Chinese Bottled Water IPO Is 1,148 Oversubscribed, Makes Founder China’s 3rd Richest Person

Tyler Durden

Tue, 09/08/2020 – 12:55

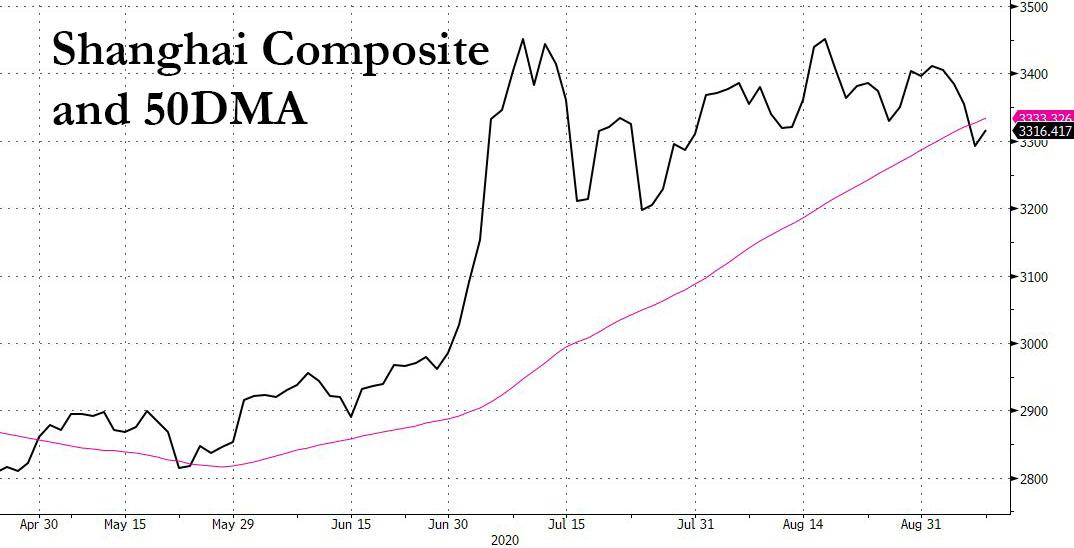

With US stocks suddenly in freefall, they are only now catching up to a recent bout of weakness in China where the Shanghai Composite – which has gone nowhere since early July – just dropped below its 50DMA.

The lack of a market meltup in China, however, has clearly not dented local appetite for stocks and as a result the founder of China’s biggest bottled water company – whose red-capped plastic bottles can be seen at most official gatherings in China because apparently in China there are huge barriers to entry to putting clean water in a plastic bottle – just became the country’s third-richest person after shares in his company surged 54% on their IPO in Hong Kong. Nongfu, raising more than $1 billion in its Hong Kong initial public offering this week.

Zhong Shanshan, founder and Nongfu Spring’s biggest shareholder, is now worth more than $50 billion, after more than 700,000 retail investors in Hong Kong submitted orders totalling HK$670.8bn (US$86.5bn) for the retail portion of Nongfu’s share offering, making it 1,148 times oversubscribed according to the FT.

The unprecedented demand for Nongfu shares meant that at one point on Tuesday, Zhong’s fortune surpassed the $51.3 billion net worth of Pony Ma, the founder of Tencent and China’s second-richest man, according to Bloomberg estimates. Jack Ma, the founder of ecommerce business Alibaba, remains China’s wealthiest individual with an estimated $57.8 billion fortune.

The pop in Nongfu’s stock pushed the value of Mr Zhong’s 84 per cent stake in the company to $40.3bn, according to Bloomberg estimates. Combined with his $9.4bn stake in Beijing Wantai Biological Pharmacy Enterprise, a maker of Covid-19 test kits, and cash and other assets of $1bn, Mr Zhong is now worth $51bn on paper.

While for many 2020 has been a dismal year, 2020 has meant nothing but windfalls for Zhong whose wealth has surged more than 670% since the start of this year. Part of that windfall was derived from his holding in Wantai Biological, whose shares are up more than 2,000% since it listed in Shanghai in April.

As the FT notes, the IPO nearly trebled the net worth of Zhong, a former mushroom grower and journalist who founded Nongfu in 1996; before the Hong Kong offering his fortune stood at $18.9 billion. In response Zhong, who is known in Chinese business circles as the “Lone Wolf” due to his distinctive personality, said “I am a man on my own,” adding “I don’t care about what my peers are doing and thinking.”

Zhong now ranks 22nd on Bloomberg’s global rich list, just above the Mexican telecoms mogul Carlos Slim.

Zhong is a true “rag to riches” story with Chinese characteristics: he dropped out of school at age 12 after his parents were targeted during the Cultural Revolution. After a brief stint as a reporter, he went into business in the early 1990s selling pills used in China to treat erectile dysfunction. After the efficacy of Zhong’s treatments — which were derived from turtle parts — came under regulatory scrutiny, he shifted to bottled water.

Little did he know that just two decades later he would be the dominant player in a massive industry: according to Nongfu’s IPO prospectus, retail sales in China’s bottled water market rose to Rmb201.7bn ($29.5bn) in 2019, with Nongfu enjoying a 20% share, the largest of any company. The market is expected to grow at an average annual rate of more than 10% between now and 2024, according to research firm Frost & Sullivan.

Also, unlike many unicorns, Nongfu is already very profitable reporting a net profit of Rmb5bn in 2019 on revenue of Rmb24bn, according to the prospectus. Its market capitalisation of about $47bn is higher than US drinks group Constellation Brands but lower than the UK’s Diageo.

The unprecedented retail demand for the offering pointed to huge demand for listings of Chinese companies, according to local brokers and traders. Businesses from the world’s second-biggest economy have raised billions of dollars in Hong Kong this year even as relations between Beijing and Washington have plunged to multi-decade lows.

Ironically, the Trump administration’s push to force Chinese companies to list outside of the US has meant tremendous domestic success for newly-public companies due to staggering demand by retail investors who have long been fascianting by the massive one-day pops on IPO days. Later this year, Ant Group, the Alibaba-backed Chinese payments business, is expected to sell up to $30bn worth of shares in Hong Kong and Shanghai this year in what could be the world’s largest IPO.

via ZeroHedge News https://ift.tt/3jW5SYw Tyler Durden