“The Correction Has Further Room To Go”: Futures Recover Early Losses As European Markets Jump

Tyler Durden

Mon, 09/07/2020 – 08:36

While the US is celebrating Labor Day and enjoying the last days of summer, markets started the Asia session with a selloff, extending last week’s decline amid disappointment that Tesla wasn’t added to the S&P 500. E-mini futures fell as much as 1.1%, before eventually recovering all losses and turning slightly green.

Even though futures managed to recover from a sharp early loss, valuation is emerging as a concern for U.S. investors and there’s also nervousness about extreme positions in technology stocks now that it has emerged that the August ramp had nothing to do with fundamentals, technicals, outlooks, etc but was the byproduct of one man with more money than brains, buying up every call option he could find and creating the biggest “gamma squeeze” in history.

The exclusion of Tesla from a group of companies that were being added to the S&P 500 weighed on the electric car maker’s Frankfurt-listed shares, which were last down 3%.

Meanwhile, world shares rose 0.2% after hitting a record high last week as central bank stimulus drove asset valuations to heady levels, but the rally has since cooled as tech stocks sold off while worries over patchy economic recovery dogged investors. Sharp sell-offs have recovered quickly in recent months though analysts expect further downside to this leg due to rising cross-asset volatility. “Our risk indices have begun to turn from their euphoria highs,” Jefferies said, adding that it was switching its weighting on MSCI All World index to “tactically bearish” in the short term. “On the balance of probabilities, last week’s correction has further room to go.”

European stocks rose extended early gains in a broad rally led by autos, industrials and health-care stocks. The Stoxx 600 rose as much as 1.5%, trimming last week’s losses while the auto sector index gained 2.2%, hitting highest level since Feb. 27, while banks underperformed, with the SX7P index up 0.2%. UK stocks, meanwhile, climbed 2% helped by a falling pound with Brexit talks plunging into crisis following Britain’s threat to override its EU divorce deal. Sterling fell around half a percent against the dollar and euro on Monday. “It is almost inevitable that the perceived probability of ‘no deal’ will escalate over the coming weeks,” Goldman Sachs analysts wrote in a note.

Earlier, Asian stocks fell: the MSCI’s broadest index of Asia-Pacific shares outside Japan was last down 0.2% after two straight days of losses toppled it from a 2-1/2-year peak last week. The drop was led by communications and consumer staples, after falling in the last session. Markets in the region were mixed, with Shanghai Composite and Hong Kong’s Hang Seng Index falling, and South Korea’s Kospi Index and Australia’s S&P/ASX 200 rising. Japan’s Nikkei fell 0.5% with SoftBank coming under heavy selling following media reports it has spent at least $4 billion buying call options on listed U.S. technology stocks. The Shanghai Composite Index retreated 1.9%, with Advanced Micro-Fab and NINGBO MENOVO posting the biggest slides. China’s country’s largest and leading homegrown chipmaker, Semiconductor Manufacturing International Corp (SMIC) tumbled on speculation the company may be added to Trump’s sanctions list.

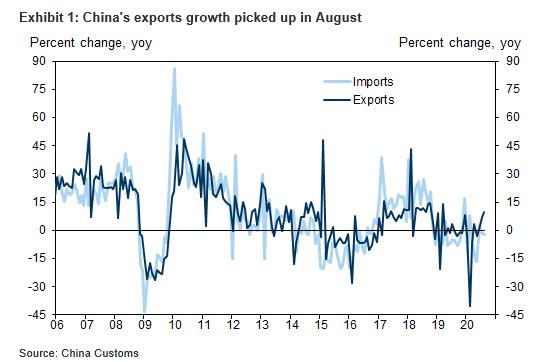

Overnight we got the latest trade data out of China, where exports accelerated to 9.5% yoy in August from +7.2% yoy in July – rising to the third-highest level on record, due to demand for medical goods, electronics, and the effects of major trading partners gradually resuming business activities. The jump was also helped by a low base (exports fell 2.7% mom sa in August 2019) and slightly above consensus expectations, with sequential growth down to +0.2% month-on-month (sa non-annualized) in August (vs. +5.9% in July). In contrast, imports shrank 2.1% yoy in August, down further from a decline of 1.4% yoy in July, slightly below consensus expectations with traders eyeing an unexpected second consecutive drop in oil imports. In month-over-month terms, exports slowed to +0.2% sa non-annualized in August (vs. +5.9% in July). Imports resumed a decline of 0.2% sa non-annualized in August (vs. -1.2% in July). China’s trade surplus remained strong at US$58.9bn in August, though down from US$62.3bn in July.

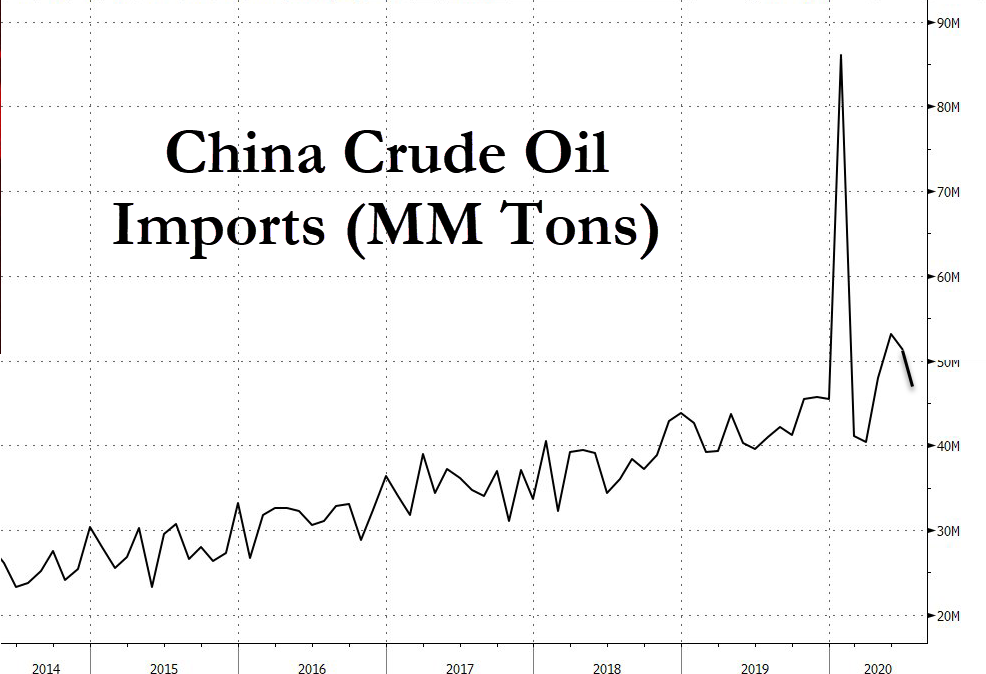

As Goldman notes, China’s export growth remained strong in August in year-on-year terms although as the bank notes, “in coming months, slower growth of exports related to COVID-19 and relatively high base could weigh on headline exports growth, though a rebound in global growth could provide support.” For major commodity imports, in value terms, copper imports slowed to 67.2% yoy in August (vs. 72.0% yoy in July); iron ore imports decelerated to -4.9% yoy in August (vs. +10.6% yoy in July); crude oil imports continued to fall on a year-over-year basis (-24.6% in August, vs. -26.8% yoy in July). In volume terms, copper imports growth moderated to 67.1% yoy in August (vs. +81.5% yoy in July); iron ore imports decelerated to 5.8% yoy in August (vs. +23.8% yoy in July); crude oil imports increased 12.6% yoy in August (vs. +25.0% yoy in July).

Global equities fell the most since June last week as doubt crept into investors minds about whether equities have risen too quickly and valuations are reaching extremes according to Bloomberg. US technology shares, which have seen a powerful rally through the depths of the pandemic, showed signs of buckling at the end of the week amid reports that huge options bets were fanning their gains. The roller coaster ensnared SoftBank Group Corp., which tumbled 7% after the market caught up with what Zero Hedge readers knew since last Thursday, that the Japanese conglomerate had made massive bets on tech-linked options trades.

“I don’t think this is a start of a downturn in asset prices,” said Robert Greil, chief strategist at Merck Finck Privatbankiers AG in Munich. “We’re only in the first phase of the economic recovery, which makes a major downturn unlikely. Naturally, setbacks are buying opportunities in such an environment.”

In currency markets, the dollar steadied in holiday-thinned trade on Monday, while traders shifted their focus to the European Central Bank’s meeting on Thursday. Most analysts don’t expect a change in policy stance. The message the ECB will deliver on its inflation forecasts is likely to set the direction for the euro, which has surged in the past few months. The dollar was flat against the yen at 106.28 ahead of a heavy week of macroeconomic data with figures on household spending, current account and gross domestic product due on Tuesday.

In commodities, oil prices hit their lowest since July, after Saudi Arabia made the deepest monthly price cuts for supply to Asia in five months. U.S. crude fell 1.26% to $39.19 a barrel. Brent crude skidded to $42.11. As Bloomberg reports, “oil extended its retreat drop $40 a barrel after Saudi Arabia cut pricing for October crude sales, as demand struggles to fully recover from the coronavirus outbreak.” Futures in New York dropped 1.7% after Saudi Aramco reduced its key Arab Light grade by a larger-than-expected amount for shipments to Asia in a sign that fuel demand in the largest oil-importing region is wavering. The company also lowered prices to the U.S. for the first time in six months. Eslewhere, Chinese crude imports fell for a second month in August, and the world’s biggest importer is expected to purchase much less in September and October than it did in May and June as independent refiners run out of quota after a buying binge earlier this year.

Markets activity will remain subdued on Monday with the U.S. closed for the Labor Day holiday.

A quick look around global markets courtesy of NewsSquawk

Asian equity markets began the week indecisively as the region reflected on Friday’s varied US jobs release and the continued tech-related losses on Wall St, with mixed Chinese trade data and ongoing tensions with the US adding to the cautious approach. ASX 200 (Unch.) traded choppy following the 2-week extension of level 4 lockdown restrictions in Victoria state although strength in the mining-related sectors and financials had initially propped up the index, whilst some economists also hopeful of a further loosening of RBA policy within the next 2 months according to a latest survey. Nikkei 225 (-0.4%) was restricted amid an uneventful currency and notable losses in SoftBank shares which slumped over 7% with investors disturbed by the Co.’s recent aggressive US tech derivatives bets, despite the Co. reportedly sitting on USD 4bln of profit from the options trades. Hang Seng (Unch.) and Shanghai Comp. (-0.2%) also swung between gains and losses amid mixed Chinese trade data which showed a surprise contraction in imports which underscored weakening internal demand. Furthermore, the US is said to mull whether to include China’s top chipmaker SMIC to a trade blacklist, which subsequently saw shares in the Co. drop around 20%, while sentiment in Hong Kong was also mired after protests resumed on Sunday in which nearly 300 were arrested.

European equity futures kick the week off firmer across the board (Euro Stoxx 50 +0.8%) as the region deviates from the mostly softer APAC lead and downbeat Wall Street performance on Friday. Further divergence is experienced between European and US equity futures, with the latter softer as US stimulus talks are seemingly making no progress, whilst US participants enjoy a long weekend due to Labor Day market holiday (desk schedule available on the headline feed). Back to Europe, UK’s FTSE 100 (+1.5%) narrowly outperforms peers with the aid of a favorable currency, whilst broad-based gains are seen across the EU. Sectors in the region are all in positive territory with no clear risk profile to be derived. Energy and Telecoms underperform with the former due to lower oil prices and the latter amid reports that Samsung has signed a USD 6.6bln 5G contract with Verizon, reportedly syphoning a portion of 5G radio contracts from Nokia (-0.4%). To the upside, Autos, and Financials are among the top performers, with the former propped up by Renault (+2.9%) after the group appointed Nicolas Maure as the head of ensuring the group’s turnaround, whilst shares also benefit from JPMorgan Chase reiterating the stock with “Overweight”. Banks saw tailwinds at the cash open from the last week’s Bankia/Caixabank merger talks, raising prospect for European banking consolidation. In terms of other individual movers. Airbus (+2.7%) is supported as sources noted that global fleets back in service in July rose to 60-65% from April’s 25%. Roche (+0.8%) holds onto gains after receiving FDA approval for Gavetro in the treatment of adults with metastatic non-small cell lung cancer. Separately, COVID-19 home antibody tests produced by the Co. are once again available for sale in the UK after validating the test in August; following a temporary UK ban in May.

In FX, sterling stands as the G10 laggard in early trade in light of a slew of Brexit developments over the weekend which added to the pessimism on an agreement reached with the EU ahead of the October deadline. First, PM Johnson brough forward the touted deadline to October 15th from the prior October 31st in order for a deal to be effective by year-end (a change EU sources are brushing off), but more notably the PM is said to be planning a new legislation to override the withdrawal agreement signed last October, in a move that threatens upcoming negotiations and unsurprisingly received backlash from Brussels. Meanwhile, Brexit negotiator Frost also reaffirmed the government’s stance that the UK does not fear a no-deal Brexit. Furthermore, on the pandemic-front, UK reported 2,988 cases on Sunday vs. 1,813 infections on Saturday, the largest increase since 23rd May and a development that sparked concern in the Health Ministry. Cable has breached the figure to the downside before taking out its 21 DMA at 1.3184 and dipping below Friday’s low at 1.3177. Meanwhile, aside from the commencement of the latest Brexit negotiation round, BoE’s Haskel is on the docket for a speech at the European Commission’s programme on ‘Moving the Frontier of Macroeconomic Modelling of Research & Innovation’.

- DXY, EUR – The Dollar index remains caged within a tight range just sub-93.000 (92.816-92.982), with most of the overnight action derived from the softer Pound amidst a lack of Dollar-specific catalyst, and with US players away on account of Labor Day Holiday. In terms of upside levels, DXY sees the 3rd Sept high at 93.074 followed by last week’s peak at 93.242, whilst Friday’s low (92.770) could prove to be mild support. Elsewhere, the single currency has been moving at the whim of the Buck, but EUR/USD also remains contained withing a narrow 1.1825-50 band and with little immediate reaction seen upon the early release of an improved EZ Sentix index and in the run-up to this week’s ECB policy decision and forecasts. In terms of pertinent FX option expiries, today’s NY cut sees EUR 2bln rolling off between 1.1800-10.

- AUD, NZD, CAD – The high-beta non-US Dollar show varying performances, with the Aussie faring somewhat better than its Kiwi and Loonie counterparts. CAD sees pressure amid lower oil prices with Saudi’s oil giant Aramco hinting to softer demand via OSP cuts across all grades to the US and Far East. USD/CAD meanders around the 1.3100 mark (vs. low ~1.3050) ahead of its 21 DMA at 1.3167. The Kiwi saw some weekend comments from RBNZ Governor Orr who reiterated that the central bank is actively preparing a package of additional monetary policy tools to support the economy if required, including negative wholesale interest rates and direct funding to banks. The governor also noted that the MPC agreed that a ‘least regrets’ policy response was to ease monetary conditions significantly. NZD/USD hovers on either side of 0.6700 with little in the way of technical levels ahead of the mid-psychological levels at 0.6650 and 0.6750. The Aussie trades sideways amid a mixed bag of Chinese trade data which saw a wider than forecast trade balance, but imports showed surprise contractions. AUD/USD seems to get gleaning more support from the AUD/NZD cross which holds above 1.0850.

- JPY, CHF – Both relatively flat and moving in tandem with the Dollar amidst a lack of fresh fundamental newsflow and the US market holiday. USD/JPY holds its head above 106.00 (106.14-38 range), with the NY eyeing USD 1.2bln in option expires at strikes 106.00-15. Meanwhile, USD/CHF retains a 0.9100+ status in a 20-or-so pip parameter at the time of writing, whilst Swiss sights deposits remain elevated heading into this month’s quarterly SNB meeting.

In commodities, WTI and Brent front month futures saw pressure at the reopen and remain subdued as Saudi Aramco cut its October official selling price (OSPs) across all grades for the Far East and US, in a sign the group sees a pullback in demand against the backdrop of rising global COVID-19 cases. Aside from that, news-flow today has been light. Reminder, WTI futures will not see a settlement today on account of US Labor Day holiday. WTI October hovers around USD 39/bbl (vs. low 38.58/bbl) whilst Brent November trades on either side of USD 42/bbl. Elsewhere, spot gold and silver mirror Dollar action, with the former around USD 1930/oz having had found a mild base at 1928/oz, whilst the latter languishes around USD 28.75/oz. Finally, Shanghai copper was supported by firm export numbers from China, albeit upside was capped by lower than expected imports, whilst iron ore imports fell some 10.9% in July due to falling shipments and COVID-19 related restrictions.

US Event Calendar:

- Labor Day Holiday

DB’s Jim Reid concludes the overnight wrap

As a heads up, tomorrow we will publish our latest annual long-term study. This year’s is entitled “The Age of Disorder”. It’s a big document but there is an 8-page executive summary that covers the whole piece. So please can I book at least 20 minutes of all your time from tomorrow lunchtime to read the exec summary. If you’re hooked feel free to read more!!!

Today should in theory be quiet-ish due to the US Labor Day holiday. However the market will be trying to come to terms with last week’s late tech rout that at one point saw the NASDAQ down c.10% in little over 24 hours between the open on Thursday and early trading on Friday. There had been bubbling speculation about a big option buyer in US stocks through August and the FT unmasked this as being SoftBank on Friday.

The story suggested they had been buying single stock call options on tech companies in large sizes and that overall volumes of calls on individual US stocks was more than triple the last 3 year average over the prior two weeks. This volume was causing dealers to hedge the contract exposure by buying stock and driving the underlying tech stocks even higher.

To be fair retail investors have also played their part in this. The fevered option activity might explain why August saw the S&P 500 (+7%) and NASDAQ (+9.6%) up aggressively but with the VIX also +2 points higher on the month. The VIX almost always moves in the opposite direction to the market so the best August for US equities for over 30 years would have normally brought about a notable drop in vol. Now that these trades have been uncovered they are likely to continue to influence trading so expect a bumpy ride ahead as we find an equilibrium and traders look to exploit their new found knowledge. Experience tells you we haven’t heard the last of this story and that unintended consequences often happen around these type of events. I remember back in 1998 when LTCM was unraveling one of the big trades that unwound was the U.K. swaps market as there was a levered convergence trade on between the U.K. and Europe that needed to be liquidated. We’re nowhere near this stage but just a warning if the rout intensifies.

Asian markets have started the week on a mixed footing with the Nikkei -0.20%, Asx -0.14% and the Shanghai Comp -0.16% all down while the Hang Seng +0.05% and Kospi +0.70% are up. Outperformance of the Kospi this morning may be on the back of the continued decline in new COVID-19 infections since the second wave began (more below). In FX, one of the big movers is the British pound which is trading down -0.34% at 1.3235 ahead of negative news (see below) on the fresh Brexit talks that start this week. Meanwhile, futures on the S&P 500 and Nasdaq are trading down -0.31% and -1.11% respectively. However, in Europe futures on the Stoxx 50 and Dax are both up +1.02% and +1.03% respectively. Elsewhere oil prices are trading down c. -1% this morning. In terms of data, China’s August exports grew 9.5% yoy (vs. 7.5% yoy expected) while imports came in at -2.1% yoy (vs. +0.2% yoy expected) bringing the August month trade balance to $59.9bn (vs. $49.7bn expected).

Brexit is returning to the headlines as the latest round of negotiations between the UK and the EU takes place on their future relationship. The probability of a deal seems to be reducing with state aid the surprising current sticking point. Britain which traditionally relies on this far less than Europe seems to be intent on giving itself maximum flexibility on this going forward. We will see if attitudes soften. Last night the FT reported that the U.K. is looking to legislate the rolling back of some of the withdrawal agreement, including on areas such as state aid and Northern Ireland. This has certainly raised the stakes at a fraught time in talks. The U.K. seem to be briefing hard in the media that they are quite prepared to walk away from talks if no progress is made.

Onto coronavirus numbers from the weekend now. These highlighted that the virus is continuing its spread in Europe with the UK reporting 2,987 cases over the past 24 hours, the most in more than three months while France also reported another 7,071 cases yesterday after reporting 8,550 cases the day before. France’s health ministry said yesterday that the pandemic is continuing to progress at a “worrying” pace and added, “The virus circulation is particularly active among young adults,” probably for lack of social distancing. That being said, case numbers in Germany are coming down again as the country reported only 670 new infections in the past 24 hours and Italy, the hotspot for Europe in the first wave, reported a relatively modest 1,296 new cases. Across the other side of world, India has become the second most infected country as it recorded 90k+ infections in the past 24 hours. Meanwhile South Korea reported 119 new cases, the fewest new infections in three weeks. Elsewhere the State of Victoria in Australia announced only a gradual easing of lockdown restrictions with residents still to face restrictions on when they can leave home until October 26, or until there are fewer than 5 new Covid-19 cases a day. The state has also said office staff will be told to work from home until at least November 23.

Moving on, in terms of the planned events over this week, we start to enter Central Bank meeting season with the Bank of Canada (Wednesday) and the ECB (Thursday) coming before the Fed next week who incidentally are now in their media blackout period.

On the ECB our European economists have written (link here ) that there are perhaps two ways that this meeting could go. Either the ECB could seek to buy time through a resolutely dovish message while they await further clarity on the outlook. Or they could take immediate action, perhaps justified through a downward revision to the weak inflation outlook. While a further deposit facility rate cut has not been ruled out, and stronger forward guidance is possible, the Asset Purchase Programme is the primary policy contender if the ECB did act again.

The data calendar is fairly light this week following a number of top-tier releases in the week just gone by. The main highlight will probably come from the US on Friday with the CPI reading for August. For the full week ahead see the day by day calendar at the end.

Reviewing a turbulent last week now. Global equity markets fell sharply as technology stocks took heavy losses for the first time since early in the summer. US stocks ended at two week lows following large selloffs on Thursday and Friday, though some late session buying on Friday kept stocks off their worst levels.

The S&P 500 dropped -2.31% (-0.81% Friday) on the week, only the second weekly loss over the last 10 weeks and the largest weekly drop since the last week of June. As noted the brunt of the selling came from US tech stocks and the Nasdaq massively underperformed this week, falling -3.27% (-1.27% Friday). The early week rally hides some of the late week losses, but from Wednesday’s peak to Friday’s intraday trough the Nasdaq lost -9.9%. In all, it was the worst week for the index since the week ending 20 March, at the depths of the pandemic selling. Though that said, for context, it still finished last week 2pts higher than it closed two Friday’s back on 21 Aug. With US equities plunging, the VIX rose over 30 for the first time since June and the volatility index had its largest one week move (+7.8pts) since the second week of June.

In Europe, the Stoxx 600 ended the week -1.86% lower as weekly coronavirus caseloads in France, Spain and the UK are all approaching 3-4 month highs. The DAX (-1.46%) and CAC (-0.76%) outperformed the STOXX 600, while other major European bourses were all lower on the week with the FTSE 100 (-2.76%), IBEX (-2.01%) and FTSE MIB (-2.27%) losing ground.

Core sovereign bonds rose on the week as risk sentiment soured. US 10yr Treasury yields only saw a small weekly change (falling -0.3bps), after bonds sold off sharply on Friday (yields rose +8.3bps) to finish at 0.718%. 10yr Bund yields were down -6.3bps (+1.6bps Friday) to -0.47%. The drop in risk did not affect high yield fixed income as much with European HY cash spreads tightening by -16bps (-1bps Friday) while US HY cash spreads widened just +1bps (+3bps Friday). Peripheral sovereign debt moved lower as risk sentiment waned with Spanish (+3.6bps), Italian (+3.6bps), Portuguese (+3.7bps) and Greek (+10.2bps) 10yr bonds widening to bunds.

The US jobs report showed that nonfarm payrolls increased by 1.37 million (vs. 1.35m expected) in August, rebounding for a fourth month in a row. The unemployment rate fell by more than expected to 8.4%, consensus was at 9.8%. One troubling aspect from the report was that the number of permanent job losers rose by more than half a million to 3.41 million, after being little changed in July. The overall strong report elicited positive feedback from Senate Majority Leader McConnell, who indicated that he could not promise additional fiscal aid. This is one to watch, as the US data improves it could harm chances of a compromise on fiscal stimulus.

via ZeroHedge News https://ift.tt/339U3XM Tyler Durden