“We Could Have Another 10% Fall, Easily” – El-Erian Warns Of “Return To Fundamentals” Regime-Change

Tyler Durden

Fri, 09/04/2020 – 11:05

Allianz Chief Economic Advisor Mohamed El-Erian told CNBC’s Sara Eisen that if the “mindset changes from technicals to fundamentals,” then the stock market could take another leg down.

“That is the tug of war that’s going to play out, and it’s going to show the DNA of investors,” he told Eisen on Thursday after main U.S. equity indexes recorded their worst session since June.

If a return to macro event kicks in, or at least a growth scare is seen, Allianz’s chief economist warned stocks could be headed for a deeper correction.

“We could have another 10% fall, easily … if people start thinking fundamentals,” he said.

S&P500’s Fibonacci Retracement Levels

El-Erian said the stock market remains decoupled from the real economy. He said if investors revert back to macro, then a further selloff could be seen as many will be forced to recognize a slowing recovery and looming corproate bankruptcies.

“If you are in a liquidity-based paradigm, you will be dominated by relative thinking, and that’s where we’ve been. If you’re in a fundamentally-based paradigm,” he said, adding “the answer is: no, you are not paying for an economy that faces not just moderation in the way of improvement, but a rising level of bankruptcies.”

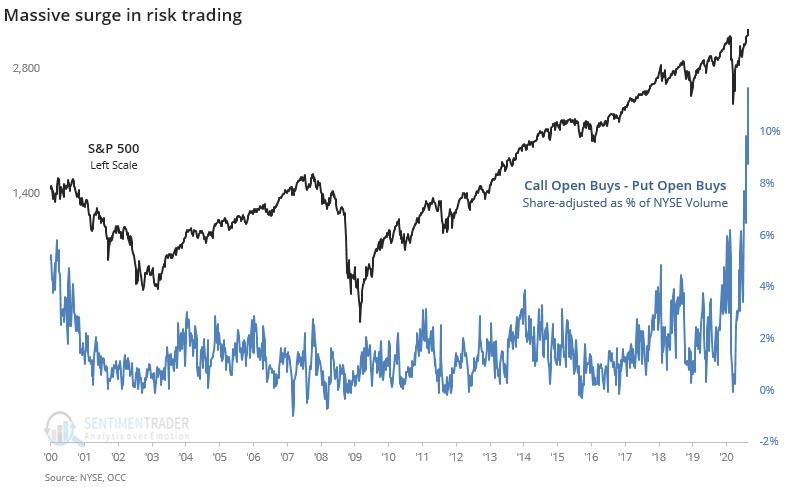

El-Erian warned, earlier this week, in a Financial Times op-ed, that a reversal in the stock market could be devastating for small investors who have piled into technology stocks over the last five months.

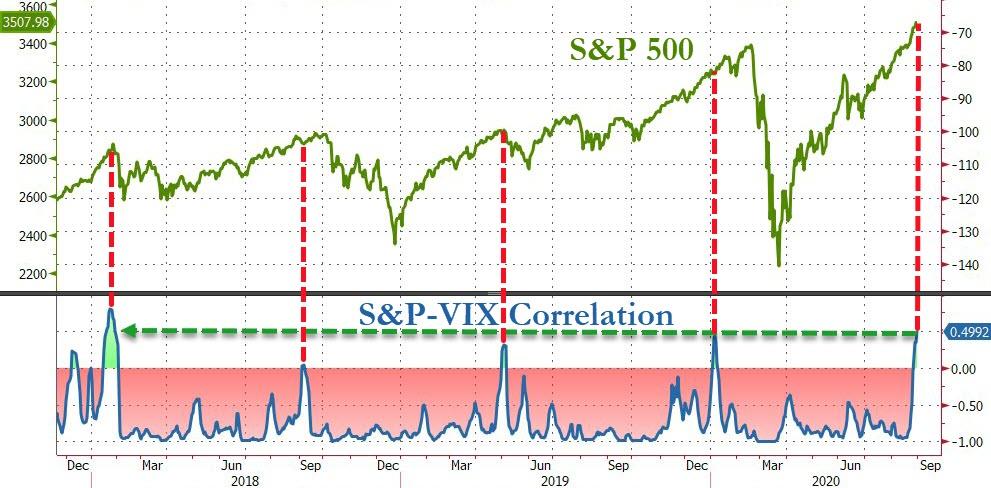

It has been supplemented by more downside “tail protection” aimed at safeguarding portfolios from sharp drops. With that, the Vix volatility index has decoupled from equity indices, adding to signals that a large market correction, should one materialise, would encourage more professional selling that could overwhelm the buy-the-dip retail investor.

This is a potentially troubling situation for central bankers, regulators and economists.

Yes, it would take a big shock for markets to move significantly lower — such as a renewed sharp economic downturn, a considerable monetary or fiscal policy mistake, or market defaults and liquidity accidents. But should such a move occur, the likelihood of further market turmoil would be high, especially given the current lack of a short base to buffer the downturn.

This exposes small retail investors to big potential losses. It risks broader economic damage and could end up pulling central banks even deeper into distorting price signals and undermining the markets’ role in efficiently allocating resources throughout the economy. – El-Erian wrote

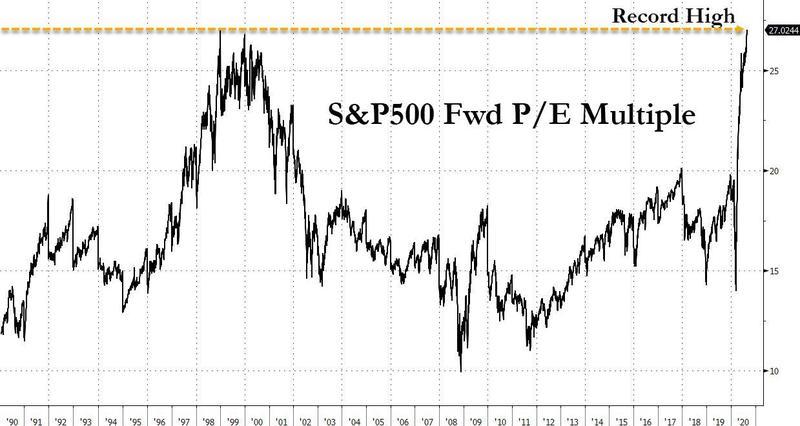

To show the market insanity, S&P 500’s P/E multiple just broke above the all-time highs from the dotcom bubble…

And, if, in fact, a growth scare is the reason why stocks are selling, not a sector rotation into value, then it could be possible investors misread the shape of the economic recovery.

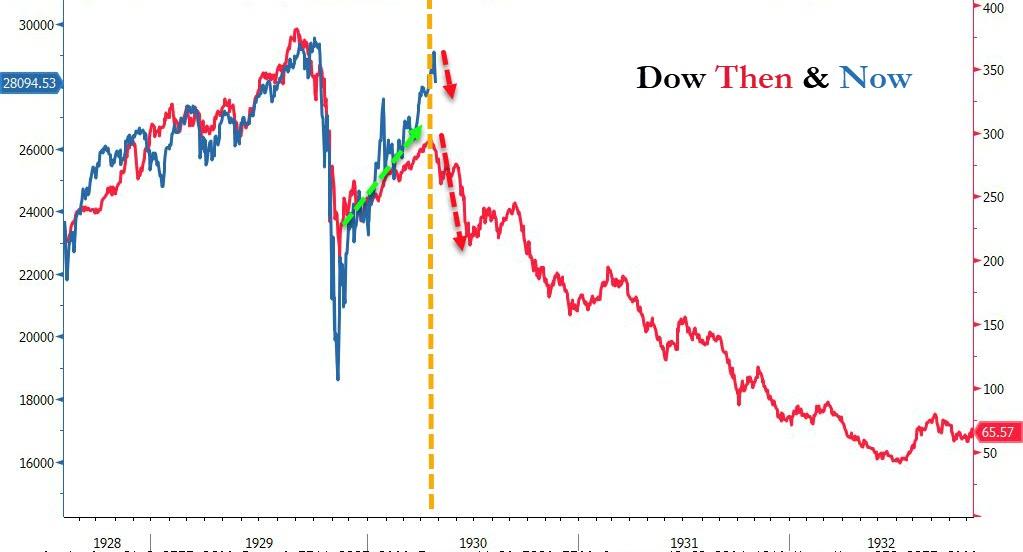

Repeat of the early 1930s?

via ZeroHedge News https://ift.tt/3i0TYMv Tyler Durden