Alan Howard Secures $500 Million In New Cash After Posting 100% Returns During Pandemic Volatility

Tyler Durden

Fri, 10/02/2020 – 13:02

For hedge funds, you have to strike while the “2 and 20” iron is hot.

Today, in our continuing “Hope for Hedge Funds?” series, billionaire Alan Howard – who doubled his investors money early on during the pandemic – is using his superlative performance early on this year to raise another $500 million for his fund, the Brevan Howard AH Master Fund.

Howard is currently in talks with investors and will reportedly take in new money until January of next year, according to Bloomberg. The fund declined to comment for Bloomberg’s story.

But the move wouldn’t be entirely unexpected: Howard is up about 100% after the volatility from Covid gave his fund a boost and also cemented the best performance of Howard’s career after years of “mediocre returns”.

Howard’s firm had started to see AUM slip, falling to about $6 billion at the beginning of 2019 from a massive $40 billion under management during 2013. The firm managed $10.6 billion at the end of August this year.

Howard’s AH Master Fund started in 2017 and makes “riskier bets” in order to achieve higher returns. Howard invests his own money in the fund, but the details of its positioning are kept “top secret”, according to Bloomberg.

Recall, it was less than a week ago that we postulated that the volatility returning to markets could be the first tailwind for hedge funds in a decade.

We noted that few in the finance industry have suffered at the hands of Fed policy that has driven the stock market nowhere but up over the last decade more than hedge funds. Investors have left hedge funds in droves as the appeal of passive investing has grown, resulting in growing outflows and lower fees.

But now, with volatility returning to the market, it seems as though there could be some hope for hedge funds after all.

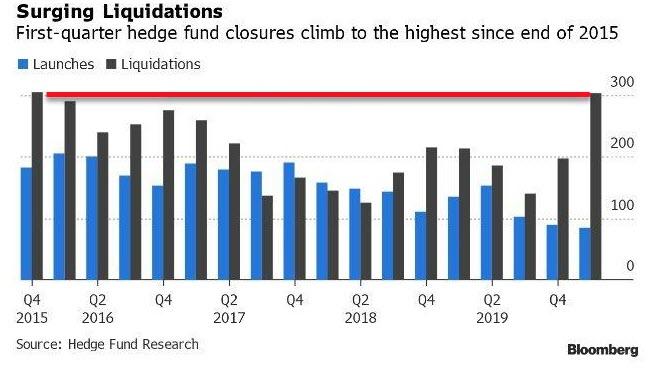

Recall, we noted this summer that hedge fund liquidations had soared to their highest level since 2015. HFR released a report in late June that showed 304 funds liquidated in 1Q20. This was the highest level of fund liquidation since the fourth quarter of 2015, when 305 funds shut down. Shown below, the number of closures in 1Q20 is about 50% higher than the last quarter in 2019.

Long-short equity hedge funds fell 5.75% in March, while the market plunged, but also posted a gain of 13.67% in the first 8 months of 2020. They were the best-performing strategy in August, according to Nomura. Hedge fund assets amount to $3.6 trillion, globally.

Philippe Ferreira at fund of hedge fund Lyxor Asset Management said: “We see great demand for strategies that protect from great volatility.”

via ZeroHedge News https://ift.tt/3jCXc9T Tyler Durden