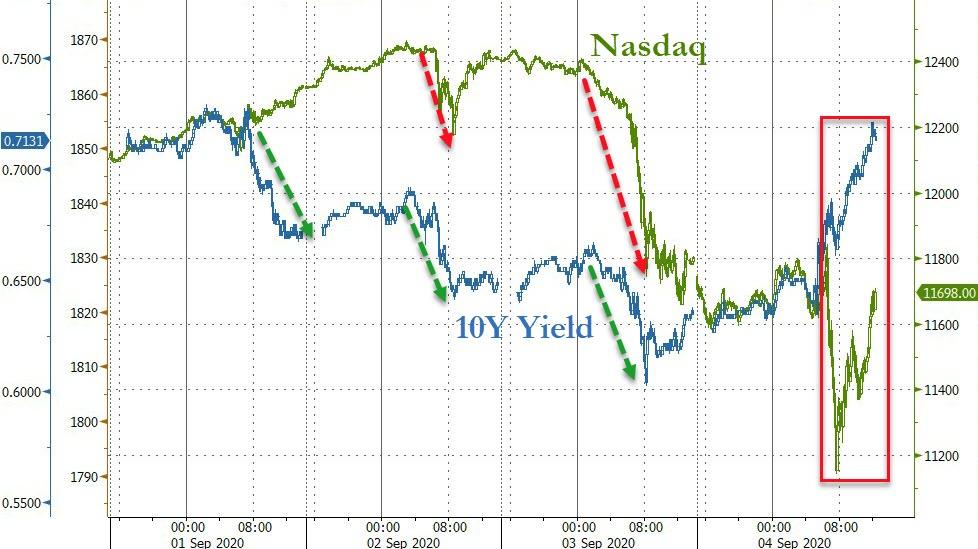

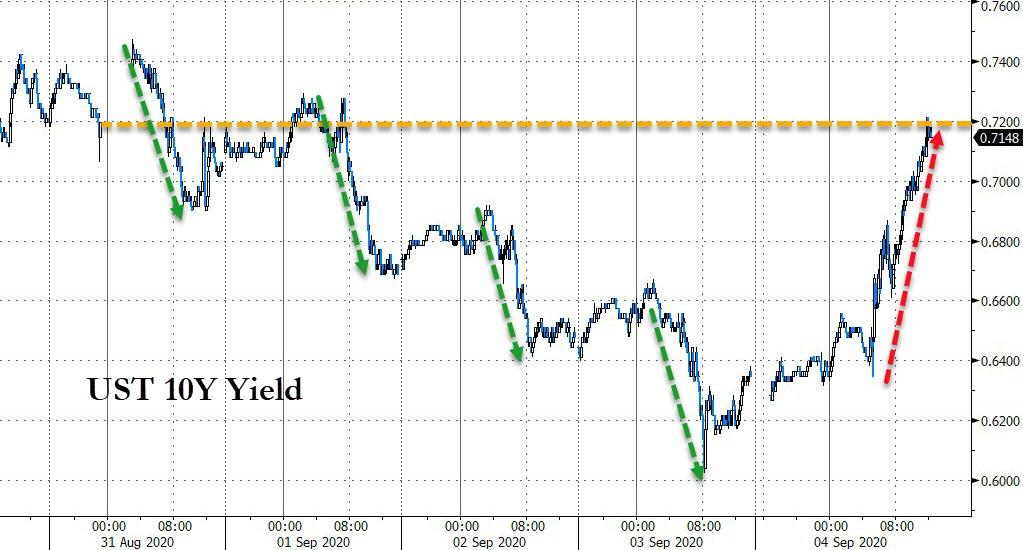

A very whippy week in bond land as yields tumbled with stocks cratering yesterday and then were also dumped alongside stocks today and accelerated even as stocks bounced back…

Source: Bloomberg

On the week, yields were mixed with 5Y +3bps, 30Y -4bps…

Source: Bloomberg

10Y surged today, back above 70bps…

Source: Bloomberg

The Dollar managed to rise on the week… for the first time in 10 weeks!

Source: Bloomberg

Cryptos were lower on the week but Ethereum managed to get back to even as Bitcoin Cash was the laggard…

Source: Bloomberg

While copper raged higher today, crude crashed and PMs were unable to hold any gains…

Source: Bloomberg

Oil was ugly with WTI back below $40..

Finally, you now have a long weekend to consider your exposure to this shitshow…

…and what happens next?

Source: Bloomberg

via ZeroHedge News https://ift.tt/3gYcpA8 Tyler Durden