China Injects $500 Billion In New Monthly Credit As Surge In US Real Yields Looms

Tyler Durden

Sun, 09/13/2020 – 20:00

While the financial punditry is preoccupied with the Fed and its $7 trillion balance sheet, whether Powell is purchasing bond ETFs or has enigmatically stopped doing so (as it did in August), and whether the US central bank has any hope of sparking inflation (with or without the help of Congress), what most are forgetting is that when it comes to any global reflationary spark, China – and its $40 trillion financial system which is double that of the US – has been a far more critical driver than the US ever since the financial crisis.

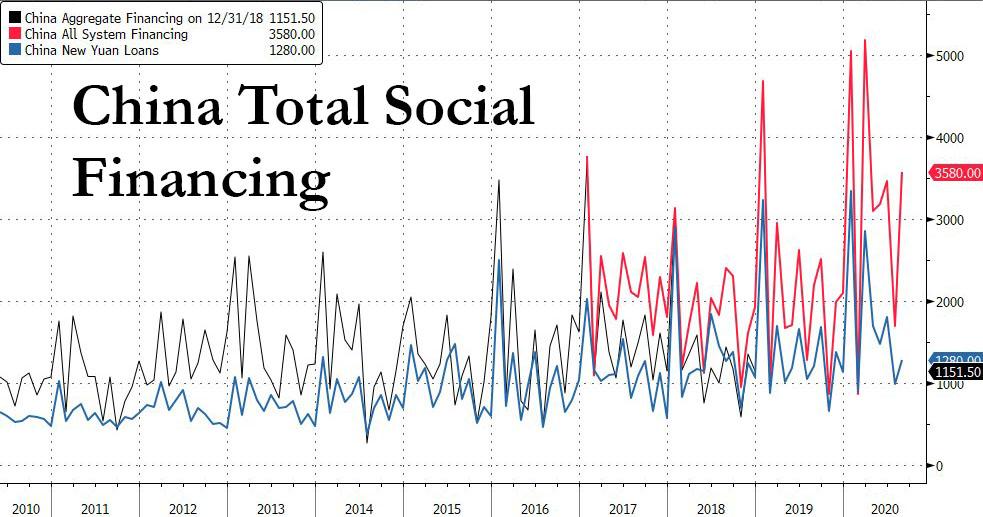

And so, five months after China injected a record 5.2 trillion yuan ($732 billion) in new total social financing – China’s broadest credit aggregate – in March to offset the catastrophic hit its economy had suffered from the covid pandemic, Beijing once again surprised to the upside when in August China injected a whopping 3.58 trillion yuan into its economy ($520 billion), above the highest Wall Street estimate (1 trillion yuan above the consensus estimate of 2.585 trillion yuan) and the biggest monthly injection since the March record.

Here is a breakdown of the latest August credit data:

- New CNY loans: 1280bn yuan, exp. 1250 billion. Outstanding yuan new loan growth: 13.0% yoy in August, in line with the 13% increase in July 13.0%.

- Total social financing: 3580bn yuan, vs. consensus: RMB 2585bn.

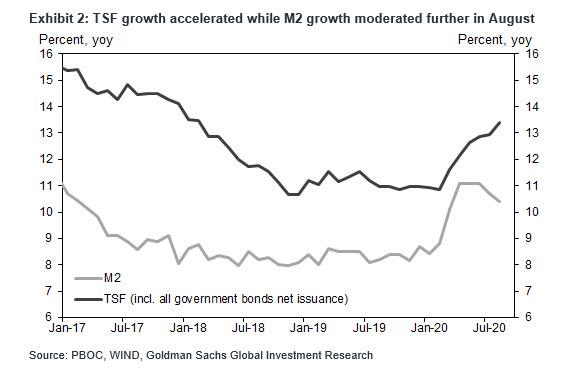

- TSF stock growth: 13.4% yoy in August, higher than 13.0% in July. The implied month-on-month growth of TSF stock accelerated to 14.8% from 12.6% in July.

- M2: 10.4% yoy in August, below the consensus of 10.7% yoy. July, and down from 10.7% yoy in July.

Some observations:

- August credit data surprised the market to the upside, although even though the sequential growth of TSF rose to 14.8% mom annualized from 12.6% in July.

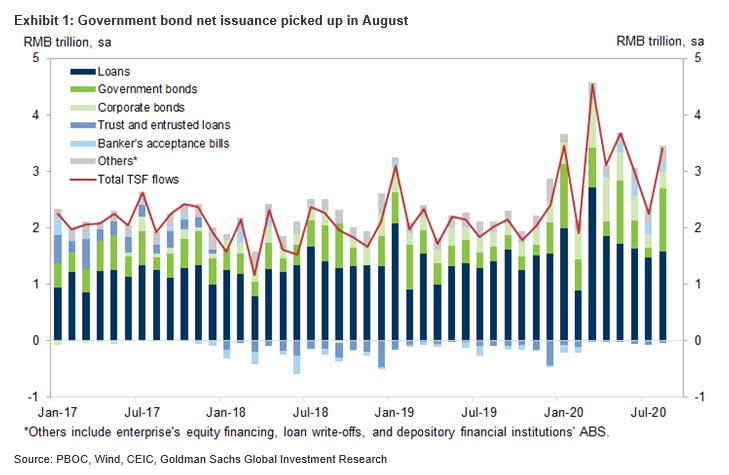

- Among major TSF components, government bonds net issuance contributed the most to the acceleration in August. Corporate bond issuance increased from last month despite higher interbank interest rates, suggesting further growth recovery.

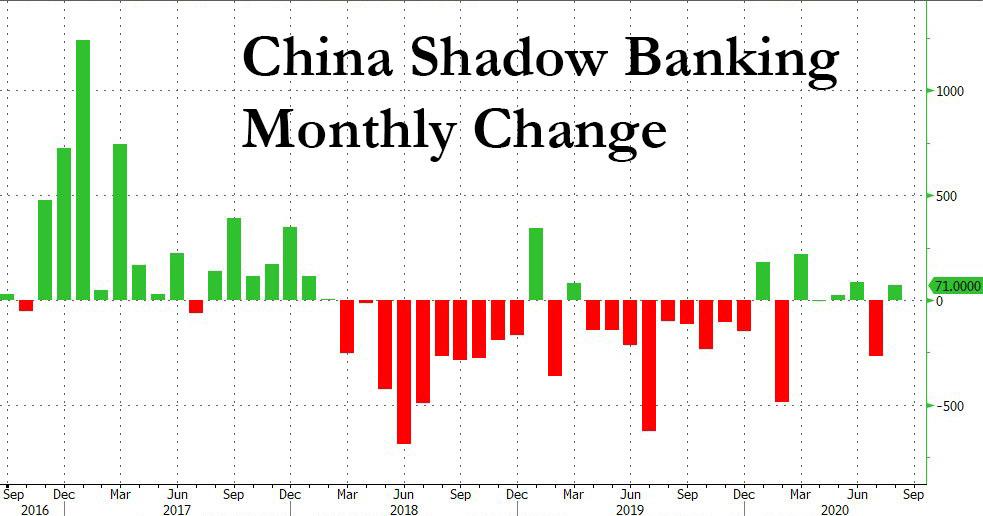

- Shadow banking rose after the steep drop in July, as Beijing appears to be easing its crackdown on sources of shadow funding. Banker’s acceptance bills increased RMB 144bn in non-seasonally adjusted terms, reversing the contraction in July. The decline in trusted and entrusted loans remained modest in August. In total some 71 billion yuan in shadow debt was created.

- On loan extension, the increase in mid-to-long term loans to households remained relatively strong, consistent with the strong property sales suggested by high frequency indicators. The increase in mid-to-long term loans to non-financial enterprises picked up in August in seasonally adjusted terms.

- Finally, in an odd divergence, despite the biggest increase in TSY growth since the start of 2018, M2 growth moderated further to 10.4% yoy in August from 10.7% in July. While it remained well above 2019 levels, it begs the question of just where this newly created credit is ending up if not in the broader monetary aggregate.

Going forward, September TSF is expected to remain “robust” according to Goldman, on continued government bond issuance. Given the recent growth momentum and credit strength, policymakers are likely to stay on hold. That said, a slowdown in credit growth will likely come in Q4 as government bond issuance is likely to slow and monetary authorities are in no rush to loosen.

Why does China’s record credit injection in 2020 matter? Because as we showed recently, China’s notorious credit impulse (which as UBS admitted several years ago is the only thing that matters for global reflation), and which is a function of how much credit Beijing creates leads real 10Y yields with a 12 month lead time. As shown in the chart below, a simple correlation suggests that real yields are set to soar by 150bps from their current -1% to approximately 50bps, and that’s assuming China does nothing to further stimulate its economy over the next 6 months.

In other words, if this relationship holds – and there is no reason to expect why it shouldn’t we are not about 6 months away from the next major spike in real yields, which while probably not as violent as Stanley Druckenmiller expects with his forecast of 5-10% inflation, will be sufficient to cause another crash in both risk assets and Treasurys, and spark some real confusion within the Fed which by then will have firmly cemented the perception that no matter what happens to inflation or real rates it will not tighten financial conditions.

Alas, now that China is once again injecting credit in its economy at a furious pace and has even reactivated the shadow banking spigots, it appears that the next spike higher in real rates is scheduled to hit some time in early 2021.

via ZeroHedge News https://ift.tt/2RldVSv Tyler Durden