Gold Prices Supported By Western Investors As Consumer Demand In China And India Slows

Tyler Durden

Fri, 10/02/2020 – 23:20

Some of the world’s most well known investors aren’t being coy about wanting to get exposure to gold. In addition to Berkshire Hathaway’s addition of Barrick Gold, Bridgewater also invested in gold backed ETFs during the second quarter.

In fact, holding up gold’s price is interest from the West that is offsetting softer demand from the East, according to FT. The demand coming out of the West has been spurred by the impact of the coronavirus and, more specifically, the idea of a path to endless money printing.

David Tait, chief executive of the World Gold Council, told FT that gold’s rally “has focused a lot of people who had historically looked at gold as the Armageddon trade to look at it through a broader lens”.

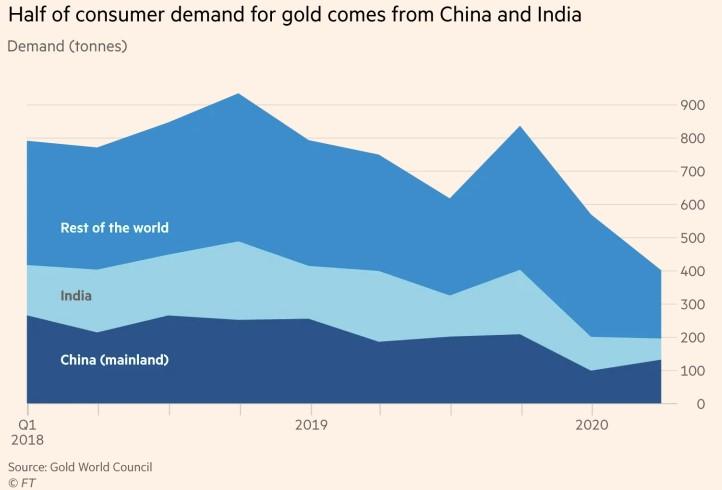

In places like India and China, however, demand for gold has been relatively soft. Buyers in the two biggest consumer markets have either been selling their holdings or borrowing against them.

The question then becomes whether or not retail consumption can continue to drive gold’s strength – and what would happen if demand from the West dries up all of a sudden. The last time demand dried up heavily in the West, gold plunged from $1,920/oz. to $1,200/oz. in 2013.

One tailwind is the fact that gold ETFs now make up 35% of global demand compared to just 8% a year ago. But inflows into these funds look as though they could be slowing. For example the GLD registered withdrawals of money in September for the first time in eight months.

A plunge in gold could trigger further selling by many of the same retail investors that have kept the commodity afloat. Gold is currently about 10% lower than its late summer highs.

Adrian Ash, head of research at BullionVault, said: “One risk [scenario] here is that Asian buyers put a floor under the market. But with demand being so abject in the big consumer nations where will that floor be?”

China and India account for more than half of global gold purchases, but demand has fallen 56% in India over the first half of the year. Suraj Popley, who owns a jewelry store in a busy neighborhood of Mumbai said: “People are coming to sell gold, in case they require cash, in case they require liquidity. Very few people are coming to buy.”

Terence Lucien, head of mutual funds at PhonePe in Bangalore said: “There is an affinity towards gold. The way Indians have bought it traditionally, there have been people buying in excess.”

But demand has slowed, also as a result of pandemic-induced lockdowns. Weddings have been postponed and have reduced the appetite for lavish spending. Longer term consumer demand is also falling; down from 900 tons a year from 2010 to 2015 to about 700 tons last year.

Shekhar Bhandari, head of precious metals at Kotak Mahindra Bank, thinks the market will rebound eventually: “Have weddings been postponed? The answer is Yes. Is the number of marriages over the [long term] going to decrease? No.”

China has seen a similar plunge in consumer demand. The country saw its lowest level of consumer demand since 2007 during the first half of this year at just 152.2 tons.

Jeremy East, a Hong Kong-based former Standard Chartered banker, said: “There’s no gold going into China and very little going into India this year. That means the [western] ETF guys need to keep buying, [especially] if at the end of the year China and India are still not buying . . . That gold has got to find a home somewhere. The market needs more money to come in to keep absorbing this gold.”

David Govett, a veteran precious metals trader concluded: “Covid-19 cases are on the rise, governments are starting to panic again, economies are facing down the barrel of a second lockdown. All in all, it should be a perfect storm for gold. There’s too much uncertainty in the world to be short gold.”

via ZeroHedge News https://ift.tt/2SlMBnx Tyler Durden