“Contested Election” It Is: Here Is How To Trade It

Tyler Durden

Wed, 09/30/2020 – 12:40

Out of the ashes of the biggest dumpster fire debate in US history, one thing emerged: a contested election – something which JPMorgan two weeks ago called the “worst case scenario for markets into year end” – is now guaranteed, resulting in investor fears that a disputed ballot could lead to a messy transfer of power. The reason for that is that while confusion and chaos raged during last night’s debate, Trump made one thing clear: the president declined to commit outright to accepting the results, repeating a recurring complaint that mail-in ballots would lead to election fraud.

“The debate drew further attention to the potential for a contested election,” said Hani Redha, global multi-asset portfolio manager, at Pinebridge. “It is likely market participants will continue to price in this issue, heightening volatility all the way to election day and its immediate aftermath.”

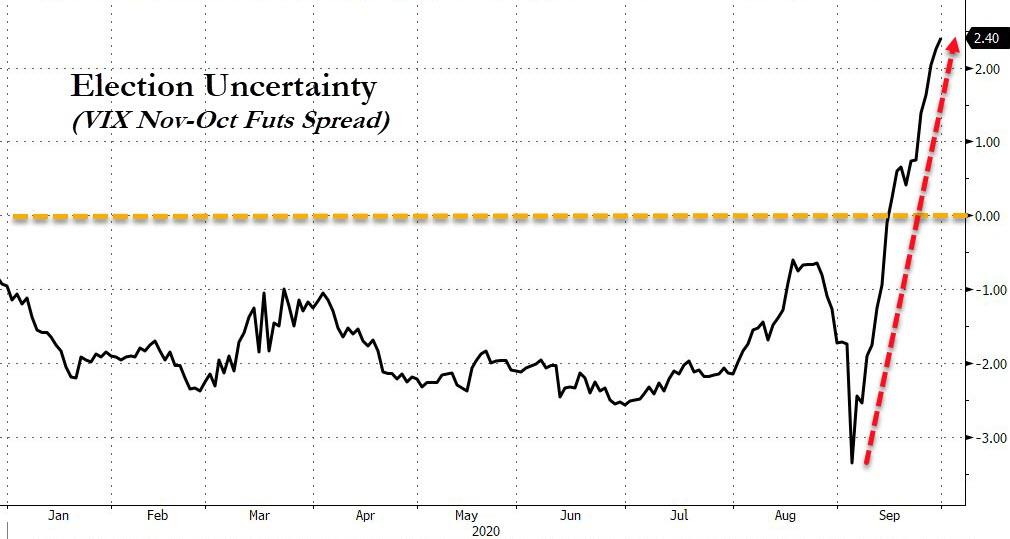

Sure enough, the VIX curve steepened further on Wednesday bracing for volatility in November…

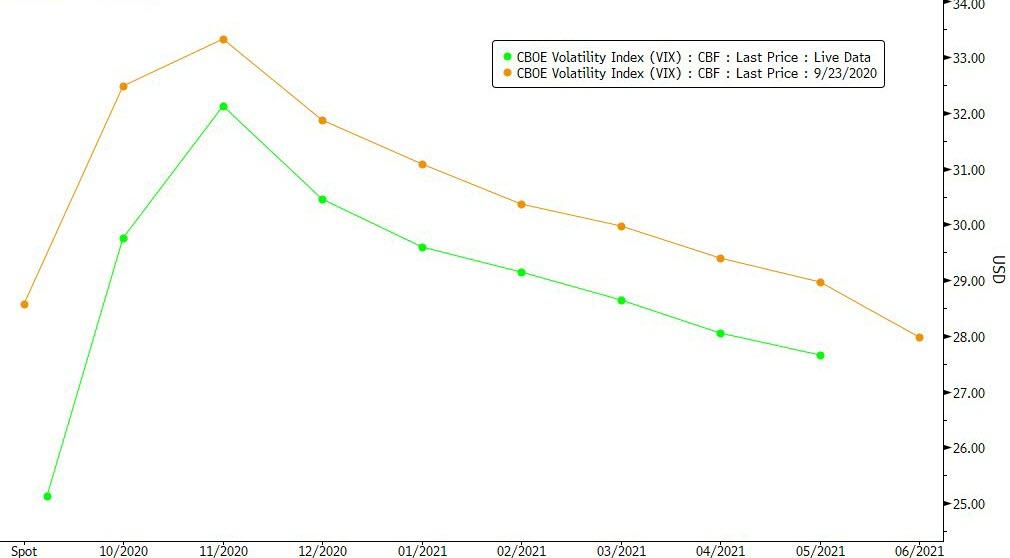

…and December and even January…

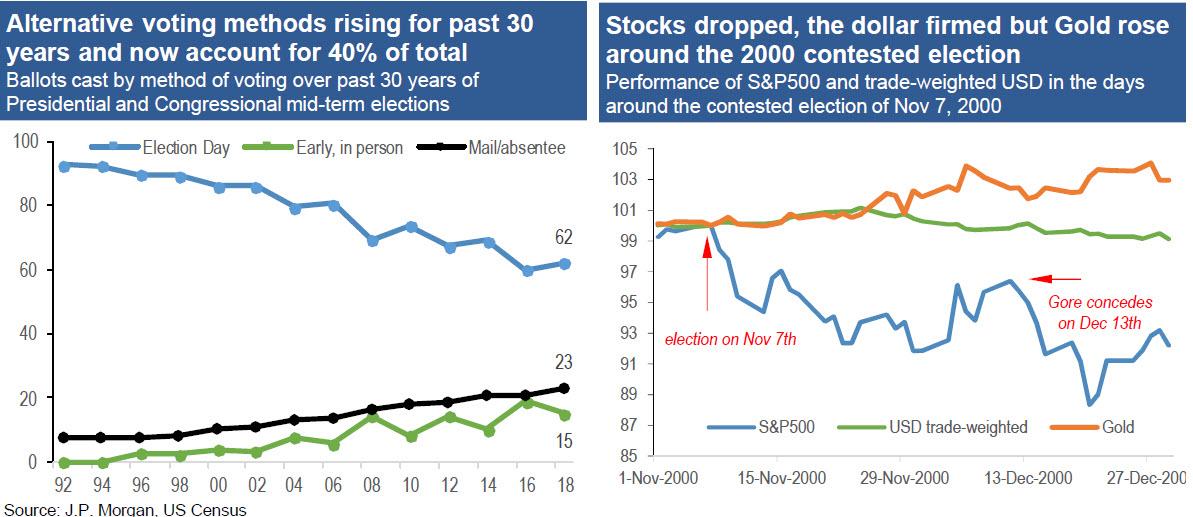

… because the use of mail-in ballots by voters – in some cases even those mailed after the election date – will mean delays of weeks or even months in announcing the winner; it also likely means that the Supreme Court may have to get involved at the conclusion of the process to declare the eventual winner and explains Trump’s eagerness to promptly appoint Amy Coney Barrett to SCOTUS.

Addressing the risk of a contested election, JPMorgan writes that contested Presidential elections are rare, having occurred only twice (1876 between Democrat Tilden and Republican Hayes, 2000 between Democrat Gore and Republican Bush). During the Gore-Bush saga which required a month to resolve, US Equities dropped about 7% from their pre-election level but never recovered meaningfully given that the US entered a recession in late 2000/early 2001. The trade-weighted dollar was firm given the early-stage recession, but Gold decoupled from FX markets and firmed during this period of uncertainty.

That said, JPM agrees that “a contested election has become the baseline” given

- the long-term rise in alternative voting methods over past 30 years;

- likely surge in postal voting this year due to COVID-19; and

- Trump’s allegations that postal voting is more susceptible to fraud. Opinion polls indicate that Republicans are more mistrustful of postal voting than Democrats.

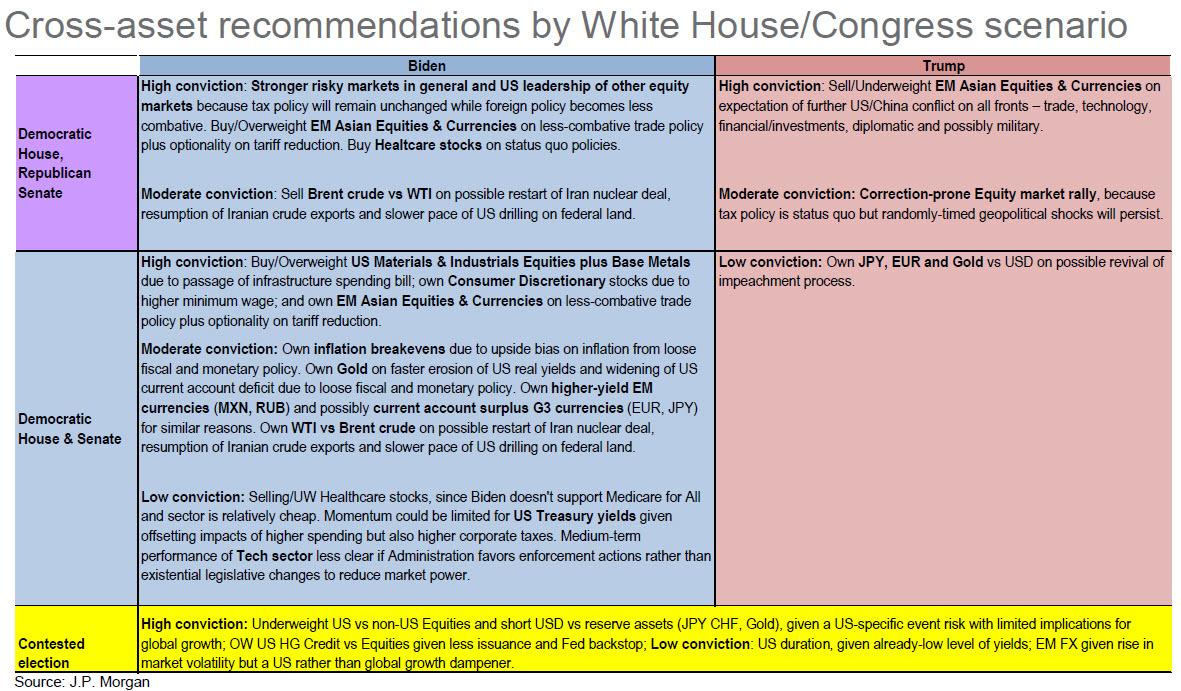

Assuming a contested election is the baseline, JPM then lays out a matrix of what the proper trades are going into November and lasting for an indefinite period of time. Here are JPMorgan’s “high conviction” trades:

Underweight US vs non-US Equities and short USD vs reserve assets (JPY CHF, Gold), given a US-specific event risk with limited implications for global growth; OW US HG Credit vs Equities given less issuance and Fed backstop;

And here are the Low Conviction trades:

US duration, given already-low level of yields; EM FX given rise in market volatility but a US rather than global growth dampener.

One final comment from JPM’s John Normand, who says that “if a Republican sweep is the least likely outcome, the most interesting scenario for markets is a Democratic sweep that puts fiscal and foreign policy in play. Either Trump’s re-election or Biden’s election with a divided Congress leaves only foreign policy and domestic social policy in play, which impacts markets across fewer dimensions.”

Full breakdown below:

d

via ZeroHedge News https://ift.tt/33d3zuC Tyler Durden