“October Shock”: Markets Tumble After Trump Tests Positive For Covid

Tyler Durden

Fri, 10/02/2020 – 07:51

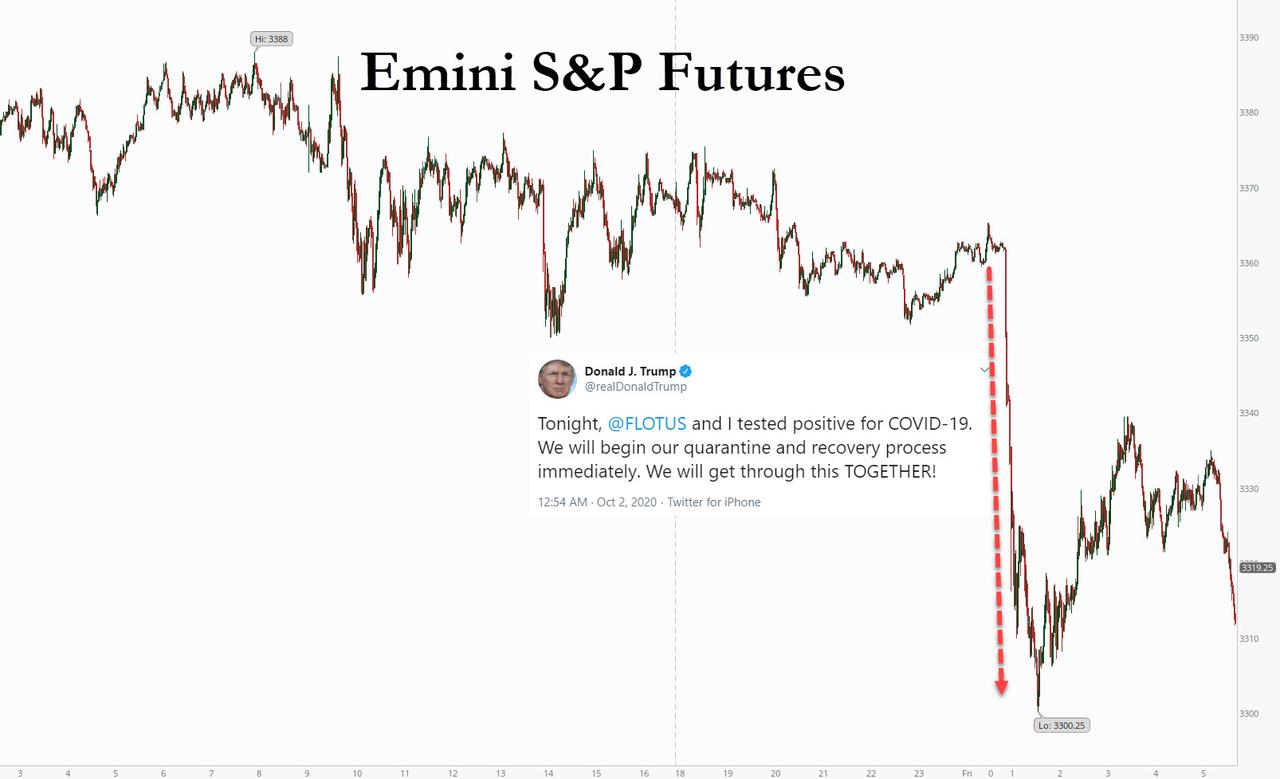

After going to bed expecting today’s jobs report to be the highlight of the day, shocked traders woke up this morning to the real October surprise: news tweeted by Donald Trump himself at 12:54am ET that he and the first lady had tested positive for covid after Hope Hicks, a senior advisor who recently traveled with the president, tested positive.

Tonight, @FLOTUS and I tested positive for COVID-19. We will begin our quarantine and recovery process immediately. We will get through this TOGETHER!

— Donald J. Trump (@realDonaldTrump) October 2, 2020

The result was an immediate flush in US equity futures and global markets which saw the Emini tumble to exactly 3,300 before rebounding modestly into the European open.

AS they sold risk assets, investors rush to safe assets such as gold, U.S. Treasuries and the Japanese yen. European shares also opened sharply lower, although they recovered some losses in early London trading after the initial overnight move. The STOXX 600 was down 0.6% as of 730am ET. The MSCI world equity index was down 0.2%.

“We’re just a month to the election so this news does throw the election campaign into a disarray for the Republican Party,” said Jingyi Pan, market strategist at IG Asia. “Even though Joe Biden is seen as the friendlier choice for Asia and a Trump absence could in some way or another keep that status quo of a Biden lead, generally, a contested election would generate uncertainties across the world and would not bode well for Asia equities as well.”

After Trump said he had coronavirus, online gambling site Betfair suspended betting on the outcome of the U.S. election. Betfair’s odds had previously shown Democratic challenger Joe Biden’s probability of winning at 60% on Wednesday after the first U.S. presidential debate.

Even before news of Trump’s infection, markets had been more bearish after Washington failed to reach an agreement on a fiscal stimulus package to help the U.S. economy recover from the impact of coronavirus. Late on Thursday, the House passed the Democratic stimulus plan which Republicans oppose, after Speaker Pelosi announce no bipartisan deal was achieved last night

The question now is what happens next as Trump’s exposure could cause a new wave of market volatility with investors braced for the presidential election in November. How long the risk-averse moves will last depends on the extent of the infection within the White House, said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners.

“We may have to wait until the end of the weekend for more clarity on the situation,” he said. “The reaction has been a bit excessive with U.S. stock futures. It doesn’t mean the U.S. administration is not able to function. It will weigh on the market today and early next week but will not induce a long-lasting correction if the infection is contained to Trump,” he added.

Following the news, the U.S. dollar index rose and the safe-haven yen made its biggest jump in more than a month, reaching 104.95. Versus a basked of currencies, the dollar was up 0.1% on the day at 93.820. The Australian dollar, which serves as a liquid proxy for risk, was down 0.5%. The euro was down 0.3% against the dollar, at $1.1721.

In rates, Treasuries remained higher led by long end after fading from session lows. Yields are still inside Wednesday’s ranges ahead of September jobs report at 8:30am ET. Yields were lower by less than 2bp at long end of the curve, with 2s10s, 5s30s spreads flatter less than 1bp; 10-year is down 1.6bp at 0.661%, outperforming little-changed bunds and gilts, after shedding as much as 2.6bp. Yields rebounded from session lows as stock futures pared declines; S&P E-minis have trimmed a 2% drop on Trump health news to about 1.4%. Germany’s benchmark 10-year bond was down around 2 basis points at -0.545%.

In commodities, oil fell, with Brent down 3.3% at $39.57 a barrel to the lowest level since June, having fallen overnight and stabilized somewhat as European markets opened. Gold rose, up 0.1% at $1,906.26 per ounce. “Depending on how this situation evolves over the weekend, notably if more members of the U.S. government’s senior leadership are diagnosed positive, gold could be set for an extended rally,” said Jeffrey Halley, a senior market analyst at OANDA.

Elsewhere, in geopolitics, EU leaders reached an agreement regarding Belarus and Turkey in which they will impose sanctions on Belarus for violence and its election, although President Lukashenko was not included in the sanctions, while it warned that Turkey could face sanctions if it continues with its gas exploration in Cypriot waters. European Council President Michel said the next 2 weeks will be crucial with Turkey and the summit deal opened a path for dialogue but also showed firmness, while they will return to the Turkey question at the December summit. Furthermore, German Chancellor Merkel said EU leaders agreed they want constructive relations with Turkey and hope for negotiating dynamic with the country

Looking ahead, the last round of monthly U.S. unemployment data before the elections is due at 0830 (see preview here), although analysts say this has been relegated to secondary importance. We also get Factory Orders, Uni. of Michigan (F), Fed’s Harker, European Council Special Meeting. Trump’s illness prompted the White House to cancel political events on Friday, including a rally planned outside Orlando, Florida. Campaign and fundraising trips planned for the coming days — including visits to key battlegrounds including Wisconsin, Pennsylvania and Nevada — are expected to be scrapped.

Market Snapshot

- S&P 500 futures down 1.2% to 3,327.75

- STOXX Europe 600 down 0.4% to 360.49

- MXAP down 0.3% to 169.91

- MXAPJ down 0.2% to 558.19

- Nikkei down 0.7% to 23,029.90

- Topix down 1% to 1,609.22

- Hang Seng Index up 0.8% to 23,459.05

- Shanghai Composite down 0.2% to 3,218.05

- Sensex up 1.7% to 38,697.05

- Australia S&P/ASX 200 down 1.4% to 5,791.50

- Kospi up 0.9% to 2,327.89

- Brent Futures down 3% to $39.71/bbl

- Gold spot up 0.2% to $1,909.27

- U.S. Dollar Index up 0.06% to 93.77

- German 10Y yield fell 0.5 bps to -0.541%

- Euro down 0.2% to $1.1721

- Brent Futures down 3% to $39.71/bbl

- Italian 10Y yield fell 4.4 bps to 0.618%

- Spanish 10Y yield fell 0.2 bps to 0.23%

Top Overnight News

- Trump’s illness prompted the White House to cancel political events on Friday, including a rally planned outside Orlando, Florida. Campaign and fundraising trips planned for the coming days — including visits to key battlegrounds including Wisconsin, Pennsylvania and Nevada — are expected to be scrapped.

- Four months of European Commission consultations with insurance companies, academics and others ends Friday, aimed at agreeing by next year what really counts as “green” in projects funded by such debt

A quick look across global markets courtesy of NewsSquawk

Asian equity markets traded lower and the E-mini S&P is showing substantial losses after US President Trump tested positive for COVID-19. ASX 200 (-1.4%) reversed yesterday’s strength in which energy and mining-related sectors led the downside following weakness across the commodities complex and as a lacklustre financials sector also contributed to the losses for the index. Nikkei 225 (-0.7 %) was initially buoyed at the open as it played catch-up on return from yesterday’s surprise trading halt in Tokyo due to hardware issues, which Japan’s FSA is reportedly to consider a punishment for. This subsequently weighed on Japan Exchange Group shares and Fujitsu was also pressured given that the Co. is the hardware provider for the market operator, while most the gains in the benchmark index were gradually pared alongside a broad tentative tone and with a lack of participants due to closures in China, Hong Kong, Taiwan, South Korea and India. Finally, 10yr JGBs were rangebound amid the mixed risk tone and with price action stuck near the 152.00 focal point, while a tepid Rinban announcement by the BoJ which were present in the market for JPY 570bln, also ensured the lackadaisical price action for government bonds.

Top Asian News

- Malaysia Airlines in Urgent Restructuring as Pandemic Worsens

- Australia’s Central Bank Is ‘Dysfunctional,’ Ex- Researcher Says

European cash indices briefly trimmed earlier losses (Euro stoxx 50 -0.9%) which were triggered by US President Trump announcing his positive COVID-19 test, in turn sparking risk aversion across markets. Since then, cash and futures have been attempting to lift off lows, with some Brexit optimism potentially providing support as the news of a videoconference between the European Commission President and the UK PM was received well by participants, alongside the Pound, whilst the two sides will continue with negotiations in the run up to the EU Summit mid-month. That being said, EU diplomats are still downbeat over a Brexit breakthrough whilst a UK minister highlighted that very significant issues need to be resolved. Nonetheless, the attempted recovery was fleeting, Europe trades mostly lower with the exception of Spanish and Austrian stocks, with the former supported by ACS (+18%) after Vinci (+2.6%) submitted a bid to acquire the Co’s industrial division. Sectors meanwhile opened lower across the board, but thereafter gained some composure; albeit, Energy remains the laggard whilst Telecoms tops the charts with follow-through from yesterday’s French 5G auction – which raised EUR 2.8bln, as Iliad (+4.0%), Orange (+2%) and Bouygues (+1.3%) prop up the sector. The sectoral breakdown paints a similar picture with Travel & Leisure still under pressure amid the implications of the COVID-19 resurgence on the sector. In terms of individual movers, Lagardere (-0.2%) trades with modest losses despite Vivendi (+0.6%) upping its shareholding of the Co. to 26.7% from 21.2%. Ryanair (-2.2%) meanwhile sees losses amid source reports that the Co. is mulling purchasing Boeing 737Max aircrafts for ~EUR 16bln, whilst traffic September traffic numbers fell -64% YY and the Co. was operating at around 53% of normal September schedule.

Top European News

- ECB Takes Major Step Toward Introducing a Digital Euro

- ACS in Talks to Sell Industrial Unit to Vinci for $6.1 Billion

- German Regulator Limits Staff Trading After Wirecard Scandal

- BlackRock Sees Board Governance at VW Going in Reverse

In FX, the Yen is in demand on safe-haven grounds after an initial Greenback rally on news of US President Trump catching the coronavirus saw the DXY knee-jerk just over 94.000, with Usd/Jpy subsequently retreating from around 105.66 to test bids/support below 105.00 and the index hovering just above a 93.709 low. Conversely, the Aussie has borne the brunt of risk aversion, as Aud/Usd reverses from the high 0.7100 region through 0.7150, with little consolation from retail sales not dropping quite as much as expected in August. Ahead, NFP would ordinarily command headline status on the first Friday of a new month, but the data now looks somewhat inconsequential in light of the aforementioned events in Washington.

- GBP – More wild swings for Sterling, partly in line with broad sentiment, but again due to Brexit developments in the main and independently of other external or domestic factors. Cable is firmly back over 1.2900 and Eur/Gbp circa 0.9060 compared to 0.9100+ at one stage following reports that UK PM Johnson and European Commission President von der Leyen will hold a video call on Saturday to assess the situation on trade talks after this week’s formal round of discussions, and the former will push for the 2 sides to enter the tunnel stage of negotiations even though EU chief of Brexit matters, Barnier, is unsure the time is right.

- CAD/NZD/EUR/CHF – All still softer against their US counterpart, with the Loonie pivoting 1.3300, Kiwi midway between 0.6654-16 parameters, Euro holding above 1.1700 within a 1.1697-1.1750 range and Franc straddling 0.9200. Aside from keeping a White House vigil in the run up to monthly US jobs data, Eur/Usd looks well flanked by decent option expiries given 1.3 bn at 1.1700, 2 bn at 1.1750 and 1.7 bn at 1.1800, if recent peaks in the headline pair are breached. For the record, very little reaction to softer than forecast prelim Eurozone inflation as the individual national reports indicated a downside skew to consensus.

- SCANDI/EM – The Norwegian Crown may be deriving some traction from a lower than anticipated September jobless rate to compensate for weak oil prices and the impending strike action, but Eur/Nok is not down as much in percentage terms as Eur/Sek, albeit back under the psychological 11.0000 level in similar vein to the latter that has crossed 10.50000 to the downside. Elsewhere, EM currencies are broadly softer vs the Usd, but especially the Rub amidst ongoing diplomatic and geopolitical tensions, on top of Brent losing grip of the Usd 40/brl handle

In commodities, WTI and Brent futures remain pressured, albeit volatility has somewhat cooled down in recent trade, with the initial downside sparked by the risk aversion experienced following President Trump’s positive test. Newsflow which sent WTI Nov and Brent Dec to lows of USD 37.22/bbl (vs. high 38.65/bbl) and USD 39.40/bbl respectively (vs. high 40.77/bbl). Again, crude-specific news flow has been light and we are awaiting the NFP data for some impetus; alongside any further developments around Trump’s COVID-19 diagnosis. Looking ahead, next week seems fairly quiet in terms of crude-specific events, although the OPEC World Oil Outlook on the 8th could garner some attention with regards to its medium-term forecasts, but there is a possibly the release will get sideline if the report is consistent with the July release – as was the case last year. Spot gold meanwhile was bid early-doors on safe-haven inflow, which took the yellow metal to a high of USD 1917/oz, whilst spot silver briefly topped USD 24/oz before both precious metals waned off highs. In terms of base metals, LME copper fell to the lowest in seven weeks due to USD upside and sentiment effect from US President Trump. Meanwhile, aluminium prices fell amid talks of US aluminium exemptions for producers in UAE and Bahrain.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 875,000, prior 1.37m; Change in Private Payrolls, est. 875,000, prior 1.03m

- Unemployment Rate, est. 8.2%, prior 8.4%

- Average Hourly Earnings MoM, est. 0.2%, prior 0.4%; Average Hourly Earnings YoY, est. 4.8%, prior 4.7%

- Average Weekly Hours All Employees, est. 34.6, prior 34.6

- Labor Force Participation Rate, est. 61.9%, prior 61.7%; Underemployment Rate, prior 14.2%

- 10am: U. of Mich. Sentiment, est. 79, prior 78.9; Current Conditions, prior 87.5; Expectations, prior 73.3

- 10am: Factory Orders, est. 0.9%, prior 6.4%; Factory Orders Ex Trans, est. 1.1%, prior 2.1%

- 10am: Durable Goods Orders, est. 0.4%, prior 0.4%; Durables Ex Transportation, est. 0.4%, prior 0.4%

- 10am: Cap Goods Orders Nondef Ex Air, est. 1.7%, prior 1.8%; Cap Goods Ship Nondef Ex Air, prior 1.5%

DB’s Jim Reid concludes the overnight wrap

I’m not sure if it’s just me but I seem to have fought off more “Daddy longlegs” in the last few weeks than I can remember in my entire life. It could be local to me but they are everywhere. The twins are very amusing as they have only just discovered Daddy longlegs and think they are the funniest thing in the world. They also ask where Mummy shortlegs are? They then laugh at their own jokes. I’ve taught them well.

The US political spider’s web continued to dominate the narrative yesterday. Notwithstanding this, markets got off to a steady but solid start to Q4. By the close, the S&P 500 was up +0.53% and at a two-week high, though the index fell back somewhat from its opening gains following a report that Speaker Pelosi had told her deputies that she was sceptical a stimulus agreement would be reached. Markets seem to be caught between the crossfire of volatile stimulus news and a steady increase in the probability of a Biden victory in recent days according to respected modellers. Indeed FiveThirtyEight’s model ticked up to an 80% probability of a Biden win for the first time yesterday. Although Trump has traditionally been seen as good for stocks, the uncertainty of a close election, and a possible contested one at that, has been a dampener of late. If markets got more and more convinced of a Democrat clean sweep then this a) reduces uncertainty and b) potentially paves the way for a bigger fiscal stimulus after January. So Biden positive news can outweigh short-term negative news on stimulus.

Indeed, US fiscal stimulus discussions again dominated headlines yesterday. Pelosi said that the two parties are still a ways apart on the total size of stimulus and the means in which it is apportioned. It is likely that the latter is the larger sticking point as the White House has offered $1.6 trillion, well above $1 trillion figures many Senate Republicans were already uncomfortable with. The Democrats’ most recent offer of $2.2 trillion – down from their original $3.5 trillion bill – passed late last night although Senate Republicans are expected to reject it. Pelosi said that she would continue talks with Mnuchin while the passed bill will act as public account for what here caucus was pushing for. The S&P 500 dropped half a per cent yesterday when the intention to vote was announced as it signaled the talks had likely not closed the gap. Lawmakers in both chambers are expected to recess ahead of the elections next week but can be called back to take part in a vote if anything were to get done.

Staying on the US, the main story developing overnight is that President Trump is to quarantine after his aide Hope Hicks tested positive for the coronavirus. The President tweeted that “The First Lady and I are waiting for our test results. In the meantime, we will begin our quarantine process!” In terms of the market reaction, S&P 500 futures fell after the news was released, and are currently down -0.29%, while the dollar index has moved higher and is up +0.22%. Meanwhile in Asia, amidst a number of public holidays, the Nikkei (+0.25%), is trading slightly higher, in spite of Japan’s unemployment rate in August rising to a 3-year high of 3.0%.

In advance of that, equity markets generally moved higher on both sides of the Atlantic yesterday amidst the stimulus discussions and increased probabilities of a more definitive election outcome, particularly large cap tech stocks once again as the NASDAQ gained +1.42%, while the S&P 500 was ‘only’ up +0.53% with the STOXX 600 up +0.20%. The biggest drivers of the S&P and the NASDAQ were those mega-cap tech stocks such as Netflix (+5.50%) and Amazon (+2.30%). On the gap between US and European equity markets, our CoTD yesterday showed that although the gap has been widening over the last decade, if you strip out just 10 mega-cap growth stocks from the S&P 500 then the Stoxx 600 has only been slightly behind the “S&P 490” since the end of 2014. See the evidence here.

Back to markets, andthe energy sector lagged behind yesterday as a result of the major declines in oil prices. Both Brent crude (-3.24%) and WTI (-3.73%) suffered significant losses thanks to concerns about oversupply. Copper, another industrial commodity, had its worst performance (-5.51%) since March as poor global demand weighed on the metal. Precious metals on the other hand rose with gold rising +1.07% and silver gaining +2.40%. Sovereign bonds rallied for the most part as well, with yields on 10yr treasuries (-0.6bps) and bunds (-1.4bps) both falling. Italian debt was the real outperformer though, with 10yr yields down -4.5bps and at a 1-year low, while the country’s 30-year yield fell a further -3.2bps to an all-time low. The dollar fell (-0.19%) for the fifth time in the last six sessions, though Wednesday’s was nearly unchanged.

In terms of the coronavirus, there was further negative news from Western Europe, as Italy reported another 2,548 cases, which was the country’s highest daily total since April 24 albeit with higher testing now. This has prompted Prime Minister Conte to seek an extension of his emergency powers until the end of January. Meanwhile in the UK, another 6,914 cases were reported, which sent the 7-day average up to 6,260. However we should note that the 7-day rolling average as seen in the table below is “only” slightly higher than it was a week ago. A similar story for most of the second wave candidates. Regardless officials noted that London may be at a “tipping point” while further restrictions were announced for parts of northern England, including Liverpool, where it will be illegal to meet with other households indoors. More restrictions may be coming to France as well where the Health Minister said they “may have no choice” but to close bars and restaurants again in Paris, saying the city is on “maximum alert”. And over in the US, New York reported the most new virus cases since May. New York City’s positivity rate on first time tests continued to climb, but remained below the 3% threshold that would close schools. Elsewhere in the US, two Wisconsin mayors have asked President Trump to cancel large rallies in the state which currently has one of the highest daily cases per capita in the US.

Today, attention will turn to the US jobs report, which also has added political significance as the last jobs report before Election Day on November 3rd. In terms of what to expect, our US economists think that nonfarm payrolls will grow by another +800k in September (consensus +875k), which should be enough to lower the unemployment rate to 8.2% from 8.4%. Remember however, that even if this were realised, nonfarm payrolls would still be over 10m beneath their peak back in February, so there’s still a long way to go before we get back to pre-Covid levels of employment.

Ahead of that later, the weekly initial jobless claims data for the week through September 26th showed a reduction to 837k, the lowest since the pandemic began. The continuing claims number for the week through September 19th also fell to a post-pandemic low of 11.767m, and the insured unemployment rate fell to 8.1%. The other main data highlight came from the manufacturing PMIs, though these were fairly unexciting, and saw little movement compared to the flash readings. The Euro Area PMI came in at 53.7, exactly in line with the flash reading, the German number was revised down slightly to 56.4 (vs. flash 56.6), and the French number was revised up slightly to 51.2 (vs. flash 50.9). Over in the US, the ISM manufacturing index came in at 55.4 (vs. 56.5 expected), which was a modest pull back from its 56.0 reading in August.

Elsewhere, it was a volatile day for the pound sterling as a raft of Brexit news came through that saw sentiment switch dramatically as the day went on. In the morning, the European Commission President Ursula von der Leyen announced the beginning of infringement proceedings against the UK on account of the parts of the UK’s internal market bill that violate the Withdrawal Agreement. The EU had previously given the UK until the end of September to remove the relevant provisions from the bill, but with that deadline passing they announced they would be sending a “letter of formal notice” to the UK, which the UK has until the end of October to respond to. Sterling fell to an intraday low of -0.77% in response, though in reality, this is arguably somewhat second order to the ongoing trade negotiations, particularly with the bill having not yet become law and facing serious obstacles in the UK House of Lords. Notably the end-month deadline for the UK to respond is also after Prime Minister Johnson’s self-imposed deadline of October 15 to reach a free-trade deal, so by that point we could be in a very different world depending on how things progress.

Not long after midday however, a tweet from the well-connected FT’s Sebastian Payne sent sterling up to an intraday high of +0.45%, after he said that “Officials with knowledge of the talks say a landing zone on state aid has been identified”. This optimism didn’t last for long though, with sterling falling back again as another headline came through saying that the reports suggesting the two sides were entering the final stage were too optimistic, with differences still remaining on the long-standing sticking points of state aid and fisheries. The 9th round of the negotiations wraps up today in Brussels, with a meeting between the two chief negotiators, so worth keeping an eye out to see if we get any statements from either side of any progress that might have taken place.

To the day ahead now, and as mentioned the US jobs report later is likely to be the main highlight. Otherwise, we’ll get the flash estimate of Euro Area CPI in September, and from the US there’s also the final University of Michigan sentiment reading for September and factory orders for August. From central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s Holzmann and Hernandez de Cos, while from the Fed we’ll hear from Harker and Kashkari.

via ZeroHedge News https://ift.tt/3inL37g Tyler Durden