Powell Says Jobs Report Was “Good” But Sees Low Rates “For Years”

Tyler Durden

Fri, 09/04/2020 – 16:37

In his first appearance since last week’s historic revision of the Fed’s mandate to one targeting higher inflation via an Average Inflation Targeting regime, Fed Chair Powell had some good and some not so good news about the economy. The former lawyer said that while the latest data on employment in the U.S. was “a good one”, he underscored that this is far from sufficient and repeated that the recovery has a long road ahead and that interest rates will remain low for a while, likely for “years.”

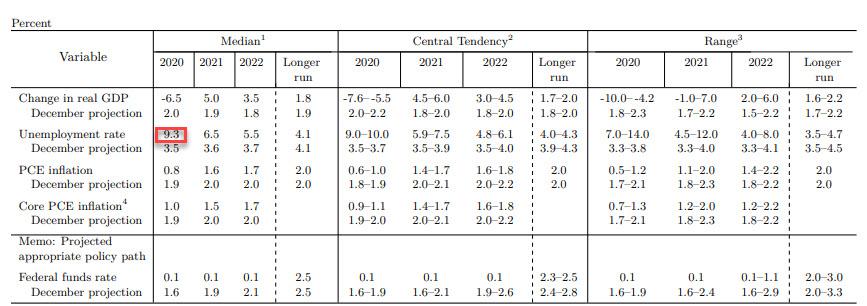

“Today’s jobs report was a good one,” Powell told National Public Radio in an interview Friday. “Through May and June, we got quite a few people back to work.” That of course is an understatement, considering that the unemployment rate plunged to 8.4% (as the economy added 1.4 million workers and nearly 3.8 million according to the Household survey) a number which is nearly 1% below the Fed’s own year-end unemployment projection of 9.3%.

And just to frontrun even stronger economic reports – because as of this moment the worst thing that can happen to the Fed is a full-blown recovery and a spike in inflation which would cripple the Fed’s credibility – in the weeks ahead of the election, Powell said that “the recovery will get harder from here.”

Of course, with AIT now firmly in place, no matter how low unemployment drops or how strong the recovery does get, the Fed will not hike rates and instead will justify ultra low rates – and thus no policy tightening – by simply noting that inflation has years to go before its returns to its hypothetical trendline of 2.0%, something the Fed has been unable to hit for years regardless. After all it is in the best interest of America’s middle class to see its purchasing power eroded as fast as possible.

And sure enough, Powell told NPR that he sees interest rates staying low for years: “We think that the economy’s going to need low interest rates, which support economic activity, for an extended period of time,” he said, adding that the period of low interest rates “will be measured in years.”

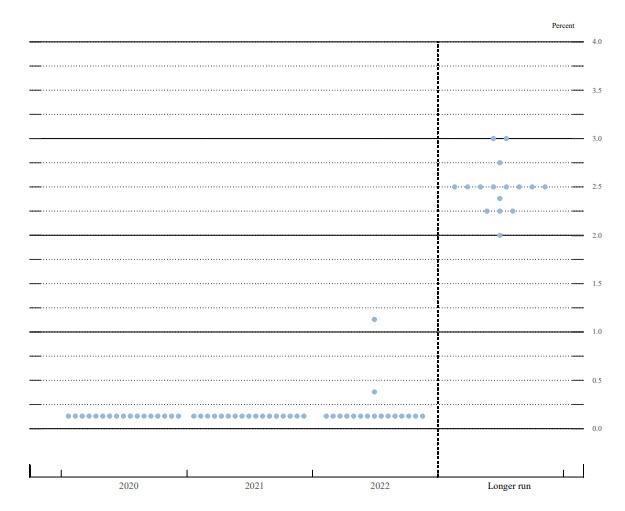

As a reminder, in the June meeting the Fed unanimously projected that the federal funds rate they target would remain near zero this year and next, with all but two FOMC members expecting rates to stay at that level in 2022 (even if the Fed kept its longer-run rate forecast at 2.5% although good luck with that).

Following its last meeting on July 28-29, the policy making Federal Open Market Committee said it expects to keep short-term interest rates pinned near zero “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price-stability goals.”

Separately, citing research from BofA, we noted that for the Fed to catch up to its AIT target, rates would need to stay ultra low for some 42 years.

Preceding Powell, a chorus of Fed members this week reiterated that they too were in no rush to build on the framework by providing more specific details on their interest-rate plans.

via ZeroHedge News https://ift.tt/331wC2K Tyler Durden