Bank of America Revenue Tumbles But Earnings Beat On Plunge In Loss Reserves

Tyler Durden

Wed, 10/14/2020 – 07:09

After yesterday’s results from JPMorgan and Citi which initially surprised with the plunge in their Q3 loss provisions (which however the banks explained was not due to some optimism over the economy but merely due to previous overprovisions), today this trend continued when Bank of America reported Q3 results which were generally in line however boosted largely by another far lower than expected provision for loan losses.

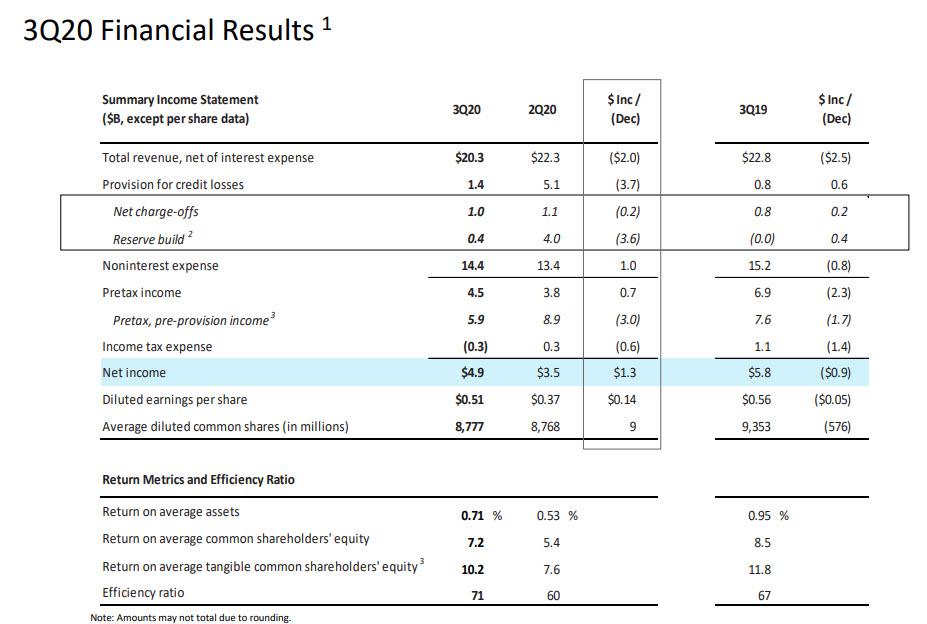

The bank reported that in Q3, revenues tumbled by 11% to $20.3BN, down from $22.8BN a year ago, pressured “by low interest rates”, and missing estimates of $20.8BN. This resulted in Net Income of $4.9BN and adjusted EPS of $0.51, also well below last year’s $5.8BN and $0.56, respectively, but slightly stronger than the $0.49 expected.

According to the bank’s presentation, these were the key revenue and net income highlights:

- Revenue of $20.3B declined 11%, driven by lower net interest income and noninterest income

- Net interest income of $10.1B ($10.2B FTE 1), down 7% from Q2, driven primarily by lower interest rates as well as lower loan levels

- Sales and Trading revenue of $3.2B and Investment Banking fees of $1.8B, declined from robust 2Q20 levels

- Noninterest expense of $14.4B increased $1.0B, or 7%, driven by elevated litigation expense, higher net COVID-19 expenses, and the addition of merchant services expenses

- Provision expense of $1.4B declined $3.7B

- Included a $0.4B net reserve build in allowance for credit losses; Net charge-offs of $1.0B were down $0.2B

However, as noted above and just like yesterday, there was just one thing investors were looking at, and that’s the bank’s loan loss provisions. And in keeping with what appears to be the narrative on Wall Street, Bank of America toed the party line, as the loss provision plunged from $5.1BN to just $1.4BN, well below the $1.8BN consensus estimate, if still up 78% from a year ago.

Developing.

via ZeroHedge News https://ift.tt/318DXxE Tyler Durden