Bond Issuance Smashes Monthly Record For The 6th Time In Past 7 Months

Tyler Durden

Wed, 09/30/2020 – 06:30

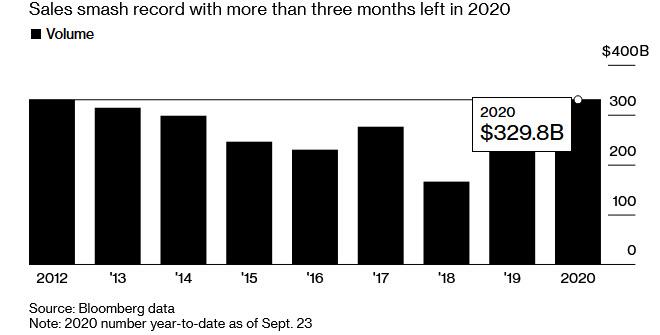

One week after the US junk bond market smashed the annual issuance record, when sales of high yield (the term is used very loosely these days) debt hit a record $330 billion last Wednesday, surpassing the previous full-year record of $329.6 billion in 2012 (and there’s three more months to go in 2020)…

… today a new corporate debt issuance record was set when ten IG bonds priced for $6.85bn on Tuesday, shattering the monthly sales record for the sixth time in the last seven months. The borrowing spree comes on the back of a Fed-backstopped, pandemic-fueled liquidity grab, as companies sell record amounts of debt at all time low yield, using the proceeds either to refi existing debt, to load up on cash or simply to resume buybacks.

The monthly IG supply currently stands at $162.7 billion, passing last September’s $158 billion record total for the month; July was the only month since March not to set a new high water mark for the respective month, according to Bloomberg, which notes that final orderbooks were 2.5 times oversubscribed and issuers paid negative 1.5bps in new issue concessions.

Among today’s IG issuers, CubeSmart, Best Buy, National Rural and DTE all upsized from announced deal sizes while Danaher printed $1bn, the high end of the $750m-$1bn target range.

Despite the record YTD new issuance momentum, supply is expected to slow into year-end with just $150 billion expected in 4Q, down about 20% over the same period last year, as most companies that could take advantage of the wide open issuance window have already done so. A modest $75 billion is expected in October, less than half the September total.

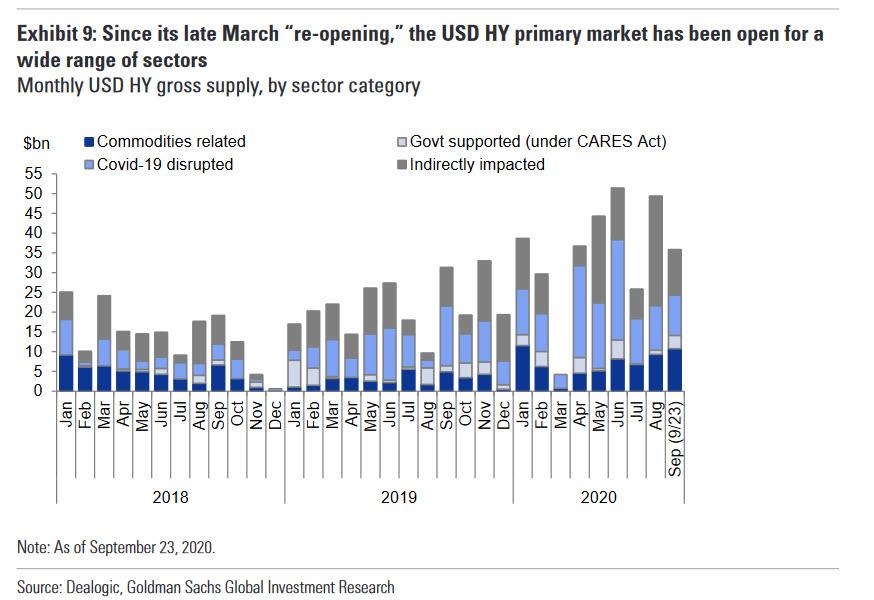

Going back to the junk bond market, the HY new issue market has been surprisingly receptive to a wide range of sectors since its “re-opening” in late March – including those groups at the epicenter of the coronavirus disruption. The chart below illustrates this by showing monthly USD HY gross issuance volumes by four broad sector categories:

- commodities related,

- government supported, under the CARES Act,

- directly disrupted by the coronavirus/sudden stop in the economy, and

- indirectly impacted.

As the chart shows, directly disrupted and government supported sectors have generated significant amounts of supply in each of the past few months, indicating the market’s continued willingness to lend to groups facing persistent headwinds related to social distancing and business restrictions. The reason: the Fed’s explicit backstop of the corporate bond market since March, when Powell announced the Fed would purchase corporate bonds and ETFs.

In recent months, junk-rated issuers have tilted away from securing liquidity lifelines and are instead looking to lock in lower interest rates and push out maturities on existing debt loads. The shift, coupled with support from the Fed, has forced investors to accept diminishing yields.

“A lot of the issuance was to get as much liquidity as you can, because things were looking like they were going to be stalled out for a while,” said Douglas Lopez, senior partner and portfolio manager at Aristotle Credit Partners. “This was the prudent move, but some companies may be building the liquidity bridge to nowhere.” It’s not just the US: Europe’s high-yield bond sales surged in July, the busiest for that month since 2009, according to Bloomberg.

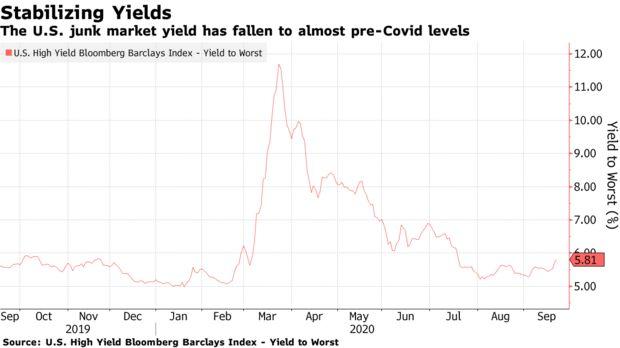

The Fed’s ZIRP policy, which is expected to last at least through 2023, has paved the way for billions of dollars to flood into funds that invest in high-yield debt as investors search for yield. That support, according to Bloomberg, has effectively turned high-yield into a borrower’s market, and yields for U.S. junk bonds have dropped to 5.81%, near pre-pandemic levels, according to Bloomberg Barclays index data.

The investor frenzy means that collateral-lite issuance is back: at the same time, call protection, which prevents a company from repaying a bond early for a period of time, has been shortened in some deals.

The flood of high yield refinancings – which have seen leveraged loans refinanced with new junk offerings – is expected to continue through September and into October, with issuers pulling forward deals to get ahead of the uncertainty around the November presidential election and a possible second wave of Covid-19. And while refinancings have surged, high-yield issuance to fund acquisitions and leveraged buyouts has yet to return, with Bloomberg noting that although early discussions for new deals is picking up, even if those are announced soon, the financings likely wouldn’t come until 2021.

And just in case there was any doubt, speaking to reporters on Tuesday, New York Fed President John Williams said that the Fed’s corporate bond purchases are giving the market confidence: “This is basically in a kind of backstop role.”

While Williams confirmed our recent observations that the Fed’s purchase of corporate bonds have slowed dramatically, saying “the level of purchases is low enough that I don’t think it’s fundamentally changing market conditions really, in a first-order way” he agreed that the Fed’s “backstop role is very important. There is still a lot of uncertainty in the economy around the pandemic. Like our other facilities, the fact that they’re there, they’re operating and ready to be used if needed, I think adds a lot of confidence and assurance to the markets that the liquidity is going to be there.”

Judging by the number of IG and HY bond issuance records smashed daily, he is certainly correct. And don’t expect that to change any time soon: “If market stresses appeared again, obviously it’s still operating and could be deployed to keep market conditions stable and well-functioning.”

via ZeroHedge News https://ift.tt/33fZTs8 Tyler Durden