The Repo Panic: One Year Later

Tyler Durden

Thu, 09/17/2020 – 15:45

By Scott Skyrm of Curvative Securities,

Let’s set the stage. After 7 years of zero percent interest rates, the Fed started draining liquidity from the market in December 2015 by tightening rates 25 basis points.

Over the next four years, the Fed continued to tighten and launched QE runoff, letting the SOMA portfolio shrink, effectively putting more Treasurys back into the market. At the same time, the Treasury was issuing a massive about of debt. The landscape was set.

Just when the Fed was draining liquidity, more Treasurys were coming into the market via QE runoff and new issuance.

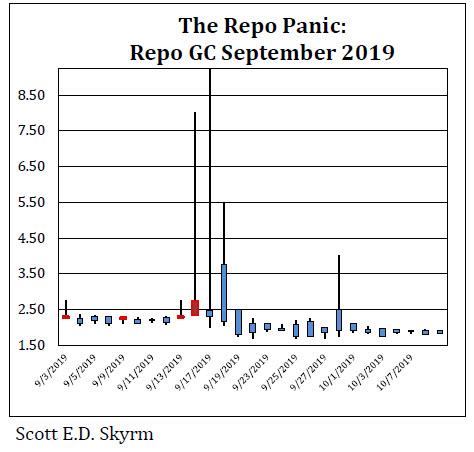

On Monday and Tuesday, September 16 and 17, GC Repo rates spiked higher, trading as high as 8.00% on Monday and 9.25% on Tuesday.

An incredible amount of volatility. But note, on both days, rates closed within their normal trading range. Strange. Though rates spiked so high, at the end of the day (especially on Monday) there was still enough cash for everyone to get funded. Regardless. Then, as a result, the Fed dusted off their RP operations program and entered the market for the first time in years.

The Repo Panic of September 2019 had a major impact on the market for six months. It was a liquidity event that pushed rates higher and created a lot anxiety. But don’t let anyone fool you.

The official history was written claiming insufficient bank reserves blah blah blah. But the answer is simple. There were too many US Treasurys in the market (ZH: and not enough liquidity).

The resurrection of the Fed’s RP program helped smooth day-to-day spikes, but the relaunch of aggressive QE buying removed enough Treasurys to stabilize the market.

via ZeroHedge News https://ift.tt/32D3PTq Tyler Durden