Fed Releases Scenarios For Second Bank Stress Test, May Extend Dividend, Buyback Limits

Tyler Durden

Thu, 09/17/2020 – 17:07

Moments ago the Fed announced two “hypothetical” scenarios for a second round of bank stress tests which will be held this year and whose results will be unveiled by the end of the year, marking the first time the Fed has examined banks more than once in a single year. The exams will show how lenders would be impacted by unemployment spiking as high as 12.5%, or well above the post Covid-shock level it’s at today. More importantly, the Fed also said that is considering extending the constraints on dividend payments and share buybacks imposed on US banks into the fourth quarter.

The Fed said it will decide whether to prolong the limits, which are scheduled to expire on Sept 30, by the end of September. Naturally, any extension through the end of the year would disappoint banks, as JPMorgan has already indicated it might resume buybacks in the fourth quarter if allowed to by regulators. On the other hand, cynics view the combination of unprecedented 2nd stress test and reappraisal of shareholder friendly activity as a smokescreen that will give the Fed a chance to announce an all clear, and having covered its back, it will then greenlight a return to normal buyback and dividend activity which was limited in June when it restricted banks from increasing their investor payouts above second-quarter levels and banning all buybacks.

In June, following pressure from lawmakers who argued banks shouldn’t be paying dividends during a pandemic, the Fed released the results of its first stress test which found that all large banks were sufficiently capitalized but in light of the heightened economic uncertainty, the Fed required banks to take several actions to preserve their capital levels in the third quarter of this year.

The Fed also said that as part of the second stress test, large banks would be tested against two scenarios featuring severe recessions to assess their resiliency under a range of outcomes. The stress tests will help to ensure “that large banks are able to lend to households and businesses even in a severe recession.”

The test will evaluate the resilience of large banks by estimating their loan losses and capital levels—which provide a cushion against losses—under hypothetical recession scenarios over nine quarters into the future.

“The Fed’s stress tests earlier this year showed the strength of large banks under many different scenarios,” Vice Chair Randal K. Quarles said. “Although the economy has improved materially over the last quarter, uncertainty over the course of the next few quarters remains unusually high, and these two additional tests will provide more information on the resiliency of large banks.”

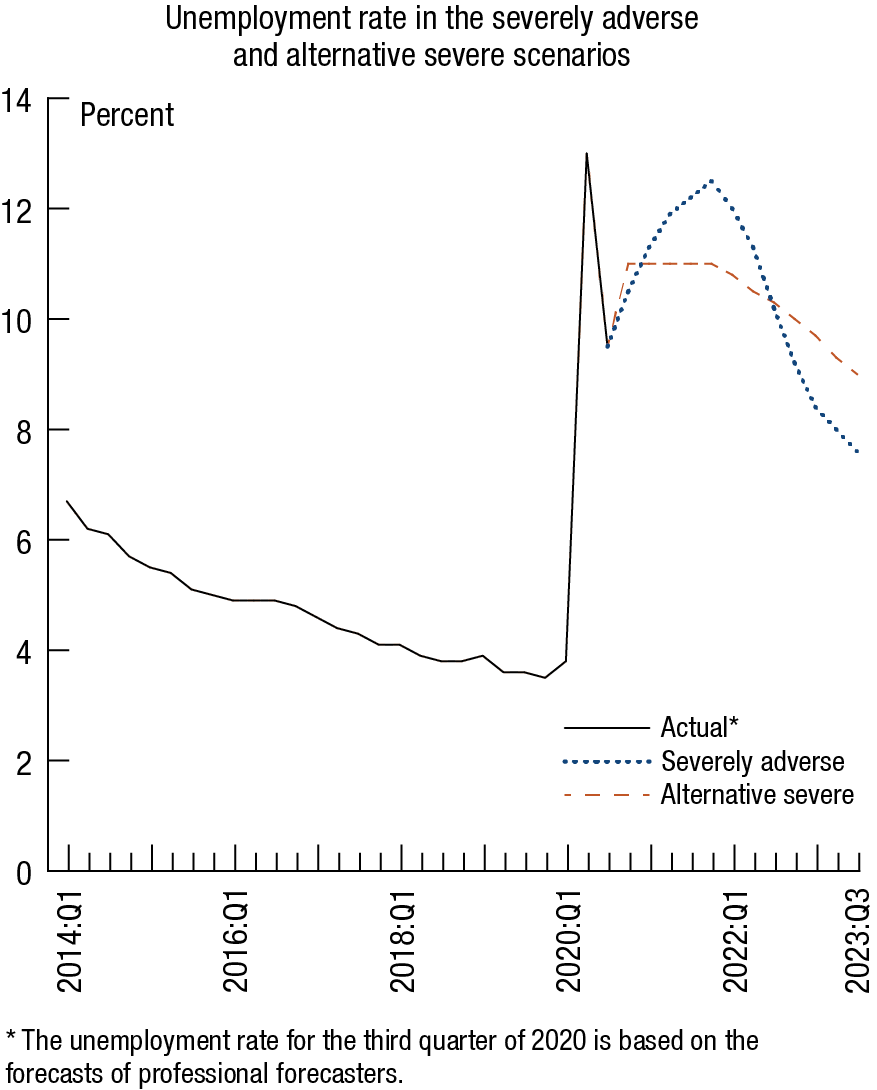

The two hypothetical recessions in the scenarios feature severe global downturns with substantial stress in financial markets. The first scenario—the “severely adverse”—features the unemployment rate peaking at 12.5 percent at the end of 2021 and then declining to about 7.5 percent by the end of the scenario. Gross domestic product declines about 3 percent from the third quarter of 2020 through the fourth quarter of 2021. The scenario also features a sharp slowdown abroad.

The second scenario—the “alternative severe”—features an unemployment rate that peaks at 11 percent by the end of 2020 but stays elevated and only declines to 9 percent by the end of the scenario. Gross domestic product declines about 2.5 percent from the third to the fourth quarter of 2020. The chart below shows the path of the unemployment rate for each scenario.

The two scenarios also include a global market shock component that will be applied to banks with large trading operations. Those banks, as well as certain banks with substantial processing operations, will also be required to incorporate the default of their largest counterparty.

via ZeroHedge News https://ift.tt/2RzOJrh Tyler Durden