Big-Tech & Black Gold Battered As Bonds & Bullion Bounce Back

Tyler Durden

Fri, 09/11/2020 – 16:00

“Margin Calls, Gentlemen!”

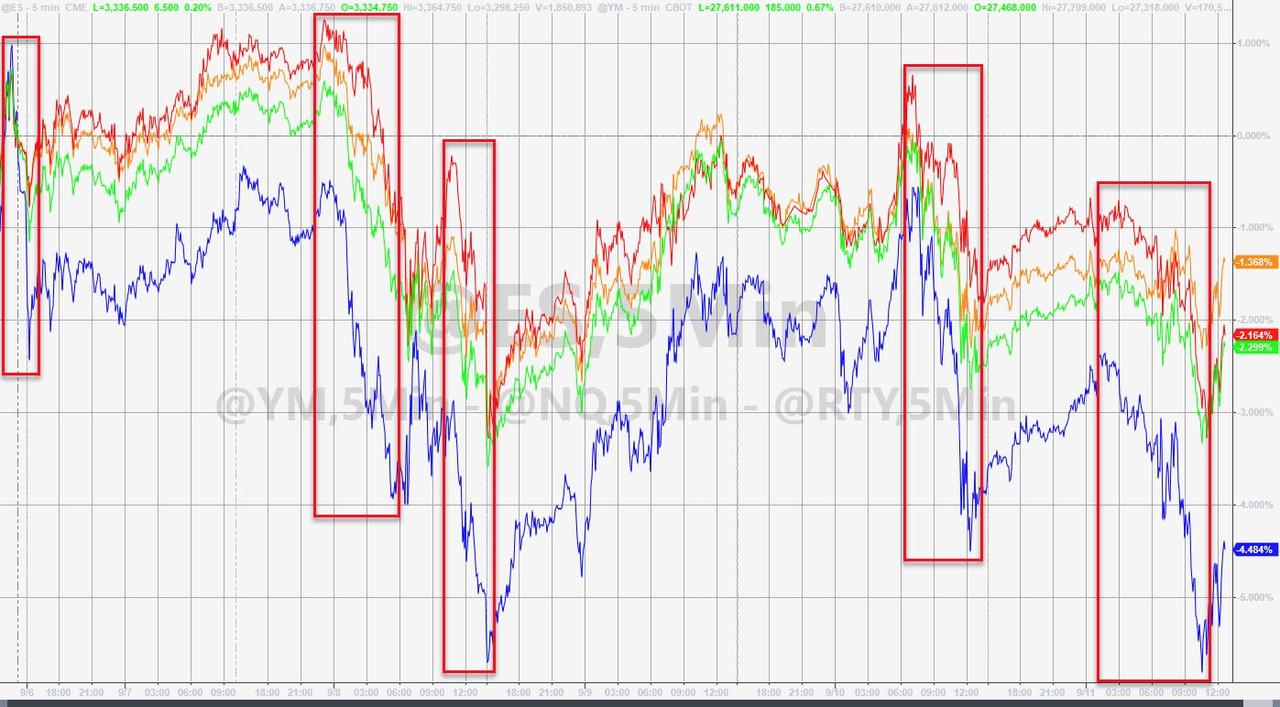

Stocks are down for the second week in a row with Nasdaq leading the plunge (worst week in almost six months)…

The mega-tech heavy index is now down almost 11% from record highs…

The Dow is back down 3% YTD…

Source: Bloomberg

In fact, FANGMAN (Facebook, Apple, Netflix, Google, Microsoft, Amazon, Nvidia) has lost over $1tn in market cap this week and still accounts for over 25% of the total market value of all S&P 500 comps.

Interestingly as FANGMAN stocks plunged this week (down 5 of the last 6 days and worst 2-week drop since March), so did Nasdaq’s “VIX” as vol-control/risk-parity are degrossing…

Source: Bloomberg

Nasdaq and Small Caps both ended below their 50DMA. The S&P bounced off its 50DMA. The Dow tested down but never reached it…

Breadth has been abysmal…

Source: Bloomberg

The internals remain ugly…

Source: Bloomberg

Stocks continue to catch down to credit’s lack of exuberance…

Source: Bloomberg

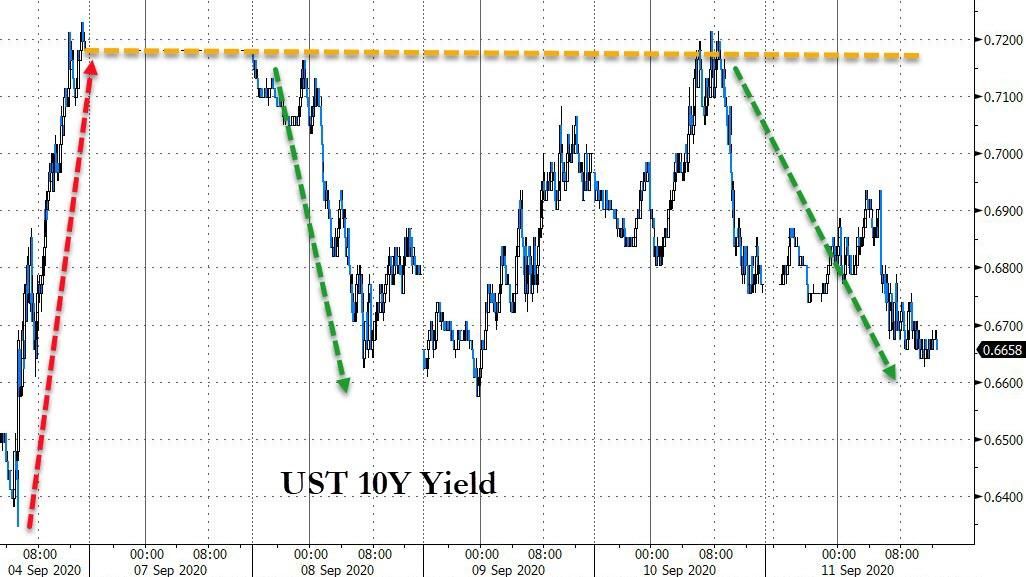

Bonds were bid on the shortened week with the long-end down around 6bps…

Source: Bloomberg

10Y Yields broke back below 70bps…

Source: Bloomberg

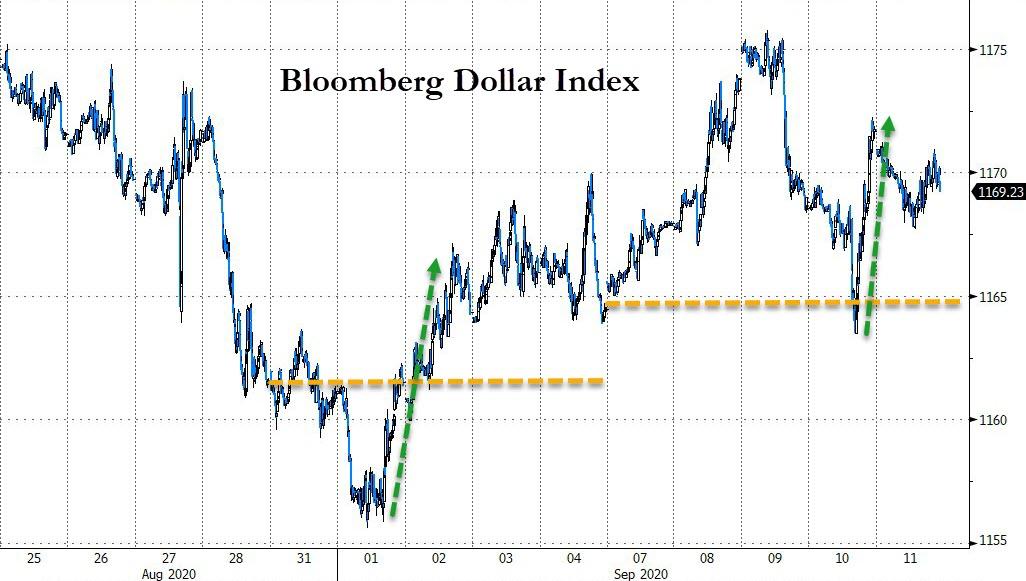

The Dollar rallied for a second week in a row

Source: Bloomberg

Cable crashed this week – worst week since March – amid Brexit anxiety…

Source: Bloomberg

Cryptos were all lower on the week (despite a big bounce back from last weekend’s lows)…

Source: Bloomberg

Gold managed modest gains on the week as oil was monkeyhammered…

Source: Bloomberg

WTI was clubbed like a baby seal this week as inventories rose amid lifted production curbs…

Gold futs managed to cling to $1950…

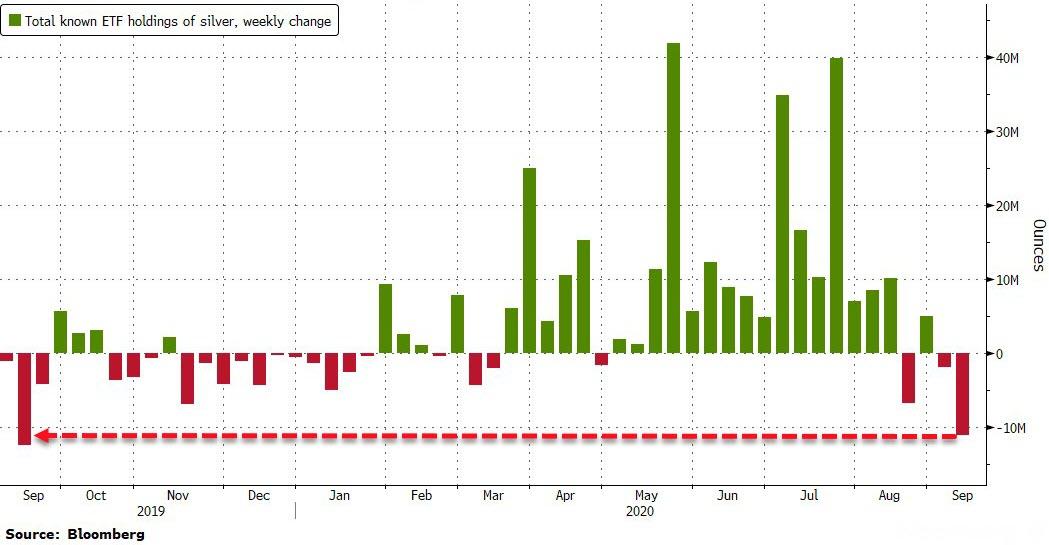

Silver futures limped modestly lower on the week, unable to hold $27…

Interestingly, Silver ETFs suffered their biggest weekly outflows in a year…

Source: Bloomberg

And finally, stocks (or bond prices) have a lot of downside if this chasm is ever to converge…

Source: Bloomberg

It can’t be this easy can it?

Source: Bloomberg

via ZeroHedge News https://ift.tt/3iAvF8x Tyler Durden