Warning Flashes As Corporate Execs Dump Most Stocks Since 2015

Tyler Durden

Fri, 09/04/2020 – 09:57

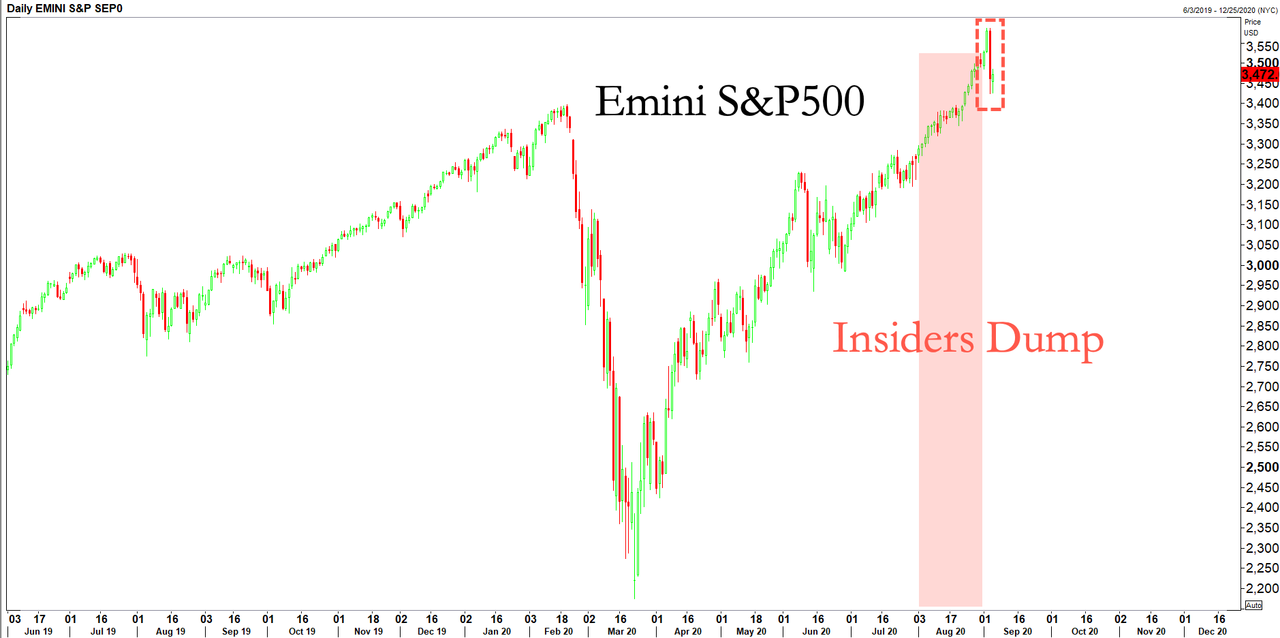

The S&P500 hit an all-time high price earlier this week, with a forward P/E multiple surpassing the dot com peak of 27x, printing at 27.02x. These mind-numbing valuations (before Thursday’s panic sell) have been met with intense insider selling as corporate executives dump billions of dollars worth of their stock into unsuspecting Robinhood traders.

Data compiled for the Financial Times by Smart Insider shows insider selling by 1,042 chief executives, chief financial officers and company directors in Aug. was the highest dollar amount since Nov. 2015. The total number of execs disposing of their stock as valuations, in some cases, surged beyond dot com levels, was the highest since Aug. 2018.

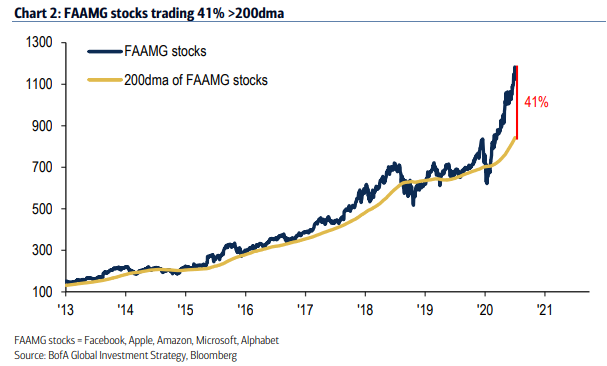

The insider selling frenzy has been happening as only a handful of technology stocks push overall main equity indexes to record or near-record forward P/Es. The optics of insiders selling in force is not a good one, indicating these business elites don’t believe in today’s rich valuations as the economic recovery stalls.

“Chief executives have been much more downbeat in their outlooks than investors,” said Max Gokhman, head of the asset allocation for Pacific Life Fund Advisors.

“If you think that your future is dim, but your stock is soaring, then it makes sense to sell,” Gokhman said.

For some historical context, after insiders dumped billions of dollars worth of stock in Nov. 2015, the S&P500 tumbled nearly 14% over 65 days into a low in late Jan.-Feb. 2016.

FT outlines the most significant insider selling transactions in Aug.:

Steven Rales and his brother Mitchell, founders of US industrial conglomerate Danaher, were the biggest sellers in August, offloading nearly $1bn worth of stock in technology specialist Fortive Group, which was spun out of Danaher in 2016.

Steven Rales pocketed $606m while Mitchell took home $363m. Fortive’s stock is up about three-quarters since the March trough. The company did not respond to a request for comment.

Leslie Wexner, the founder of L Brands, which owns Victoria’s Secret, sold $89m of the company’s stock — which has more than tripled since the rally began. Mr. Wexner has made headlines in recent years for hiring Jeffrey Epstein, the disgraced financier who died in prison last year, to manage his personal fortune. L Brands did not respond to a request for comment. -FT

In a separate report via StoneX, a brokerage, insider selling of Nasdaq 100 tech stocks over the second quarter hit $10.4 billion, up 171% over the same quarter in 2019.

“Insiders at Nasdaq 100 index companies are harvesting a once-in-a-millennium bonanza,” said Vincent Deluard, a macro strategist for StoneX.

Insiders are suggesting that current valuations aren’t just rich, but the latest rally in stocks this summer is not sustainable, rather it could be viewed as a blowoff top.

For more color, we recently penned a couple of pieces (see: here & here) that shows insiders have been dumping through the summer, meanwhile, Robinhood daytraders are panic buying every dip as they might just be transformed into bagholders.

via ZeroHedge News https://ift.tt/2R828a9 Tyler Durden