“A Mere Flesh-Wound” Or Beginning Of The End Of The Bull-Bounce?

Tyler Durden

Sat, 09/05/2020 – 15:00

Authored by Sven Henrich via NorthmanTrader.com,

Straight Talk: Bear Raid

A confluence of factors led to this week’s sell-off in markets. In the lead up to this week’s market top we saw all the classic signs: Weakening participation, highly overbought readings, vast technical extensions, historic valuations accompanied by extreme complacency and bear capitulations.

And make no mistake: This sell off was intense. $NDX dropped 10% within 2 days off of all time highs, one of the fastest and steepest drops from all time highs in history if not the most in history. High flying tech stocks such as $AAPL and $TSLA dropped 20% and 26% in 2 days as well.

A mere flesh wound in what was an unstoppable rally or signs of the end or the beginning of the end?

I’m discussing these issues and more of the macro context in a new edition of Straight Talk. As announced this week I’ve moved Straight Talk to a podcast format and in the next few days/weeks I’ll make sure it gets listed in your favorite podcast directories such as Apple Poscats, Spotify and Google Podcasts and perhaps others as well so you can follow new episodes from there as well.

For now here’s the newest edition of Straight Talk:

As I discuss some charts in the episode I post some here for reference.

Namely:

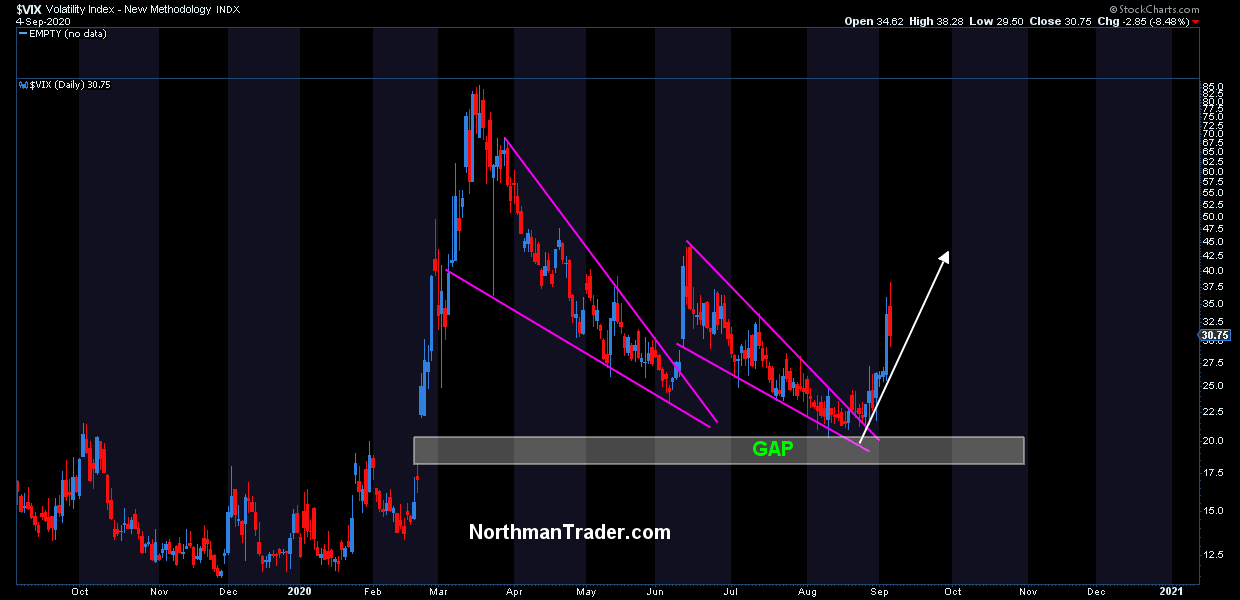

The $VIX. In August I published $VIX 46 when $VIX was trading at 22 calling for a breakout to come with a target for 46. While the target has not been reached as of this writing we did get a major breakout and the $VIX hit 38 on Friday an over 70% move from the original post:

Also in August I mentioned the $DJIA having potential of its February gap and this gap was filled this week and it produced a rejection from here:

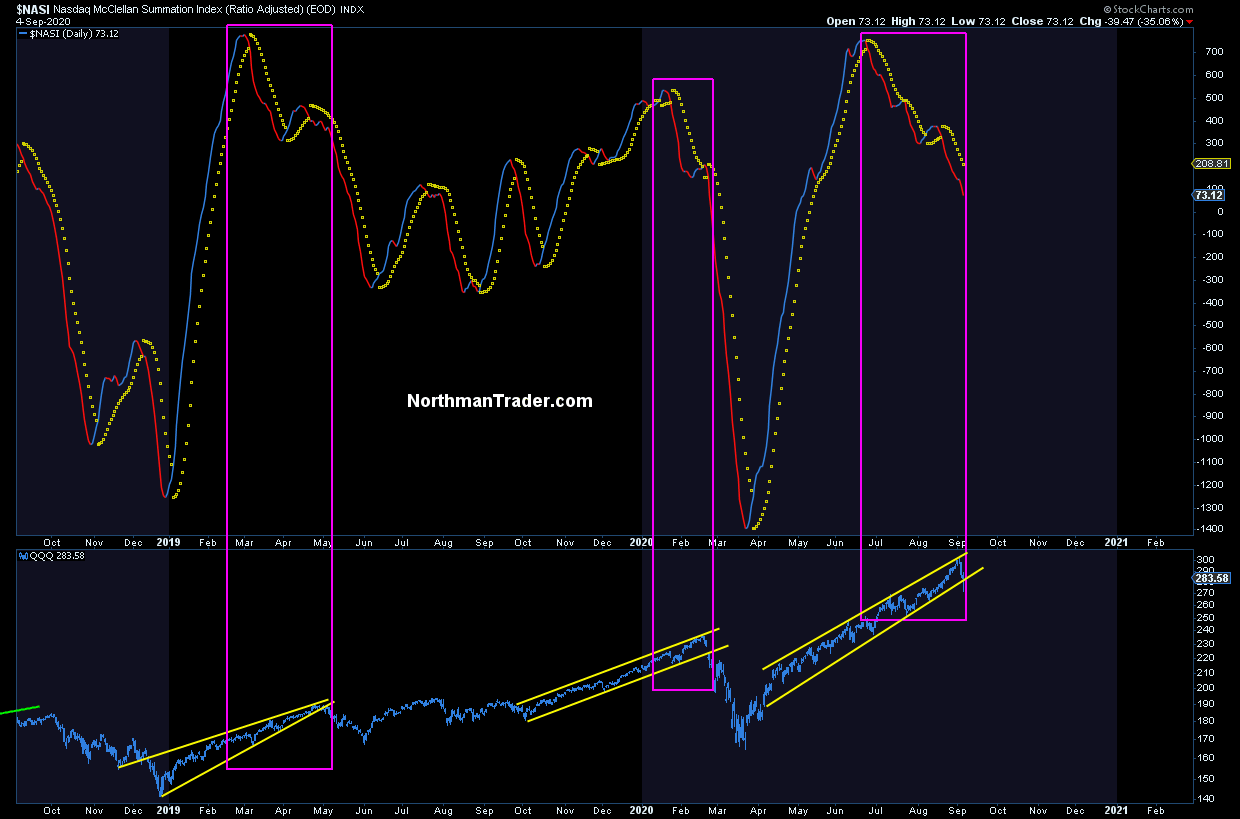

Also in August I kept talking about the weakening signals underneath and a warning sign on tech specifically the $NASI pointing to a coming correction in tech:

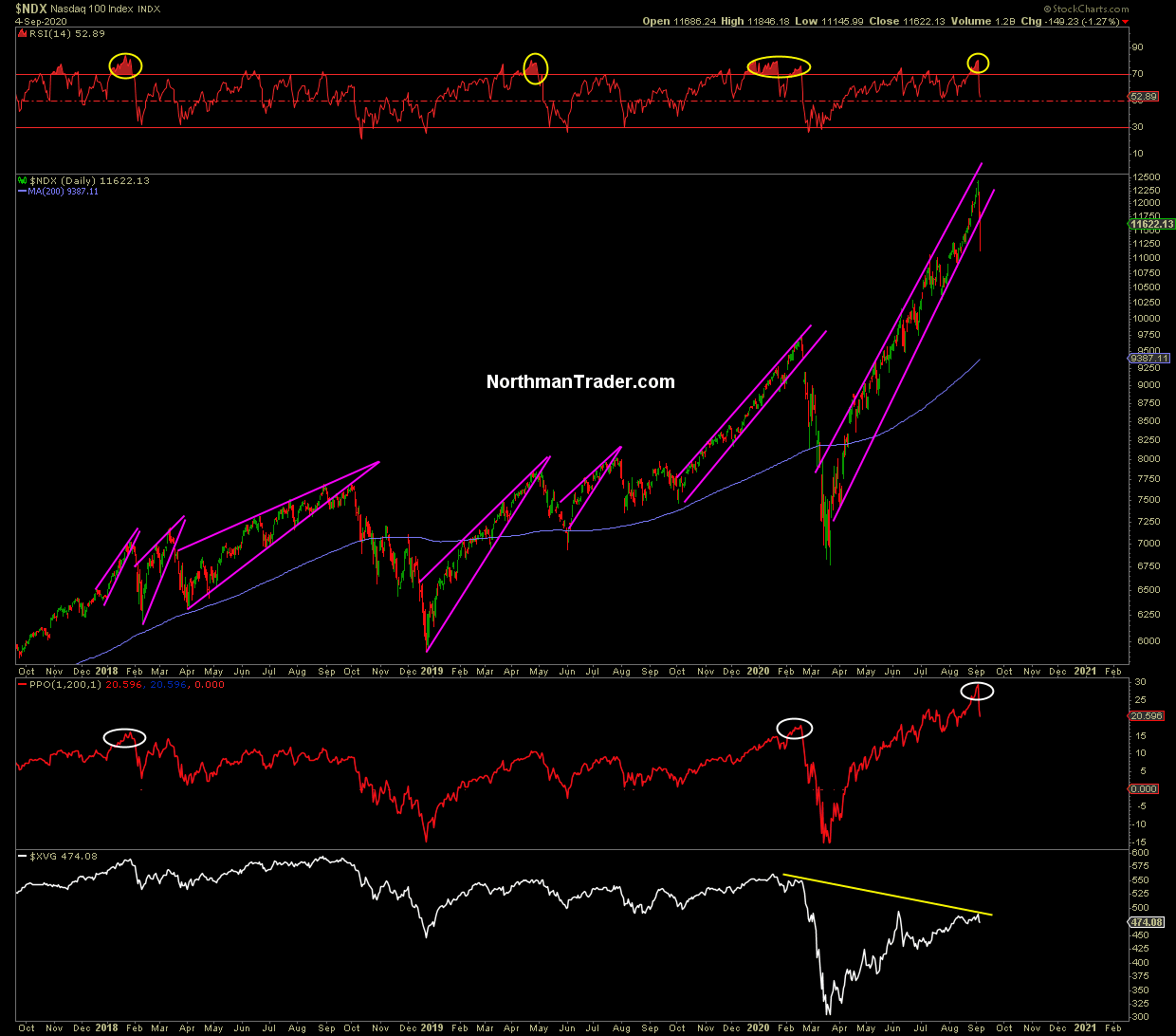

And I kept talking about the lack of confirmation in the value line geometric index $XVG with its message:

I repeat: New highs in select indices have been highly deceiving. They were driven by a few mega cap stocks.

The $XVG index suggests a border market still in a bear market.

Based on that measure $SPX would be trading at 2,600 were it not for mega cap expansions in 6/7 stocks. pic.twitter.com/UFSi7HchgD— Sven Henrich (@NorthmanTrader) September 4, 2020

While indices kept driving to new highs in ever more extended patterns, similar to rallies we’ve seen before with this being the most extended since the year 2000. $SPX traded the highest above its 200MA and $NDX reached prices 33% above its 200MA:

All this as put/call ratios hit historic lows:

I repeat: New highs in select indices have been highly deceiving. They were driven by a few mega cap stocks.

The $XVG index suggests a border market still in a bear market.

Based on that measure $SPX would be trading at 2,600 were it not for mega cap expansions in 6/7 stocks. pic.twitter.com/UFSi7HchgD— Sven Henrich (@NorthmanTrader) September 4, 2020

While markets levitated to the highest disconnect from the underlying size of the economy ever:

market cap to GDP dropped to 181% yesterday pic.twitter.com/glw6zSaOvO

— Sven Henrich (@NorthmanTrader) September 4, 2020

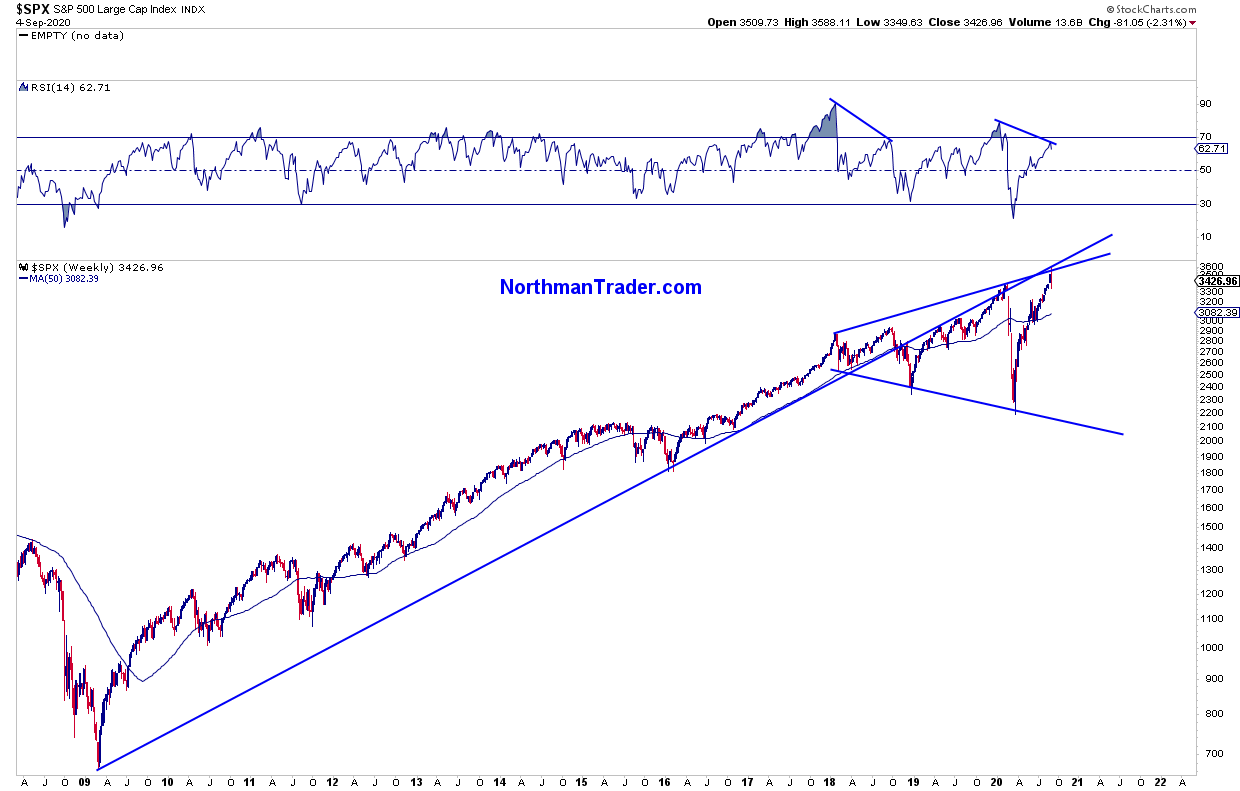

And finally as outlined in Bear Capitulation and Panic Buying $SPX was reaching historic resistance as evidence by 2 key trend lines, both were hit this week and $SPX rejected from there:

In the context of history is this a coincidence that this all happened to come together at the beginning of September?

After all, following the market top in March of 2000 the subsequent counter rally peaked on September 1 and the top in 1929 ended on September 3rd, as did now this rally. This rally topping on September 2nd and in pre-market on September 3rd could all be a coincidence of course, but only time will tell.

The similarity in structure though between the historic run leading to the top in 1929 and the last 13 years is striking:

Pretty wild actually. Not sure if it means anything, but the structural similarity, despite all the differences in time and global technology is pretty impressive. pic.twitter.com/GHs15JDT81

— Sven Henrich (@NorthmanTrader) September 3, 2020

I’ll be publishing a detailed analysis of the technicals and implications tomorrow Sunday September 5th in the latest edition of Market Videos (if not signed up yet you can do so via the link)

For now I hope you enjoy the discussion in Straight Talk: Bear Raid.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2RbGjqd Tyler Durden