Vatican Fires Senior Official As London Property Investments Bleed Millions Of Euros In Losses

Tyler Durden

Wed, 09/30/2020 – 04:15

When market conditions worsen, it’s always interesting to see who gets caught with their pants down. During the financial crisis, Bernie Madoff’s JPM-abetted Ponzi scheme made headlines as the largest financial fraud in history, with prosecutors estimating the size of the fraud at $64.8 billion (of course, as whistleblower Harry Markopolos claimed, more than half of that money never really existed, but rather included fictional profits reported by Madoff.

The London property market was already showing signs of weakness as early as 2019, before the coronavirus hammered the city’s economy, leaving its commercial areas virtually deserted. The reverberations have been felt across the city’s super-luxury market, which, as it happens, is just where one senior Vatican clergyman-bureaucrat decided to invest hundreds of millions of euros of the Catholic Church’s money, apparently hoping to make a quick profit for the church.

But vague allegations that Cardinal Giovanni Angelo Becciu, the second-in-command of the Vatican’s powerful Secretariat of State, may have tried to strike some kind of shady deal have allowed the Vatican to fire Becciu and scapegoat him for the investment scheme. The 72-year-old cardinal resigned Monday at the Pope’s request, and has pledged to defend himself and clear his name.

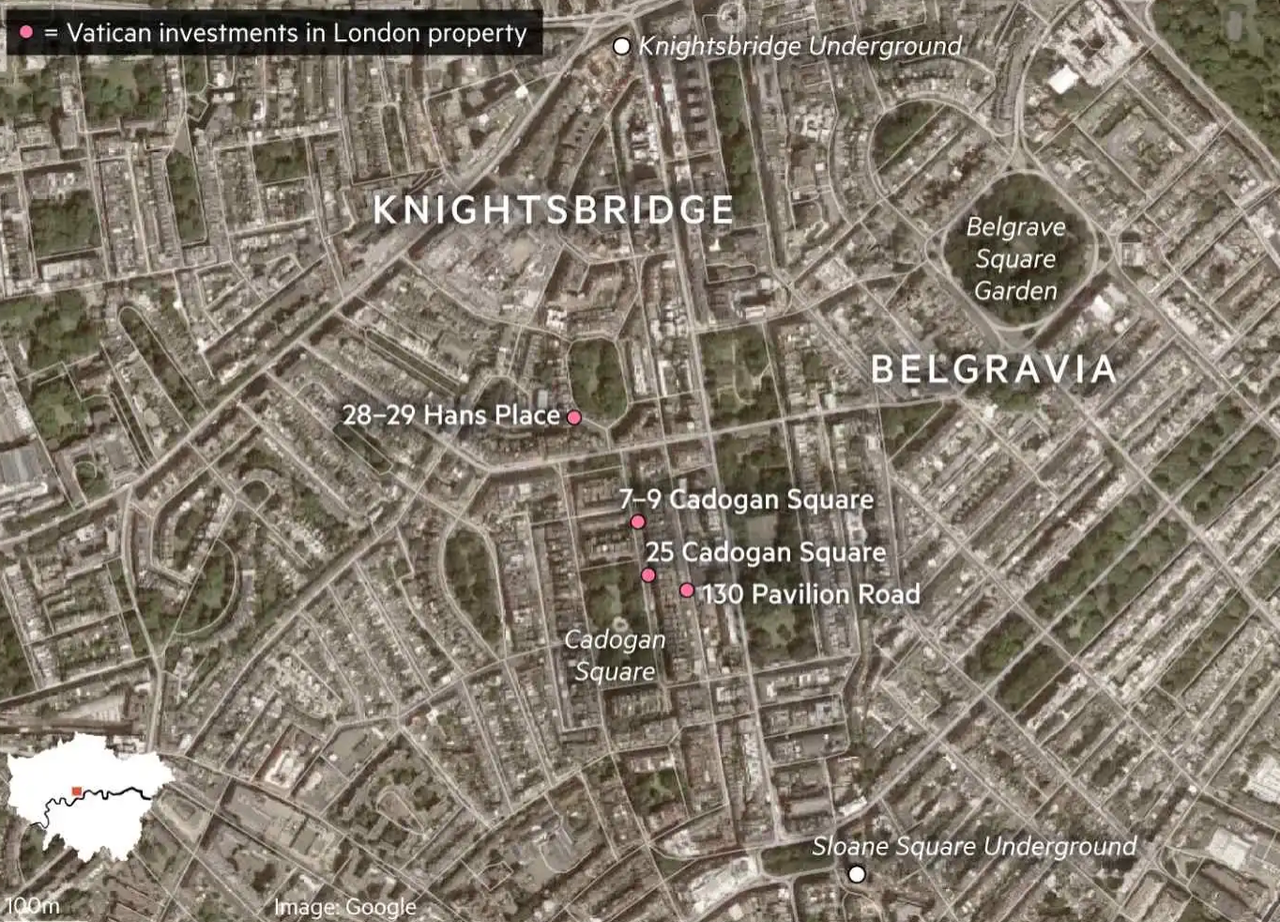

The documents show Cardinal Becciu oversaw a development that involved buying three apartments on 7-9 Cadogan Square for a total of £19.25m and spending £1.25m on redecoration and building reforms, including £39,000 on fireplaces, £52,000 on flooring and £7,000 on wallpaper, a document outlining the refurbishments shows. The Secretariat also purchased 25 Cadogan Square as well as apartments located on 28-29 Hans Place and 130 Pavilion Road. The acquisitions amounted to £95.75m. That total was partly funded with mortgages from the now defunct Swiss bank BSI, and Rothschild, according to details of the loan agreements seen by the FT.

But that’s not all: Vatican investigators are examining another property deal purportedly organized by Becciu where the Holy See invested millions in a commercial property project in Chelsea. The massive €350 million investment has reportedly led to huge losses. In response, the Vatican has arrested the London-based businessman who acted as a middle man in the deal.

The revelations of additional high-end London property acquisitions decided by the 72-year-old Italian clergyman come as Vatican magistrates are investigating a separate €350m investment in a large building in Chelsea called 60 Sloane Avenue, which Cardinal Becciu also oversaw when it was made in 2014. The Holy See has said the Sloane Avenue deal caused large losses. A London-based businessman, Gianluigi Torzi, was charged and arrested by the Vatican authorities with “extortion, embezzlement, aggravated fraud and self laundering” for payments made to him for his role as a middleman in the purchase. The Italian, who was released from custody, denies wrong doing.

The investment was made through four Jersey-incorporated companies, which isn’t terribly uncommon during large property deals.

The development plan was managed by a British company called Sloane and Cadogan, with an aim of selling the refurbished apartments on at a profit. The properties were purchased by the Secretariat of State through four Jersey-incorporated companies named Charybdis, Princeps, Civitas and Valerina, according to corporate filings. Sloane and Cadogan, which is not suspected of any wrongdoing, declined to comment.

The hints at some kind of a potential kickback scheme emerged in 2017, when some of Cardinal Becciu’s subordinated tried to get a second management company involved with the project, though the initial management company pushed back.

In 2017, three years after the initial investment, two Vatican officials reporting to Cardinal Becciu — Alberto Perlasca and Fabrizio Tirabassi — informed Sloane and Cadogan that a different investment company based in Switzerland called Valeur was to be given part of the fees charged to manage and develop the properties, according to correspondence seen by the FT. Both Mr Perlasca and Mr Tirabassi have been suspended by the Vatican authorities as part of the continuing investigation into the 60 Sloane Avenue investment. That investment was separate and not linked to the Cadogan Square developments.

When reached by the FT, the Cardinal reportedly claimed that these types of property deals were an accepted practice at the Vatican, and that he did nothing wrong. Sometimes, things don’t work out. That’s life.

One would think the Catholic Church would show a little understanding. In summary: while this hardly rates as a juicy scandal by Vatican standards (the church was once roped into a Mafia money laundering scheme back in the 20th century made famous in “The Godfather: Part III”), it’s interesting to see the Church scapegoat such a powerful official over a wayward investment. One can’t help but wonder if there might be other motives afoot.

via ZeroHedge News https://ift.tt/3cH2Uop Tyler Durden