“Sell All The Things!” – Tech Wrecked, Dollar Dumped, & SNOW Flaked

Tyler Durden

Thu, 09/17/2020 – 16:00

Since Powell dropped his statement yesterday – explaining what The Fed hopes will happen but not how it will make it happen – investors have switched into sell-all-the-things mode with the dollar, stocks, bonds, and gold all lower…

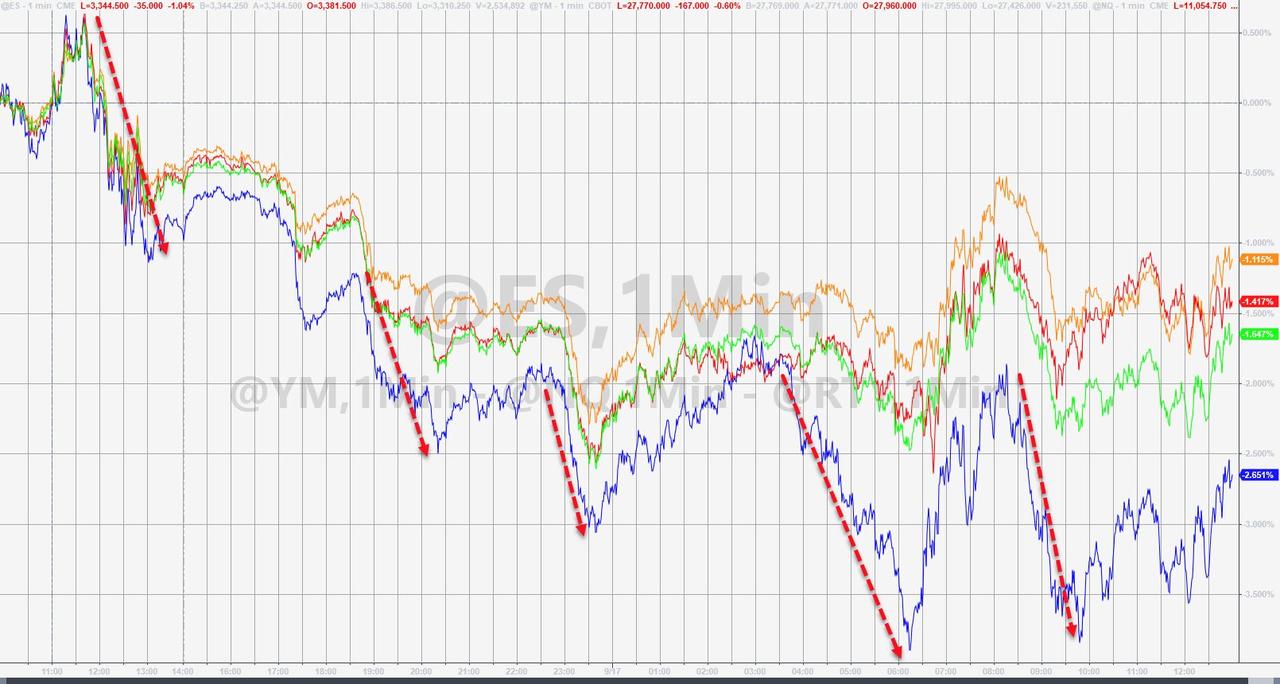

Since The FOMC Statement, Nasdaq was down almost 4% overnight, leading the drop among all the major US equity indices (The Dow is the least bad, down around 1%)…

SNOW no mo’…

And MOMO no mo’…

Source: Bloomberg

“Sell, Sell, Sell!”

Nasdaq continues to notably underperform, now at one-month lows relative to Small Caps…

Source: Bloomberg

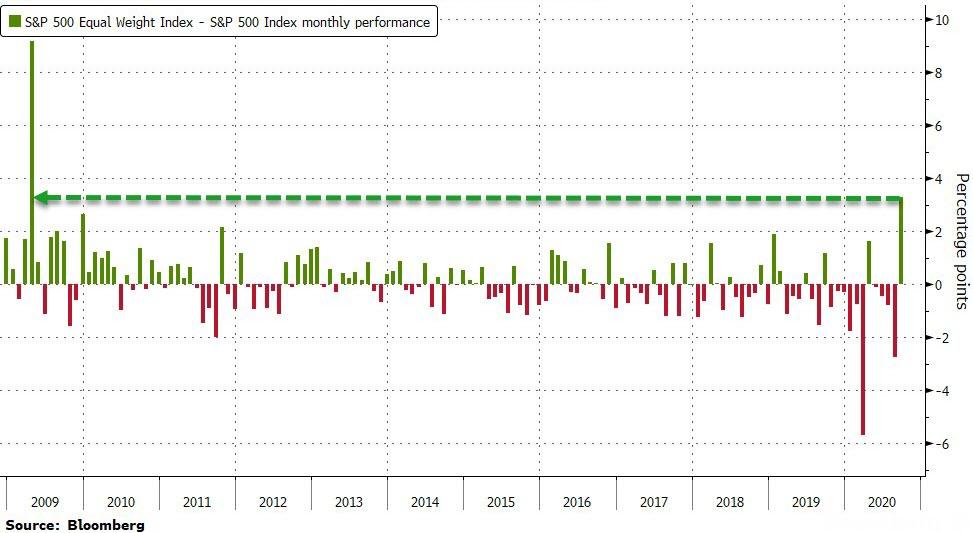

Also of notes is the fact that, as Bloomberg points out, strip out megacap technology stocks and the S&P 500 Index is doing fine this month.

Source: Bloomberg

The equal-weighted version of the benchmark widened its monthly performance spread over its cap-weighted peer to 3.3 percentage points on Wednesday, enough to put it on track for the best relative gain since April 2009.

Source: Bloomberg

~50% of the NASDAQ-100 Index is now below the 50-day moving average. Trend is over, had the blowoff a few weeks back. Doesn’t mean it has to go down 50% like people want, but it’s not going back above the highs for awhile.

Source: Bloomberg

The S&P 500 and Nasdaq both ended back below the 50DMA…

Source: Bloomberg

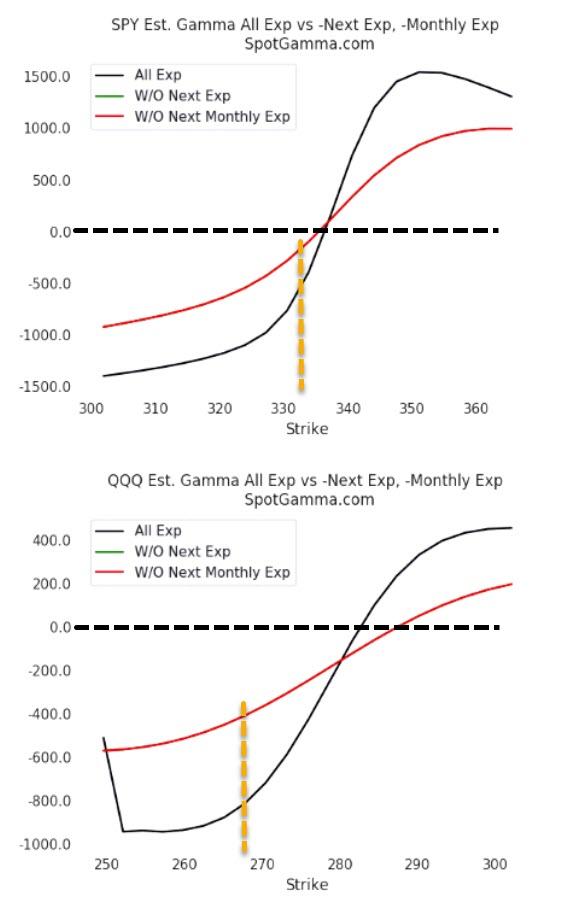

Don’t forget, tomorrow is quad witch…

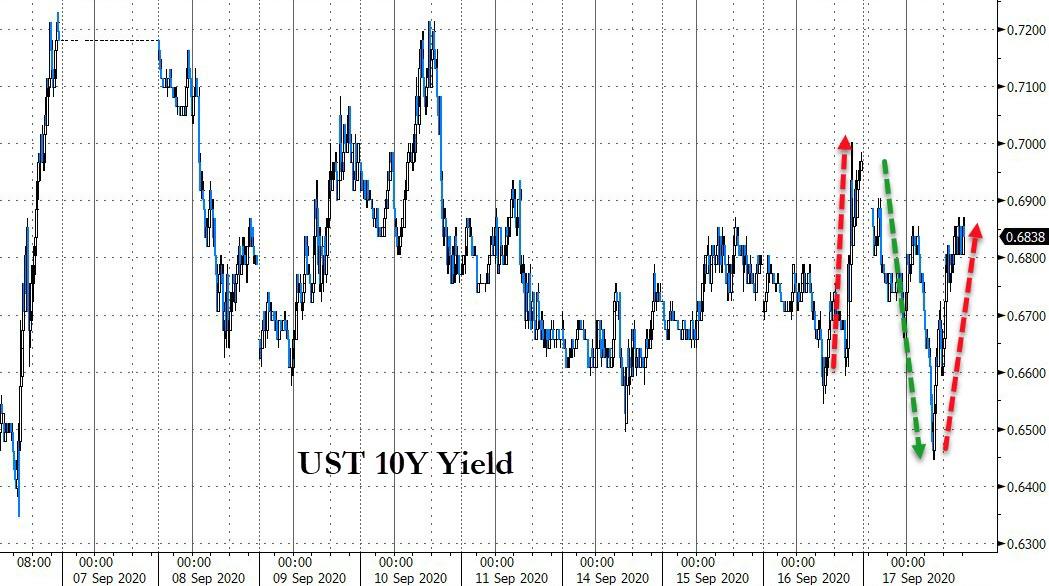

Treasury yields chopped around all day today but ended up very modestly higher in yield on the week…

Source: Bloomberg

Yields tumbled overnight but reversed higher as stocks sold off during the US session (bonds and stocks degrossed?)

Source: Bloomberg

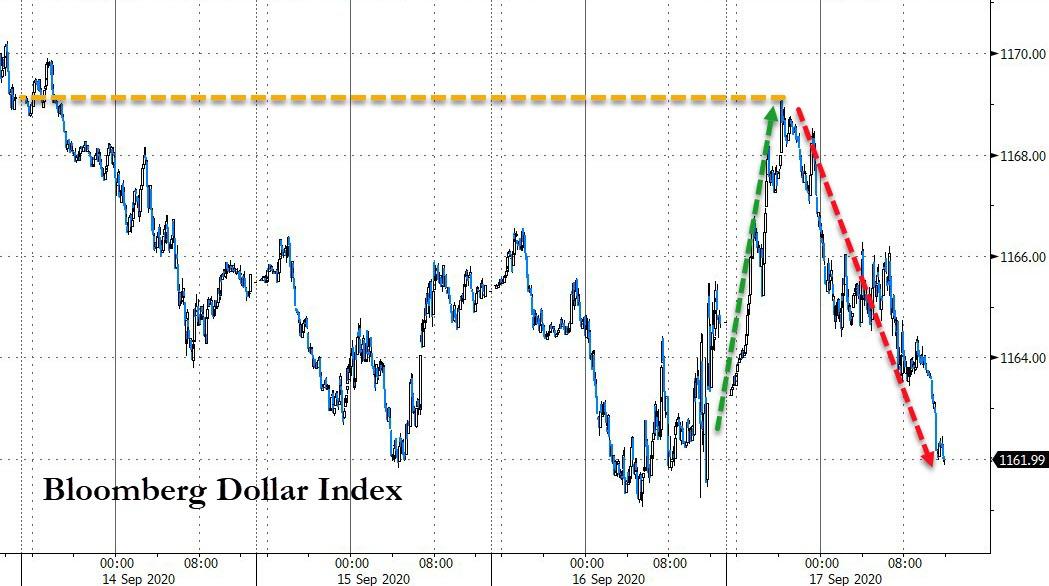

The Dollar was clubbed like a baby seal today after extending its post-Powell gains overnight (perfectly tagging unchanged on the week before dumping)…

Source: Bloomberg

Breaking down to 3 week lows…

Source: Bloomberg

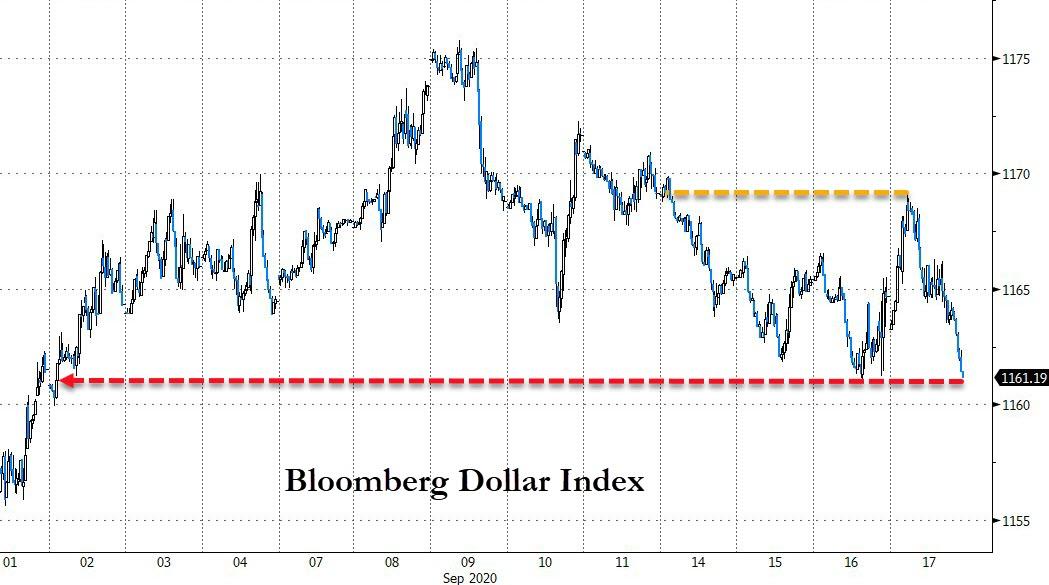

The Yuan is back at its highest since May 2019…

Source: Bloomberg

You can also see the election risk in the term structure of the yuan, which is sensitive to potential changes in U.S. trade policy. The gap between the yuan’s two-month and one-month implied vol is near a record high.

Source: Bloomberg

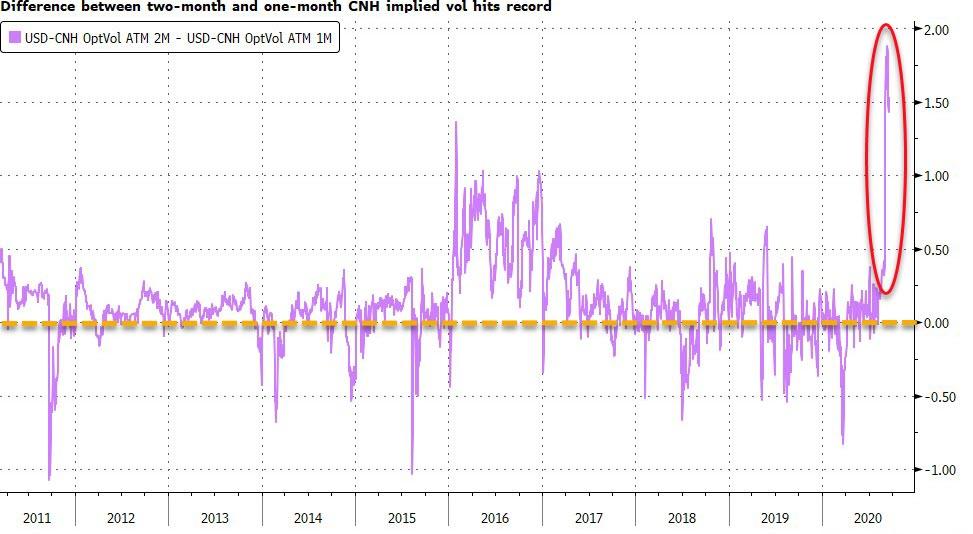

The Yen is surging (as Abe leaves)…

Source: Bloomberg

The annual weekly correlation between S&P 500 and USD/JPY has flipped to negative, meaning a decline in stocks has been accompanied by depreciation of the yen vs the dollar.

In this new era of lower-for-longer rates, correlation breakdowns may become more common, as Jens Nordvig at Exantedata, noted:

In a world of generally zero rates, it is logical that correlations that were normal for decades, will no longer apply. The world has changed, and risk properties associated with currencies are evolving too.

Cryptos mixed again with Bitcoin leading the week and Litecoin lagging…

Source: Bloomberg

There was something that was bid today – oil! With WTI surging back above $41…

But as oil surged, NatGas was monkeyhammered lower…

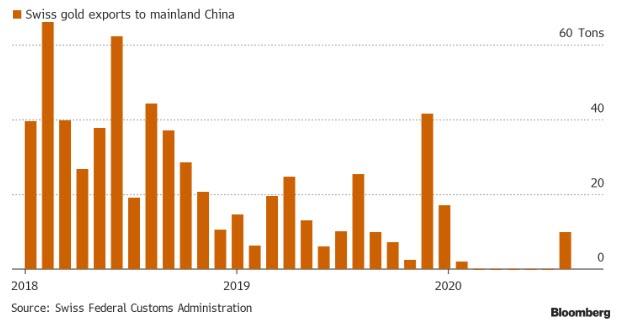

Finally, on the one-year-anniversary of the repo crisis, Gold shipments from Switzerland, Europe’s refining hub, to China resumed in August after a five-month break…

Source: Bloomberg

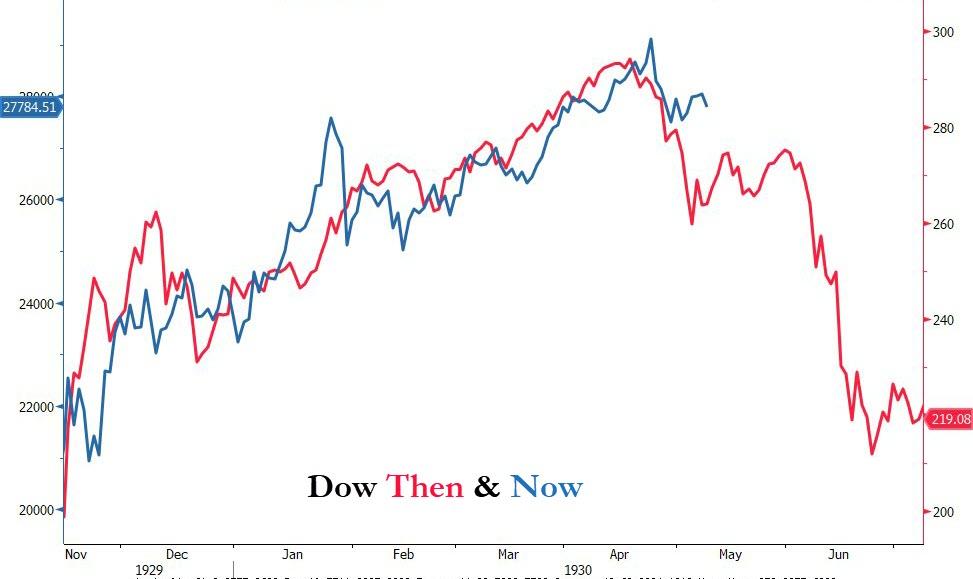

And the 1930 dead-cat-bounce called…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2HazMdw Tyler Durden