(Negative) Convexity Cuts Both Ways: Nomura Confirms ‘Gamma’ Remains Most Important Flow In Market

Tyler Durden

Fri, 09/04/2020 – 10:35

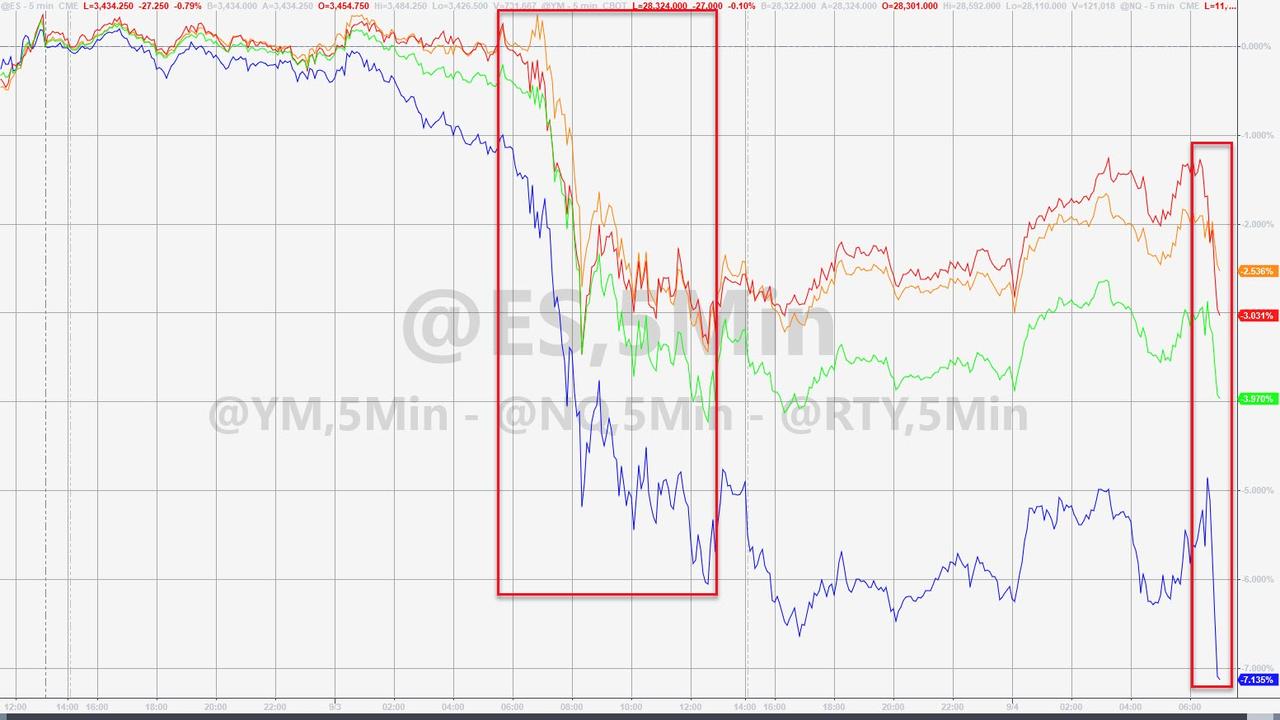

Yesterday’s sudden and violent, non-news-catalyst-driven collapse in Nasdaq (and the rest of the US equity market), especially focused on the go-go momo names, has brought home to many freshly-minted stock market gurus that risk is real and markets don’t always go up.

In fact, just as Nomura’s Charlie McElligott warned yesterday (before the crash), “something’s gotta give,” and it did.

Simply put, as the Nomura MD has explained numerous times before, the great and austere US equity market is nothing more than a weak dog being wagged by the tail of speculative mania in options markets – in other words, gamma is the market’s most important flow.

(Negative) Convexity cuts both ways:

Yesterday was obviously the “…as it turns the other way to the downside” part, with the coiling convexity that is the reality of hedging “short gamma” as it relates to the sensitivity of the options that dealers are short to the then vacuum-like collapse in price of the underlying securities, i.e. the single-name Tech momentum longs which saw all the buying of calls, call spreads and riskies traded recently as part of the large upside buying flow from the institutional mkt participant as well as the Robinhood short-dated OMT Calls in said “gamma proxies” (i.e. continue to watch TESLA spot as a “leading indicator” today); to single-name delta and the NQ & ES “upside” & futs bot by dealers to hedge “CRASH UP” over the past few weeks).

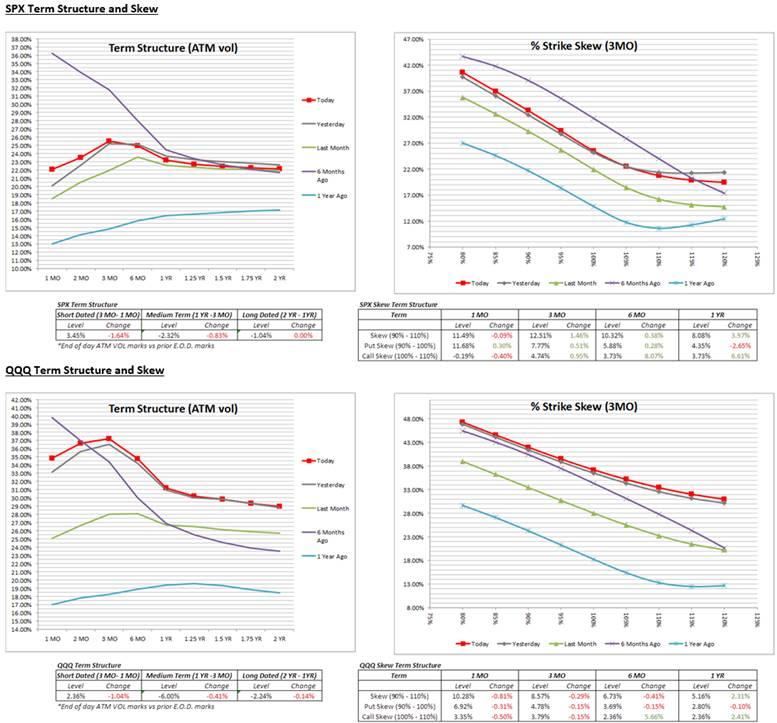

So as to the point of my recent notes, the Vol market told us that something was going to happen (as foretold by the epic and perverse recent moves in skew, implied vs realized vol, “vol-of-vol,” SPX- and VIX- term structure…need I go on?!)…and the Equities market caught-down to that reality yesterday in self-fulfilling “tail wags the dog” fashion.

Yesterday saw some sanity / rationality restored, and that’s a healthy development:

-

SPX 1m tenor jump +2vols, QQQ outperforming at +3vols

-

SPX 3m-1m term structure was smashed -1.5vols

-

SPX Put Skew (ratio of 10d puts v 25d) came off from local highs

-

1m “vol of vol” jumped 15vols higher

-

UX2-UX1 spread flattened 2 vols, with VIX skew flattening off local highs as a function of the move lower in short-dated SPX put skew

But as McElligott notes, this is not over yet.

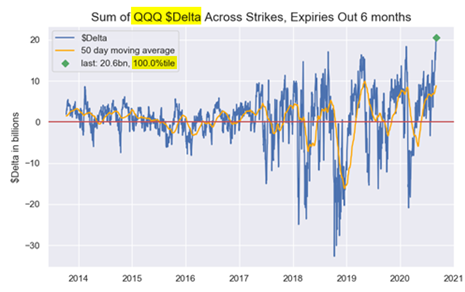

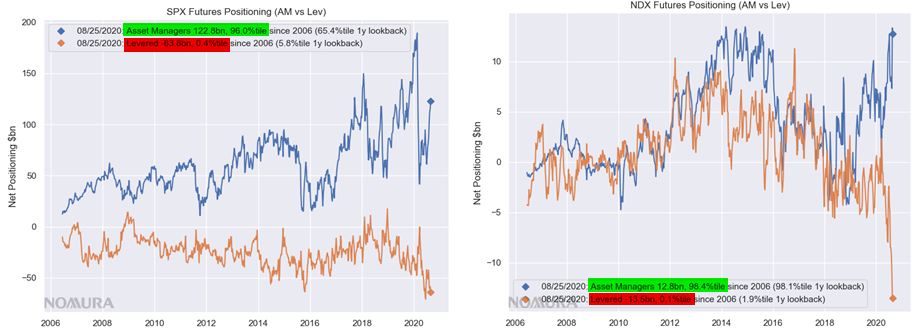

That much accumulated “short gamma” doesn’t just go away in a ~4% flush – the Street is still very much in a dangerous space, and that flow is still out there in full “Resevoir Dogs” standoff fashion both to UPSIDE AND DOWNSIDE (again, short gamma = sell when mkt going lower, buy when mkt going higher)

I also think it is still worth reiterating what I’ve recently mentioned regarding “extreme” positioning in the market to capture the “length” out there which realistically cannot be cleared in a single session as well: from the unprecedented $Delta from the “heavy” options positioning to the magnitude of the US Eq futs positioning from Asset Managers—remember these charts?

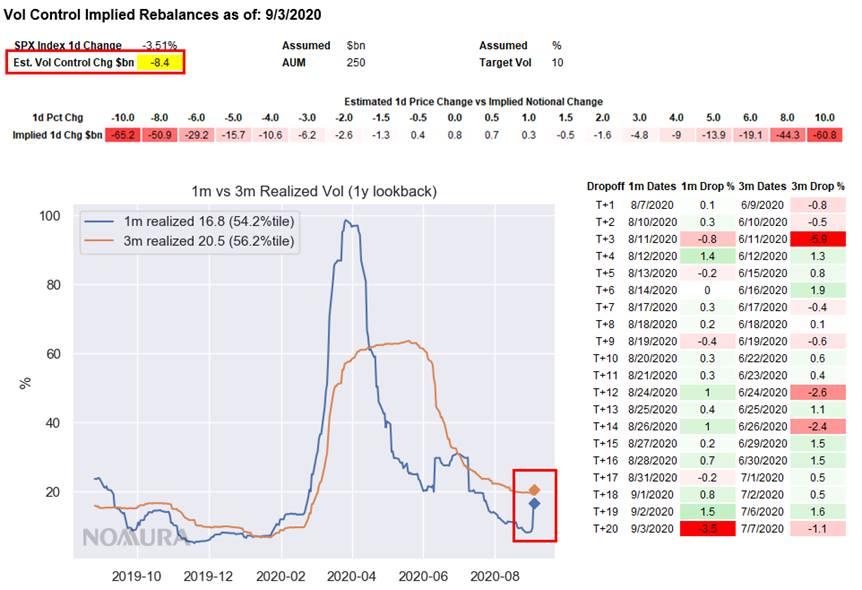

However now, in light of yesterday’s market shock and the mathematically factual “drag-UP” impact it will have on trailing realized volatility windows…

…if we were to see this “realized vol UP” dynamic sustain moving-forward, then Vol-Control as a source of prior enormous releveraging “buy” flow can very easily again turn to a mechanical incremental SELLER – again, all thanks to this market structure built upon “volatility as your exposure toggle.”

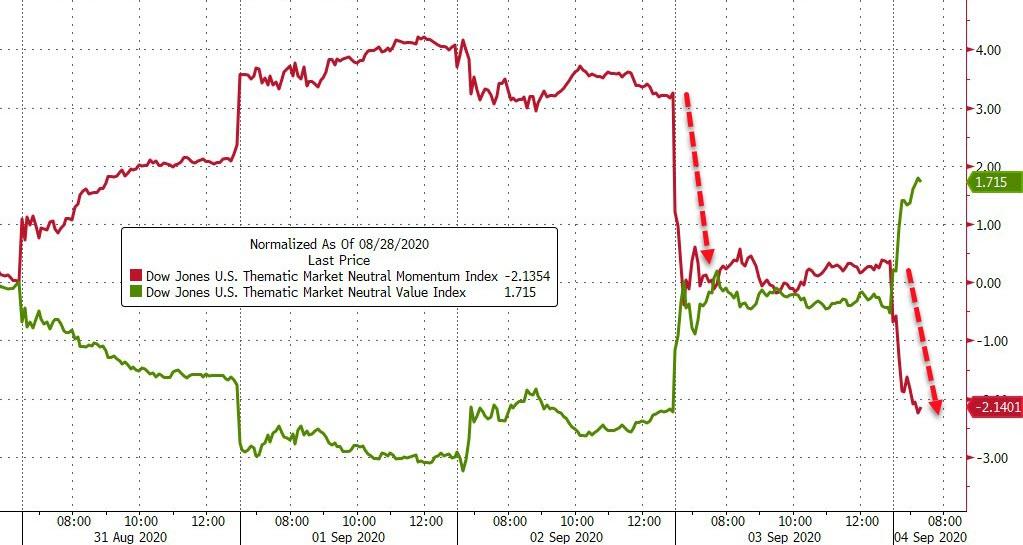

So far today is more of the same with pure “gross-down”: Fins, energy, indus, and mats (value cyclicals) are all UP and leading S&P; tech conm svc and cons disc (secular growth)…all down… crushing the momo factor…

What goes up (on negative gamma) comes down even harder…

via ZeroHedge News https://ift.tt/2QVcAkZ Tyler Durden