Chinese Farmers Hoard Wheat In Hopes Of Creating Shortages That Push Prices Higher

Tyler Durden

Wed, 09/09/2020 – 23:00

The latest Chinese inflation data released overnight showed that consumer prices slowed again, dropping to 2.4% Y/Y, the lowest since early 2019, largely moderating on lower pork inflation (still over 50% y/y, but slowing), while producer price inflation remains negative.

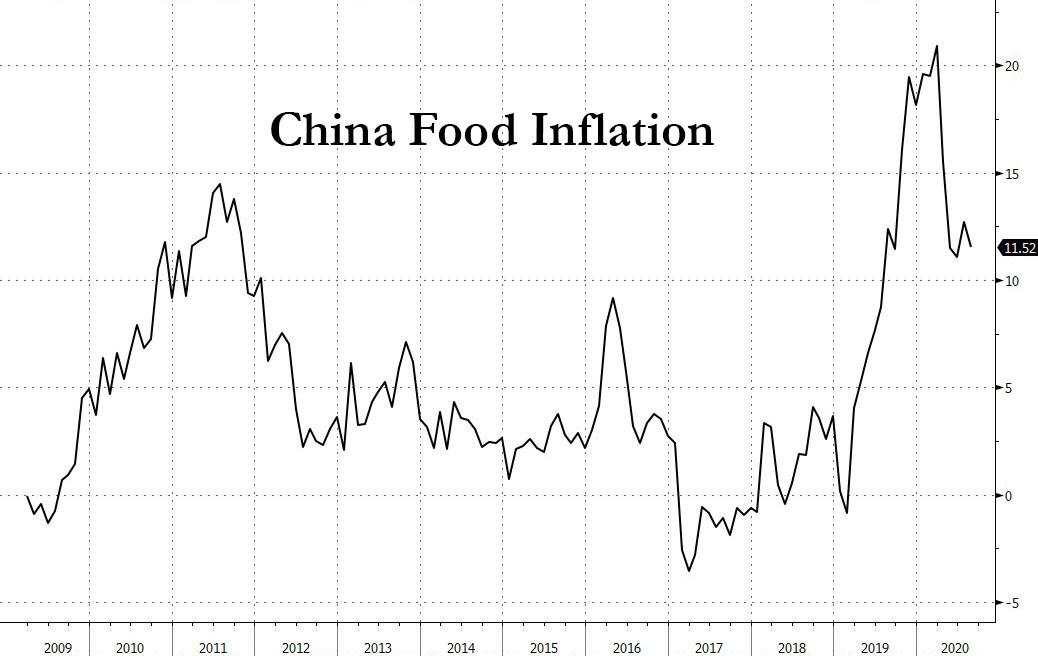

And while Chinese food inflation dropped in half from the record 20% Y/Y increase hit in March as Chinese supply chains were disrupted by the covid lockdowns…

… this decline may not last because as Caixin reports, China’s farmers are stockpiling more of their wheat harvest this year rather than selling to the government and the market as they expect prices to rise and want to hold onto their stocks in case of shortages stemming from the severe summer flooding and fallout from the coronavirus pandemic.

Farmers in the country’s main wheat-growing regions sold only 49.3 million tons of their crop for commercial use and to state reserves as of Aug. 31, 20% less than in the same period last year, according to government data. Within that total, sales to the National Food and Strategic Reserves Administration, which stockpiles and manages the country’s strategic food reserves, sank by almost 70% to 6.2 million tons. Wheat purchased by market participants such as mills accounted for about 86% of the total in 2020, up from 70% last year, the official Xinhua News Agency reported on Aug. 14.

Fears about food security in China have intensified this year amid the coronavirus pandemic and severe flooding that’s hit swathes of agricultural land since June. Speculation that shortages of basic foodstuffs like rice and wheat could emerge has sent prices soaring even as government officials have sought to reassure the population that the country is self-sufficient in staple crops and that the recent price fluctuations in the grain market are temporary.

“As state purchases of wheat dropped this year, market purchases accounted for a higher portion, increasingly becoming the main channel of wheat purchases,” Tang Ke, senior official at Ministry of Agriculture and Rural Affairs said at a press conference on Aug. 26.

In keeping with Chinese tradition of stockpiling strategic reserves across most commodities, since 2006 the government has purchased wheat at annual state-set prices to ensure that any dramatic decline in market prices would not discourage farmers from cultivating the crop. When market prices are low, farmers can opt to sell more of their crop to state purchasers to support their income.

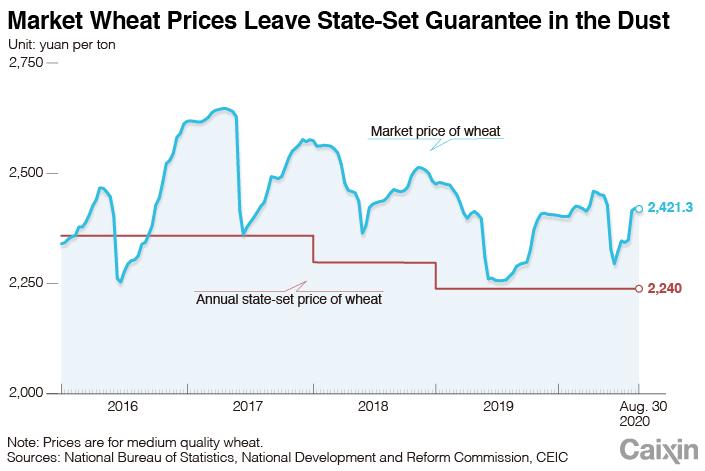

Currently, the market price for medium-quality wheat from China’s major grain-growing regions is around 2,421.3 yuan ($354) per ton. That compares with the minimum state purchase price of 2,240 yuan, according to government data. For high-quality wheat, the market price is around 2,440 yuan to 2,460 yuan per ton, compared with the state purchase price of 2,320 yuan, according to commodity research firm Sublime China Information Co. Ltd.

As the chart below shows, market prices have risen sharply since July amid widespread flooding and an increase in the price of corn, which has prompted many farmers to switch to wheat to feed their animals, adding to demand for the grain. Meanwhile, prices of pork remain elevated due to the recent outbreak of so-called “Pig Ebola” which decimated the local pig population. The Zhengzhou grain wholesale market, located in the major wheat-producing province of Henan in Central China, reported high-quality wheat prices were up 6.6% year-on-year in July.

Similar to oil traders who stockpile crude on ships to take advantage of contango and higher future prices, as Chinese farmers expect further price increases, they are less interested in selling now and are preferring to wait so that they can earn more money, multiple sources including farmers, grain traders, and heads of flour mills told Caixin. However, some industry participants don’t expect prices to rise much further. One insider told Caixin that flour mills will find it difficult to accept further increases while Tang, the agriculture ministry official, said that pressure on wheat prices will moderate as the jump in corn costs gradually eases.

Despite fears of supply shortages, China had a record wheat harvest this summer, with output increasing by 756,000 tons year-on-year, or 0.6%, despite a 1.2% decline in planted acreage, according to data released in July by the National Bureau of Statistics. Nevertheless, production in Henan, which accounts for nearly 30% of the country’s wheat output, may have declined due to natural disasters including a cold wave and drought which hit the southern part of the province earlier this year, several industry insiders said. Official data show that as of Aug. 5, the state purchased 9.1 million tons of wheat in the province, a year-on-year decline of 5.4 million tons, the biggest drop of all major wheat-growing regions.

“Previously, we could harvest at least over 2,700 kilograms per acre, but this year we only had about 2,120 kilograms,” a farmer in southern Henan told Caixin. One grain merchant in the area said he purchased less than 1,000 tons of wheat, half as much as in 2019, as many farmers saw declines in wheat production due to bad weather.

via ZeroHedge News https://ift.tt/3hgpk0v Tyler Durden