Futures Surge After Stimulus Pessimism Turns To Stimulus Optimism

Tyler Durden

Thu, 10/01/2020 – 08:09

Narratives used to explain market moves have become so simple enough even 16-year-old Robinhood traders can understand them: if markets are down, it’s due to stimulus pessimism, rising covid cases and/or a fading economic recovery; if markets are up, it’s due to stimulus optimism, covid vaccine hopes and/or a stronger economic recovery.

Case in point, yesterday we for the former, when late in the session news out of McConnell and Mnuchin hit market sentiment late in the session. However, all that reversed overnight, when Roll Call reported that Mnuchin had proposed a $1.62 trillion compromise proposal including more state and local aid and $400 a week in unemployment insurance. Talks continue today after the House delayed a vote on its $2.2 trillion plan to give Mnuchin and Nancy Pelosi more time to try to thrash out a deal

That was enough to boost market sentiment, while allowing traders to ignore the latest flood of mass layoff announcements as American Air and United said they’ll start laying off a combined 32,000 workers (but said they would reverse the move if the government agrees to additional support in the coming days, adding more pressure on policy makers to reach an eleventh-hour stimulus deal, according to Bloomberg). Also overnight, President Trump signed a stopgap spending legislation early Thursday to avert a government shutdown weeks before the presidential election.

As a result futures S&P 500 E-mini futures breached Wednesday’s highs, gaining as much as 1%, and the dollar weakened as investors “remained hopeful” – as Reuters put it – of a new coronavirus fiscal aid package ahead of a clutch of economic data including consumer spending and weekly jobless claims. European stocks advanced, led by technology firms.

Shares of American Airlines Group, Delta Air Lines, United Airlines and JetBlue rose all between 1.3% and 3.6% in thin premarket tradin, after the White House proposed a new stimulus bill to House Democrats worth more than $1.5 trillion that includes a $20 billion extension in aid for the battered airline industry. U.S. airlines have been pleading for more payroll support to protect jobs after the current package expired at midnight on Thursday.

Boeing rose 2.7% a day after Federal Aviation Administration Chief Steve Dickson conducted a 737 MAX test flight, a milestone for the jet to win approval to resume flying after two fatal crashes. PepsiCo gained 2.2% after it forecast full-year profit above estimates as consumers bought more of its snacks such as Doritos and Cheetos, while staying indoors due to the COVID-19 pandemic. Nasdaq futures also rose as tech giga-caps including Apple, Nvidia, Microsoft and Alphabet all rose between 1.3% and 2.4%.

Europe’s Stoxx 600 pared its advance to 0.1%, with FTSE 100 also relinquishing some gains on Brexit concern as the EU started the first step of legal action against the U.K. for breaching the terms of the Withdrawal Agreement. Travel and leisure shares fare worst on Stoxx 600, while chip stocks rallied after STMicroelectronics N.V. raised its revenue guidance. The French-Italian chipmaker jumped 6.4% after it saw a sharp rise in automotive and microcontrollers demand in the third quarter, setting it on course to top its 2020 forecast. Bayer AG shares fell as much as 13% in Frankfurt after the agriculture and pharma giant issued a profit warning. Engine maker Rolls-Royce Holdings Plc dropped after announcing a share sale. The UK’s FTSE 100 trims advance even as GBP falls; midcap FTSE 250 almost wipes gains of as much as 0.6%.

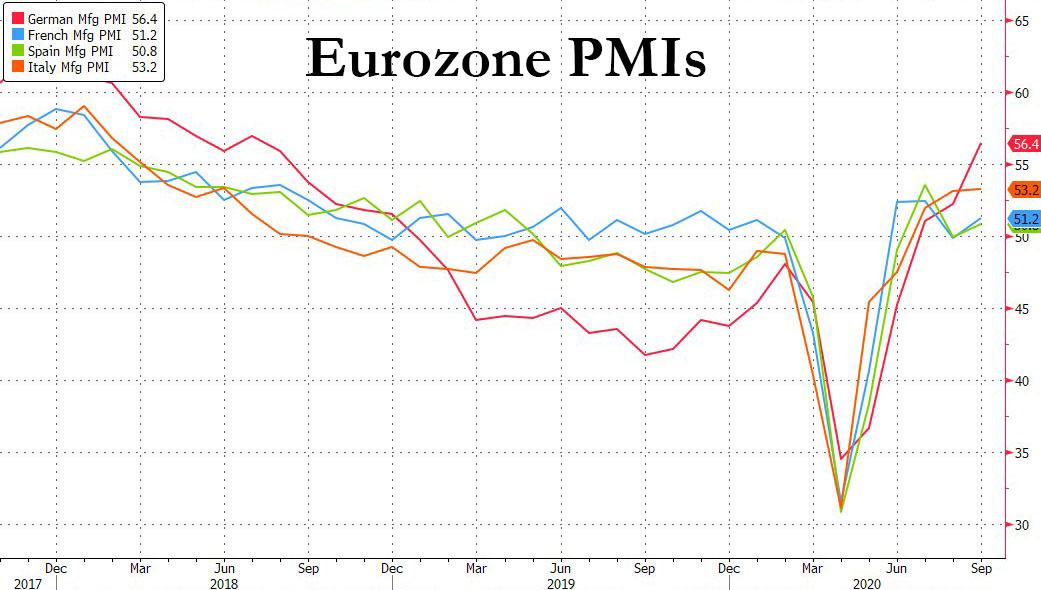

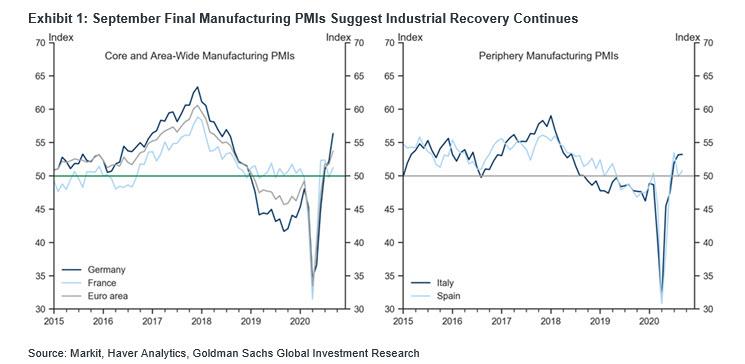

The recovery in euro zone manufacturing activity gathered pace last month but it was largely driven by strength in powerhouse Germany, and rising coronavirus cases across the region may yet reverse the upturn, a survey showed. The Euro area manufacturing PMI for September was unrevised from its flash estimate of 53.7, primarily reflecting partially offsetting revisions to the German (-0.2pt) and French (+0.3pt) counterparts, and somewhat stronger PMIs elsewhere than initially implied. The Italian manufacturing PMI rose only modestly further (below expectations), whereas the Spanish counterpart rose more notably (above expectations). The composition of both the Italian and Spanish readings was mixed, with some commonalities such as (i) weaker domestic but stronger foreign demand, and (ii) relative weakness in consumer goods and strength in investment goods.

Commenting on the data, Goldman said that “the September manufacturing PMI readings across the Euro area suggest the recovery in the industrial sector has continued, reflecting a net positive impulse despite (primarily domestic) headwinds amid a recovery in global industrial activity.”

Earlier in the session, the Tokyo Stock Exchange halted trading for the entire day Thursday. Japan Exchange Group, the operator of the TSE, said the problem occurred due to a failed switchover to backups following a hardware breakdown. The exchange will replace hardware and restart its system, aiming to resume trading as normal on Friday. Elsewhere, Asian stocks gained, led by materials and finance, after falling in the last session. The Topix was little changed, with Kyokuyo rising and Kyokuyo falling the most.

In rates, US Treasuries have been under modest selling pressure after S&P 500 E-mini futures breached Wednesday’s highs, gaining as much as 1%. The long-end yields are cheaper by ~2bp, steepening 2s10s, 5s30s by ~1bp each; 10-year, higher by 1.7bp at 0.70%, trails bunds and gilts by ~1bp. 30-year rose as much as 2.7bp to 1.482% in European trading.

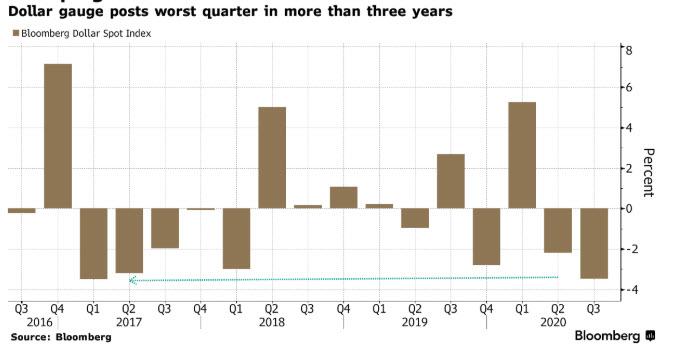

In FX, the dollar slipped against most of its G-10 peers even though trading was muted in Asian session with Hong Kong and China shut for a holiday. The weakness continue what was the worst quarter for the dollar in more than three years.

The Bloomberg Dollar Spot Index slipped, yet came off a an early London session low as a rally in equities lost steam. The pound sank versus the euro after the European Union started legal proceedings against the U.K. over Prime Minister Boris Johnson’s plan to breach terms of its Brexit divorce deal. However, pound options traders are in no rush to hedge the risk of a sharp decline in the U.K. currency due to Brexit risks, according to Bloomberg. The Australian and New Zealand dollars rose to a one-week high as gains in U.S. stock futures and China’s yuan lift sentiment.

In commodities, crude futures continued to decline in tandem with sentiment in Europe as Brexit remains in the doldrums while crude-specific news-flow for the complex remains light; as participants look towards the day’s European Council gathering & key US data. WTI Nov trades on either side of USD 40/bbl (vs. high 40.47/bbl) whilst Brent Dec oscillates around the USD 42/bbl mark (vs. high 42.55/bbl). Elsewhere, spot gold remains capped by the USD 1900/oz mark as the yellow metal failed another jab at the psychosocial levels, whilst spot silver retraces some of yesterday’s losses and sees itself north of 23.50/oz.

With a clutch of better-than-expected data also boosting sentiment in the previous session, investors will turn to consumer spending figures for August and the latest batch of weekly jobless claims on Thursday to gauge the pace of the domestic economic recovery. Initial jobless claims are not expected to show much improvement from last week’s 870,000 total when the data is released at 8:30 a.m. Eastern Time. The number comes as more companies announce they are going to move ahead with layoffs with American Airlines Group and United Airlines Holdings cutting a combined 32,000 positions. Goldman Sachs Group is also swinging the ax. Increasingly, signs are pointing to the rapid rebound in activity in the third quarter grinding to a near halt, according to Bloomberg. September data on the manufacturing sector is also due at 10 a.m. ET, while the Labor Department’s jobs report is scheduled for release on Friday.

Looking at today’s session, U.S. economic data includes initial jobless claims and August personal income and spending (includes PCE deflator) at 8:30am, final September Markit manufacturing PMI (9:45am), August construction spending and September ISM manufacturing (10am); jobs report is ahead Friday.

Market Snapshot

- S&P 500 futures up 0.6% to 3,372.75

- STOXX Europe 600 up 0.3% to 362.31

- MXAP up 0.4% to 170.66

- MXAPJ up 0.6% to 560.29

- Nikkei unchanged at 23,185.12

- Topix unchanged at 1,625.49

- Hang Seng Index up 0.8% to 23,459.05

- Shanghai Composite down 0.2% to 3,218.05

- Sensex up 1.6% to 38,668.04

- Australia S&P/ASX 200 up 1% to 5,872.93

- Kospi up 0.9% to 2,327.89

- German 10Y yield rose 0.3 bps to -0.519%

- Euro up 0.03% to $1.1725

- Brent Futures down 0.8% to $41.98/bbl

- Italian 10Y yield rose 1.4 bps to 0.662%

- Spanish 10Y yield rose 0.3 bps to 0.251%

- Brent Futures down 0.8% to $41.98/bbl

- Gold spot up 0.5% to $1,894.65

- U.S. Dollar Index down 0.02% to 93.86

Top Overnight News from Bloomberg

- President Donald Trump signed stopgap spending legislation early Thursday to avert a government shutdown weeks before the presidential election, the White House said

- U.S. Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi plan to resume discussions Thursday on a new pandemic relief package, racing against the clock to resolve their differences on another round of coronavirus stimulus

- The European Commission will on Thursday send a “letter of formal notice” to the U.K. for breaching the terms of the Withdrawal Agreement, a person familiar with the matter says

- The ECB’s emergency stimulus has propelled excess cash sloshing around the euro area’s economy past 3 trillion euros ($3.5 trillion) for the first time

- The Tokyo Stock Exchange halted trading for the entire day Thursday, freezing buying and selling in thousands of companies in the worst-ever outage for the world’s third-largest bourse

- Sweden’s Riksbank said in the minutes of its latest monetary policy meeting that if there is a need for more monetary policy stimulus, further expansion of the balance sheet remains an important tool

A quick look at global markets courtesy of NewsSquawk

European cash indices trade with modest gains (Eurostoxx 50 +0.3%), albeit off best levels as Q4 gets underway. Direction is potentially in part due to gains in US equity index futures, which remain elevated near yesterday’s best levels as policymakers in Capitol Hill continue to attempt to broker some form of agreement on COVID-19 stimulus. Focus ahead, will likely be on whether the administration and Democrats can bridge the gap between their respective USD 1.62trl and USD 2.2trl offers respectively and then ultimately whether any agreed deal can make its way through Congress; failure to do so at this juncture will likely mean that the US will not receive a fiscal boost until after the November election. From a European perspective, the DAX (+0.2%) has been a modest laggard throughout the session amid losses in index-heavyweight Bayer (-10.5%) after the Co. announced it is intending to cut around EUR 1.5bln in annual costs whilst citing weakness in the agricultural sector, which desks suggest further undermines the efficacy of the Co.s’ purchase of Monsanto. From a sector standpoint, retail names have been underpinned by upside in H&M (+6.6%) after its Q3 update posted a beat on expectations and revealed plans to lower its store count by 250 in 2021. IT names are also firmer this morning after prelim Q3 earnings from STMicroelectronics (+5.8%) saw the Co. raise its net revenue outlook for the quarter to USD 2.67bln from USD 2.45bln whilst nothing that Q3 was fuelled by “significantly better than expected market conditions throughout the quarter”; peers such as Infineon (+5.7%) and Dialog Semiconductor (+4.1%) have been seen higher in sympathy. Elsewhere, travel & leisure names are the clear laggard in the region with losses in airline names such as IAG (-3.9%), easyJet (-2.3%) and Ryanair (-2%). Finally, Rolls-Royce (-9.5%) have faced heavy selling pressure throughout the session after the Co. announced a GBP 2bln rights issue alongside the intention to begin a bond offering raising at a minimum of GBP 1bln.

Top European News

- Brexit Prompts 7,500 City Jobs, $1.6 Trillion to Leave U.K.

- H&M German Unit Fined $41.4 Million for Snooping on Staff

- ECB’s Overnight Funding Rate Falls to Record Low Amid Cash Glut

- UniCredit CEO Says M&A Isn’t a ‘Panacea’ for His Bank

Asia-Pac markets were quiet, owing to the closures in key bourses across the region with China, Hong Kong, Taiwan and South Korea all observing holidays, while trade in Japan was also mired by system issues for the Tokyo Stock Exchange which forced JPX to announce a halt of trade for the entire day. The lack of participants resulted in an uneventful overnight session; however, the mood was still positive as US equity futures extended on gains which had been attributed to month-end flows, strong data and increased stimulus hopes. This was after attempts by US Treasury Secretary Mnuchin and House Speaker Pelosi to reach an agreement on COVID relief and although progress was said to have been made, an actual deal remained elusive and House Democrats were forced to postpone the vote on their USD 2.2tln bill to Thursday to allow more time for talks with the White House. ASX 200 (+1.0%) traded with firm gains and surged above the 5,900 level with the index underpinned as miners led the broad strength in all its sectors, while Nikkei 225 remained suspended alongside Tokyo trade but Osaka futures were higher by 0.2% with a mild lift provided by the tailwinds from US and amid reports Japan is to consider further stimulus to address the pandemic. There was also mixed Tankan data which despite mostly missing expectations including on the headline Large Manufacturers Index, it still showed an improvement of the index for the first time in 11 quarters and Large All Industry Capex also topped estimates. Finally, 10yr JGBs futures were steady just above the 152.00 psychological level with price action contained as firmer results in the 10yr JGB auction was nullified by the system issues in Tokyo.

Top Asian News

- Rare Ouster of Indian Bank CEOs to Spur Drive to Find Suitors

- Top India Carmaker’s Sales Soar to 2-Year High After Lockdown

- Global Investors Sell Record Japanese Debt as FX Swaps Sour

- Korea Exports Rise in September for First Time Since Pandemic

In FX, sterling stands as the marked underperformer with initial downside sparked by source reports that the UK and EU have failed to narrow differences on State Aid in trade talks, whilst notably, a senior diplomat said the final agreement will be contingent on the UK withdrawing the Internal Market Bill – a move the UK PM previously rejected, citing UK safeguards. Thereafter, the European Commission President announced that Brussels will begin infringement proceedings against the UK for the breach of the Withdrawal Agreement, again in relation to the IMB. As such, Cable slid from an overnight high of 1.2950 to print a base at 1.2820 before stabilising, whilst EUR/GBP was propelled from 0.9070 to a high just shy of 0.9150. EUR/USD meanwhile has been under some pressure, potentially on Dollar-follow-through from the Sterling weakness as final manufacturing PMIs and an in-line EZ unemployment rate were brushed aside, with the pair briefly dipping below 1.1725 (vs. high 1.1758), whilst today’s NY cut sees a raft of large EUR/USD opex including some EUR 1.175bln rolling off between 1.1700-50 and EUR 2bln between 1.1680-85.

- DXY – The broader Dollar and index remain within a tight range but off worst levels with the aid of the aforementioned Sterling weakness, with overnight losses a function of the then upbeat sentiment across markets, with talks on State-side stimulus still in limbo but the two sides seemingly in tense negotiations for an agreement. DXY resides around the middle of its current 93.614-876 intraday band, with downside levels including the 50 DMA at the 93.50 psychological level. The Buck now eyes US PCE Price Index and ISM Manufacturing PMI, alongside another wave of Fed speakers, relief bill talks and the fallout from the Special European Council Summit.

- AUD, NZD, CAD – The non-US Dollars stand as the G10 gainers and hold onto APAC upside which was fuelled by overnight sentiment coupled with a firm CNH performance in the absence of the PBoC, and amidst a lack of pertinent data. AUD/USD trades just below 0.7200 having had tested the level to the upside overnight. A breach to the upside would open the door to the 50 and 21 DMAs at 0.7206 and 0.7211 respectively. The Kiwi similarly remains buoyed with a 0.6600+ status but just shy of the 0.6650 psychological level vs. the USD which lines up with the 21DMA. The Loonie’s gains meanwhile are to a lesser extent as the decline in oil prices weigh on the currency, but nonetheless USD/CAD meanders around 1.3300 having printed a current range of 1.3280-3327.

- JPY – Shallow losses for the JPY but seemingly on Dollar-dynamics after the technical glitch in Tokyo stock markets. USD/JPY sees itself a touch above 105.50 as it eyes Tuesday’s high at 105.73 and the 50 DMA at 105.75. Note: today’s notable option expiries see USD 1.6bln at 105, USD 1.1bln between 105.30-35 and USD 1.4bln between 105.70-80.

In Commodities, WTI and Brent futures continue to decline in tandem with sentiment in Europe as Brexit remains in the doldrums with the EU readying legal actions against the UK on breaches of “good faith”, whilst crude-specific news-flow for the complex remains light; as participants look towards the day’s European Council gathering & key US data. WTI Nov trades on either side of USD 40/bbl (vs. high 40.47/bbl) whilst Brent Dec oscillates around the USD 42/bbl mark (vs. high 42.55/bbl). Elsewhere, spot gold remains capped by the USD 1900/oz mark as the yellow metal failed another jab at the psychosocial levels, whilst spot silver retraces some of yesterday’s losses and sees itself north of 23.50/oz. Finally, LME copper prices have retreated from earlier highs as the red metal tracks losses in stock markets, Dollar dynamics and overall sentiment.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 850,000, prior 870,000; Continuing Claims, est. 12.2m, prior 12.6m

- 8:30am: Personal Income, est. -2.5%, prior 0.4%; Personal Spending, est. 0.8%, prior 1.9%

- 9:45am: Markit US Manufacturing PMI, est. 53.5, prior 53.5;

- 10am: Construction Spending MoM, est. 0.7%, prior 0.1%

- 10am: ISM Manufacturing, est. 56.4, prior 56; New Orders, est. 65.2, prior 67.6; Prices Paid, est. 58.8, prior 59.5

- Wards Total Vehicle Sales, est. 15.7m, prior 15.2m

DB’s Jim Reid concludes the overnight wrap

Welcome to October and the last quarter of what has been a decidedly strange year. Markets rounded off a fairly solid Q3 yesterday, even if September was more difficult. The quarter ended on a decent note though, as hopes rose among investors that a US stimulus deal might finally be reached between Republicans and Democrats, even if we were off the highs for the session as nothing materialised from talks. Henry is publishing the latest monthly, quarterly and YTD performance numbers in the next hour so watch out for that. As a spoiler the worst performer in September was the best in Q3. I’ll let you guess what that was before the note hits your inbox.

In terms of yesterday’s developments, the day started with higher expectations on the US fiscal front as Treasury Secretary Mnuchin said on CNBC that he hoped to have an “understanding” worked out with Speaker Pelosi by today. However after having met Pelosi for around 90 minutes yesterday, Mnuchin said that there was no agreement on an additional stimulus package. He tried to keep the mood upbeat, saying “we’ve made progress in a lot of areas.” Pelosi agreed in her own statement, “we found areas where we are seeking further clarification. Our conversations will continue.” The House was supposed to vote on the most recent Democratic proposal for a $2.2 trillion package overnight but it seems that’s now today’s business. That bill will likely be dead on arrival in the Republican Senate, where Senate Majority Leader McConnell called it “outlandish”. McConnell has tempered expectations quite a bit, saying the two sides were “very, very far apart on a deal.” Overnight, the Roll Call has reported that Mnuchin has offered a $1.62t relief proposal to Pelosi which includes more state and local assistance than Republican negotiators had previously offered and $400 per week in unemployment insurance.

The earlier initial hopes that a stimulus deal might soon be reached were a boon for risk assets, as the S&P 500 was up +1.74% intra-day. However after Mnuchin and McConnell’s comments the broad index retraced over 1.5% before a slight rally into the close saw the S&P finish +0.83%. Elsewhere the NASDAQ followed a similar pattern, finishing well off its highs, but closing up +0.74%. In Europe, the STOXX 600 fell -0.11% as fiscal stimulus was an issue as well, with Germany warning that delays to the European Union’s Recovery Fund were inevitable given disputes between member countries.

The net positive sentiment in the US was further supported by some positive data surprises. To start with, the ADP’s report of private payrolls in September showed a +749k increase (vs. +649k expected), while the previous month’s figure was revised up by +53k. Furthermore, pending home sales in August saw an +8.8% increase (vs. +3.1% expected), and the MNI Chicago PMI rose to 62.4 in September (vs. 52.0 expected), which was its highest level since December 2018.

Overnight in Asia, the markets which are open are mostly trading up including the Asx (+1.58%) and India’s Nifty (+1.14%). Futures on the S&P 500 are also up +0.51%. Japanese bourses have halted trading for the whole session following a serious hardware breakdown at the Tokyo Stock Exchange. This is the worst breakdown that the world’s third-largest bourse has ever suffered. Currently, there is no guidance on if trading will resume tomorrow. Meanwhile markets in China, Hong Kong and South Korea are closed for a holiday. Chinese markets will remain closed for a week. In Fx, the US dollar index is trading down -0.21%. Elsewhere, spot gold and silver prices are up +0.36% and +1.33% respectively.

In overnight news, President Donald Trump signed an executive order aimed at expanding domestic production of rare-earth minerals vital to most manufacturing sectors and reducing dependence on China. Meanwhile, the Fed has extended through the rest of the year its constraints on dividend payments and share buybacks for the biggest US banks citing “economic uncertainty from the coronavirus response” and the need for the banking industry to preserve capital. Elsewhere, Bloomberg has reported the White House is planning to announce an investigation into Vietnam’s currency practices, under section 301 of the 1974 Trade Act, after the Departments of Commerce and Treasury in August determined that Vietnam had manipulated its currency in a specific trade case involving tires.

The main data highlight of the day ahead will be the manufacturing PMIs from major economies. We have already seen the Jibun Bank Japan PMI come in at 47.7 (vs flash 47.3). In the West, the flash readings generally showed global manufacturing PMIs in expansion territory and roughly in line with expectations, whereas the services readings disappointed. In the Euro Area, the flash manufacturing PMI rose to 53.7, the highest reading since August 2018. While Germany’s flash manufacturing PMI rose to 56.6, not every region saw robust momentum with France (50.9) closer to the 50pt line that divides expansion and contraction. The US ISM manufacturing reading was quite strong last month at 56.0 and the market is expecting 56.4 today. It will be key to see if a recent pickup of covid-19 cases in the Midwest (particularly towards the latter end of the month) affect any momentum. Similarly if the rising coronavirus cases and reintroduction of some restrictions in Europe have affected data there.

In terms of the coronavirus itself, Spain became the most recent country to order restrictions on movement and social gatherings. Spanish Health Minister Illa indicated that a majority of the 17 regions of Spain agreed to the new rules which will limit public services and retail to 50% capacity and install a 10pm closing hour. The measures are meant to target regions with more than 50 infections per 10,000 people or where ICU capacity is strained, currently including Madrid. In the UK, the government reached a compromise with rebel Conservative MPs, as the Health Secretary announced that MPs would be able to have a vote on national regulations before they come into force “wherever possible”. It came as a further 7,121 cases were reported yesterday, pushing the 7-day average up to 6,220. Elsewhere in New York City, the positivity rate fell back to 0.94%, a day after it had been above the 3% threshold which if maintained over a 7-day rolling average could trigger school closures. At the moment, the 7-day rolling average is at 1.46%. See our table below for all the latest Covid cases numbers. The rolling 7-day number remains our focus. Also as we showed in our CoTD link here yesterday, covid has moved up to 20th in the list of the worst pandemics in history. Find out in the note how far it could end up going by looking at other pandemics through history.

Overnight we also saw some vaccine related news, with the CEO of Moderna saying that the company would not be ready to seek emergency use authorisation from the US FDA before November 25 at the earliest. He also added that the company doesn’t expect to have full approval to distribute the drug to all sections of the population until next spring. On the positive side, Bloomberg reported that the European Medicines Agency is expected to announce an accelerated “rolling review” for the University of Oxford and AstraZeneca Plc vaccine candidate as soon as this week to grant it an emergency approval. Such reviews allow regulators to see trial data while the development is ongoing to speed up approvals of drugs and vaccines. The move comes even as the US FDA widened its investigation of a serious illness in AstraZeneca’s vaccine study by asking for data from earlier trials of similar vaccines developed by the same scientists.

As investors moved away from safe havens, the dollar index (-0.01%) fell for a 3rd consecutive session, which concluded a quarter in which the greenback had weakened -3.51% in its worst performance since Q2 2017. And sovereign bonds also sold off on both sides of the Atlantic, with 10yr Treasury yields climbing +2.79bps to reach 0.684%, while in Europe 10yr bunds (+2.3bps), OATs (+2.4bps) and BTPs (+1.5bps) all saw yields rise.

Staying on Europe, following the weak German inflation print on Tuesday, both the French and Italian readings similarly showed readings that were below expectations. In Italy, inflation fell to -0.9% (vs. -0.4% expected), while over in France, inflation came in at 0.0% (vs. +0.2% expected), which was the lowest since April 2016. We’ll get the flash reading for the whole Euro Area on Friday, but given the Euro’s +4.34% appreciation against the US dollar over Q3, the figures will represent yet more unwelcome news for ECB policymakers.

On the US election, there wasn’t a lot of news yesterday following the raucous presidential debate we covered yesterday, and we won’t find out if there’s been any impact on the polls for a few days yet. Nevertheless, the betting/prediction markets have shifted somewhat in Biden’s favour in the last 24 hours, probably because there is little that’s likely to jolt the race out of the current dynamic with a persistent Biden lead in the mid-to-high single digits. The next set-piece event is on Wednesday, with the Vice-Presidential Debate between incumbent VP Mike Pence and California Senator Kamala Harris.

To the day ahead now, and as mentioned earlier the manufacturing PMIs from around the world will be the main data highlight. Otherwise, there’s also the Euro Area unemployment rate for August, the weekly initial jobless claims from the US, as well as US data on personal income, personal spending and construction spending for August. From central banks, we’ll hear from the ECB’s Lane and Hernandez de Cos, the BoE’s Haldane, and the Fed’s Williams and Bowman. Finally, EU leaders will gather in Brussels for a Special European Council summit.

via ZeroHedge News https://ift.tt/33iqMLL Tyler Durden