Yields Dip After Solid 20Y Auction

Tyler Durden

Tue, 09/15/2020 – 13:15

Unlike last month, when both the 20Y and 30Y auctions were so ugly they repriced the long-end well higher for the next few weeks, last week’s stronger than expected 30Y auction hinted at continued strength in the primary market for duration, and sure enough moments ago the 20Y auction, a 19-year 11-month reopening of Cusip SQ2, was also impressively strong.

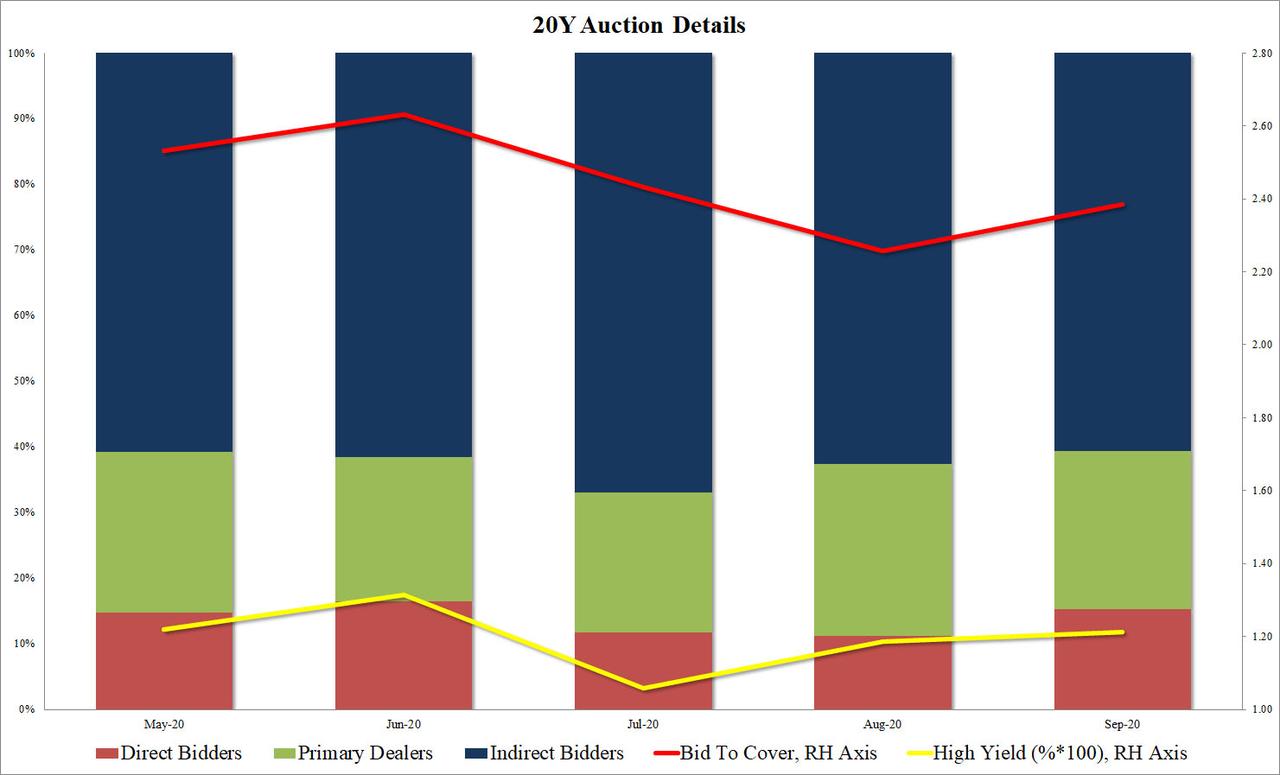

The sale of $22BN in 20Y bonds – down $3 billion from last month – priced at a high yield of 1.213%, stopping through the When Issued 1.218% by 0.5bps, a solid improvement from last month’s 0.9bps tail.

The Bid to Cover also jumped from last month’s 2.26 to 2.39 (if below the btc of the first three 20Y auctions since the tenor was reintroduced in May). The internals were less impressive, with Indirect Bidders taking just 60.7%, down from 62.6% last month. And with Directs taking down 15.3%, above last month’s 11.2%, Dealers were left with 24.0%, also an improvement to last month’s 26.2%

The impressive buyside demand for 20Y paper, a substantial improvement to the dismal 20Y auction last month, was enough to push 10Y yields modestly lower by half a basis point, although the move was too small to write home about.

Curiously, despite the general improvement market tone, the 10Y auction is now trading at 0.6772%, exactly where it was one month ago when a far uglier 20Y auction priced. In other words, in a time when Yield Curve Control is one sharp selloff away, Treasury auction specifics are just as irrelevant as all other fundamental data.

via ZeroHedge News https://ift.tt/3c4XgMC Tyler Durden