Zoltan Pozsar Spots A Possible Year-End Funding Crisis, But Not Everyone Agrees

Tyler Durden

Wed, 09/09/2020 – 22:20

It seems like an eternity ago and in far simpler time, when bond markets were worried about such trivial things as bank reserve and funding levels, and repo rate squeezes. And yet, it was almost exactly one year ago, on Sept 16 (the 11th anniversary of the Lehman collapse), when it suddenly became apparent that despite $1.3 trillion in “excess” reserves, there was not enough liquidity in the system. A month later we were the first to piece together the puzzle, which confirmed that it was JPMorgan’s drain of over $100 billion in repo and money market liquidity that was the precipitating factor for the repo market collapse. In other words, not only did JPMorgan precipitate the repocalypse (and it’s not just us who make this claim, but other more “reputable” websites and news sources have since joined our clarion call), but with its actions it also triggered the launch of the repo liquidity flood and, a few weeks later, the Fed $60BN in T-Bill purchases, aka QE4. This dynamic grew to become the biggest market event of 2019.

Of course, considering what happened just 6 months later when the Fed nationalized the bond market on March 23, 2020, launched unlimited QE, injected $3 trillion in liquidity in three months and started corporate bond buying, the gnashing of teeth over the repocalypse seems oddly trivial. Indeed, the recent explosion in bank reserves has made any concerns about repo underfunding an ancient anachronism. If anything, banks – not to mention Robinhood daytraders – are swimming in a sea of liquidity.

Yet a new dynamic could mean that a year-end funding squeeze is once again on the table, similar to what happened in both 2019 and also 2018.

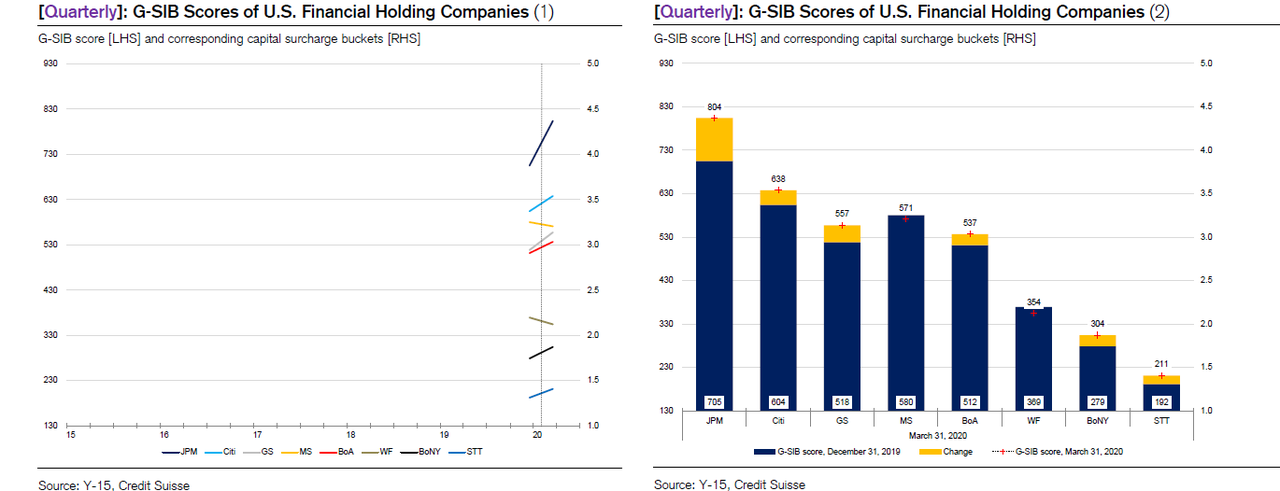

In a note published earlier this week by former NY Fed staffer and current Credit Suisse strategist, Zoltan Pozsar, the repo guru gives a preview of this week’s release of bank Y-15 report, and looks at various banks’ G-SIB scores with a focus once again on – guess who – JPMorgan, and predicts that as a result of “regulatory changes and market trends since the Covid-19 pandemic”, JPMorgan’s capital surcharge could gap higher from 3.5% in the first quarter by as much as 100 bps to 4.5% in the second quarter.

He explains his reasoning as follows:

Regarding the likely path of the second quarter scores, three developments are worth noting.

- First, the April 1st, 2020 exemption of reserves and Treasuries from the calculation of the SLR will reduce “total leverage exposure” used to calculate the size systemic risk scores. This exemption, plus inputs already available from banks’ Y-9C reports on securities outstanding, level 3 assets, and available-for-sale and trading securities that aren’t HQLA point to a 20 point decline in categories that make up about a half of J.P. Morgan’s G-SIB score.

- Second, repo books and derivatives activity are down since the first quarter, and that should also help scores fall some.

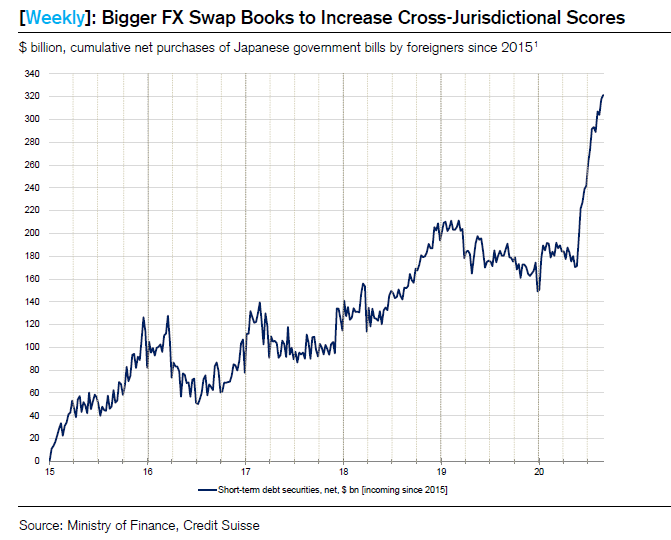

- Third, and in contrast to the first two, FX swap books are up a lot since the first quarter, which has the potential to mitigate or even offset the decline in scores coming from the above sources.

This “expansion of FX swap books” on JPM’s balance sheet during Q2 likely pushed its capital surcharge score into the 4.5% capital surcharge bucket…

… which according to Pozsar, “would mean much less FX swap intermediation at J.P. Morgan going into year-end and a year-end turn much worse than what’s currently being priced by the market – unless U.S. banks with lower G-SIB scores or foreign banks pick up the slack.”

Now, when Pozsar – who is among the handful of people who has intimate knowledge and understanding of the US repo system plumbing – speaks everyone – especially those at the Fed shut up and listen: after all, he predicted with uncanny accuracy the events of the repocalypse and also the Fed’s “all in” response to the covid pandemic.

Yet this time not everyone agrees, because now that banks have released the latest Y-15 reports that regulators use to determine how much extra capital the largest banks must hold, debate around the likelihood of funding market stress over year-end has intensified.

Case in point: another prominent STIR strategist, BMO’s Jon Hill, agrees with Pozsar that the balance-sheet snapshots taken of the major banks in the first quarter show four moved into a higher surcharge zone for G-SIBS, global systemically important banks. Hill adds that the largest US bank, JPMorgan, is “by far the most likely” to jump to a higher bucket – meaning at the year-end assessment regulators could require a bigger surcharge. No disagreement with Pozsar here.

However, where Hill disagrees with the closely-followed Hungarian, is in his assessment about year end funding stress: unlike Pozsar, he is “skeptical” that it will emerge for two reasons:

- First, snapshots from Q1 “were taken near peak Covid-crisis stress and may not be applicable to later in the year”, and the four banks in question were all able to manage their G-SIB scores in the prior quarter; “if they do so again, three of the four will revert to the prior G-SIB bucket.”

- Second, while banks managing their balance sheets may itself cause stress, G-SIB scores were notably lowered last year “without corresponding disruptions to funding markets.”

Will Hill be right in expecting banks to self-police themselves in a time of record excess reserves thus avoiding a year-end funding crunch, or will Pozsar be correct in predicting a collapse in FX intermediation by JPM, which in turn could lead to a sharp liquidity squeeze? The answer could have substantial implications not only on the repo market which will be directly impacted, but also on overall funding conditions and ultimately, widespread risk assets.

How to trade it? As Hill concludes, based on his expectation of “a relatively quiet year-end”, the BMO strategist recommends selling the December 2020 FRA/OIS contract, which however has already collapsed from its March wides. On the other hand, if Pozsar is right then FRA/OIS is likely to blow out, which would be especially odd in a time when the Fed has provided unlimited liquidity via both QE and unlimited repo operations.

And yet… it is Pozsar, and he has yet to make a prediction that falls short.

Of course, it will be ironic if despite the Fed’s $7 trillion balance sheet, it is none other than JPM which demonstrates to the market how even that record liquidity is not sufficient to cover all funding needs. It will be even more ironic if it is JPMorgan that, just like during the “NOT QE” phase is the bank that prompt the next massive, multi-trillion liquidity injection which, one way or another, will push the S&P to fresh all time highs for the simple reason that the Fed will never allow the biggest US bank to fail if the opportunity cost is creating a few trillion electronic dollars with the push of a button.

via ZeroHedge News https://ift.tt/2RdmM8O Tyler Durden