The Fed’s Dilemma: Support Jobs or Head Off Asset Bubble

Tyler Durden

Mon, 09/07/2020 – 15:50

Submitted by Masao Muraki, strategist at SMBC Nikko Securities

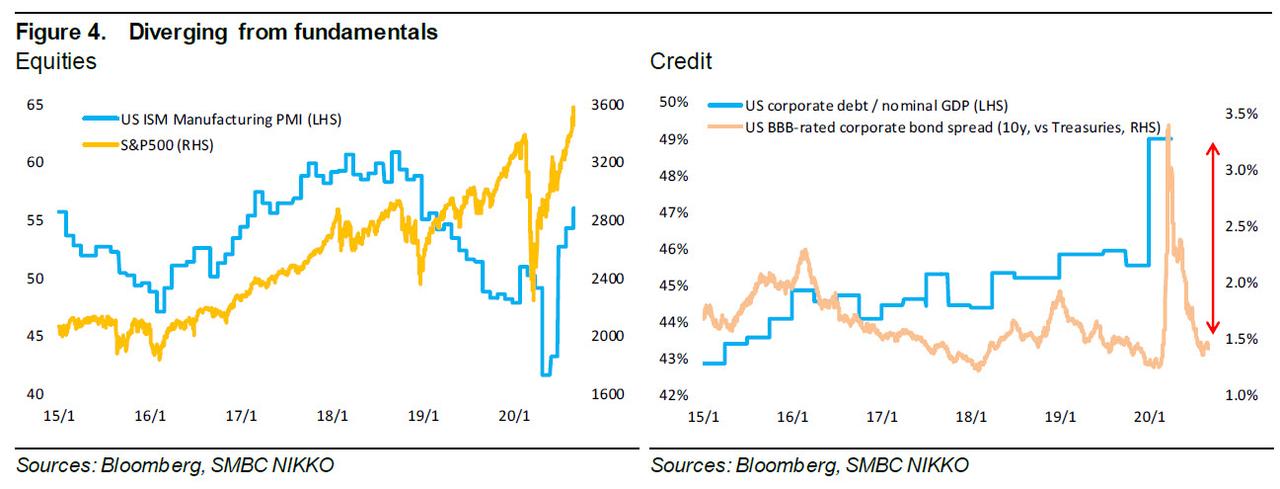

On 3 Sep, US tech stocks plunged and the VIX rose. Meanwhile, US bank stocks outperformed the S&P500 by 2.8%. Since March we have highlighted the possibility that the Fed’s measures to head off a liquidity crunch and collapse in asset prices (panic selling divorced from fundamentals) could in fact fuel a melt-up in asset prices (buying spree divorced from fundamentals).

The Fed’s balance sheet began to shrink from June, but tech stock valuations have continued to soar amid improving economic sentiment (ISM/PMI).

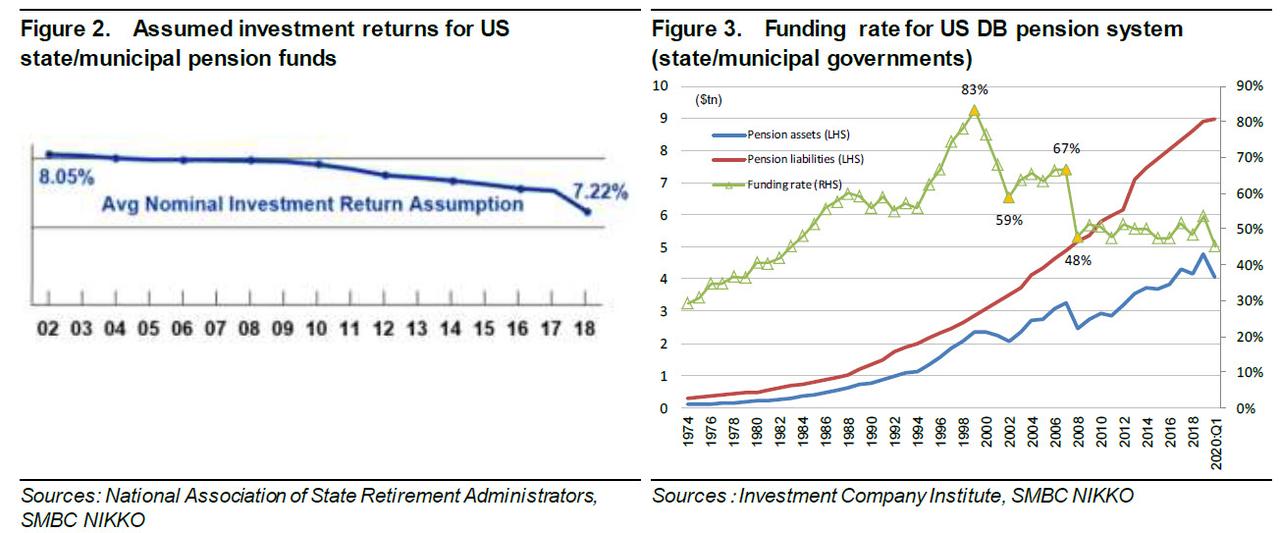

We attribute this to a resurgence in risk taking amid low super-long interest rates by investors with fixed liability burdens (who need high yields to meet these future obligations) such as pension funds, life insurers, and retail investors.

While the market environment itself has not changed, namely a peak-out in Covid infections, improvement in economic sentiment, and low interest rates, we believe the following factors triggered the 3 Sep stock market plunge:

- the Fed has recently adopted a strategy that considers financial stability;

- long rates have risen temporarily;

- the US presidential election is approaching (the biggest risk is a hair-tight race with disputed balloting);

- rising tensions between the US and China;

- growing concerns of a tech stock bubble forming.

We have received a number of inquiries from equity investors who are increasingly concerned about inflation due to rising expected inflation rates, Berkshire Hathaway’s selling of some US bank stocks and buying of commodity-related names, etc. Amid the prolonged low inflation and rate environment, for investors who are overwhelmingly overweight on growth stocks a resurgence in inflation represents a tail risk on par with the dislocation triggered by the GFC. However, we believe the strong recovery in value stocks such as life insurers in Aug indicates that investors have been establishing hedge positions to some degree.

On the flip side, we have also had many questions from fixed-income investors on the CECL reserve build by US banks in terms of when defaults may trigger drawdowns. They are notably cautious on the economic outlook, including the US-China tension.

In this report we discuss how the Fed plans to address the imbalance of financial markets.

Fed’s near-term stance: Wait-and-see mode, further easing put off till things get worse

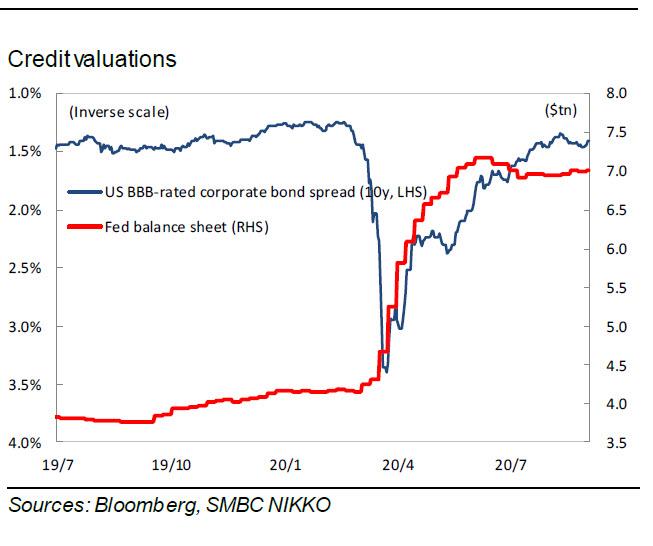

The Fed expanded its balance sheet significantly to tackle the liquidity crunch back in Mar (jump in bank funding costs, Treasury market liquidity dried up) but started paring back from Jun after liquidity improved.

Beefed-up forward guidance and YCC (yield caps or targets, or YCT) essentially appear to have been kicked down the road for now because 1) the economy and financial markets are getting back on track, in part thanks to government help, and 2) bond markets are not expecting a Fed rate hike through end-2023. That said, the minutes for the most recent FOMC, released on 19 Aug, takes a pretty grim tone on the outlook ahead and the Fed seems ready to consider further action if things head south.

Given that the Fed expects economic conditions to worsen and banks are tightening up lending standards severely, we think it is unlikely the Fed will expend any monetary policy bullets to head off a surge in stock prices. At most they may try to talk it down.

Fed’s longer-term stance: How to address the imbalance in financial markets

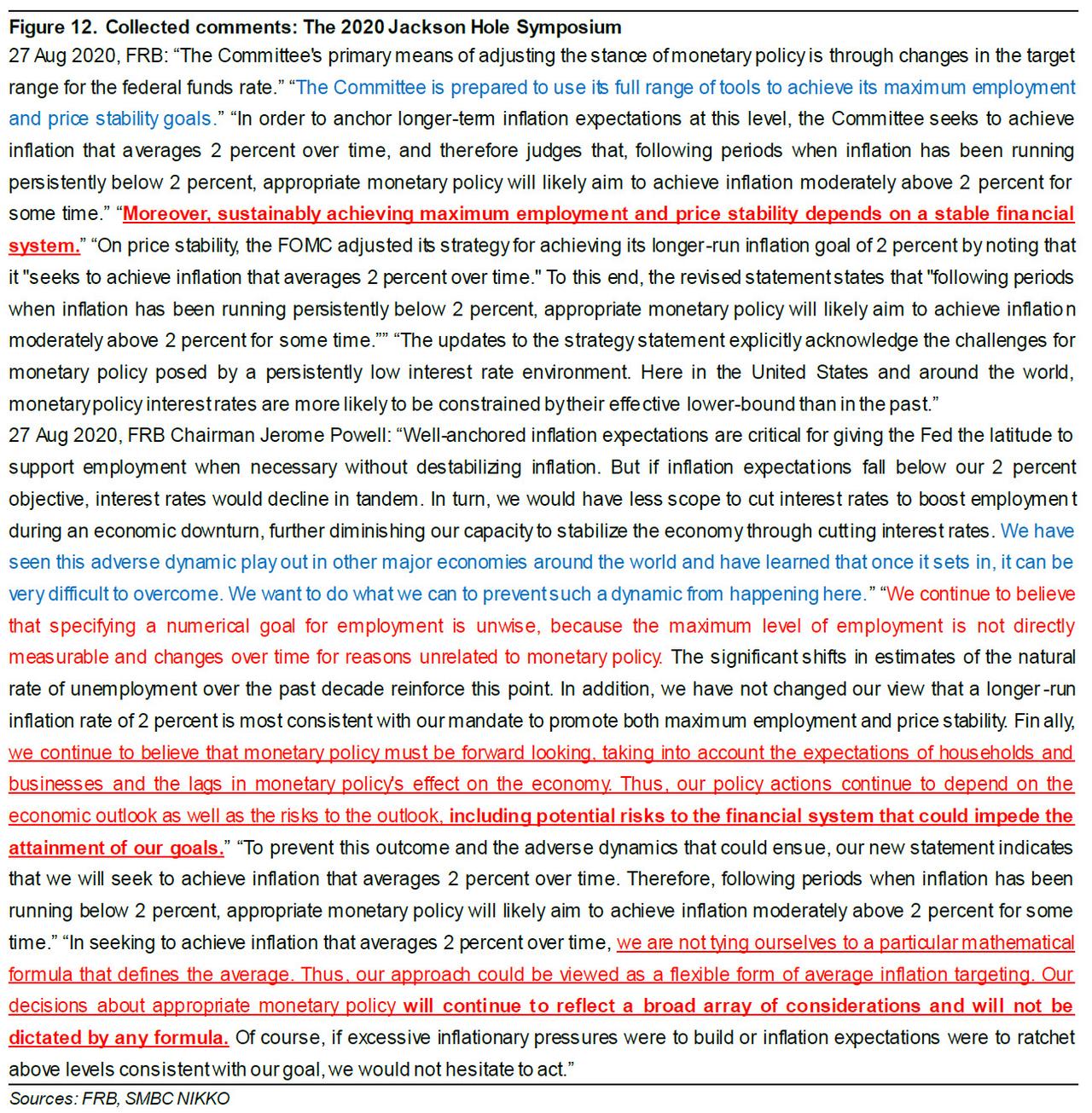

On 27 Aug, Fed Chair Powell announced a new monetary policy framework in his Jackson Hole speech: the Fed will adopt average inflation targeting. This strategy amounts to trying to make up lost inflation when it misses the 2% target by allowing it to overshoot at other times depending on conditions (Figure 12).

The framework has been debated in earnest since Jan 2019. What was new this time: 1) a focus on maximizing employment in line with the receding risk that employment growth will trigger inflation; 2) positing that stabilizing the financial system is the key to optimizing both employment and prices (based on the example of several recessions in the past). The Fed will normally target maximum employment, but it has tacitly added an emergency escape clause that the Fed may give up on optimizing both employment and inflation in the short term when financial system imbalances are elevated (Figure 11 comments).

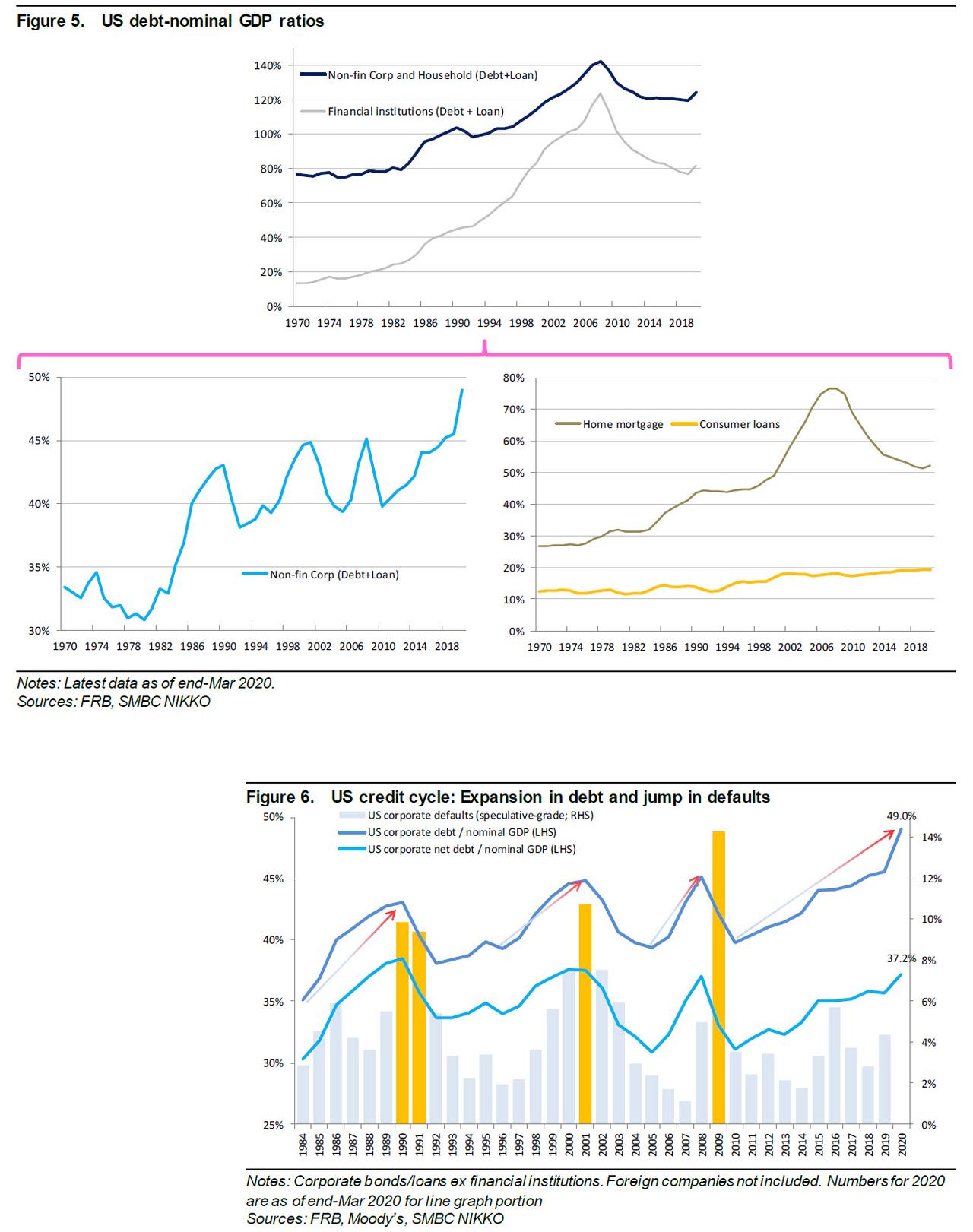

Regarding point 2) chairman Powell has pointed out since 2018 that the disruption in financial markets in the past two recessions (three if you count the current one) were exacerbated by excessive risk taking and the fallout from that more than inflation. Members have argued in three past FOMC meetings (Dec 2019, Jan 2020, July 2020) that prolonged low interest rates can fuel excessive risk taking and may worsen financial market imbalances, and that the Fed needs to change its stance on monetary policy in addition to macroprudential policy (regulation, supervision).

In light of the Fed hiking its view of financial system vulnerability in May from moderate to significant, we wrote the following in our 26 June report: We expect the Fed to address the following once the economic crisis passes:

- removal/reduction of the easing measures,

- reinstatement/increase of bank capital ratios through implementation of tough stress tests in light of recent developments,

- increase in CCyB in light of imbalances such as excessive corporate sector debt,

- identification of causes of liquidity crunch (vulnerabilities) and crafting of new regulations/supervision (may not be achievable by Fed alone), and

- repositioning of the relationship between monetary and macroprudential policy (monetary policy that takes into account financial imbalances that have a major impact on prices and employment).

Even if tech stocks plunge, the impact on the financial system should be limited (though it could have some adverse impact on the wealth effect). The most important factors for financial stability are the debt-to-GDP ratio and credit prices.

Excess liabilities for non-financial companies are rising further as a result of Covid-19…

… but credit spreads are tightening due to the Fed’s policies (Figure 1).

As the coronavirus impact eases, the Fed could fine-tune its balance sheet strategy to address financial market imbalances (even more carefully than before). Investors should closely monitor the impact on Fed policy of the melt-up in asset prices and excessive corporate debt problem.

via ZeroHedge News https://ift.tt/324SMlG Tyler Durden