Kashkari Explains Why He Dissented Against The FOMC’s Decision

Tyler Durden

Fri, 09/18/2020 – 11:37

While the latest FOMC announcement on Wednesday was generally in line with expectations (even as the market strongly hints that it could have been far stronger in terms of supporting risk assets) there was one notable surprise in that not one but two FOMC voters dissented. This is what we said at the time:

Kaplan was a hawkish dissent. To Kashkari not even the superdovish Fed was dovish enough

— zerohedge (@zerohedge) September 16, 2020

Feeling the urge to explain himself further, Kashkari earlier today published a blog titled “Why I Dissented“, in which he admits he “would have preferred the Committee make a stronger commitment to not raising rates until we were certain to have achieved our dual mandate objectives.”

In other words, the Fed – which is buying $120BN in securities each month, including corporate bonds and ETFs and has rates pegged at zero until at least 2023 – wasn’t dovish enough.

To justify his uber-dovish bias, in the first part of the essay Kashakri provides a rehash of the Fed’s admission that the Phillips curve has been broken for years. Discussing the broken linkage between “maximum employment” and the inflation it was supposed to spur, Kashkari first reviews what he learned from the recent tightening cycle that began in 2015, and writes that “that policy tightening was predicated on the Committee’s view that the labor market was reaching maximum employment and therefore inflation was around the corner. When I first became an FOMC voter, I dissented against all three of the Committee’s rate hikes in 2017 because, as I wrote then: “We are still coming up short on our inflation target, and the job market continues to strengthen, suggesting that slack remains.” Recently, Governor Brainard commented: “had the changes to monetary policy goals and strategy we made in the new [monetary policy strategy] been in place several years ago, it is likely that accommodation would have been withdrawn later, and the gains [to the labor market] would have been greater.” We misread the labor market and, as a result, the tightening cycle that we embarked upon was not optimal to achieving our dual mandate goals of maximum employment and stable prices.”

He then notes that “in recent years, we have repeatedly believed we were at or beyond maximum employment only to be surprised when many more Americans reentered the labor market or chose not to leave, increasing the productive capacity of the economy without causing high inflation. To me, maximum employment is the point at which the labor market is just tight enough to deliver 2 percent inflation in equilibrium. If we were to push the labor market harder, we would end up with inflation greater than 2 percent. By this definition, even in January 2020, we had not yet reached maximum employment.“

Of course, regular readers will know what the issue is here: it was back in… oh 2010, or a decade ago, when we first noted that as a result of America’s transformation into a part-time worker society, corporations had learned to get away with paying the absolute minimum as well as avoiding full time hiring in order to maximize profits. This meant that even as employment hit the so-called “maximum”, wages failed to keep up. Yet the Fed – which targets 2% inflation for the purely optical purpose of “ensuring” rising wages as it serves as the “budget constraint” to maximum employment – failed to grasp this simple fact, and kept insisting that ever lower unemployment rates – which were the result of record hiring in minimum and low paid jobs such as the record surge in waiters and bartenders under the Obama administration – would eventually lead to higher wages and, hence, inflation.

That never happened. So in his next discussion of why the Fed “consistently made this error”, Kashkari writes that:

“First, we heard repeatedly from businesses who complained that they couldn’t find workers. Some said we had a “historic worker shortage.” At the same time, wages were only rising modestly. I learned that businesses want qualified workers at wages they are used to paying. If they can’t readily find workers at historical wage levels, then they declare a worker shortage. The fact that wages weren’t climbing more quickly helped me to see through their complaints and realize that there was likely still slack in the labor market.

Well that’s truly insightful – after years of reading Fed beige books in which the recurring lament was a shortage of qualified workers, yet an unwillingness by employers to raise wages and find qualified workers – something finally clicked in the Fed’s collective head, and it may have had to do with the fact that despite “maximum employment” there were 100 million people not in the labor force who gladly would jump right back into the labor force (courtesy of the Fed’s crusade to destroy savers with ZIRP and soon NIRP), and who persistently kept wages low on the margin.

In other words, it only took Kashkari (and the Fed) 10 years to catch up to what we said in 2010.

Kashkari then gets to the crux of the issue, and in highlighting the FOMC’s new “outcome-based” forward guidance…

“The Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

… he writes that while he supports the adoption of outcome-based forward guidance “as an important step forward for the Committee’s approach to setting monetary policy” his preference “would have been for this new forward guidance to be stronger.”

Specifically, this new language still relies on the Committee to assess whether we are at maximum employment and whether inflation is expected to climb. As I just reviewed, those are difficult judgments to make in real time. For example, what would have happened had the FOMC adopted this forward guidance in 2012, when it first adopted its 2 percent inflation target? Inflation briefly crossed 2 percent in January 2017 before falling back down. Given that we believed at the time we were at or beyond maximum employment, this new forward guidance would likely have deferred liftoff from December 2015 to January 2017, a little more than one year later. While that would have been an improvement over what the Committee actually did, we still would have been lifting off based on a misreading of the labor market and a false signal that underlying inflation had really returned to target. Hence, we still may not have achieved our dual mandate goals of maximum employment and 2 percent inflation.

This reminds us of what we wrote at the end of August, when referring to a speech by Fed vice chair Richard Clarida who made the same point, we said that the Fed’s 2015-2018 tightening cycle may have cost Hillary Clinton the election, something the Fed is clearly disappointed about (and as ex-NY Fed president Bill Dudley scandalously mused last year, the “apolitical” Fed may well have to spark a major market selloff to get rid of Trump; indeed still has 6 weeks to make good on this plan).

So what does Kashkari propose? Why delaying tightening until the Fed succeeds in doing something it has failed to do for the past decade: wait until there is a “sustained” increase in inflation above 2% – arguably as a result of rising wages – before hiking, to wit:

In June 2019, I proposed forward guidance that I continue to believe would better assist the FOMC in achieving its dual mandate goals. Specifically, I propose the following: “The Committee expects to maintain this target range until core inflation has reached 2 percent on a sustained basis.” By eliminating both the direct reference to our assessment of maximum employment and any forecast of inflation climbing, this proposed language guards against the risk of underestimating slack in the labor market. We would only lift off once we had demonstrated that we really were at maximum employment, because core inflation would have had to actually hit or exceed 2 percent on a sustained basis in order to lift off. Policymakers will have a range of opinions about what constitutes a sustained basis, but for me in this environment, it means roughly a year.

In short, capitalizing on the Fed’s recent transition to an Average Inflation Targeting framework, Kashkari is doubling down as the de facto AIT voice at the Fed, and arguing that no hikes should take place until “average” inflation is sustainable above 2%. Of course, as we noted a few weeks ago, Bank of America calculated that for that to happen and for the AIT regime to offset years of inflation misses, the Fed would have to be at ZIRP for, drumroll, 42 years!

Which of course is perfectly find with Kashkari.

So “What might go wrong?” as the Minneapolis president muses in the conclusion to his essay, and “under what scenario might the Committee regret adopting the forward guidance I propose?”

As he explains, “if inflationary pressures are building, we might have to raise rates to keep inflation expectations anchored at 2 percent. Once core inflation crosses 2 percent on a sustained basis, my proposal allows the Committee to do exactly that. This scenario should not be a concern. We heard in the last expansion that there might be nonlinearities in the inflation process — that once inflation started climbing, it might accelerate, requiring a very strong policy response to control it. At the time, I called such theories ghost stories, because there was no evidence they were true but they also couldn’t be ruled out. I believe that characterization is still appropriate today. The FOMC has powerful tools to combat high inflation but only limited tools to combat low inflation. Persistent low inflation is posing challenges to advanced economies around the world. If this new forward guidance helped to generate higher inflation that the FOMC then had to respond to by raising rates, I think we would consider that a high-class problem.”

Right, just ask Paul Volcker his “easy” it was to combat runaway inflation with the Fed’s “powerful tools” – while several generations of Americans were not even born yet, the stagflation of the 1970s and early 1980s remains a most horrid memory. It is precisely this stagflation that the Fed wants to – and will – unleash on the US with its average inflation targeting, even without adopting Kashkari’s even more dovish framework.

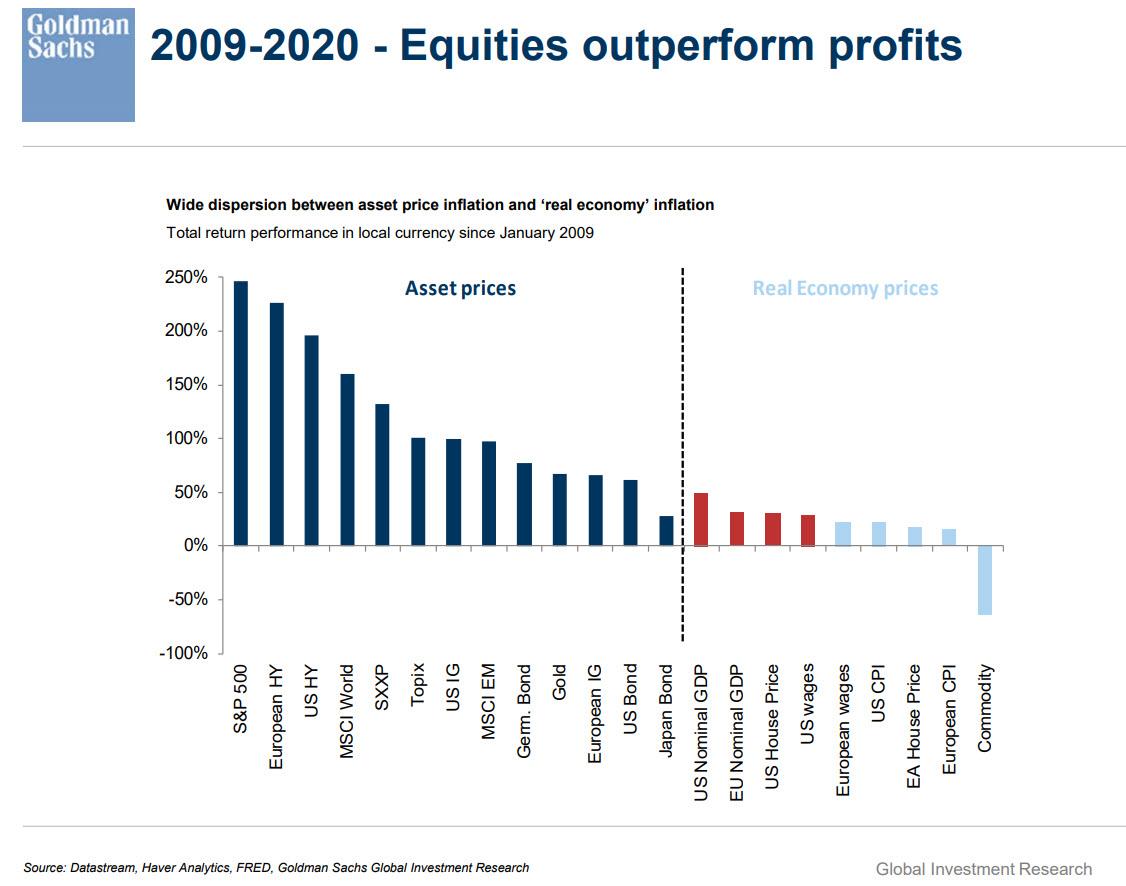

Furthermore, there was one scenario that “might go wrong” that Kashakri conveniently decided to ignore: the Fed sparking an even bigger asset bubble than the one we have now. As a reminder, while the Fed has indeed failed to spark higher wages and promote benign inflation in the “real economy”, it has been tremendously successful in creating runaway asset inflation as the following Goldman chart shows.

Keeping rates at zero for years (or decades) only assures that what is already the world’s biggest asset bubble will only get bigger. Which for a trickle-downer former banker such as Kashkari is what it’s all about, and explains why it never even crossed his mind that such a scenario is among the alternative of “what might be wrong.”

In any case, while Kashkari entire rationalization is just a strawman to keep rates at zero (or lower) in perpetuity merely to prop up risk assets and stock prices (never forget that Kashakri is first and foremost a Wall Street proxy at the Fed, having worked at both Goldman and Pimco before inexplicably taking over the Minneapolis Fed), he did need some economic justification to make his uber-dovish position felt, especially since the next administration – whether a continuation of Trump or Biden – will need the biggest dove it can find to monetize deficits that will make this year’s record $3 trillion seems like amateur hour.

Consider Kashakri’s “dissent explanation” his informal application for the role of Fed Chair under the 46th president of the United States.

via ZeroHedge News https://ift.tt/2RElrrI Tyler Durden